Indiana Pledge of Shares of Stock

Description

How to fill out Pledge Of Shares Of Stock?

Are you in the location where you will require documents for potentially business or personal reasons almost every day? There are many valid document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast selection of form templates, including the Indiana Pledge of Shares of Stock, which can be tailored to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Indiana Pledge of Shares of Stock template.

- Locate the form you need and ensure it is for the correct area/region.

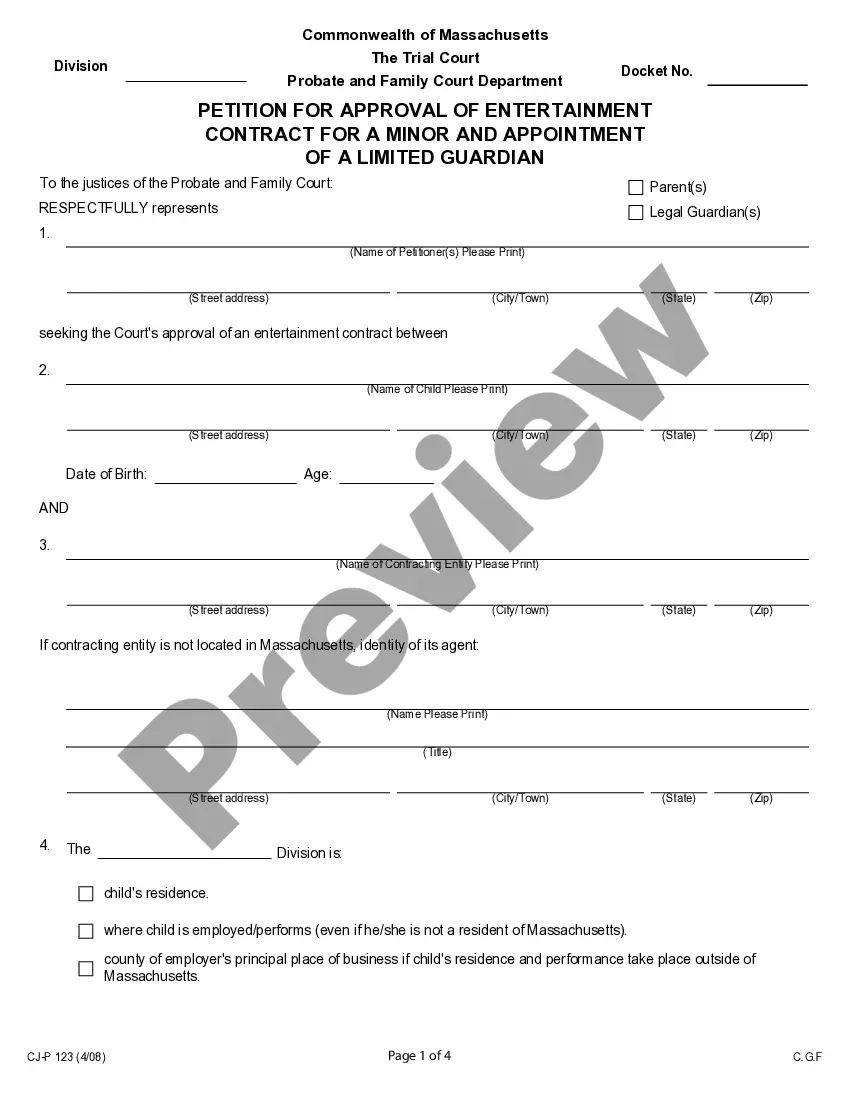

- Utilize the Preview option to view the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you prefer, fill in the required details to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

To perfect a stock pledge, you must follow specific legal steps to ensure the lender's rights are recognized by third parties. Generally, you file the pledge agreement with the appropriate state office and notify the issuing company of the pledge. This process ensures that your Indiana Pledge of Shares of Stock is legally binding and enforceable.

Yes, typically you will receive dividends for pledged shares while the agreement is active. The Indiana Pledge of Shares of Stock does not automatically transfer the dividend rights to the lender. However, you should check the specific terms of your pledge agreement to understand how dividends are handled.

Pledging shares online can be conveniently done through platforms like USLegalForms. Begin by selecting the appropriate form for the Indiana Pledge of Shares of Stock. Simply follow the prompts, inputting your share and lender information, and review your pledge agreement carefully. After you confirm your details, your pledge can be processed efficiently.

To pledge shares online, you typically start by accessing a reliable platform like USLegalForms. You’ll need to fill out the necessary forms, providing details about your shares and the pledge agreement. This process allows you to manage your Indiana Pledge of Shares of Stock with ease. Once completed, submit your information to finalize the pledge.

To pledge shares, you will generally need several key documents, including a pledge agreement and any certificates representing the shares. Additionally, you might be required to provide identification and proof of ownership of the shares in question under the Indiana Pledge of Shares of Stock. Consulting with a legal expert or using a platform like US Legal Forms can streamline gathering these documents, ensuring you're prepared for a smooth transaction.

The process of pledging shares typically begins with evaluating your financial needs and determining the value of the shares to be pledged. Once decided, you will need to draft a pledge agreement, outlining the terms and conditions as per the Indiana Pledge of Shares of Stock. This agreement must be executed and may require the endorsement of your shares. After meeting these steps, your lender will secure the pledge and hold the necessary documents until you fulfill the commitment.

If you choose not to pledge your shares, you retain full ownership and control over them. This means you can sell or transfer your shares freely, without any restrictions imposed by a financial agreement. However, not pledging your shares also means you may lack access to immediate funding, as you won't have the advantage of using your shares as collateral. Evaluating your financial needs is crucial in deciding whether to pledge your shares or keep them unencumbered.

To invoke a pledge of shares, start by drafting a written notice to the shareholder outlining the pledge terms. Make sure to include the reasons for invoking the pledge and the relevant details under the Indiana Pledge of Shares of Stock guidelines. This formal communication ensures clarity and maintains legal standing.

A share pledge involves a transaction where shares are held as collateral for a debt. In the Indiana Pledge of Shares of Stock, the lender receives the right to take ownership of the shares if the borrower fails to meet their obligations. This arrangement provides security for the lender while allowing the borrower to utilize the shares effectively.

Enforcing a share pledge typically involves ensuring compliance with the terms set out in the pledge agreement. If the borrower defaults, the lender can reclaim the shares as stipulated in the Indiana Pledge of Shares of Stock. Engaging legal assistance can also help navigate this process and protect your rights.