Indiana Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a broad selection of legal template options that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Indiana Revocable Trust for Lottery Winnings in just a few minutes.

If the form does not meet your needs, utilize the Search feature at the top of the page to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Next, choose the payment plan that suits you and provide your details to register for an account.

- If you have a current monthly subscription, Log In and retrieve the Indiana Revocable Trust for Lottery Winnings from the US Legal Forms database.

- The Download button will be available on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple guidelines to help you start.

- Ensure you have chosen the correct form for your city/state.

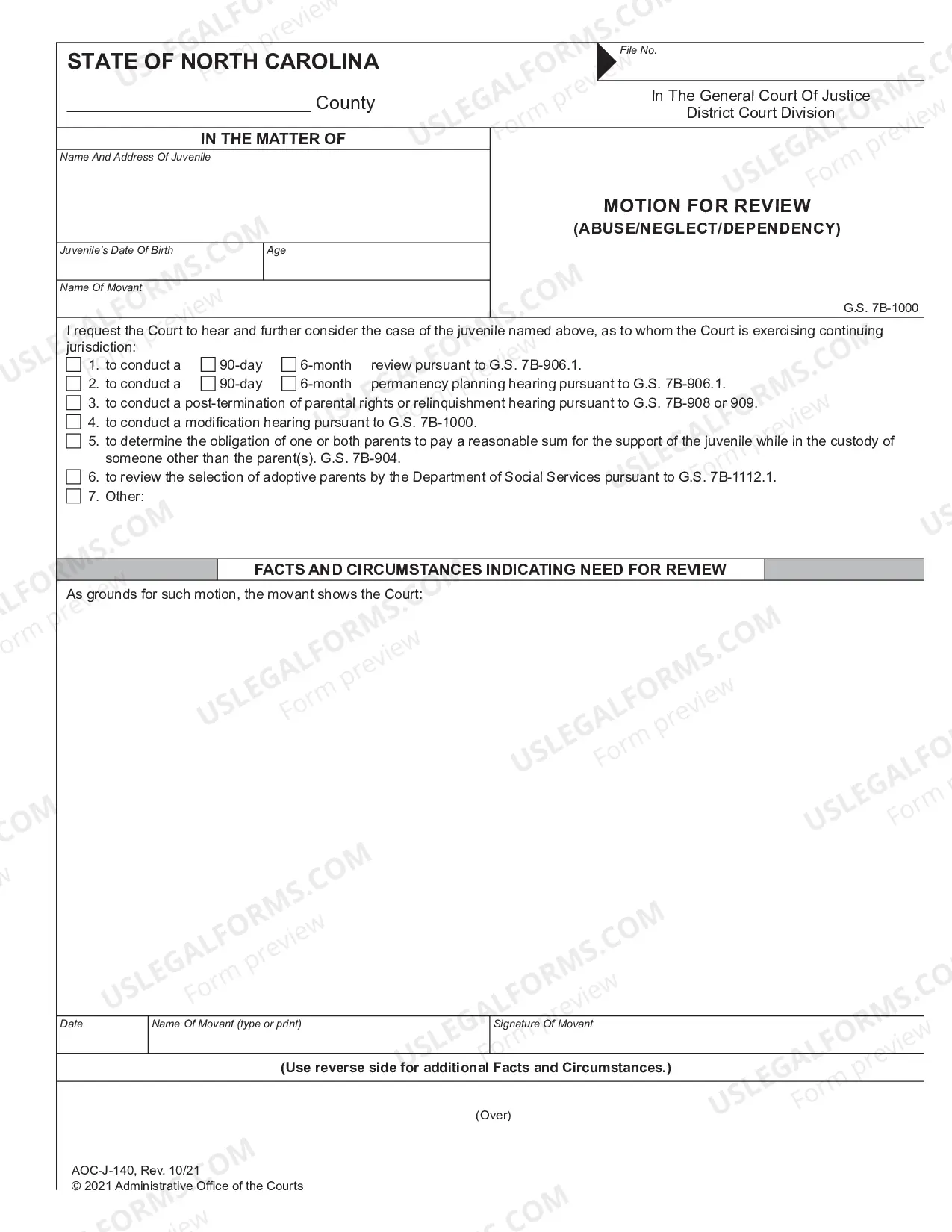

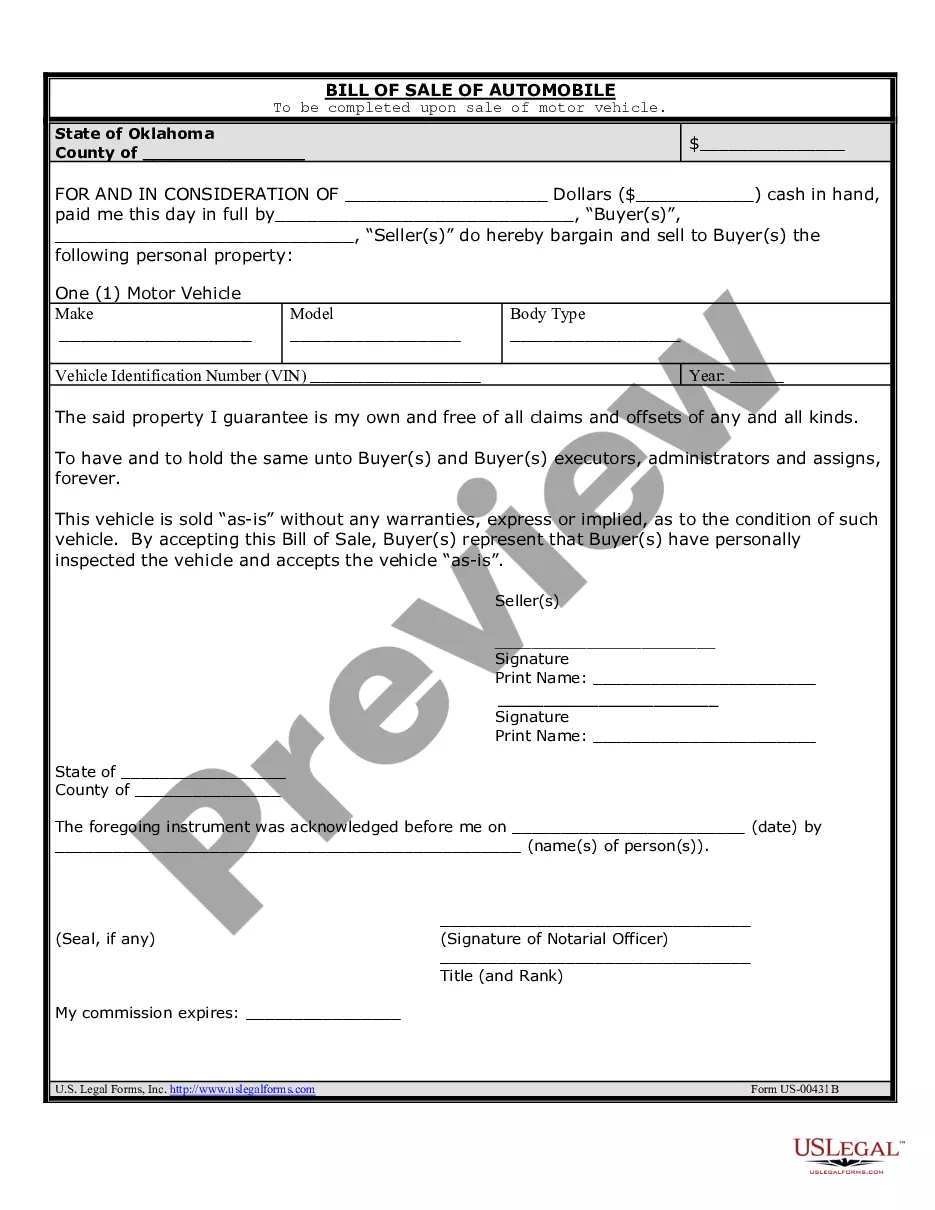

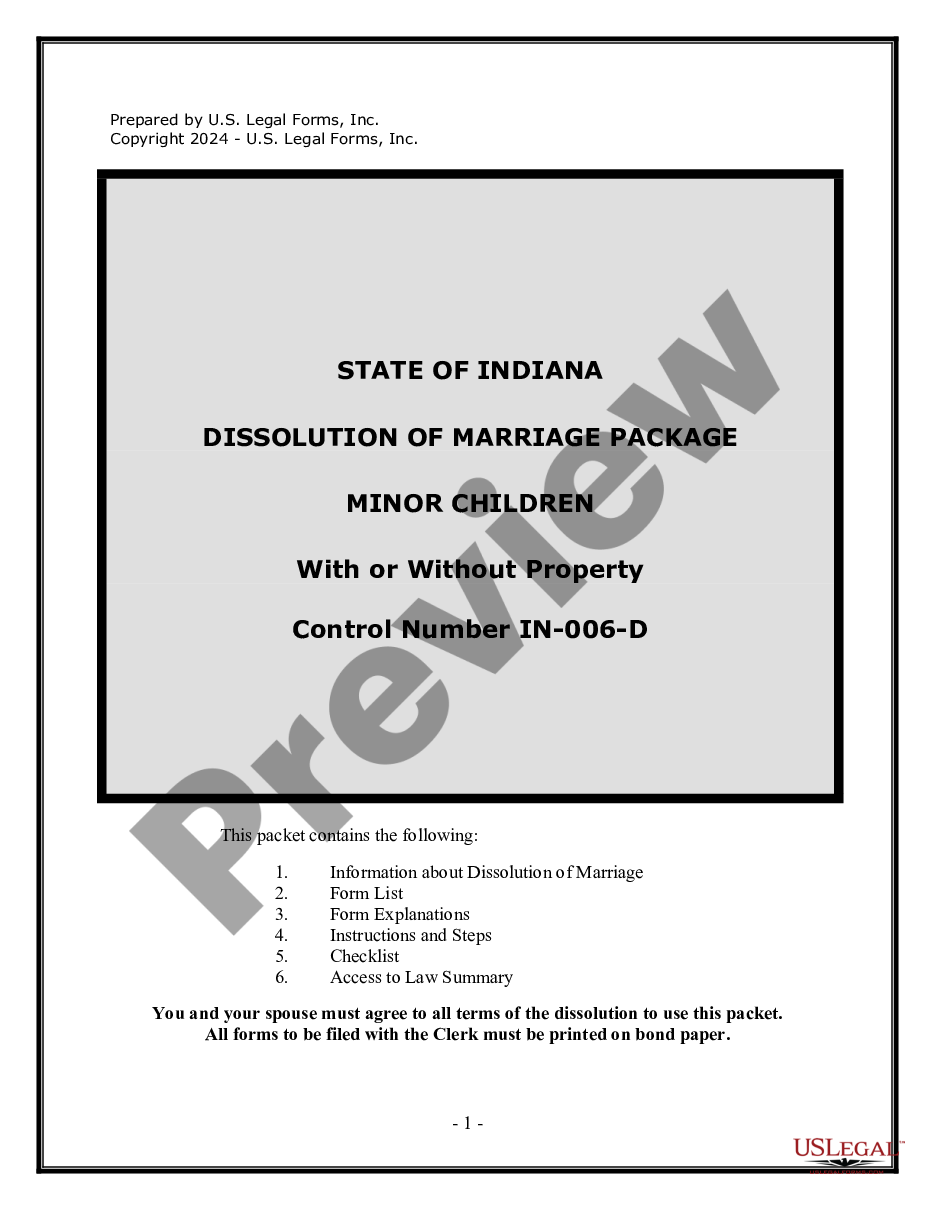

- Click the Review button to examine the content of the form.

Form popularity

FAQ

To claim lottery winnings with a trust, start by setting up an Indiana Revocable Trust for Lottery Winnings. When you win, you can present the trust documentation along with your claim form to the lottery commission. This method not only streamlines the claims process but also offers benefits like tax planning and asset protection.

The best place to deposit your lottery winnings generally includes reputable banks that offer secure options and competitive interest rates. Consider looking into banks that have a history of good customer service. If you choose to create an Indiana Revocable Trust for Lottery Winnings, you may also explore setting up an account in the trust's name for added asset protection.

In Indiana, winners may not fully remain anonymous, but there are ways to protect their identity. A popular method is setting up an Indiana Revocable Trust for Lottery Winnings, as this allows you to claim the prize with the trust's name instead of your personal name. This strategy adds privacy and keeps your financial details private.

Handling large lottery winnings requires a thoughtful approach. Start by consulting with financial advisors and estate planners who can help structure your assets efficiently. Establishing an Indiana Revocable Trust for Lottery Winnings allows you to protect your assets and plan for the long term while ensuring you make the most of your newfound wealth.

To avoid gift tax on lottery winnings, consider establishing an Indiana Revocable Trust for Lottery Winnings. This type of trust allows you to manage your assets without immediately transferring them to others. By placing your winnings in this trust, you can control how and when your gifts are distributed, potentially minimizing tax implications. Consulting with a tax professional and using platforms like uslegalforms can help you navigate the complexities of trust creation and ensure compliance with tax regulations.

The best investment after winning the lottery often includes diversifying your portfolio with real estate, stocks, and bonds. It's crucial to work with financial advisors to build a balanced approach that meets your financial goals. Establishing an Indiana Revocable Trust for Lottery Winnings can help in managing these investments effectively while providing safeguards for your assets. Strategic investments can significantly enhance your wealth over time.

The best trust to establish upon winning the lottery is typically an Indiana Revocable Trust for Lottery Winnings. This trust allows you to maintain control over your assets while providing the privacy that many winners seek. It also makes the transfer of wealth to heirs easier and avoids probate delays. Consider consulting with uslegalforms to assist in setting up the right trust for your situation.

An Indiana Revocable Trust for Lottery Winnings is often the best choice for managing lottery prizes. This type of trust offers flexibility, allowing you to modify terms as your circumstances change. Additionally, it provides a level of protection against creditors and can streamline the distribution of your assets. Having a personalized trust tailored to your needs can enhance your financial security.

The first step after winning the lottery should be to stay calm and consider establishing an Indiana Revocable Trust for Lottery Winnings. This trust can help manage your winnings effectively and provide you with a solid foundation for your financial decisions. Setting up a consultation with a financial advisor can also guide you through the process of safeguarding your newfound wealth. Planning ahead is crucial to maximizing your benefits.

In Indiana, winners of a lottery can remain anonymous if they set up an Indiana Revocable Trust for Lottery Winnings. By claiming your prize through this trust, you can protect your identity while still enjoying the financial benefits of your winnings. This approach not only adds a layer of privacy, but also helps in strategic financial management. Always ensure to follow the legal procedures when opting for this route.