This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

Selecting the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Indiana Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse, which you can utilize for professional and personal purposes.

All documents are vetted by experts and comply with federal and state regulations.

Once you are confident that the form is correct, click the Get now button to acquire the form. Choose the pricing plan you wish and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template onto your device. Complete, edit, print, and sign the acquired Indiana Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse. US Legal Forms is the largest library of legal forms where you can find various document templates. Utilize the service to obtain professionally-crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Indiana Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

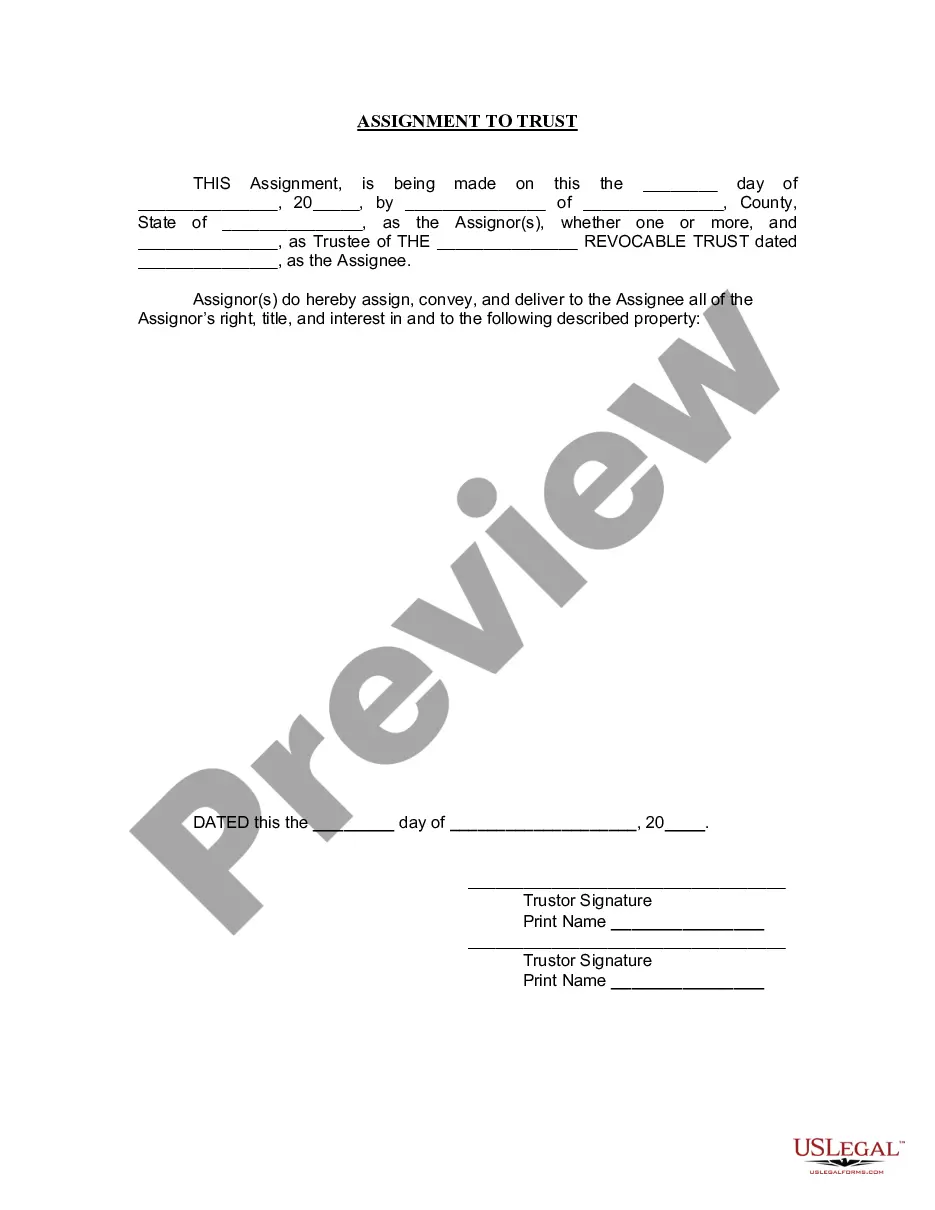

- First, ensure you have selected the correct form for your city/region. You can review the document using the Preview button and check the form details to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate document.

Form popularity

FAQ

liable spouse refers to an individual who cannot be held accountable for debts or liabilities of their partner. The Indiana Notice of NonResponsibility for Debts or Liabilities Contracted by Spouse solidifies this status by legally defining the boundaries of financial responsibility. This designation is crucial in protecting spouses from being burdened by unapproved debts. You can access helpful materials and legal forms on US Legal Forms to better understand how to establish this nonliability.

An innocent spouse is someone who can demonstrate that they were unaware of any tax liabilities incurred by their partner. For an individual to qualify under the Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, they must meet certain criteria, including proving that they did not benefit from the debt. In such cases, the innocent spouse may avoid financial implications related to their partner's obligations. Resources available on US Legal Forms can aid in navigating these requirements.

In general, a wife may not be held responsible for her husband's tax debt if she did not sign the tax returns. The Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse offers clarity in these situations. This notice protects all parties by clearly stating that resources from one spouse will not be used to cover the other spouse's liabilities. If you seek more detailed guidance on this, platforms like US Legal Forms can provide the necessary documents.

You can submit the injured spouse form by attaching it to your joint tax return when you file, or you can file it separately if you have already submitted your return. Be careful to ensure it is complete and accurate to avoid delays, especially if it relates to the Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. The uslegalforms platform can provide you with templates and guidance for proper submission, making the process smoother.

Yes, the injured spouse form can be denied if it doesn't meet the eligibility criteria outlined by the IRS. Common reasons for denial include incomplete information or incorrect submission of forms. If your claim relates to the Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, make sure all relevant details are correctly filled. Consider leveraging the uslegalforms platform to help you avoid common pitfalls in your application.

The injured spouse form is filled out by the spouse who wants to claim the injured spouse relief. This individual must typically provide details about their income and the tax withheld. It’s vital, especially for those referencing the Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, to provide accurate information. Using resources like the uslegalforms platform can simplify this process and enhance your accuracy.

To file an injured spouse claim under the tax Act, start by using IRS Form 8379. Ensure you include this form when you file your joint tax return, or submit it separately if you have already filed. This is particularly important if your spouse's debts are a concern, as it relates to the Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. Additionally, the uslegalforms platform can guide you through this process and ensure you meet all requirements.

You can confirm the acceptance of your injured spouse form by checking your tax return status. After filing it, the IRS usually processes returns within a few weeks. If the Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse is relevant, you should see any applicable refund adjustments reflected in your account. Additionally, you may contact the IRS directly for further inquiries regarding your form.

A non obligated spouse is an individual who is not responsible for debts or liabilities incurred by their partner during the marriage. This status can be established through an Indiana Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. By filing this notice, a spouse indicates that they should not be held accountable for any financial obligations taken on by their partner. This distinction is important for protecting one’s financial interests and ensuring clear separation of individual financial responsibilities.

liable spouse is specifically recognized as not being responsible for the debts or liabilities incurred by their partner. This distinction is essential for protecting individual credit ratings and financial independence. An Indiana Notice of NonResponsibility for Debts or Liabilities Contracted by Spouse can help clarify this legal position. It's beneficial to document these terms to avoid future complications.