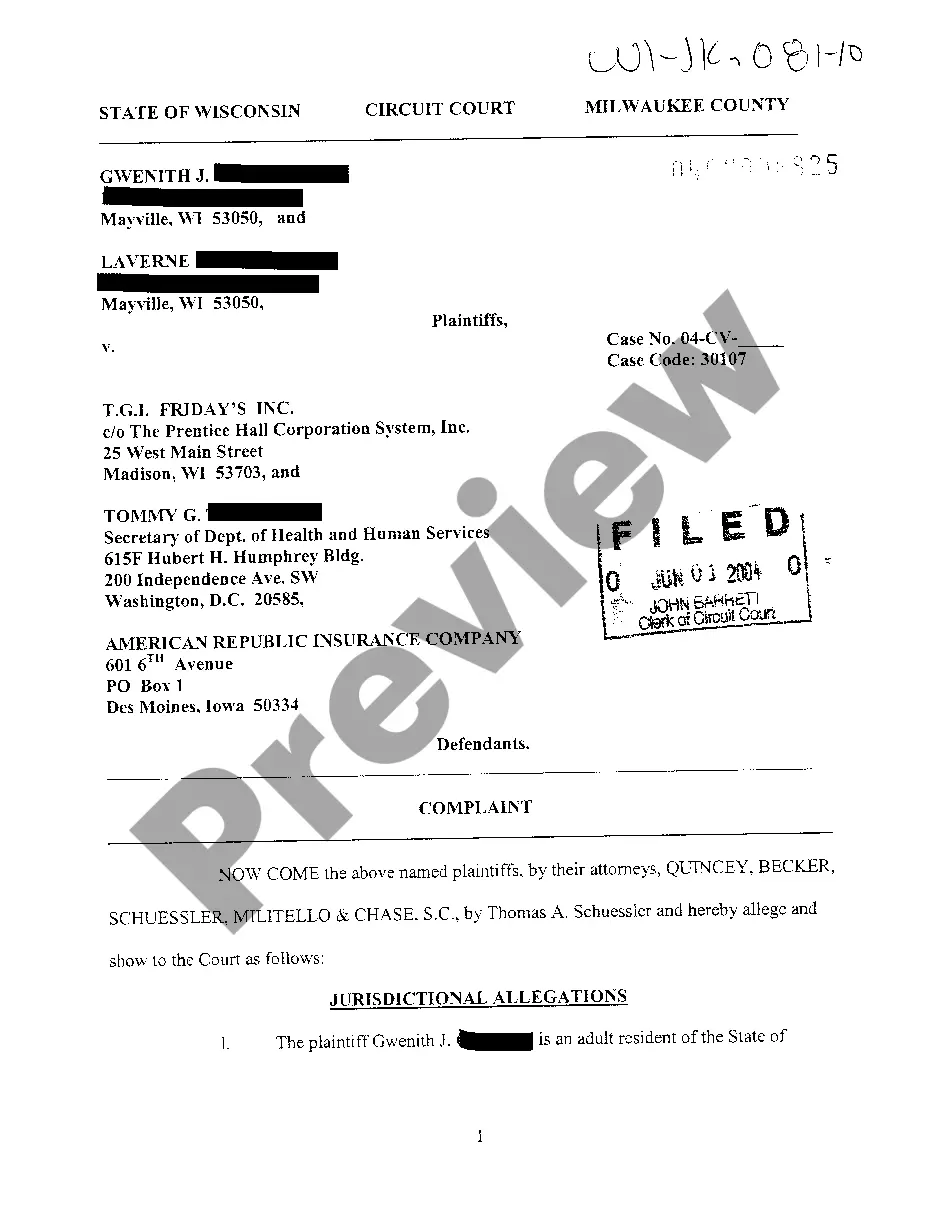

This is an agreement in which Spouse A (the spouse who is ordered by the court to make alimony and/or child support payments to Spouse B) must put assets (the principal) in a trust, from which the payments are made to Spouse B.

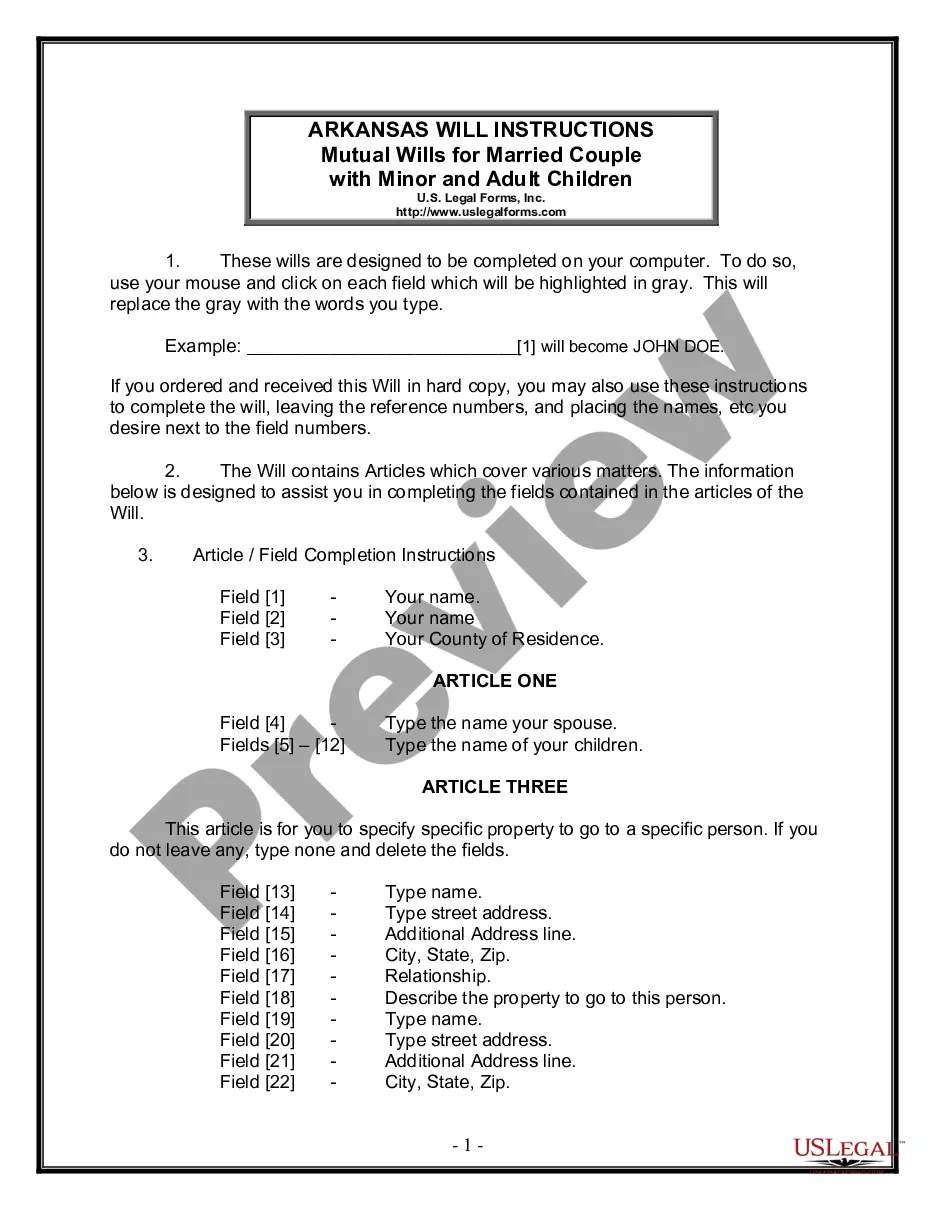

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.