Indiana Security Agreement regarding Member Interests in Limited Liability Company

Description

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

If you desire to be thorough, obtain, or print out legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Make use of the site's user-friendly search feature to find the documents you require. A variety of templates for business and personal use are organized by categories, states, or keywords.

Employ US Legal Forms to access the Indiana Security Agreement pertaining to Member Interests in a Limited Liability Company in just a few clicks.

Every legal document template you purchase remains yours indefinitely. You will have access to every form you saved in your account. Click on the My documents section and choose a form to print or download again.

Be proactive and obtain, and print the Indiana Security Agreement concerning Member Interests in Limited Liability Company with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download option to locate the Indiana Security Agreement regarding Member Interests in Limited Liability Company.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

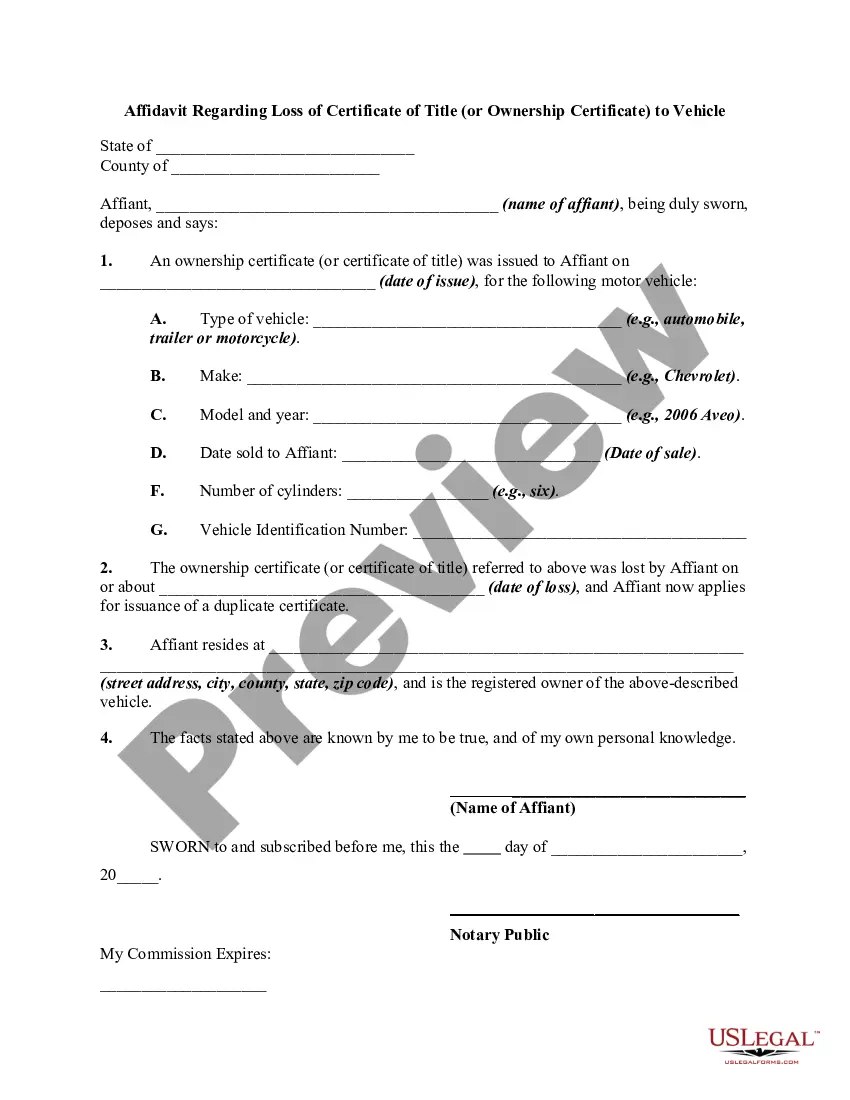

- Step 1. Confirm you have selected the correct form for your city/state.

- Step 2. Use the Review function to inspect the form's details. Be sure to read the descriptions.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now option. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Indiana Security Agreement regarding Member Interests in Limited Liability Company.

Form popularity

FAQ

Limited liability partnership interests are typically securities, since, like in limited partnerships, LLP limited interests lack managerial powers and have limited liability.

Limited liability companies (LLCs) do not have stock, nor can they issue it. Despite this fact, LLCs may have advantages over corporations, depending on your particular business needs and goals.

As a result, lenders desiring to secure their loans with an equity pledge (typically either in the borrower itself or its subsidiaries) are increasingly taking pledges of LLC membership interests as part of their collateral.

Under LLP structure, liability of the partner is limited to his agreed contribution. Further, no partner is liable on account of the independent or un-authorized acts of other partners, thus allowing individual partners to be shielded from joint liability created by another partner's wrongful acts or misconduct.

Because the Agreement of Limited Partnership is considered an investment contract, the SEC classifies LP units as securities. If the partnership is sold to the public, then they must be registered under the Securities Act of 1933.

In California, shares of an LLC in which any member is not continuously actively involved in the management of the LLC would qualify as securities.

Under most circumstances, an LLC interest is a general intangible, and the lender will perfect its security interest by filing an initial UCC financing statement in the state where the pledgor is located, which for an individual pledgor is the state of his/her principal residence and for a registered organization

Hence, a general partnership interest is not necessarily or even typically securities unless the Animal Farm1 rule applies, i.e., some general partners have much greater power and/or control of the information so that the other general partners are seen more like relatively passive investors.

Under this definition, a membership interest in an LLC is a security for California law purposes unless all of the members are actively engaged in management. Thus, interests in a manager-managed LLC where not all members are managers are securities under California law.

Like a company, an LLP is a body corporate and therefore a separate legal entity and an LLP member's liability is limited. However, like a partnership the relationship between the LLP members is governed by private agreement. An LLP does not have shareholders or directors and is taxed like a partnership.