Indiana Identity Theft Checklist for Minors

Description

How to fill out Identity Theft Checklist For Minors?

You can spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

It is easy to obtain or create the Indiana Identity Theft Checklist for Minors from the platform.

If available, use the Preview button to review the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that meets your needs and specifications. Once you have found the template you want, click Buy now to proceed. Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to the document if needed. You can complete, modify, sign, and print the Indiana Identity Theft Checklist for Minors. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the Indiana Identity Theft Checklist for Minors.

- Every legal document template you obtain is yours forever.

- To get an additional copy of any purchased form, visit the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Read the form description to confirm you have chosen the suitable form.

Form popularity

FAQ

Signs of identity theft Mail that you're expecting doesn't arrive. You get calls or texts about products and services you've never used. Strange emails appear in your inbox. A sudden increase in suspicious phone calls, texts or messages through social platforms.

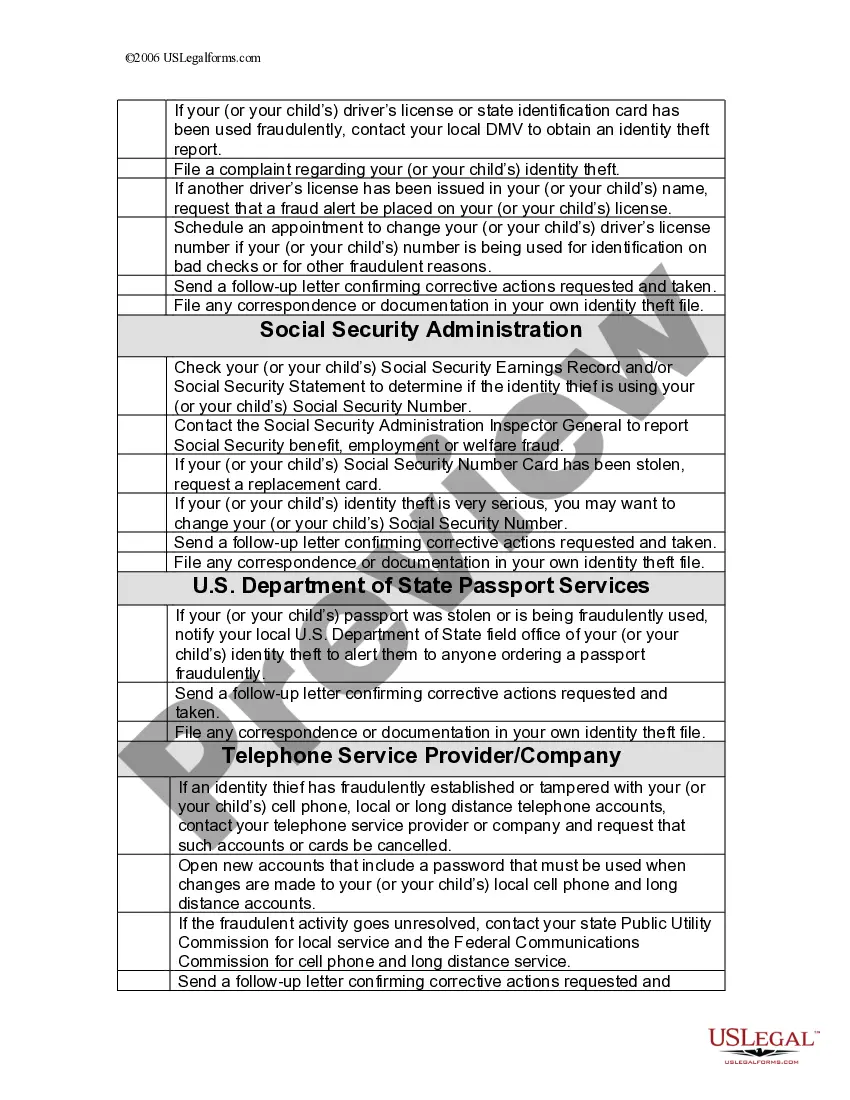

Federal prosecutors work with federal investigative agencies such as the Federal Bureau of Investigation, the United States Secret Service , and the United States Postal Inspection Service to prosecute identity theft and fraud cases.

Use a credit monitoring service Consider signing up for a credit monitoring service that notifies you when changes are posted to your credit report. This is one of the fastest ways to find out if someone has opened new accounts in your name.

Warning signs of identity theft Bills for items you did not buy. Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

Your name, address and date of birth provide enough information to create another 'you'. An identity thief can use a number of methods to find out your personal information and will then use it to open bank accounts, take out credit cards and apply for state benefits in your name.

They may think it's okay to use their child's identity temporarily. But if you don't pay it back, you will damage your child's credit score and set them up for financial hardship when they reach adulthood. The law remains the same, regardless of the circumstances.

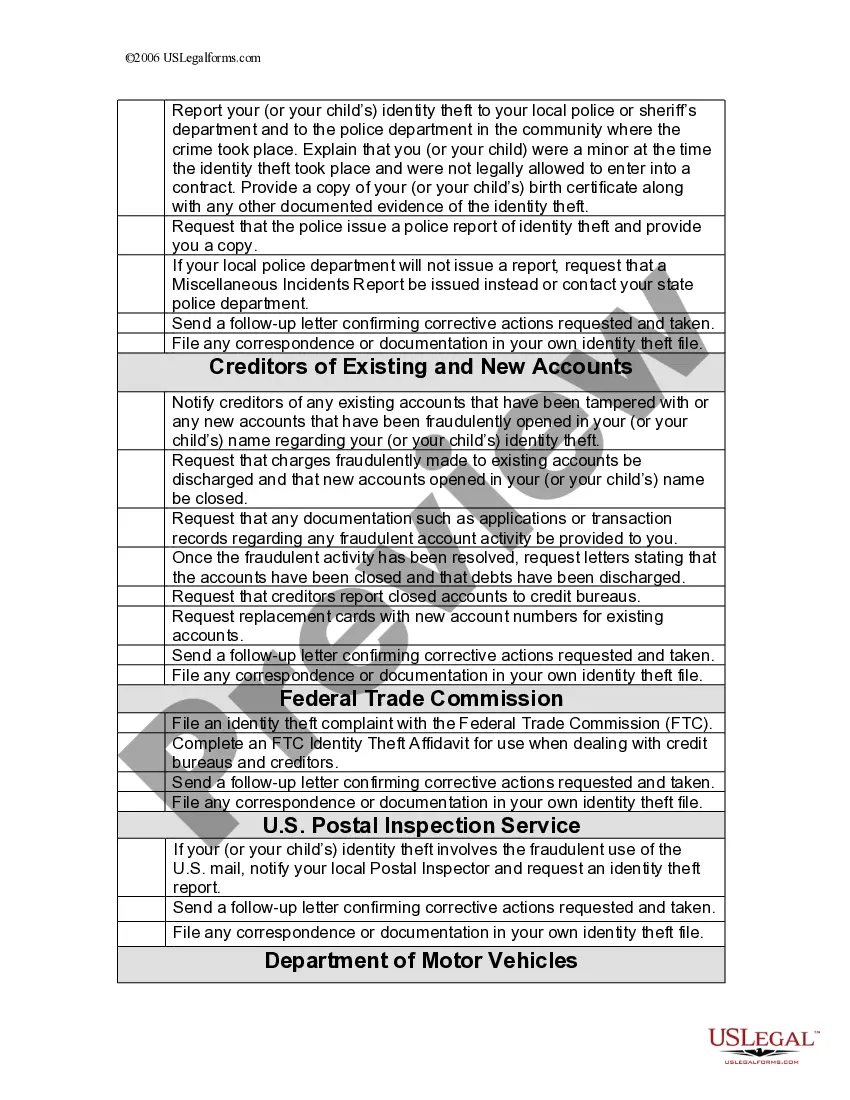

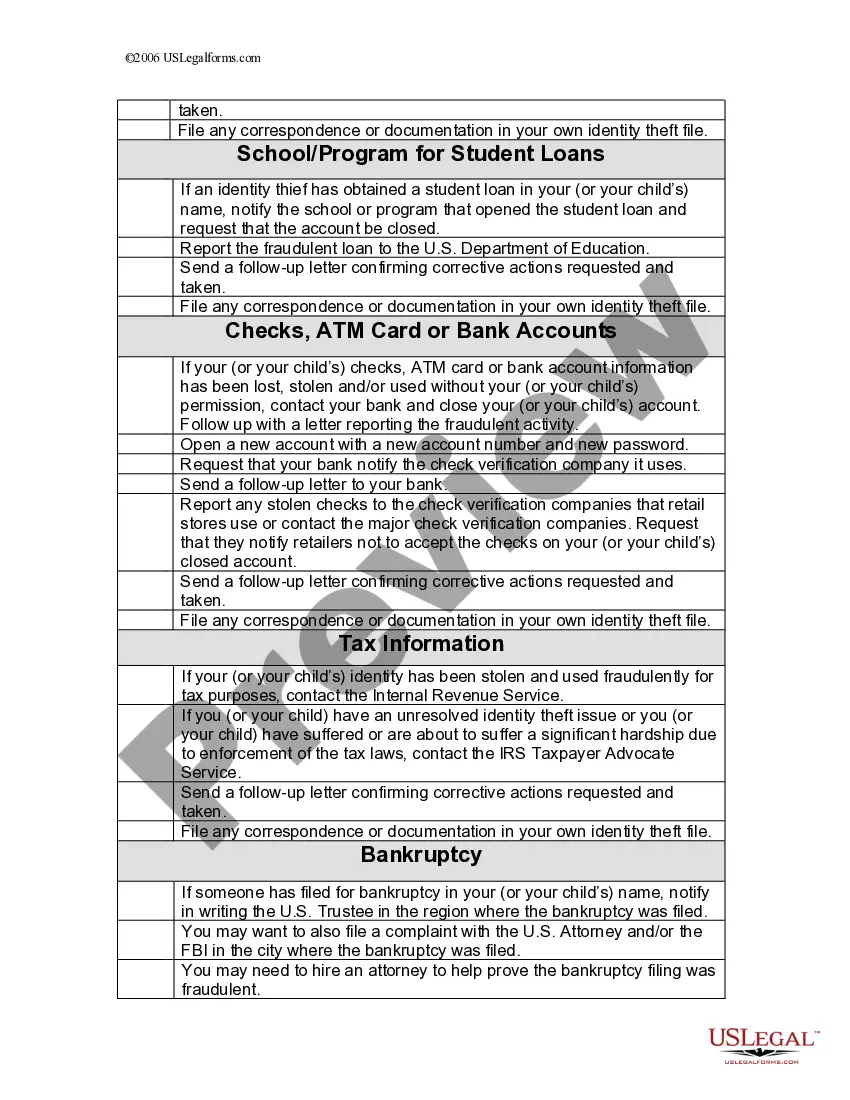

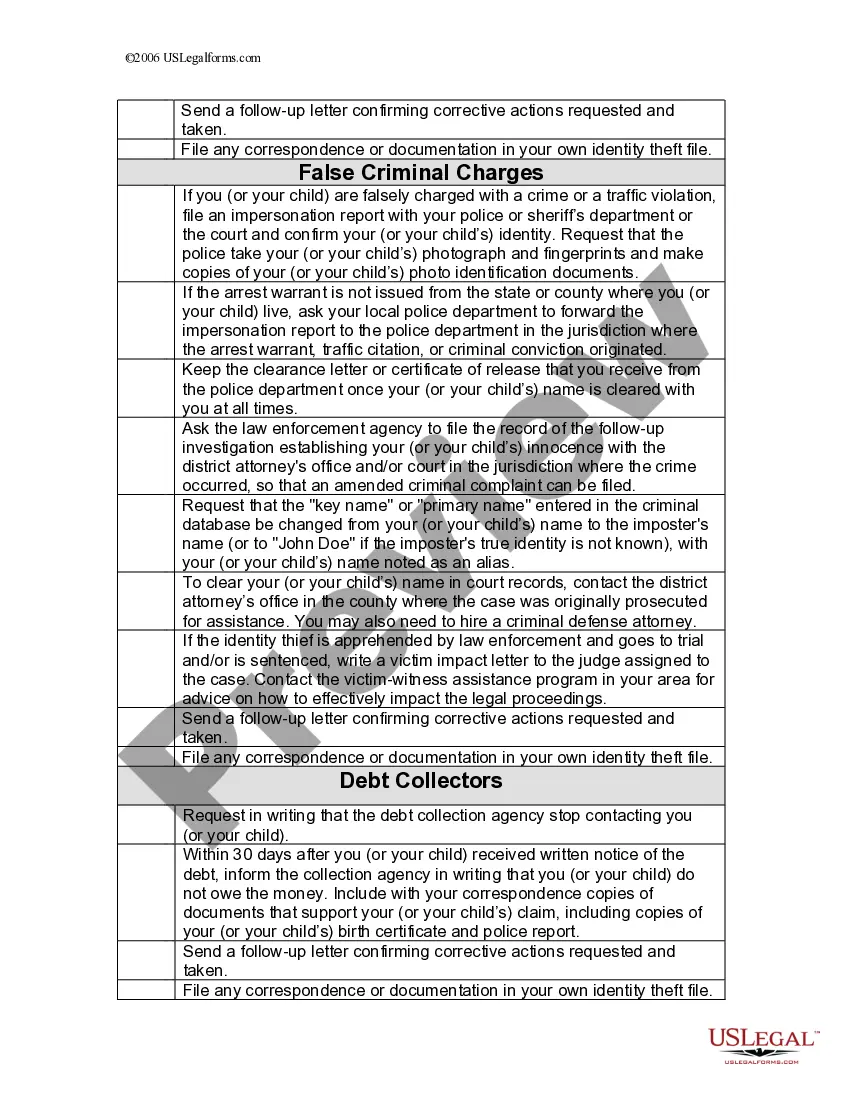

If your child's identity has been stolen, here are some steps you can take: Contact the Federal Trade Commission (FTC) to report the ID theft and get a recovery plan. Contact your local law enforcement and get a police report. Contact the fraud departments of companies where accounts were opened in your child's name.

Warning Signs of Child Identity Theft Unexpected bills addressed to your child. Collection notices that arrive by mail or phone, targeting your child. Denial of government benefits for your child on the basis that they've already been paid to someone using your child's Social Security number.