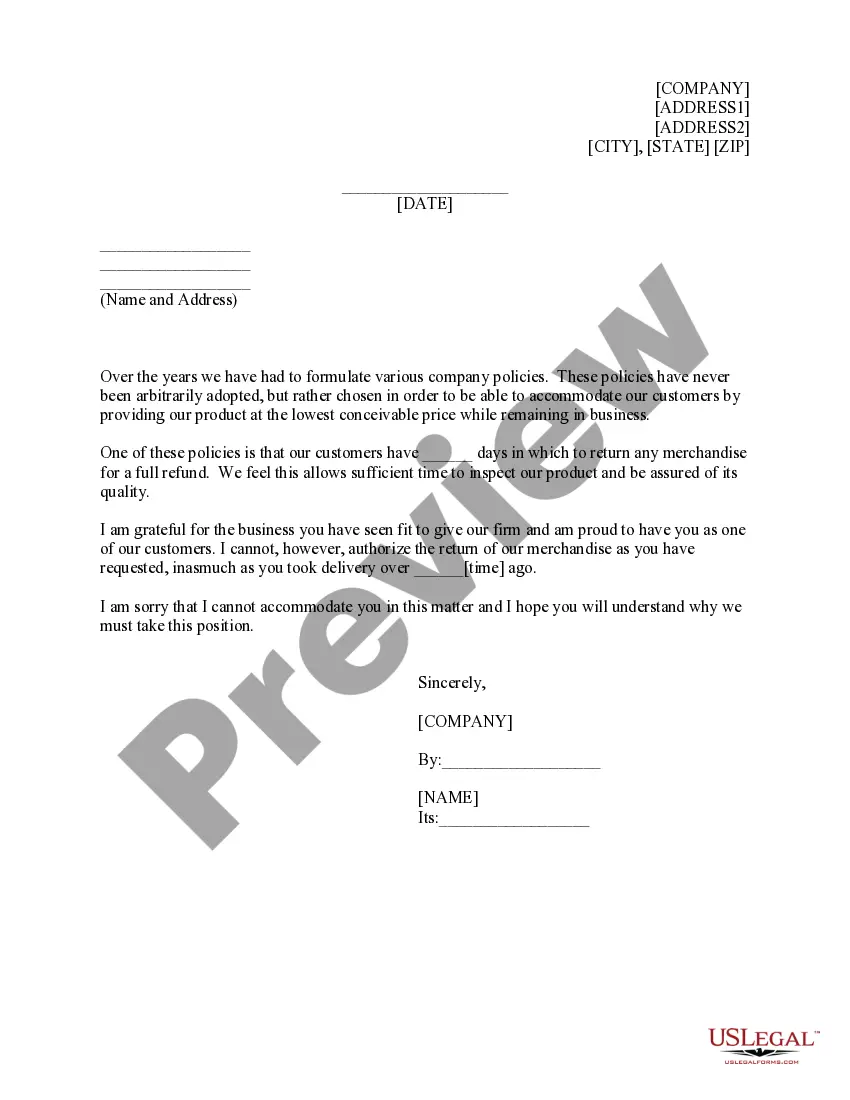

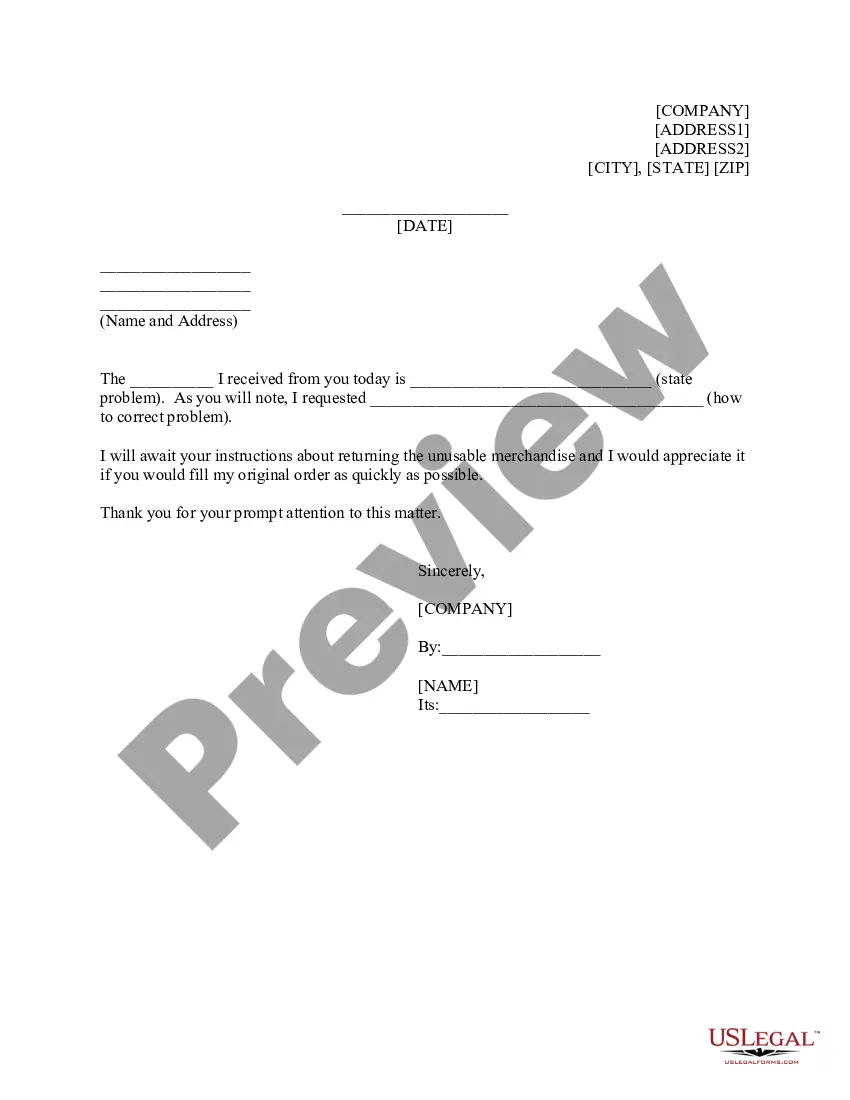

This is a form for return of merchandise by a customer.

Indiana Merchandise Return

Description

How to fill out Merchandise Return?

If you desire to finalize, obtain, or produce legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to acquire the documents you need. Various templates for business and personal purposes are organized by categories and claims or keywords.

Utilize US Legal Forms to acquire the Indiana Merchandise Return with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Check the My documents section and select a form to print or download again.

Complete, download, and print the Indiana Merchandise Return using US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to download the Indiana Merchandise Return.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Make sure to read through the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Indiana Merchandise Return.

Form popularity

FAQ

In Indiana, any corporation doing business in the state must file a corporate tax return. This includes domestic and foreign corporations that earn income or derive benefits within Indiana. Filing accurately is crucial for compliance, especially when managing aspects like Indiana merchandise returns, which often involves understanding your tax obligations.

Obtaining a registered retail merchant certificate in Indiana involves filling out the necessary application online. You will need to provide your business details and make a small payment. This certificate not only allows you to collect sales tax but also plays a crucial role in the Indiana merchandise return process.

In Indiana, certain items are exempt from sales tax, including food for human consumption, certain prescription drugs, and specific agricultural products. This exemption can significantly impact how you manage your inventory and returns. Understanding these exemptions helps streamline the Indiana merchandise return process, ensuring compliance and efficiency.

To obtain a seller's permit in Indiana, you can apply online through the Indiana Department of Revenue website. You'll need to provide your business information and complete the application form. Once approved, the permit allows you to sell goods and collect sales tax, which is crucial for managing Indiana merchandise returns effectively.

In Indiana, an inheritance tax waiver form may be required to exempt certain beneficiaries from inheritance tax obligations. This form allows heirs to ensure they do not face tax claims on inherited property until distributed. Knowing whether you need this form can influence how estates are handled in relation to tax filings. For those dealing with Indiana merchandise return issues linked to inheritance, this form is an important consideration.

Yes, you typically need to file an Indiana tax return if you meet certain income thresholds or if you owe tax. Even if you do not meet the requirements, filing may be beneficial to claim refunds or credits. If you operate a business, understanding these requirements is crucial, especially when filing your Indiana merchandise return. Consulting with a tax professional can help clarify your specific filing obligations.

The BT-1 form in Indiana is the application required for registering a business for sales tax purposes. This form helps businesses begin collecting sales tax on sales made within the state. Completing the BT-1 is a vital step once you decide to engage in selling goods or services in Indiana. To navigate your Indiana merchandise return effectively, ensure you have your sales tax registration finalized with the BT-1.

Title 1 of the Indiana Code pertains to general provisions that govern state law, including the interpretation of state statutes. It encompasses rules and regulations that affect various legal areas within Indiana. Understanding Title 1 is crucial for anyone dealing with legal matters or seeking to understand Indiana law better. Your inquiries about Indiana merchandise return can connect with insights from Title 1 provisions, dictating practices related to taxation.

When filing your Indiana tax return, you need to include several documents. Typically, you should attach W-2 forms, 1099 forms, and any relevant schedules that support your return. Additionally, if you claim deductions or credits, include documentation to substantiate those claims. Properly preparing your Indiana merchandise return with all necessary documents ensures a smooth filing process.

The primary residence exemption in Indiana allows homeowners to reduce their property tax burden on their main home. This exemption can significantly lower your assessed property value, ultimately decreasing your taxes. To qualify, you must occupy the property as your primary residence on January 1 of the assessment year. If you are navigating through Indiana merchandise return queries, understanding tax exemptions like this is essential.