Indiana Checklist for Business Loans Secured by Real Estate

Description

How to fill out Checklist For Business Loans Secured By Real Estate?

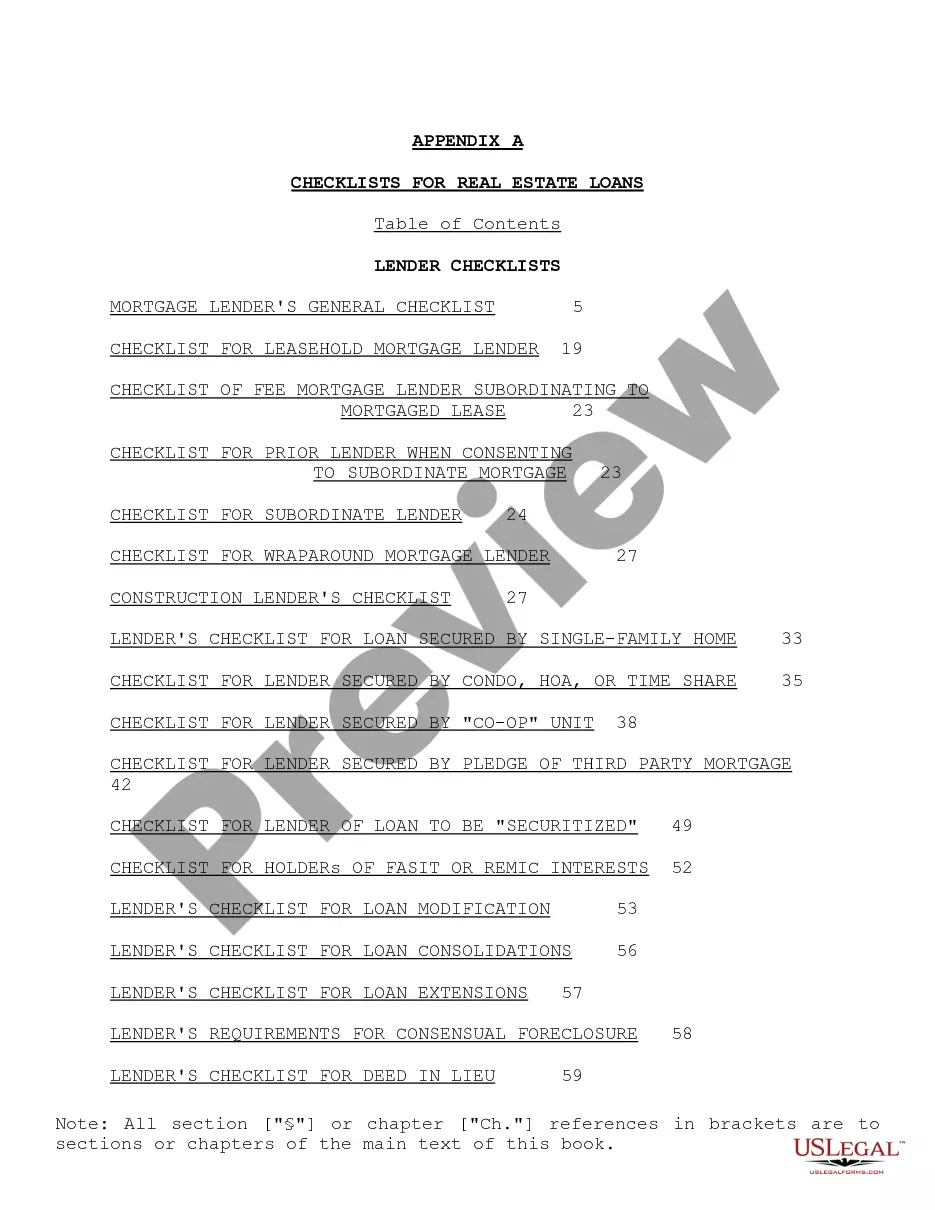

Choosing the best authorized record template can be a struggle. Obviously, there are tons of templates accessible on the Internet, but how will you obtain the authorized form you need? Make use of the US Legal Forms web site. The services offers a huge number of templates, like the Indiana Checklist for Business Loans Secured by Real Estate, which you can use for enterprise and private demands. Every one of the kinds are examined by professionals and meet up with state and federal demands.

If you are already registered, log in in your accounts and click the Download switch to obtain the Indiana Checklist for Business Loans Secured by Real Estate. Make use of your accounts to search from the authorized kinds you may have ordered formerly. Go to the My Forms tab of the accounts and obtain another copy of the record you need.

If you are a new end user of US Legal Forms, here are straightforward guidelines so that you can follow:

- Initially, be sure you have chosen the correct form for your personal city/state. It is possible to check out the form while using Preview switch and browse the form outline to make sure it will be the right one for you.

- When the form fails to meet up with your needs, take advantage of the Seach area to obtain the proper form.

- Once you are sure that the form is acceptable, click on the Acquire now switch to obtain the form.

- Pick the costs program you would like and enter in the required information. Design your accounts and pay money for an order with your PayPal accounts or Visa or Mastercard.

- Choose the document formatting and acquire the authorized record template in your product.

- Total, modify and printing and indication the attained Indiana Checklist for Business Loans Secured by Real Estate.

US Legal Forms is the greatest collection of authorized kinds where you can discover different record templates. Make use of the company to acquire professionally-created documents that follow condition demands.

Form popularity

FAQ

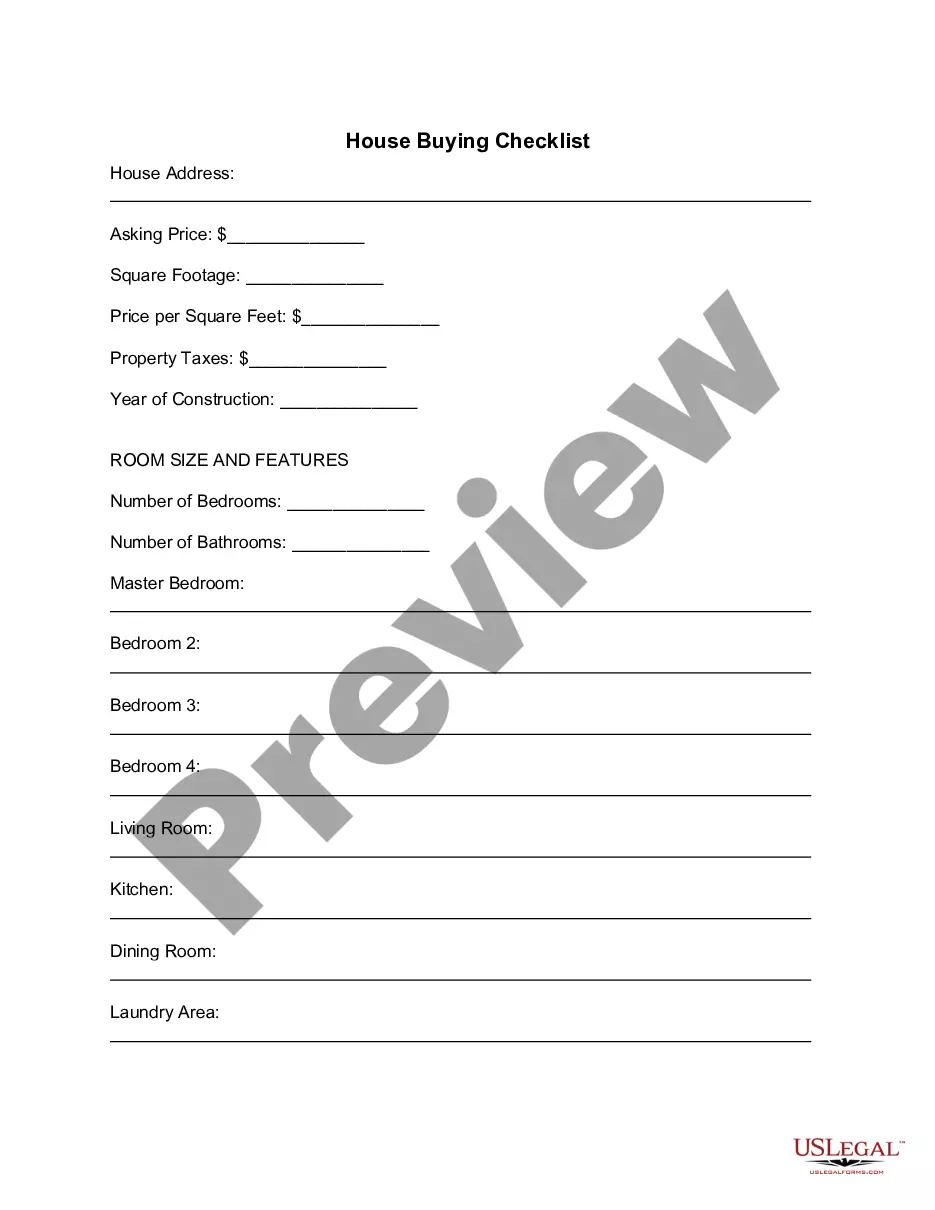

A secured business loan requires a specific piece of collateral, such as a business vehicle or commercial property, which the lender can claim if you fail to repay your loan.

What can I use as collateral for a business loan? Cash is the most liquid form of collateral, while securities like treasury bonds, stocks, certificates of deposit (CDs) and corporate bonds can also be used. Tangible assets, such as real estate, equipment, inventory and vehicles, are another popular form of collateral.

Secured business loans use collateral to reduce lender risk, allowing small business owners to potentially unlock more attractive rates and terms. Collateral can include cash deposits, business assets or real estate. But if you fail to repay the loan, the lender can seize the collateral to recoup its losses.

Secured business loans enable you to access funding by providing an asset, such as a property your business owns, as security. Because there's less risk to the lender, interest rates can be lower compared to unsecured business loan rates. The lender can sell your asset to recover the funds if you don't repay.

Using property as collateral on a business loan Lenders prefer assets of a high value that can be resold relatively quickly in the event of default. This allows them to recoup their money with few issues and as property is one of the highest value assets available, it's commonly used to secure a business loan.

Collateral is an item of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses.