Indiana Software Sales Agreement

Description

How to fill out Software Sales Agreement?

Are you presently in a circumstance where you frequently require documentation for either corporate or personal purposes? There are numerous authentic document templates accessible online, but locating forms you can trust is not straightforward.

US Legal Forms offers thousands of document templates, such as the Indiana Software Sales Agreement, that are designed to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Indiana Software Sales Agreement template.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Indiana Software Sales Agreement at any time if needed. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, the largest collection of valid templates, to save time and avoid errors. This service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- Acquire the document you need and verify it is for the correct county/state.

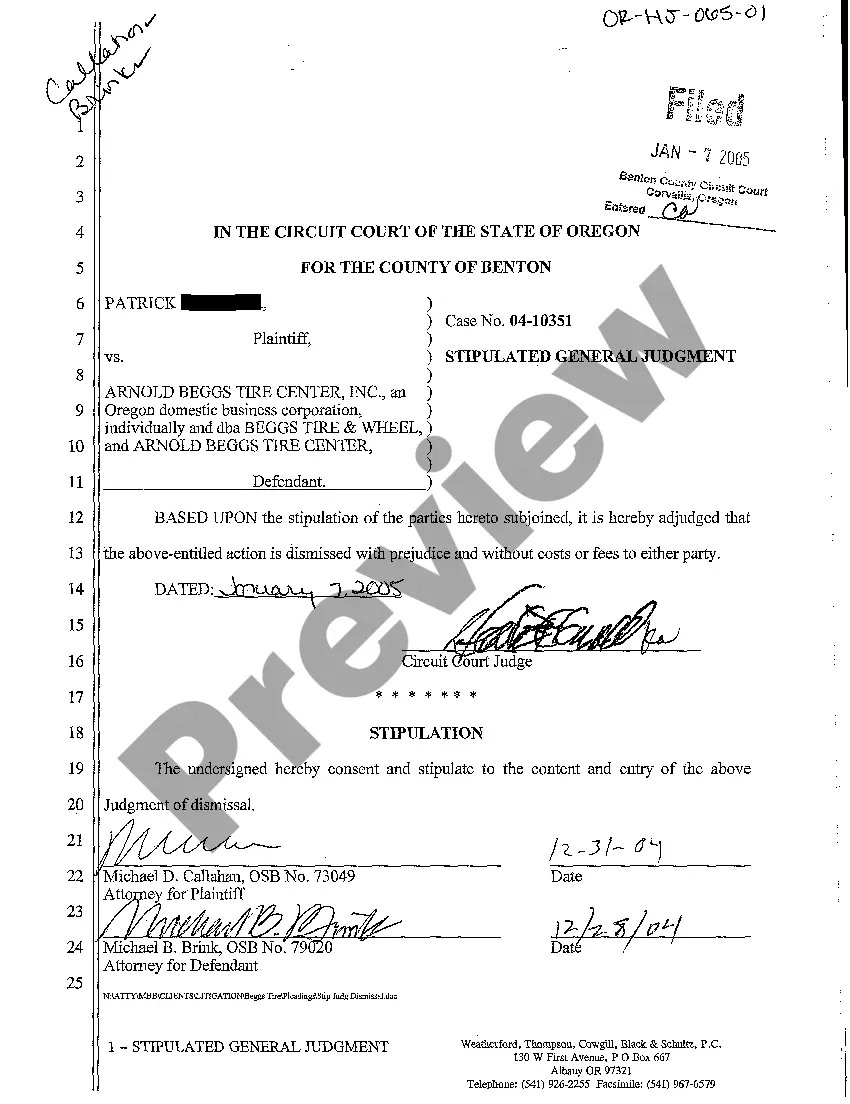

- Utilize the Preview button to examine the document.

- Review the outline to confirm you have selected the right form.

- If the document does not meet your needs, use the Search field to locate the form that fits your requirements.

- Once you identify the appropriate document, click Buy now.

- Choose the pricing plan you prefer, provide the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- Select a convenient file format and download your version.

Form popularity

FAQ

The cost of the downloaded software is incidental (less than 10% of the total price of the transaction) to the service, so the transaction with the business customer is exempt from sales tax. The service provider, however, is subject to Indiana sales/use tax on the purchase of this software.

The Indiana Department of Revenue is set to start enforcing a law passed in 2017 on Oct. 1. If you buy products online from out-of-state companies, you'll be charged the state's 7 percent sales tax. The law lets the state collect the sales tax from online retailers even if they don't have a physical store in Indiana.

What's the threshold for economic nexus law in Indiana? Threshold: $100,000 in gross revenue in the previous calendar year, or makes sales into Indiana in more than 200 separate transactions in the previous calendar year.

Sales of custom software - delivered on tangible media are exempt from the sales tax in Indiana. Sales of custom software - downloaded are exempt from the sales tax in Indiana.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Making good on his State of the State promise to provide clarity on the previously murky topic of software-as-a-service (SaaS) and its sales tax status, today Governor Holcomb signed Senate Bill 257 into law.

Indiana Tax NexusGenerally, a business has nexus in Indiana when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

Generally, purchases of tangible personal property, accommodations, or utilities made directly by Indiana state and local government entities are exempt from sales tax.

Indiana Tax NexusGenerally, a business has nexus in Indiana when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

The term "nexus" is used in tax law to describe a situation in which a business has a tax presence in a particular state. A nexus is basically a connection between the taxing authority and an entity that must collect or pay the tax.