Indiana Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan

Description

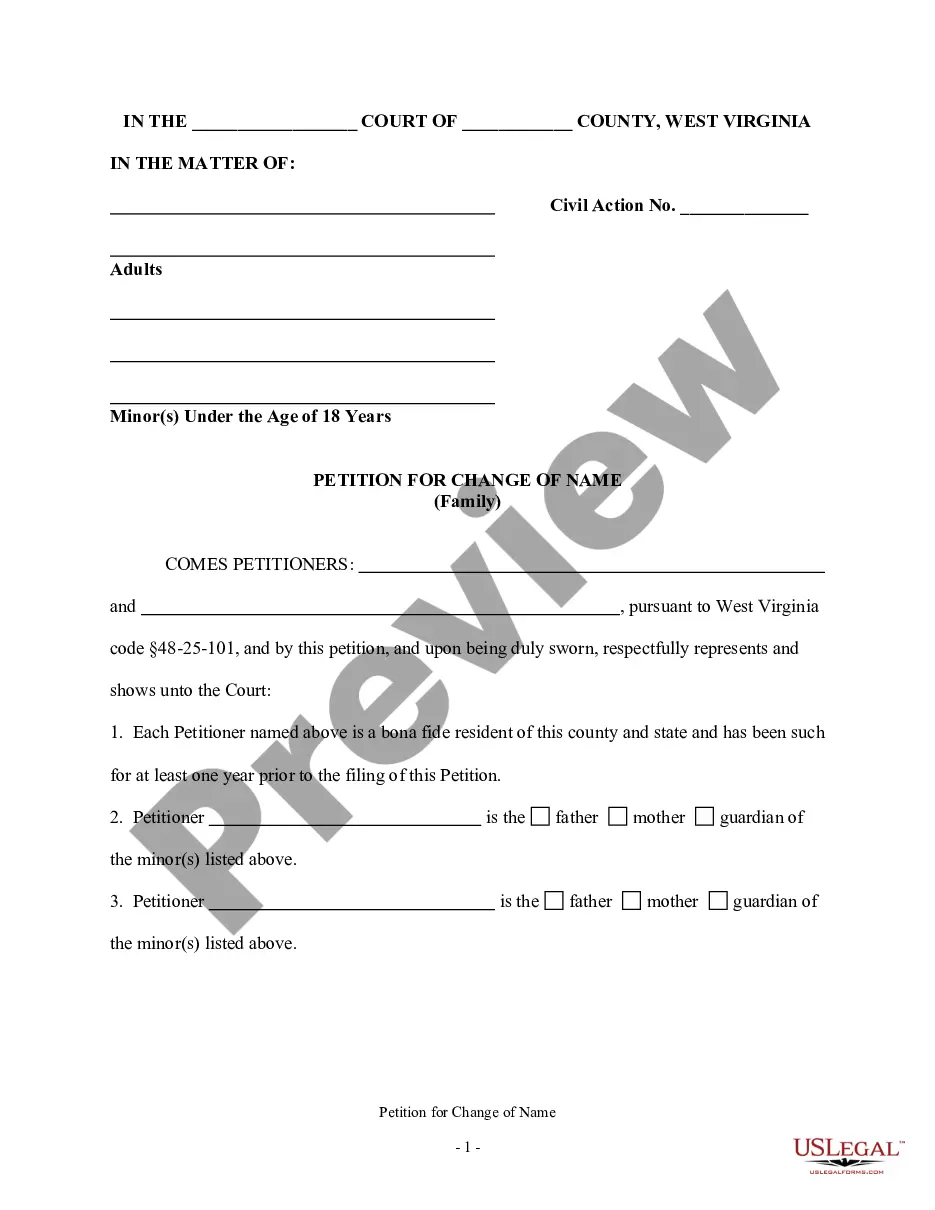

How to fill out Exhibit To UCC-1 Financing Statement Regarding A Fixture Filing For A Commercial Loan?

US Legal Forms - among the greatest libraries of authorized types in the States - gives a variety of authorized papers templates you are able to obtain or print out. Using the web site, you can get thousands of types for organization and person reasons, categorized by categories, says, or key phrases.You will find the most up-to-date variations of types much like the Indiana Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan in seconds.

If you already possess a subscription, log in and obtain Indiana Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan from your US Legal Forms collection. The Obtain switch can look on each form you perspective. You get access to all in the past downloaded types within the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, listed here are straightforward guidelines to help you began:

- Make sure you have chosen the right form for your personal area/region. Go through the Preview switch to examine the form`s content material. Browse the form description to ensure that you have selected the proper form.

- When the form doesn`t satisfy your specifications, take advantage of the Look for industry at the top of the display to get the one who does.

- In case you are satisfied with the form, validate your choice by clicking on the Buy now switch. Then, pick the costs program you prefer and offer your references to sign up for an accounts.

- Method the transaction. Make use of bank card or PayPal accounts to complete the transaction.

- Select the format and obtain the form in your gadget.

- Make changes. Complete, revise and print out and signal the downloaded Indiana Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan.

Each and every web template you included in your bank account does not have an expiry particular date and is also your own property permanently. So, in order to obtain or print out one more version, just visit the My Forms segment and click on the form you need.

Get access to the Indiana Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan with US Legal Forms, probably the most extensive collection of authorized papers templates. Use thousands of skilled and status-particular templates that satisfy your organization or person requirements and specifications.

Form popularity

FAQ

In general, a UCC filing is not bad for your business ? it simply serves as an official notice to other creditors that your lender has a security interest in one or all of your assets. However, UCC filings can impact your business credit, risk your company's assets and/or hinder your ability to get future financing.

"Amendment" means a UCC record that amends the information contained in a financing statement. Amendments include assignments, continuations and terminations. "Assignment" is an amendment that assigns all or part of a secured party's power to authorize an amendment to a financing statement.

The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default. However, in many cases, the terms UCC lien and UCC filing are used interchangeably.

The place to file a UCC document is listed in I.C. 26-1-9.1-501. If you are unsure of the appropriate place to file, you should seek legal counsel. To record a new UCC with our office, fill out and submit the UCC Financing Statement form.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

Remember: as long as an asset has a UCC lien filed against it, you're not allowed to transfer, sell, or use it as collateral for any other loan.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

A fixture filing is a UCC-1 financing statement authorized and made in ance with the UCC adopted in the state in which the related real property is located. It covers property that is, or will be, affixed to improvements to such real property.