This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

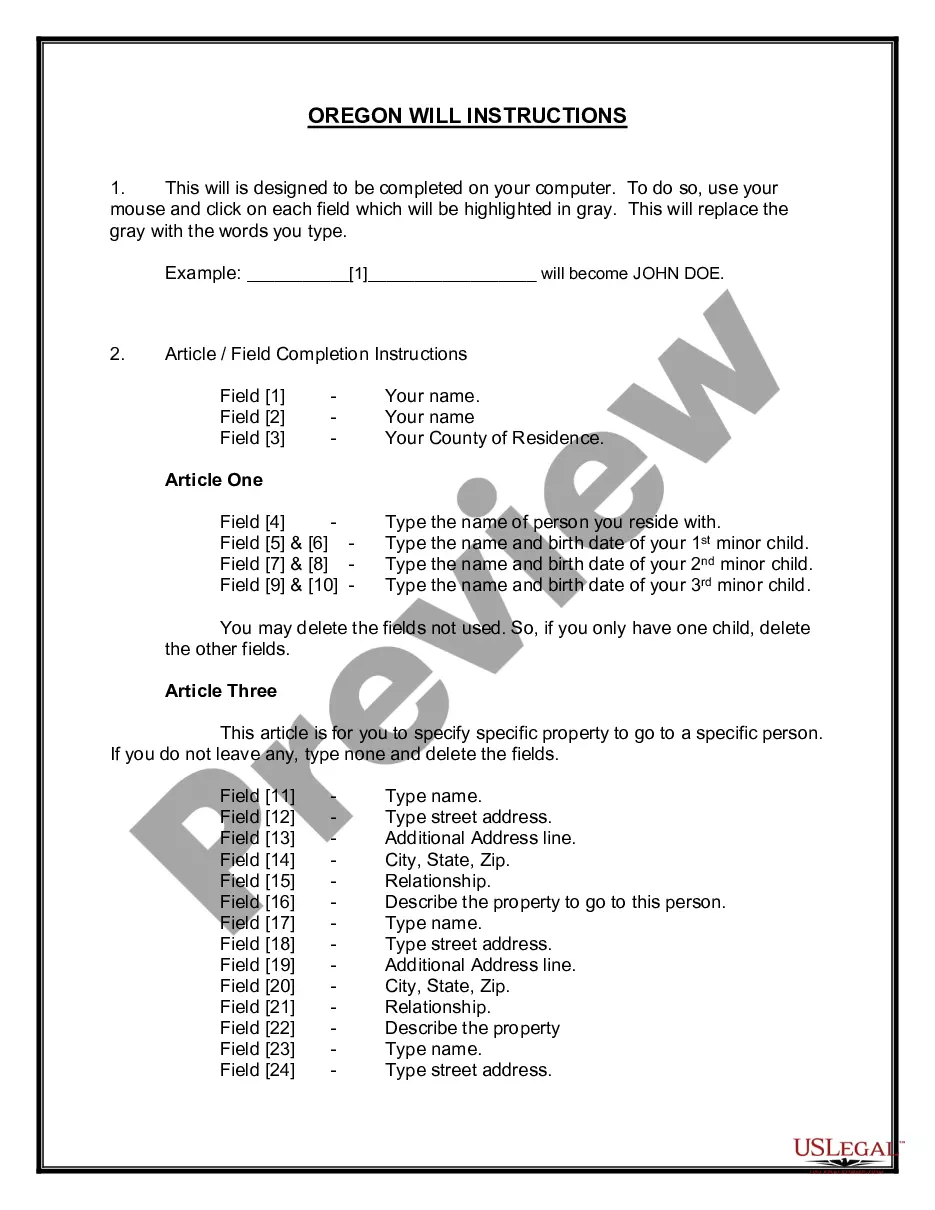

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

It is feasible to invest time online trying to locate the legal document template that complies with the federal and state requirements you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can easily download or print the Indiana Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually from our platform.

If available, utilize the Preview option to look over the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download option.

- After that, you may complete, edit, print, or sign the Indiana Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually.

- Every legal document template you acquire belongs to you indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

A promissory note without a maturity date is open-ended, meaning repayment does not have a set deadline. This can create flexibility for the borrower but may also pose challenges for the lender in tracking repayment. In contrast, an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually specifies terms that create structure. If you’re considering such options, clarity in terms helps define expectations.

The maturity value of a promissory note is the total amount due at the time of maturity, including the principal plus any accrued interest. It reflects the financial commitment of the borrower based on the agreement's terms. For an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, understanding the maturity value is crucial for both parties' financial planning. It ensures clarity and preparedness for repayment.

Some disadvantages of a promissory note include the risk of default by the borrower and potential legal complications if terms are violated. Additionally, if the note lacks clear conditions, it could lead to misunderstandings. On the other hand, an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can be designed to minimize these risks through clearly defined terms. Properly structured, such notes can be a reliable tool.

Yes, you can create a promissory note with no interest, which is known as a non-interest bearing promissory note. This type of note can help simplify transactions, making it easier for both parties. However, an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually may offer more financial benefit for the lender. Choose the type that fits your financial goals.

Promissory notes must be clear and concise in their terms to be enforceable. They generally require a date, the names of the borrower and lender, repayment terms, interest rate, and any default terms. For an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it’s crucial that these details are explicitly outlined. Following legal guidelines ensures the note remains valid in court.

Interest does compound on a promissory note if the terms specify that it will. In the case of an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the interest accumulates until the maturity date. This means the total amount owed grows over time, enhancing the return for the lender. Understanding these terms can help you make informed financial decisions.

Yes, the income generated from an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is generally taxable. When you receive interest payments, they are considered taxable income. Additionally, when the note matures or if you sell it, any gain from the transaction may also be subject to taxes. For personalized advice, you might find it helpful to consult a tax professional or explore resources on the US Legal Forms platform for understanding your obligations.

In Indiana, the statute of limitations for enforcing a promissory note is six years. This applies to an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, meaning creditors must act within this timeframe to enforce payment. It's essential to maintain accurate records and track deadlines to ensure proper enforcement. US Legal Forms provides resources to help you keep everything organized.

Yes, you can create a promissory note without interest, often called a non-interest-bearing note. However, this may not be typical for an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, which usually includes an interest component. Be sure to document all terms clearly to avoid misunderstandings. Explore options on US Legal Forms to create notes that fit your financial situation.

Interest on an Indiana Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually accumulates over the life of the note. This means that the total amount due at maturity will include both the principal and the accumulated interest. When you create your note, specify the interest rate and the compounding period to clarify how interest will grow. Understanding this concept helps you manage the financial aspects effectively.