Indiana Demand Letter - Repayment of Promissory Note

Description

How to fill out Demand Letter - Repayment Of Promissory Note?

You might invest time online trying to locate the proper legal document format that meets federal and state requirements you need.

US Legal Forms provides countless legal templates that have been reviewed by professionals.

You can easily retrieve or print the Indiana Demand Letter - Repayment of Promissory Note from our services.

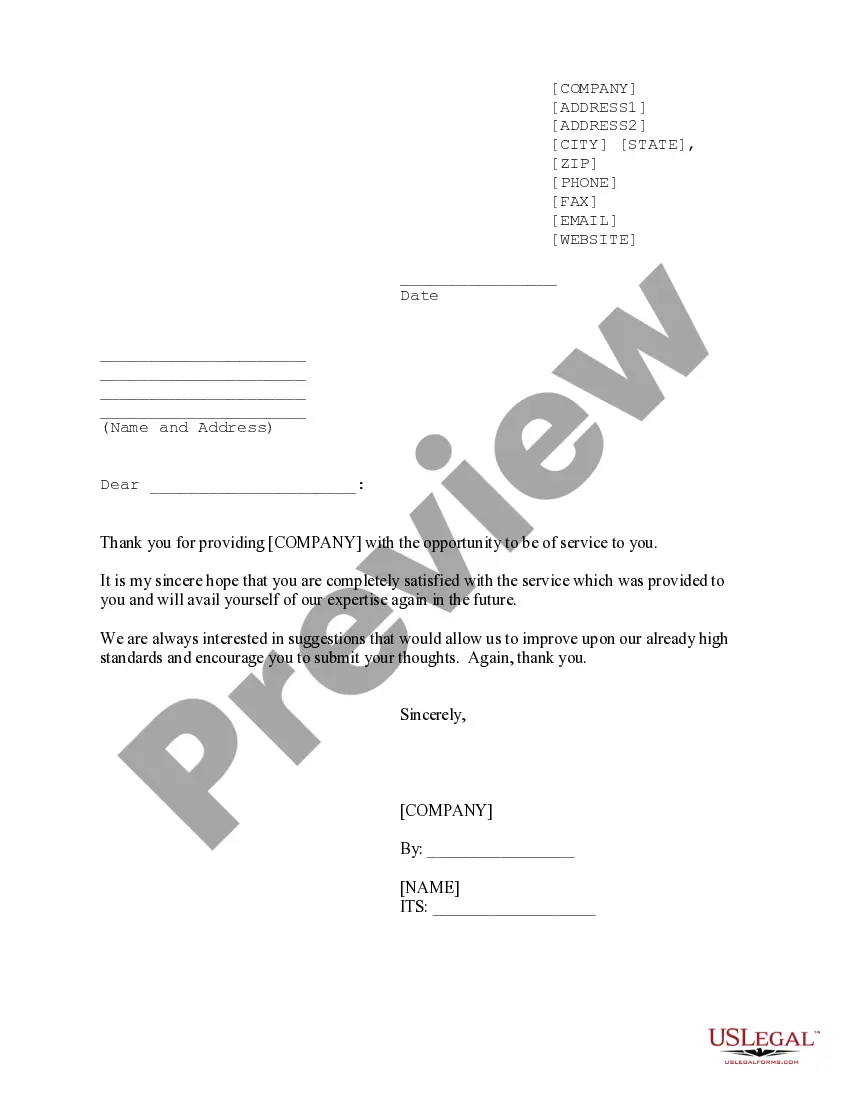

If available, use the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Indiana Demand Letter - Repayment of Promissory Note.

- Every legal document template you buy is your own property indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, make sure you have selected the appropriate document format for the area/city of your choice.

- Review the template outline to ensure you have selected the correct form.

Form popularity

FAQ

An on-demand promissory note should clearly state that the borrower agrees to repay the lender upon request. Include all key details such as the principal amount, interest rate, and payment terms. You can utilize resources like the Indiana Demand Letter - Repayment of Promissory Note to guide your understanding and ensure that all legal aspects are covered.

Yes, a promissory note can be structured to be payable on demand. This indicates that the lender has the right to request payment whenever they choose. It is important for both parties to agree on the terms clearly, to avoid confusion. Utilizing an Indiana Demand Letter - Repayment of Promissory Note can clarify these terms and ensure that both parties understand their obligations.

Once a note has been paid off, it's time to wrap up any loose ends and release the parties from their duties. A clean break will provide peace of mind, discharge all obligations, and lead to an amicable conclusion. A release is the definitive end of the parties' commitments under a note.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Such an early release of a promissory note without full payment may be considered by the Internal Revenue Service ( IRS) to be a taxable event. The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.