Indiana Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

Locating the appropriate sanctioned document format can be challenging. Of course, there are numerous templates available online, but how will you find the sanctioned form you need? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Indiana Sample Letter for Tax Deeds, which you can use for professional and personal purposes. All of the templates are vetted by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click the Download button to obtain the Indiana Sample Letter for Tax Deeds. Use your account to browse through the sanctioned templates you have previously acquired. Navigate to the My documents section of your account and retrieve another copy of the document you desire.

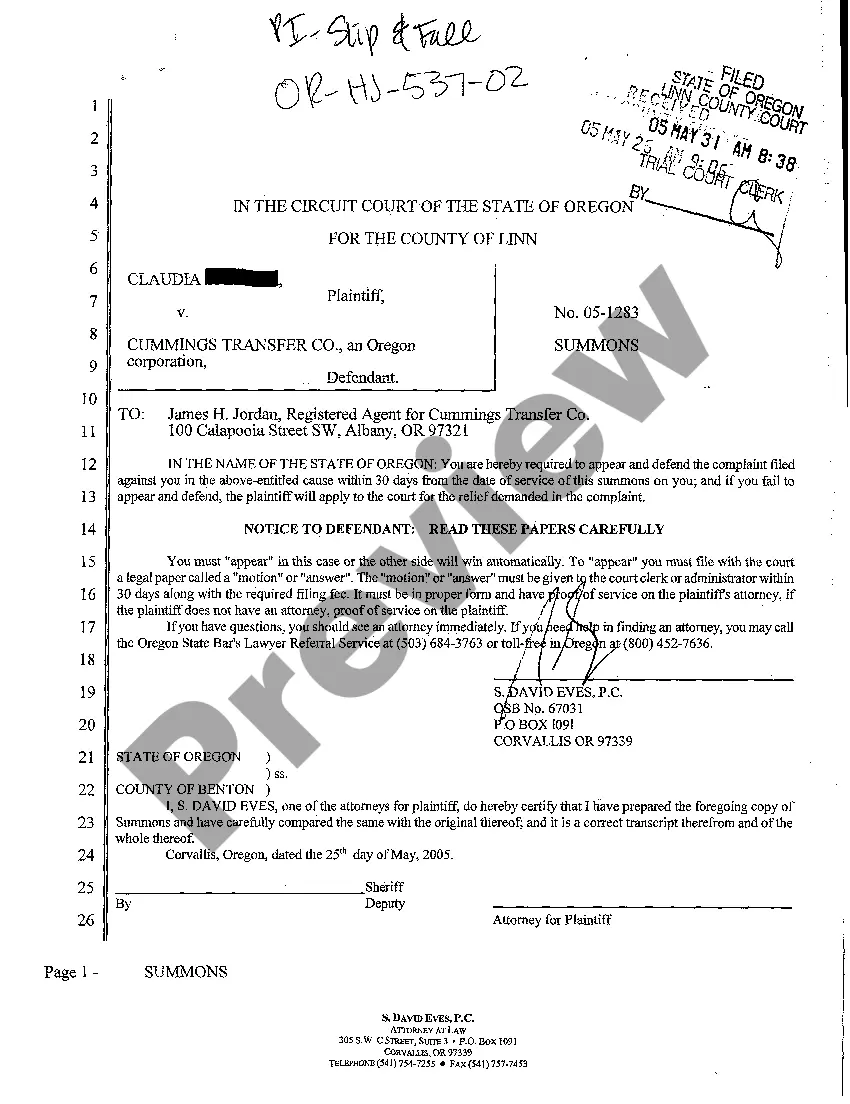

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can review the document using the Review button and read the document description to confirm this is indeed the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is suitable, select the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the sanctioned document format to your device. Complete, edit, print, and sign the obtained Indiana Sample Letter for Tax Deeds.

- US Legal Forms is the largest repository of sanctioned templates.

- You can find various document formats.

- Utilize the service to obtain professionally crafted documents.

- That comply with state regulations.

Form popularity

FAQ

After the 10 years is up, the IRS and Indiana must stop their tax collection efforts. A ?statute of limitations? refers to the amount of time a creditor has to file a lawsuit to collect an unpaid debt.

Pay Your Balance Online or by Mail If you received a tax warrant from issued by the Indiana Department of Revenue or from the Department of Workforce Development and need to pay the balance please use one of the options below. If you have questions, please call 317-327-2448.

To be eligible for a tax warrant expungement, all outstanding tax liabilities must be paid in full or otherwise resolved and the taxpayer must be current on all tax filings for the previous five years.

Today I'm answering your question, ?Is Indiana a tax lien state?? The answer is yes! So how do Indiana tax liens work? Property owners who fail to pay property tax when levied by the county treasurer will be penalized. Treasurers levy tax, and that's followed by their attempt to collect property tax.

The most simple way to remove a lien in Indiana is to simply to pay it off. A lien is a balance of money that must be paid before a property is sold. It simply attaches to your property like a mini-loan or mini-mortgage that must be eventually paid off.

Applicants may mail the completed Tax Clearance Form to Titles & Clearances Division 100 N. Senate Ave, Indianapolis, IN 46204. Applicants may file the Tax Clearance Form in person at Room N-105, Indiana Government Center North.

In Indiana, real estate may be sold for failure to pay real property taxes. Such a sale can and will remove a valid mortgage lien from the real estate unless the real estate is redeemed. There are three notices required under Indiana's statutory tax sale scheme: (1) pre-sale notice of the tax sale, I.C.

Indiana Code 6-8.1-5-2 defines the statute of limitations for sales tax assessment as 3 years from either the return filing date or the end of the calendar year when the return was due (whichever comes later).