Indiana Lease of Computer Equipment with Equipment Schedule and Option to Purchase

Description

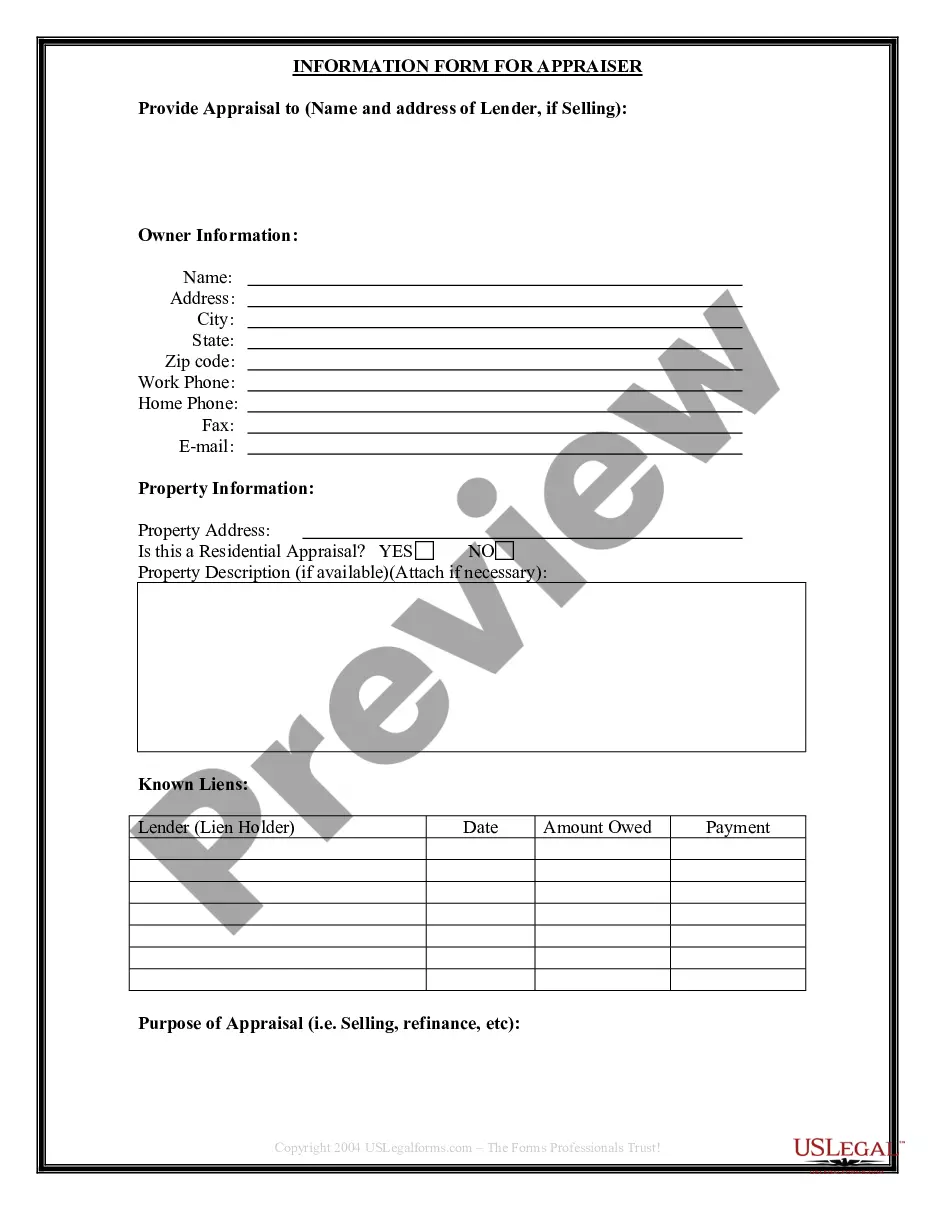

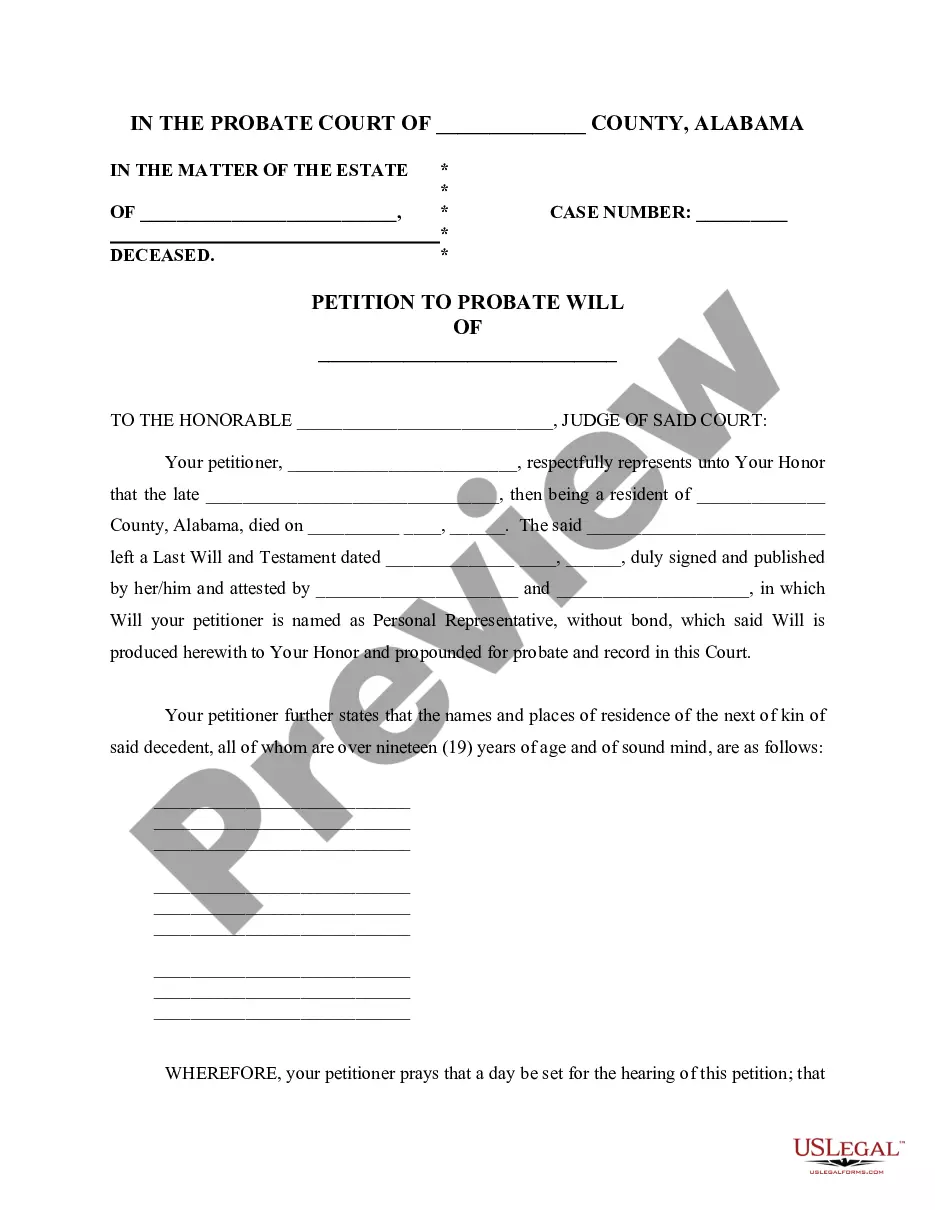

How to fill out Lease Of Computer Equipment With Equipment Schedule And Option To Purchase?

Are you in a situation where you require documents for either business or personal use almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a wide variety of template options, including the Indiana Lease of Computer Equipment with Equipment Schedule and Option to Purchase, designed to meet federal and state regulations.

Once you find the right document, click Get now.

Select the pricing plan you wish, fill in the required information to create your account, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Indiana Lease of Computer Equipment with Equipment Schedule and Option to Purchase template.

- If you do not yet have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/region.

- Use the Preview button to review the document.

- Check the information to confirm that you have selected the correct document.

- If the document is not what you're looking for, use the Search field to find a document that meets your needs.

Form popularity

FAQ

The two main types of equipment leases are operating leases and finance leases. An operating lease allows you to rent equipment without ownership at the end, suitable for short-term needs. In contrast, a finance lease typically leads to ownership after making all payments—the perfect choice if you plan to keep the equipment long-term. Understanding these options can help you decide which aligns best with your goals.

In a finance lease, the equipment is considered an asset owned by the lessee for accounting purposes. While the leasing company holds the title, the lessee has the rights to use the equipment and claim depreciation benefits. This structure positions the lessee as the effective owner, aligning with tax advantages and balance sheet benefits. Understanding these aspects can simplify financial planning for your business.

Because of the high costs of owning and operating equipment, many small business owners opt to lease. Leasing offers advantages that owning does not, including lower monthly payments typically spread over months or years rather than delivered in a lump sum.

Leasing may be worth considering if the equipment you need is likely to date quickly or if you are looking for a short-term commitment. However, leasing over long term may not be cost-effective, as you may end up paying more than the equipment is worth.

Advantages Of Leasing This can help small businesses keep up with the technological curve. Smooths Out Cash Flow: Breaking the cost of your equipment down into predictable monthly payments has its advantages, even if you are paying more over time.

Leases are usually easier to obtain and have more flexible terms than loans for buying equipment. This can be a significant advantage if you have bad credit or need to negotiate a longer payment plan to lower your costs. Easier to upgrade equipment. Leasing allows businesses to address the problem of obsolescence.

Leasing provides you with a laptop with the most current software, and many arrangements allow you to trade in your laptop for a more up-to-date model after a specified period. Leasing agreements come with technical support, so you never have to worry about your laptop warranties expiring.

There are many reasons why companies lease equipment. Equipment leasing provides flexibility and protection against technological obsolescence. Leasing allows a company to better match cash outflow with revenue productions through the use of equipment. Leasing conserves valuable working capital and bank lines.

Provides an income tax break, because you can deduct your leasing costs as a business expense. Offers an easier way to get the equipment you need if your company's credit is iffy. Eliminates the hassle and cost of trashing outdated and sometimes environmentally harmful equipment.

Equipment Leasing Definition: Obtaining the use of machinery, vehicles or other equipment on a rental basis. This avoids the need to invest capital in equipment. Ownership rests in the hands of the financial institution or leasing company, while the business has the actual use of it.