Indiana New Employee Survey

Description

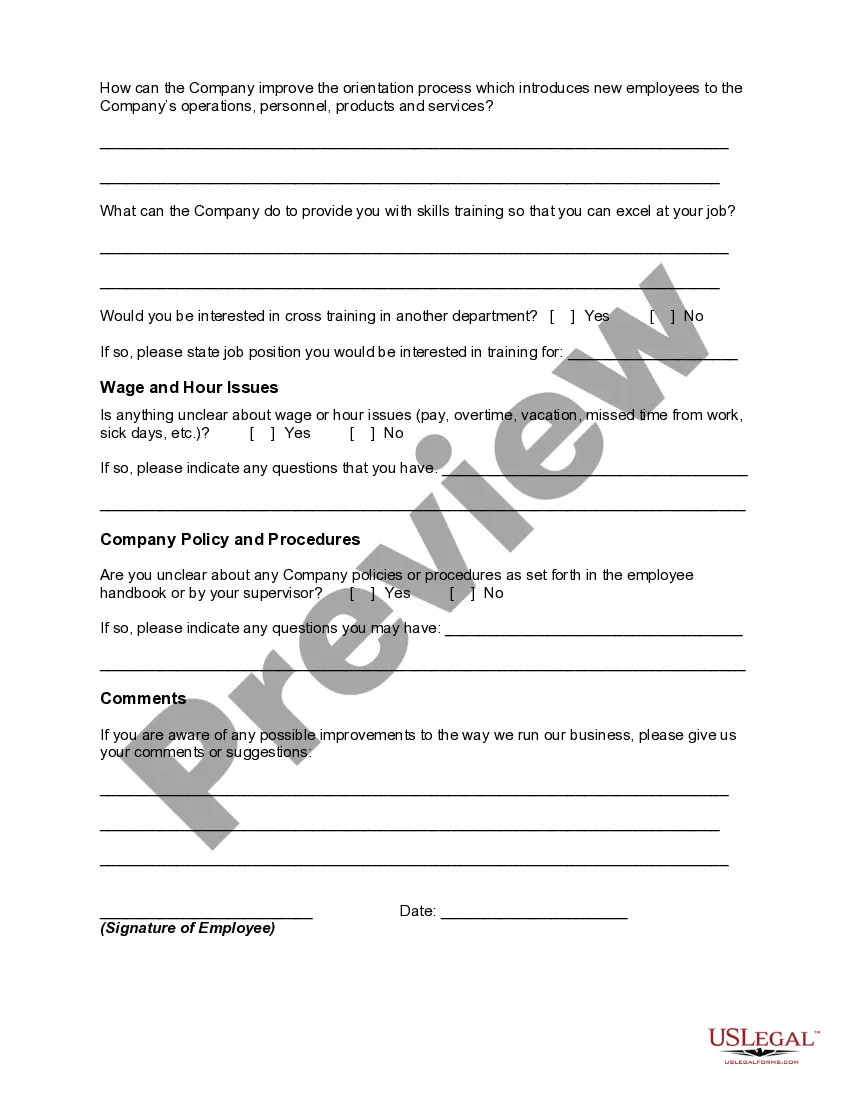

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest templates such as the Indiana New Employee Survey in just minutes.

If you already have an account, Log In and download the Indiana New Employee Survey from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the template and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Indiana New Employee Survey. Every template saved in your account has no expiration date and is yours forever. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Indiana New Employee Survey with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/state.

- Click the Review button to examine the content of the form.

- Check the summary to ensure you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the subscription plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Steps to Hiring your First Employee in IndianaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Paperwork. The tax documents and Form I-9 must be completed on or before your first day of employment. To comply with federal law, we must verify the identity and employment authorization of each person we hire, and retain a Form I-9 for each employee. Indiana state government is an E-verify employer.

Required Employment Forms in IndianaSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Indiana State/County Withholding WH-4 form.Employee Personal Data Form (Template)Company Health Insurance Policy Forms.More items...?

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

Companies who pay employees in Indiana must register with the IN Department of Revenue for a Taxpayer ID Number and the IN Department of Workforce Development for a SUTA Account Number. Apply online using the IN BT-1 Online Application and receive a Taxpayer ID number in 2-3 business days.

Please visit to report new hires. Find Frequently Asked Questions on New Hire reporting here.

In Indiana, employers must pay wages in cash, check, draft or money order, or via direct deposit. You cannot force an employee to accept direct deposit, however.