A disclaimer deed is a deed in which a spouse disclaims any interest in the real property acquired by the other spouse. A mortgage company often asks a borrower to sign a disclaimer deed so that his spouse not having her name on the loan, cannot claim any interest in the property.

Indiana Disclaimer Deed

Description

How to fill out Disclaimer Deed?

Are you presently in a scenario where you need documentation for both business or personal purposes nearly every working day.

There are numerous legal document templates available online, but finding ones you can trust isn't straightforward.

US Legal Forms offers a vast array of form templates, such as the Indiana Disclaimer Deed, that are designed to meet state and federal requirements.

Utilize US Legal Forms, one of the most extensive collections of legal documents, to save time and avoid mistakes.

The service provides properly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit simpler.

- If you are already acquainted with the US Legal Forms website and possess your account, simply Log In.

- Then, you can download the Indiana Disclaimer Deed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

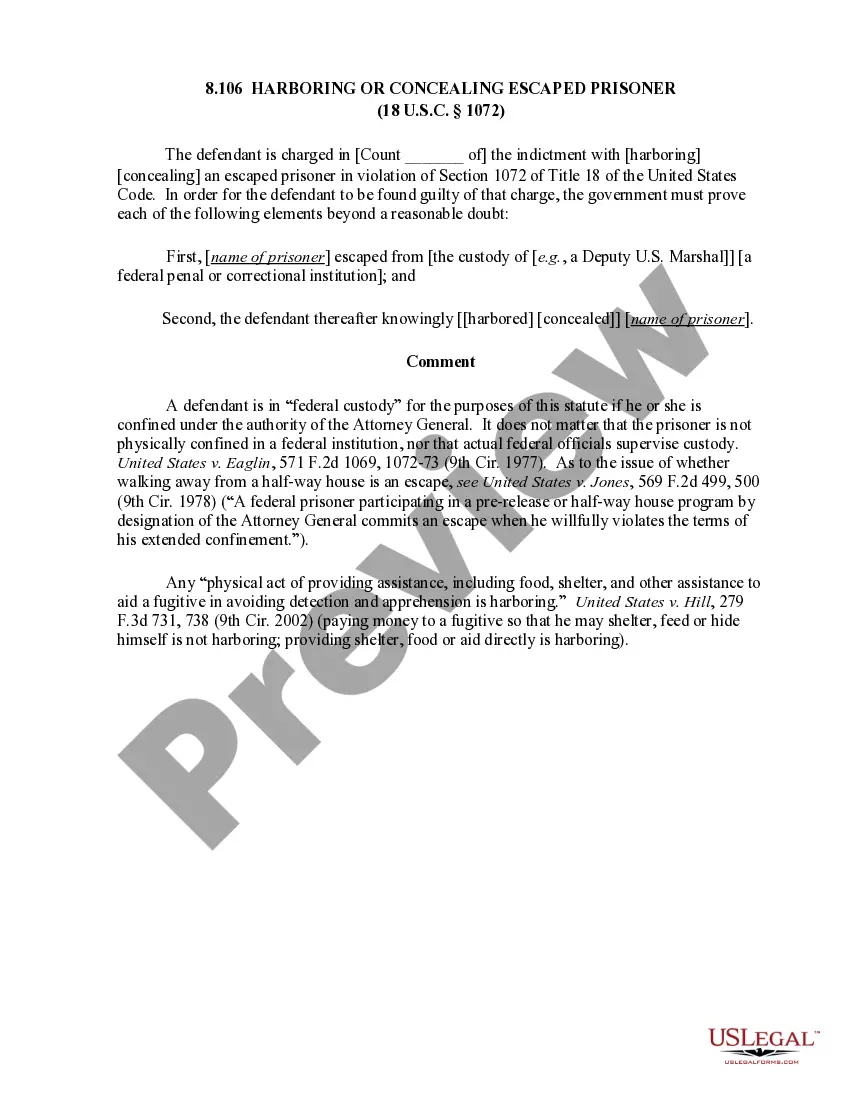

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Acquire now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and purchase the order with your PayPal or credit card.

- Select a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can download an additional copy of the Indiana Disclaimer Deed at any time if needed. Just click on the necessary form to download or print the document template.

Form popularity

FAQ

The primary purpose of a disclaimer is to allow individuals to refuse ownership of property, which can provide significant tax advantages and simplify estate management. An Indiana Disclaimer Deed serves as a formal notification that a beneficiary does not wish to accept the property or its associated responsibilities. This process can help maintain harmony among family members and adhere to the estate's intentions. Ultimately, it is a useful tool for managing property transitions smoothly.

When a disclaimer is applied within an estate, it enables a beneficiary to refuse their inheritance, allowing it to pass directly to the next heir. This can streamline the distribution process and minimize estate taxes. Using an Indiana Disclaimer Deed can help avoid complications and ensure that the estate is settled according to the deceased's wishes. This approach promotes clarity and fairness among beneficiaries.

An Indiana Disclaimer Deed allows an individual to renounce their interest in a property without accepting liability for debts associated with it. This legal document ensures that the property automatically passes to the next designated heir or beneficiary. It simplifies the transfer process and helps avoid potential conflicts among heirs. By using a disclaimer deed, you can effectively communicate your intentions regarding property ownership.

To obtain a copy of a deed in Indiana, you can visit the county recorder's office where the property is located. Often, these offices maintain online databases where you can search for the Indiana Disclaimer Deed and request a copy. Additionally, you can utilize platforms like US Legal Forms to access templates and instructions that guide you through the process of obtaining your deed. This ensures that you have the correct documentation for your needs.

People often choose to disclaim property to avoid tax liabilities or to simplify an estate. By using an Indiana Disclaimer Deed, individuals can formally refuse a gift or inheritance, thereby passing it on to the next beneficiary. This process can help prevent disputes among heirs and ensure that the property goes to the intended recipient. Ultimately, it offers a straightforward way to manage property without the associated burdens.

In Indiana, a Disclaimer of inheritance does not always require notarization, but it is often a good practice to have it notarized to ensure authenticity. Having a notarized disclaimer can help prevent any disputes or challenges to its validity. For accurate guidance and to access necessary forms, you can explore US Legal Forms, which provides templates and insights for Indiana Disclaimer Deed filings.

To disclaim a property, you need to prepare a written disclaimer that states your refusal to accept the property. This document should be filed with the probate court where the estate is being administered. For those unfamiliar with the process, US Legal Forms offers comprehensive resources to assist you in preparing a proper Indiana Disclaimer Deed.

Writing a disclaimer example involves drafting a formal document that includes your name, the property description, and your intent to disclaim. It should be concise and clear, ensuring it meets the legal requirements outlined in Indiana law. US Legal Forms is a great resource to find examples and templates that can help you craft your disclaimer effectively.

To write a disclaimer of inheritance, clearly state your name, the decedent's name, and your intention to refuse the inheritance. Make sure to describe the specific property involved, and include your signature and date. For detailed guidance, consider using US Legal Forms, which provides templates tailored to Indiana Disclaimer Deed procedures.

An example of a Disclaimer of estate could be a situation where an heir chooses to refuse their share of property left to them in a will. The heir would draft a disclaimer that specifies the property and their intention to decline the inheritance. For those in Indiana, it’s beneficial to refer to US Legal Forms for precise templates that align with Indiana Disclaimer Deed laws.