Indiana Security Agreement for Promissory Note

Description

How to fill out Security Agreement For Promissory Note?

It is feasible to dedicate time online looking for the sanctioned document template that meets the state and federal requirements you will need.

US Legal Forms provides thousands of official forms that are evaluated by experts.

It is easy to obtain or print the Indiana Security Agreement for Promissory Note from our service.

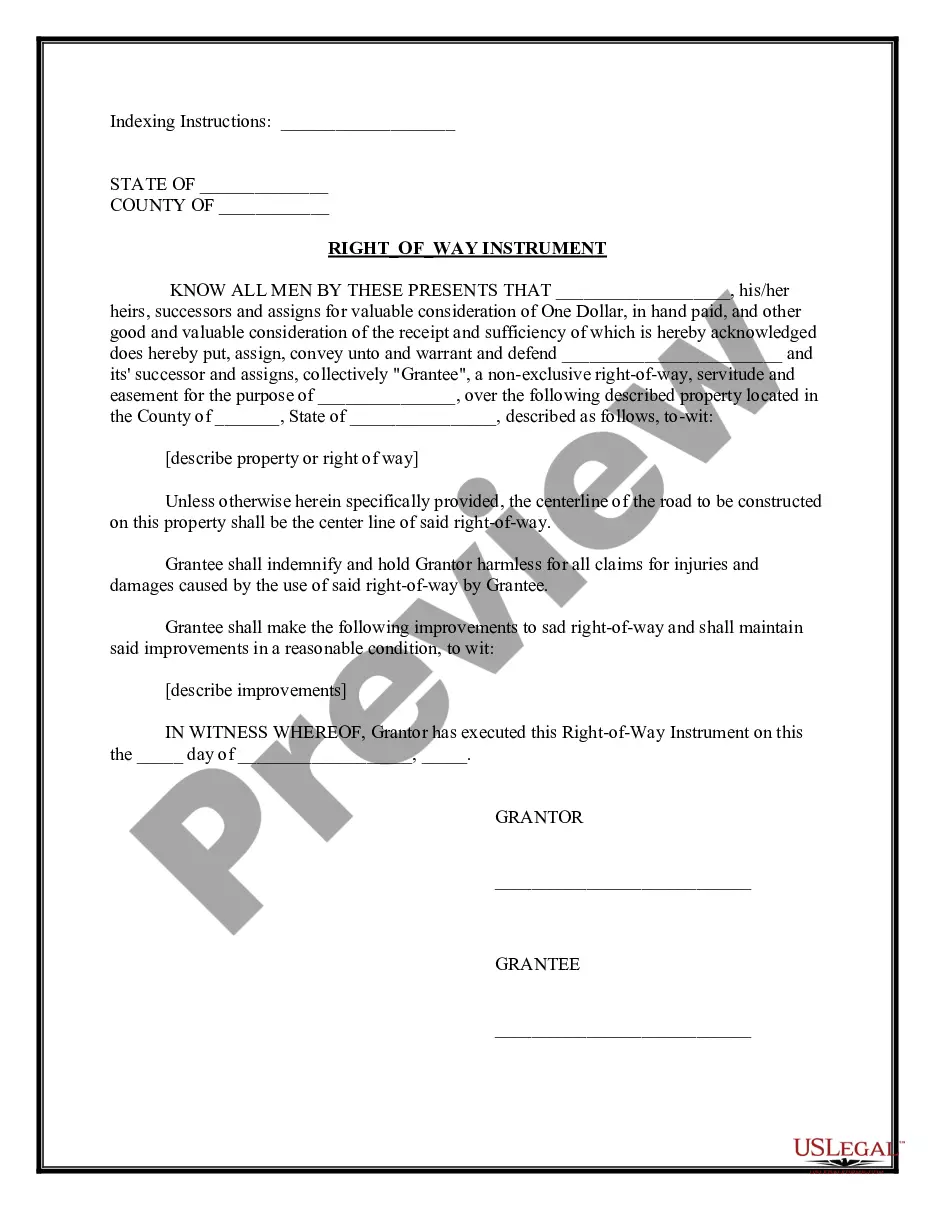

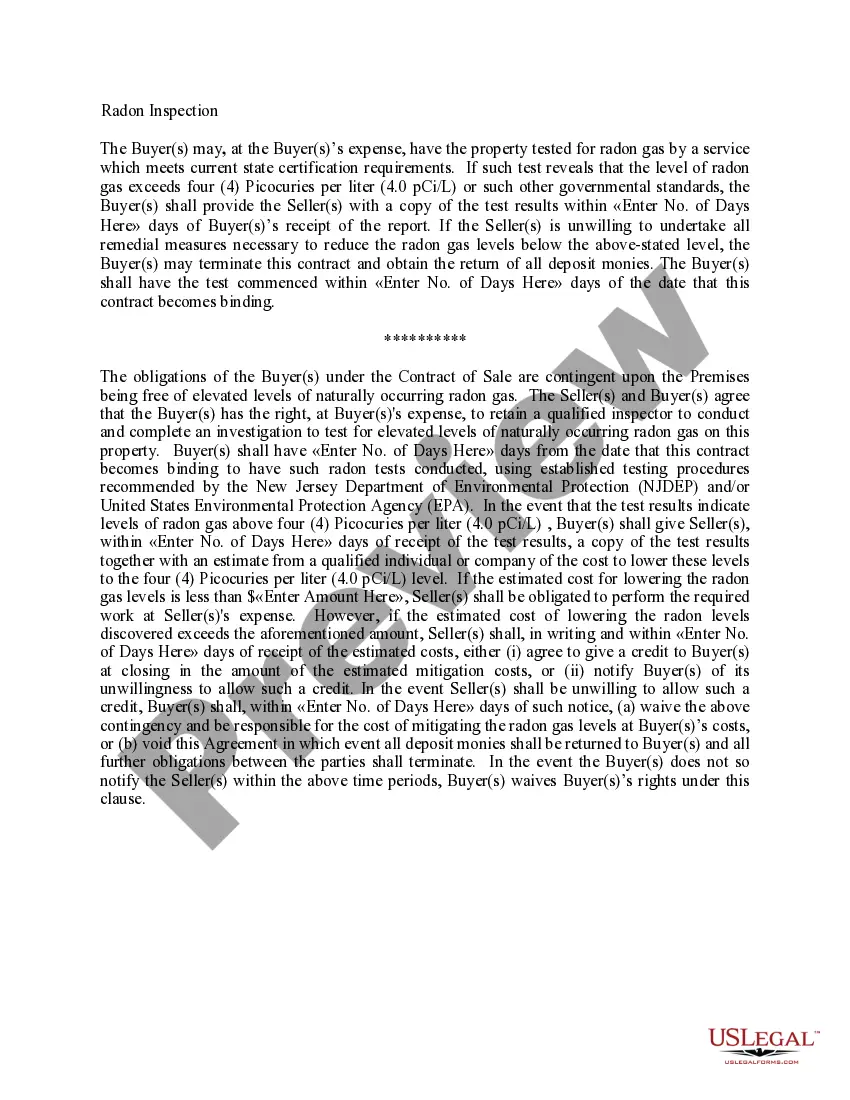

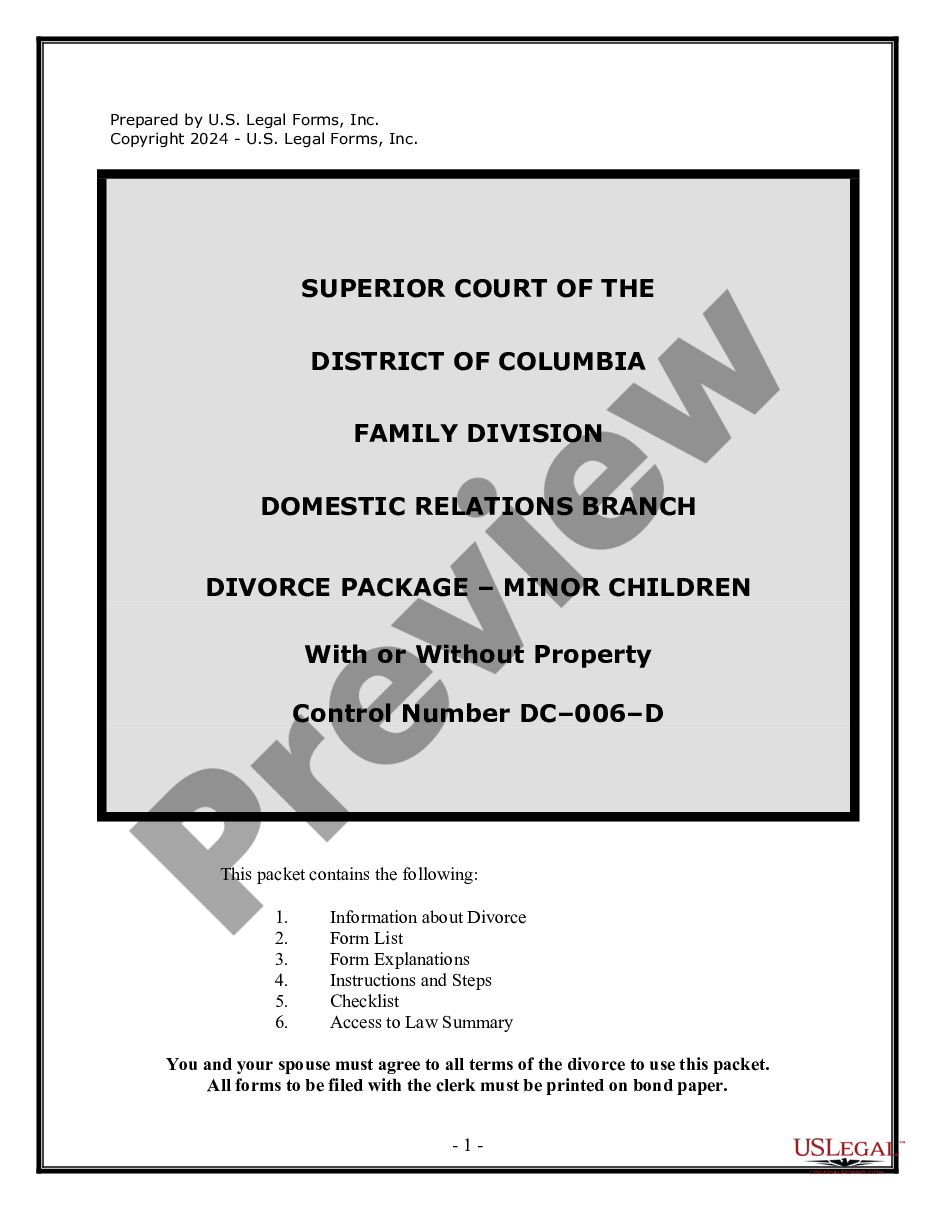

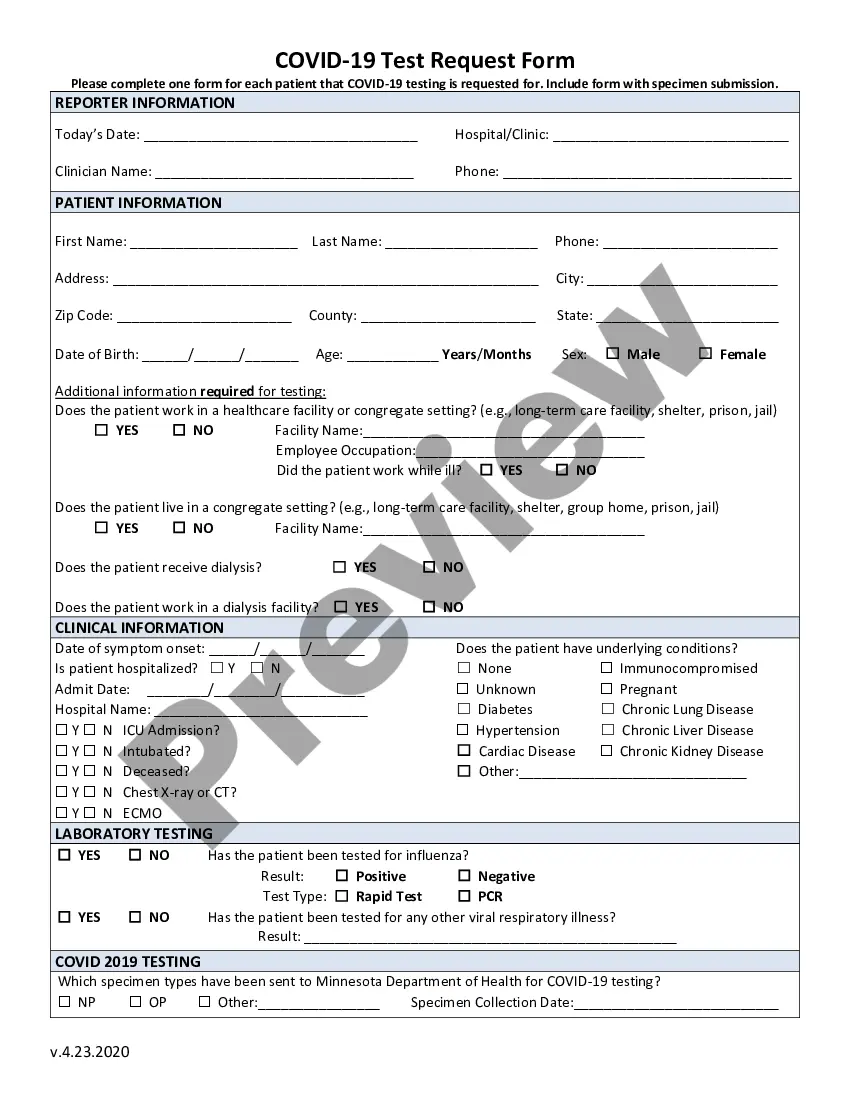

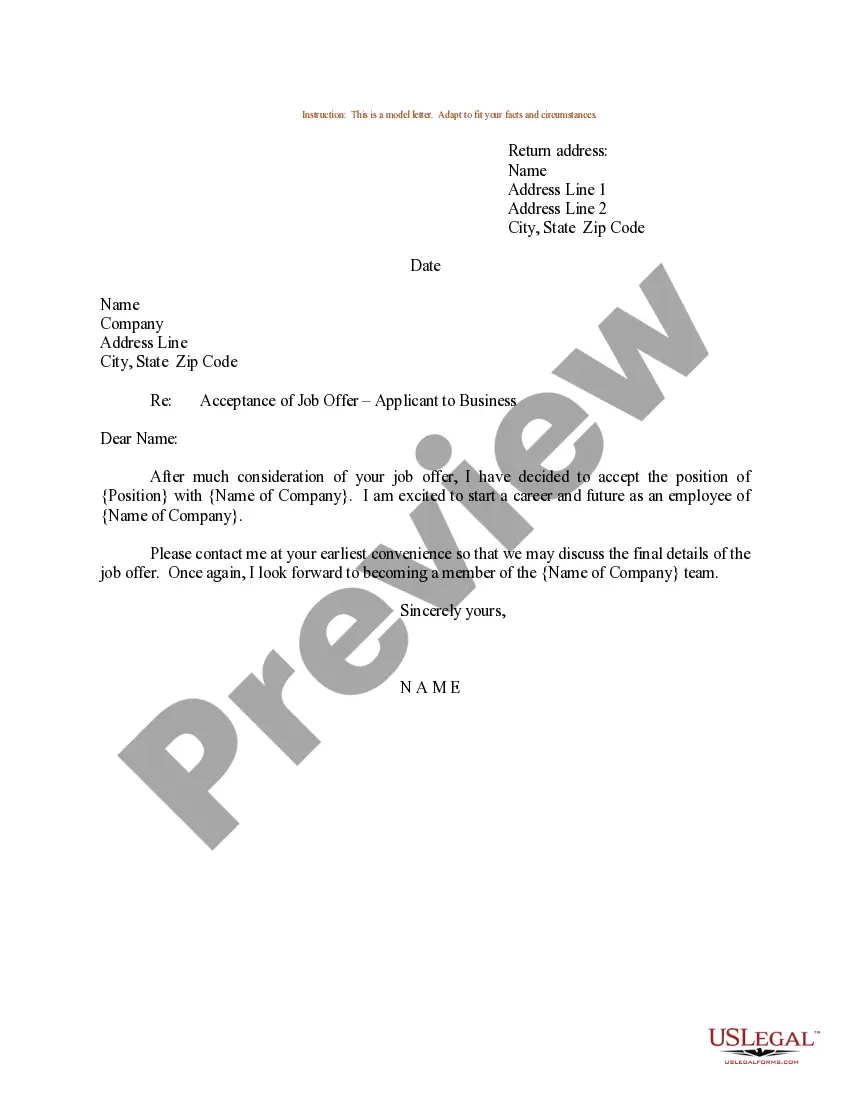

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, amend, print, or sign the Indiana Security Agreement for Promissory Note.

- Every official document template you receive is yours indefinitely.

- To get another copy of any obtained form, go to the My documents tab and click on the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form outline to confirm you have chosen the correct form.

Form popularity

FAQ

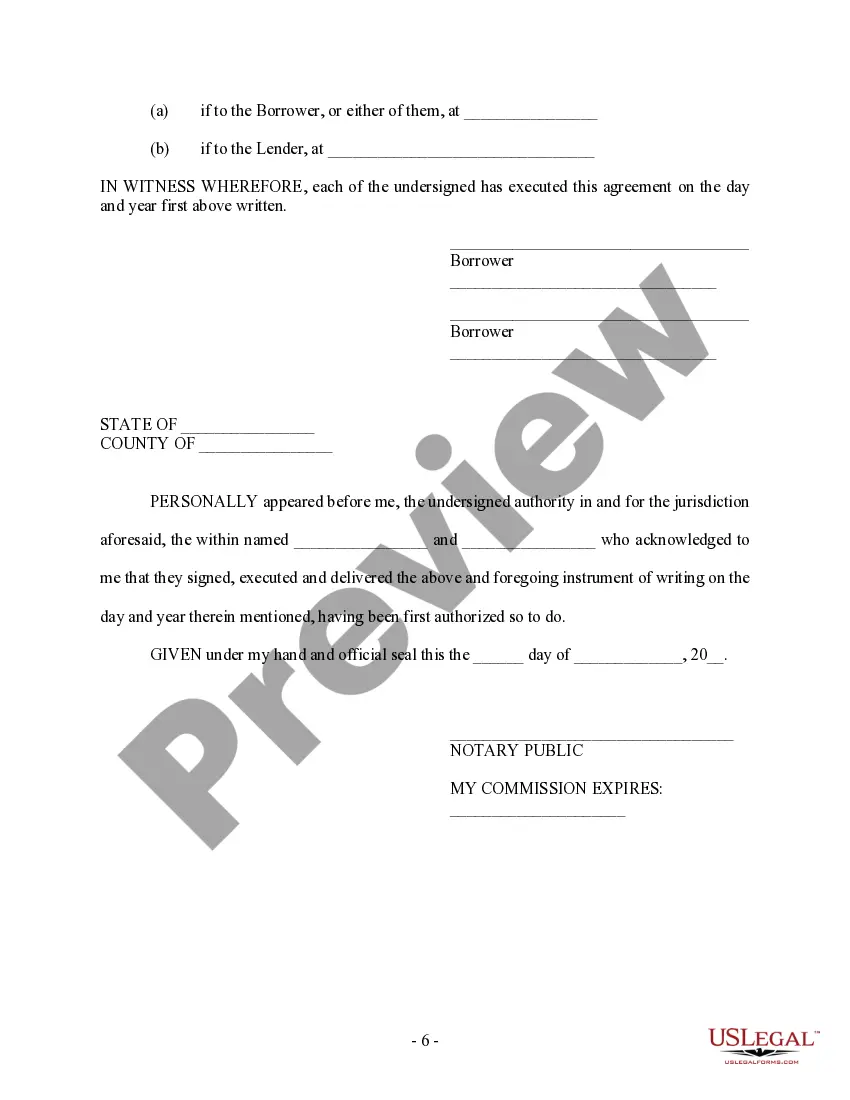

Dated Signature: In Indiana, both unsecured and secured promissory notes must be signed and dated by the borrower and any co-signer; the lender need not sign. The promissory note should be signed by a witness and notarized.

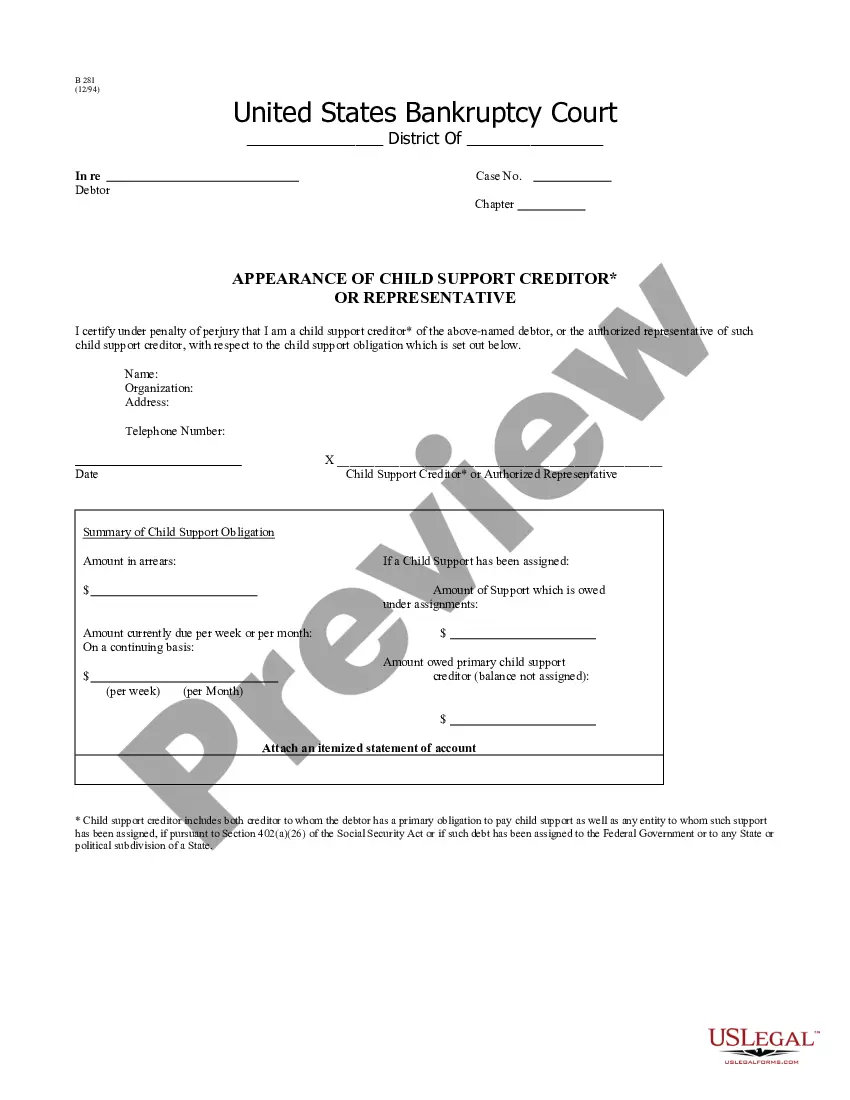

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

Secured Promissory NotesA secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.

Only legal tender money is acceptable as promissory note. Rare currencies or coins wouldn't be taken as valid promissory notes. The amount to be paid should also be certain. It is not payable to bearer It is illegal to make promissory note payable to bearer under the provisions of the RBI Act.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.