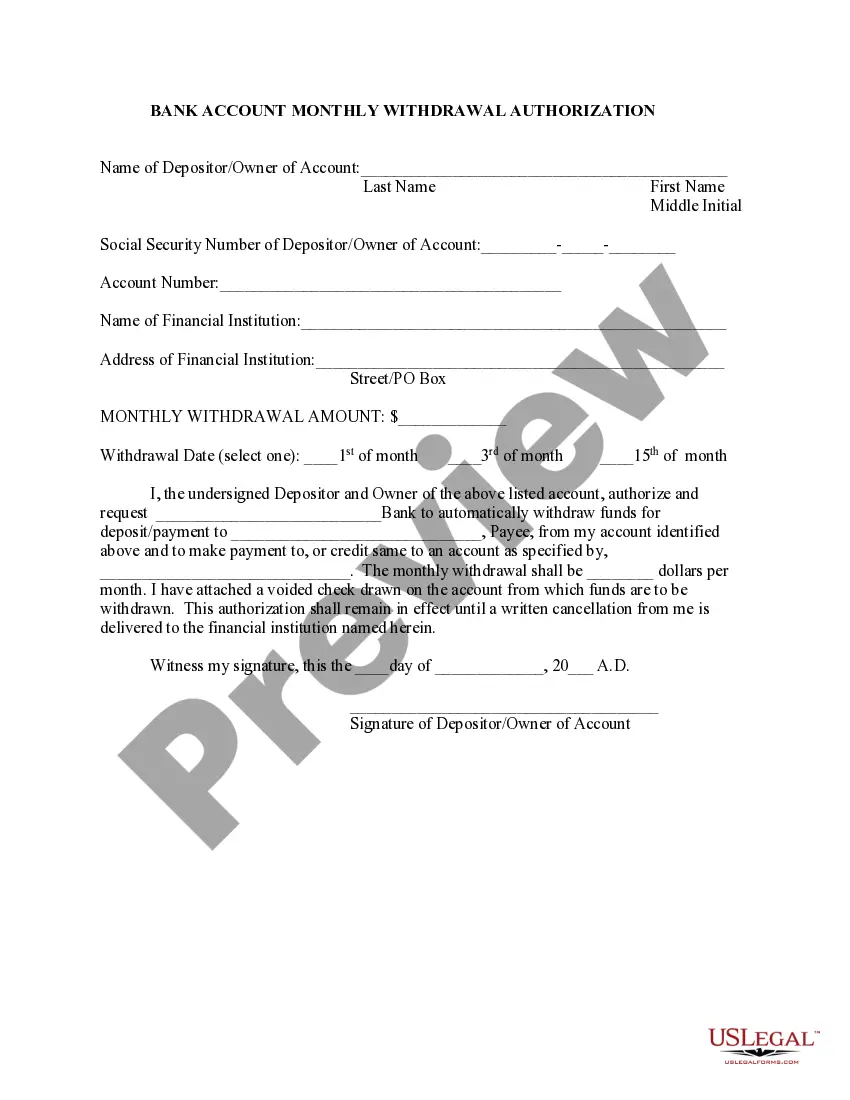

Indiana Bank Account Monthly Withdrawal Authorization

Description

How to fill out Bank Account Monthly Withdrawal Authorization?

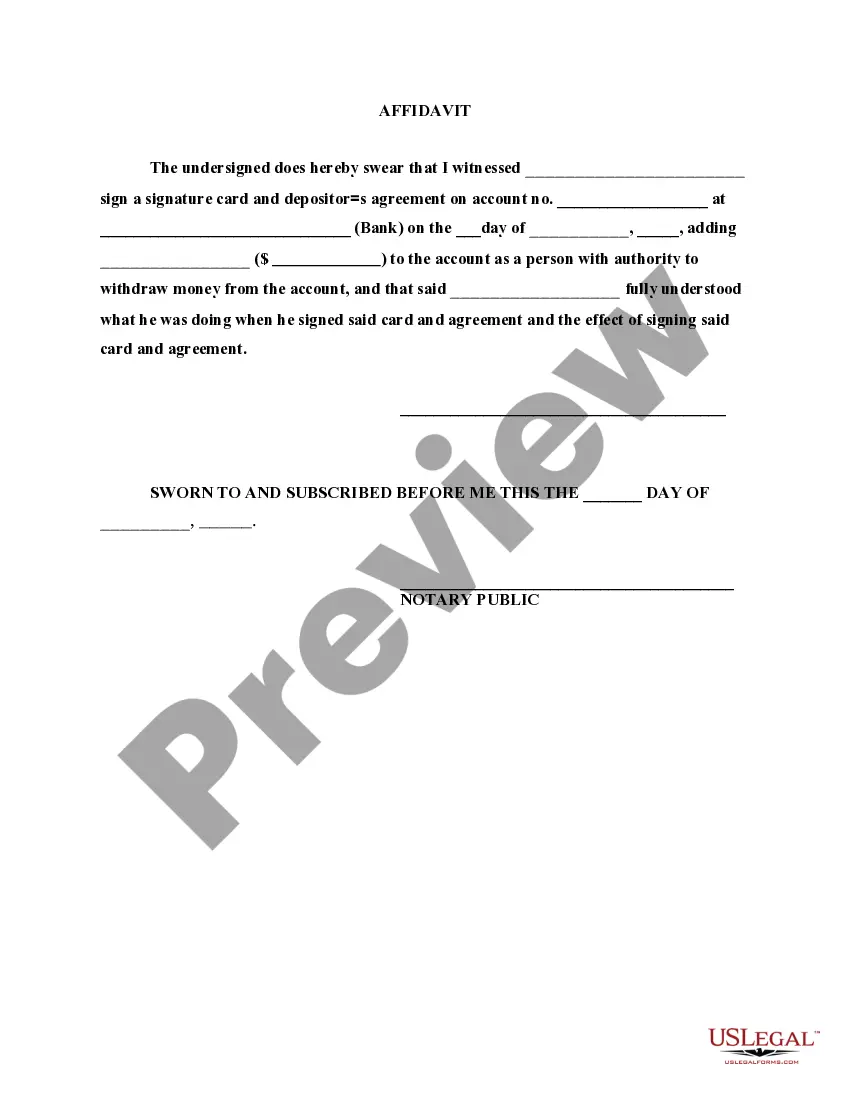

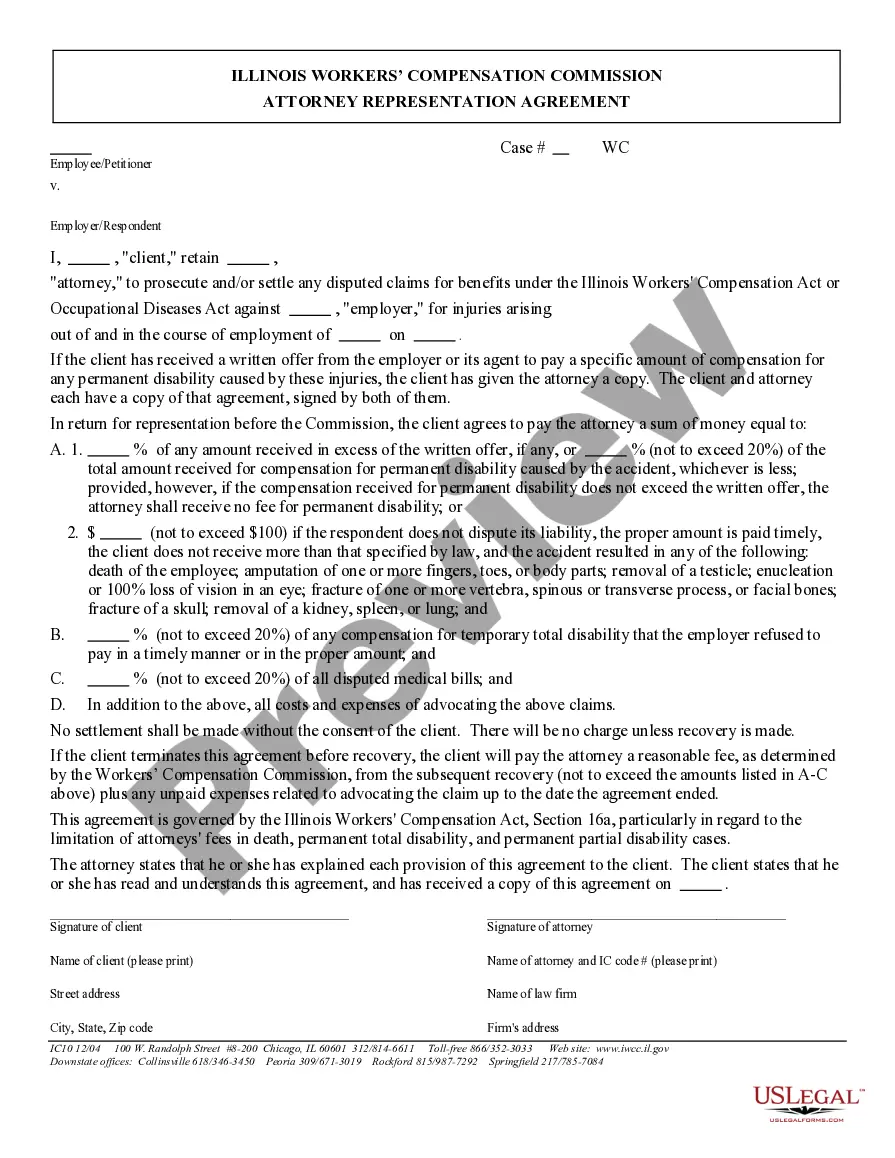

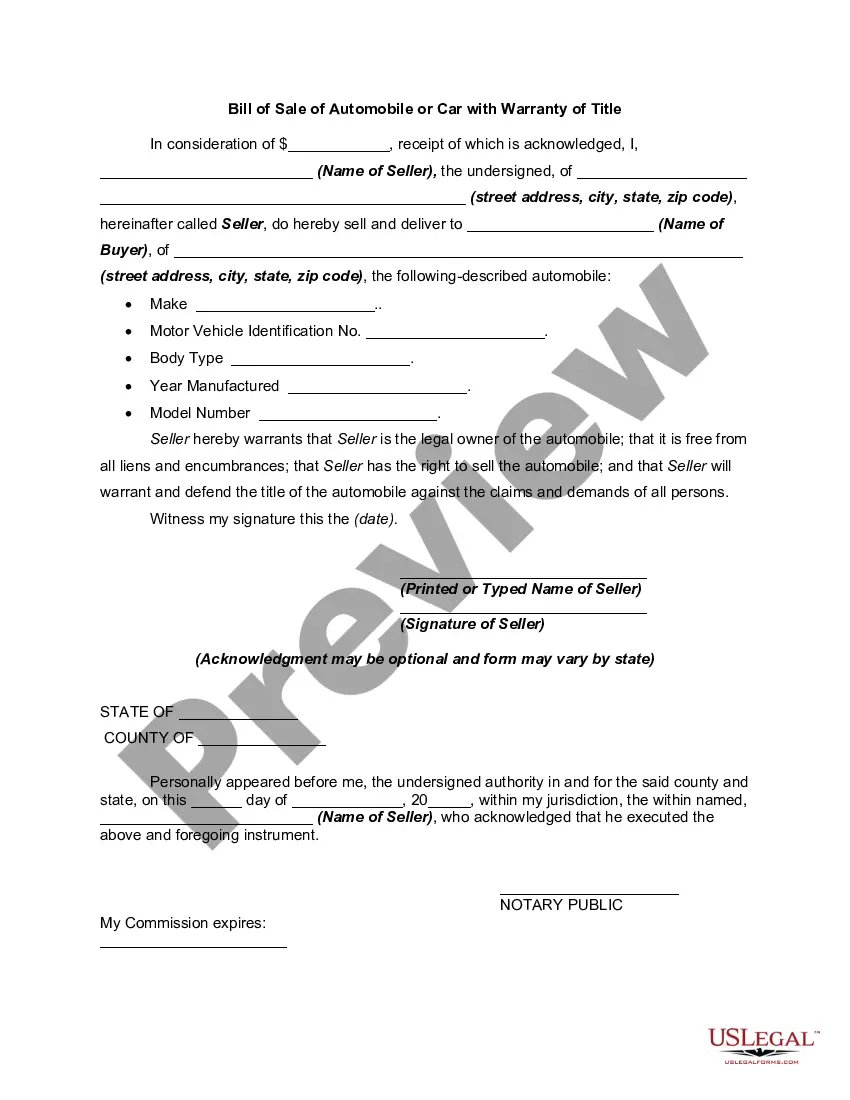

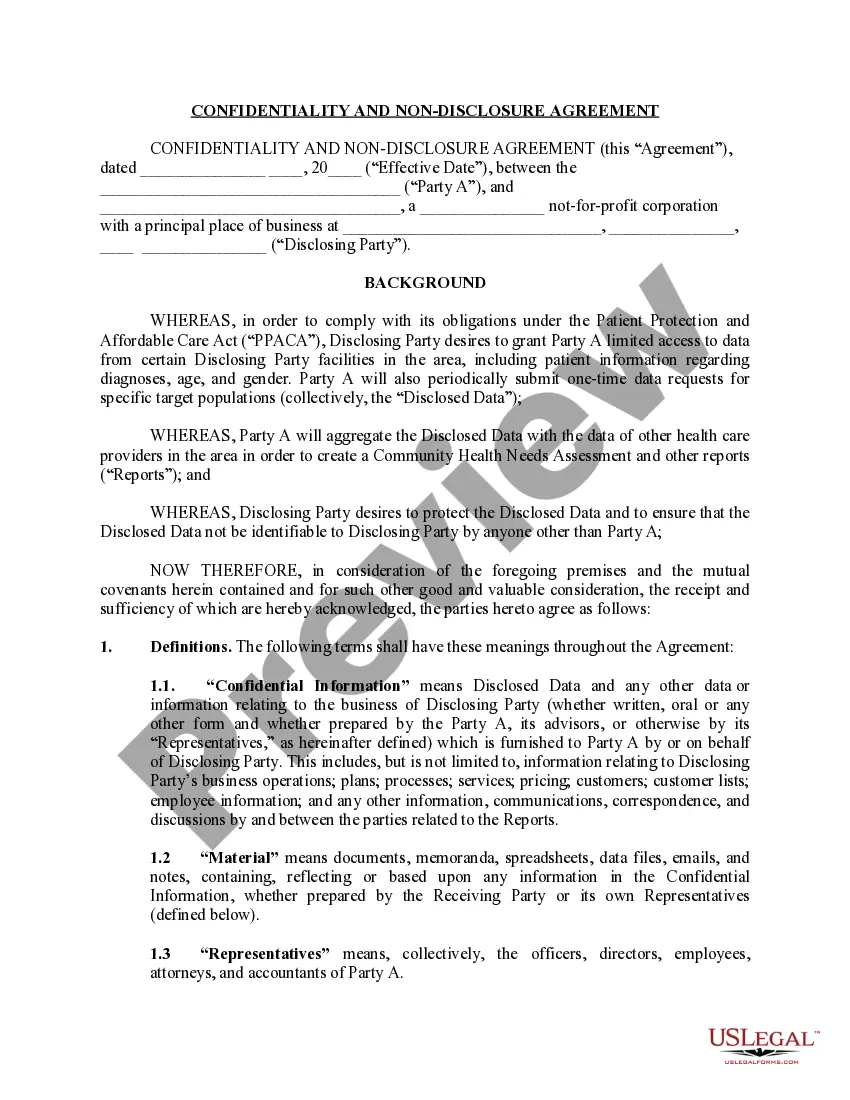

Choosing the best authorized file template might be a battle. Of course, there are plenty of templates available on the Internet, but how will you find the authorized type you will need? Utilize the US Legal Forms site. The assistance delivers 1000s of templates, for example the Indiana Bank Account Monthly Withdrawal Authorization, which you can use for company and personal requires. All the types are checked by professionals and meet state and federal needs.

Should you be presently signed up, log in for your bank account and then click the Download option to have the Indiana Bank Account Monthly Withdrawal Authorization. Utilize your bank account to check from the authorized types you have ordered formerly. Proceed to the My Forms tab of your bank account and obtain another duplicate from the file you will need.

Should you be a new end user of US Legal Forms, here are easy instructions that you should stick to:

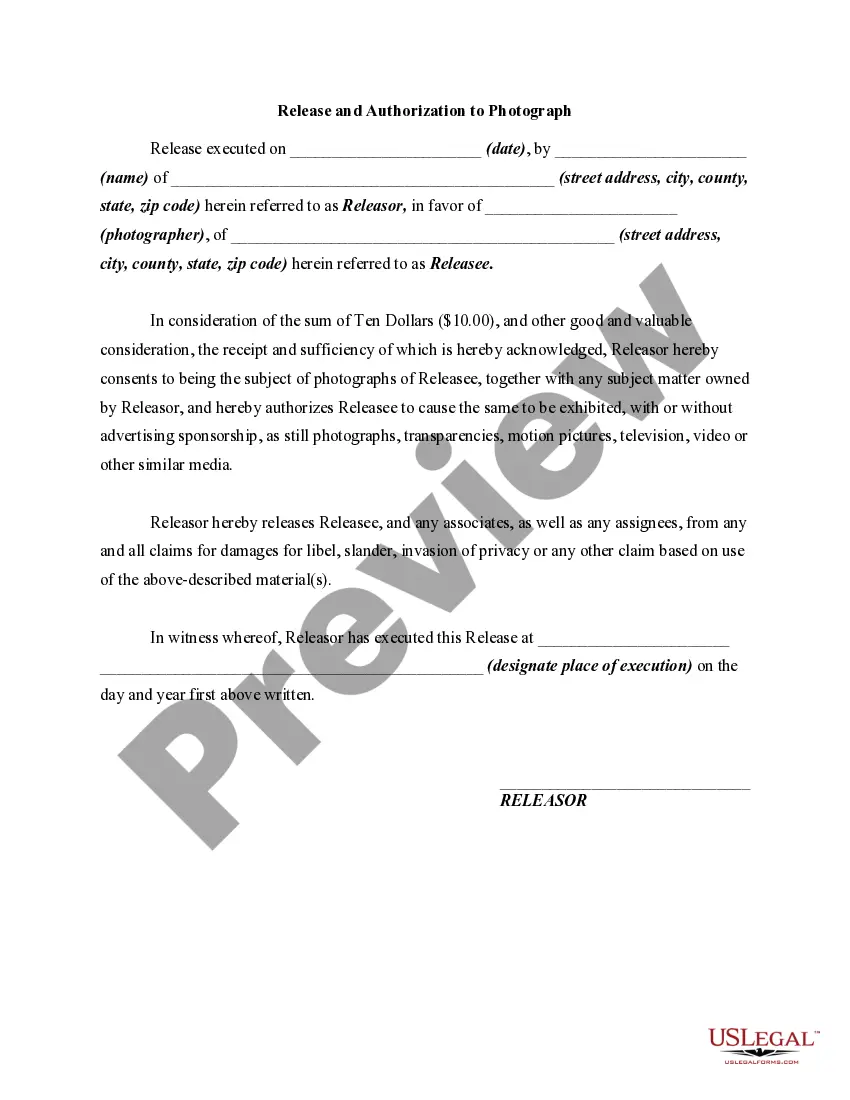

- First, be sure you have selected the proper type for your metropolis/area. You are able to look over the shape making use of the Review option and read the shape explanation to ensure it is the best for you.

- In case the type is not going to meet your requirements, utilize the Seach industry to get the right type.

- When you are certain the shape is proper, select the Buy now option to have the type.

- Select the prices strategy you desire and enter in the necessary information. Make your bank account and pay for your order with your PayPal bank account or charge card.

- Select the file formatting and download the authorized file template for your device.

- Full, change and printing and indicator the acquired Indiana Bank Account Monthly Withdrawal Authorization.

US Legal Forms is definitely the greatest collection of authorized types for which you can discover various file templates. Utilize the service to download professionally-created paperwork that stick to condition needs.

Form popularity

FAQ

Full-Year Residents A general rule of thumb is to file Indiana state taxes if your income is $1,000 or more. When in doubt, it is best to file. To determine if you're required to file, first, figure your Indiana exemptions.

The IntiMe dietary supplement helps regenerate the microbiota of your intimate parts. It has been demonstrated that colon microbiota also affects the vaginal flora. The IntiMe dietary supplement can be used to boost the immunity of your whole body.

Return Line Item: When the ?Return Line Item? option is selected, choose the type of tax return form that was most recently submitted to validate the account.

Indiana Tax Identification Number You can find your Tax Identification Number in any mail you have received from the Department of Revenue. If you're unsure, contact the agency at (317) 233-4016.

Any individual filing an Indiana tax return may claim a $1,000 exemption for themselves. This exemption is available even if the individual can be claimed as a dependent on another taxpayer's return.

Indiana Tax Information Management Engine: INTIME If assistance is needed with an individual income tax, business or corporate tax account, contact DOR using INTIME to submit a question or get your issue resolved easily and efficiently.

Step 1: Navigate to INTIME at intime.dor.in.gov and click on the ?New to INTIME? Sign Up? hyperlink to create a logon username and password. Step 2: Go to the "Create Username" panel and click on the hyperlink.

Step 1: Log in to INTIME at intime.dor.in.gov, go to the ?All Actions? (tab) page and locate the ?Payment Plan? panel. Click on the ?Add a payment plan? hyperlink. Step 2: Click the checkbox at the bottom of the ?Is a payment plan right for me?? to proceed with requesting a payment arrangement, then click ?Next.?