Indiana Option to Purchase Stock - Short Form

Description

How to fill out Option To Purchase Stock - Short Form?

If you need to detailed, procure, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

A selection of templates for business and personal purposes is organized by categories and jurisdictions, or keywords. Utilize US Legal Forms to find the Indiana Option to Purchase Stock - Short Form with just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access every form you acquired in your account. Click the My documents section and select a form to print or download again.

Stay competitive by obtaining and printing the Indiana Option to Purchase Stock - Short Form with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Indiana Option to Purchase Stock - Short Form.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

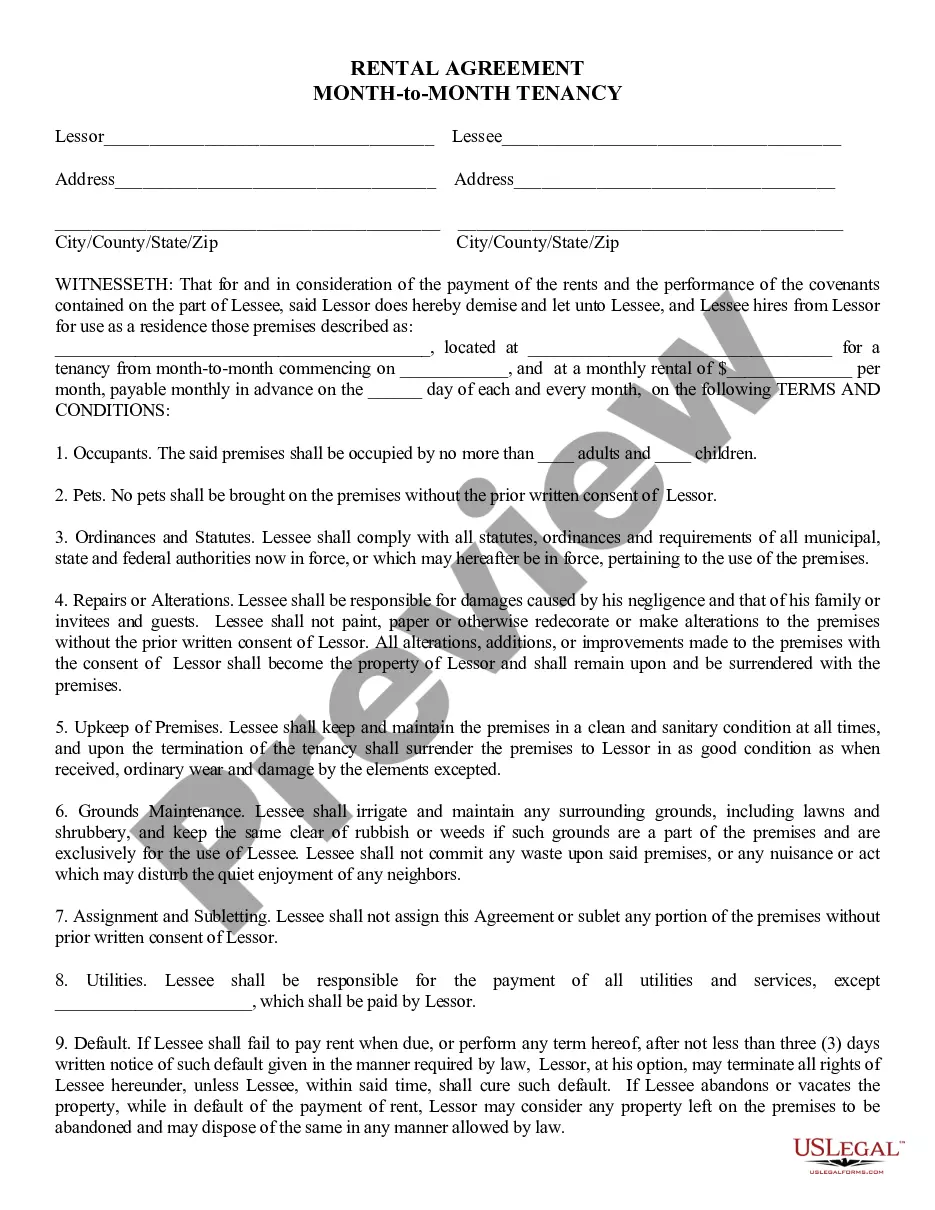

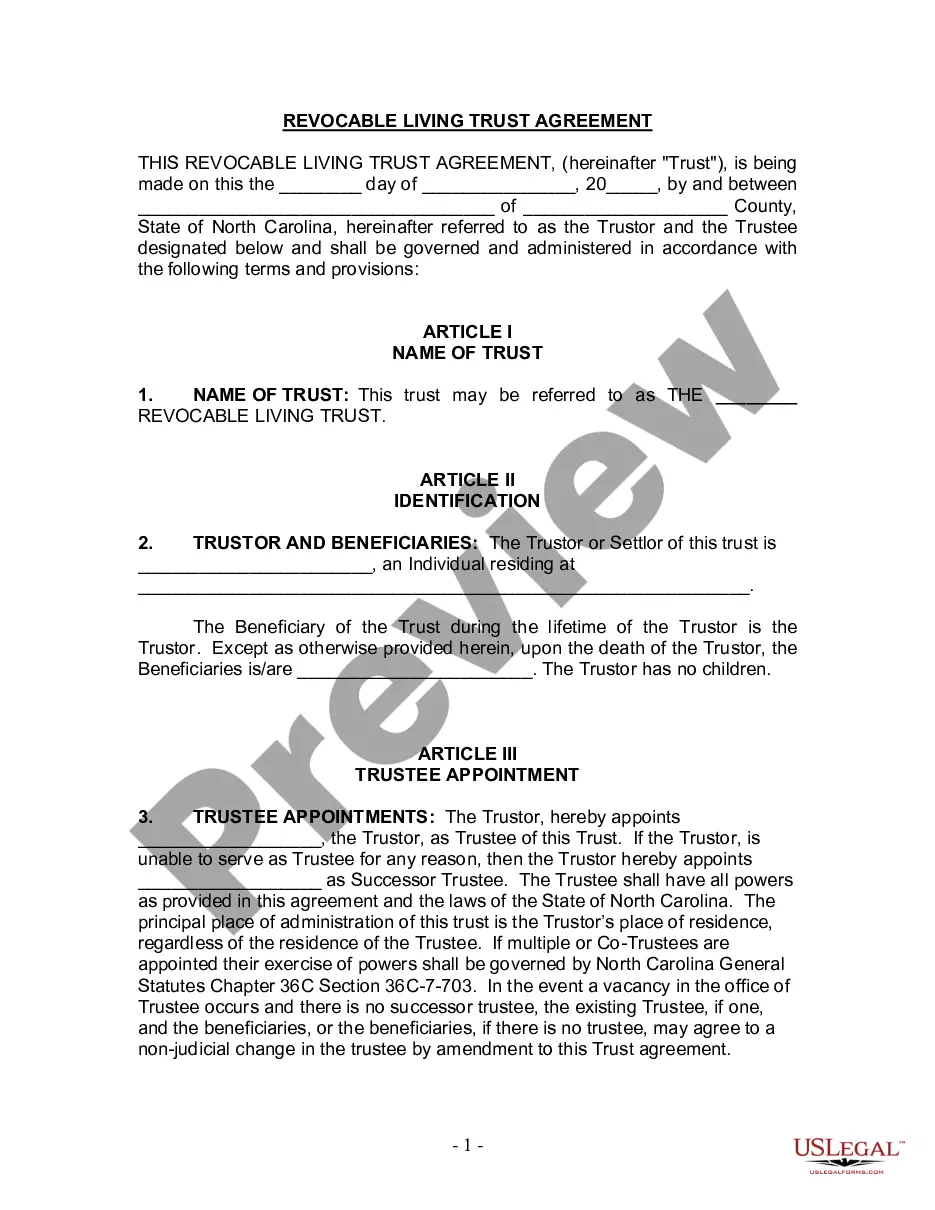

- Step 2. Use the Review feature to preview the form's information. Make sure to read through the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Get now button. Select the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can pay using a credit card or PayPal to finalize the purchase.

- Step 6. Locate the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Indiana Option to Purchase Stock - Short Form.

Form popularity

FAQ

When you short a call option, you're selling it before you buy it. That turns the whole transaction around so that you make money only if the call option price drops prior to contract expiration. It's similar to shorting a stock except you have a deadline (when the contract expires).

When you short a call option, you're selling it before you buy it. That turns the whole transaction around so that you make money only if the call option price drops prior to contract expiration. It's similar to shorting a stock except you have a deadline (when the contract expires).

A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. If the price drops, you can buy the stock at the lower price and make a profit.

Both short selling and buying put options are bearish strategies that become more profitable as the market drops. Short selling involves the sale of a security not owned by the seller but borrowed and then sold in the market, to be bought back later, with potential for large losses if the market moves up.

How to Short a Stock in Five StepsOpen a Margin Account With Your Brokerage Firm.Identify the Type of Account You Want to Open.Direct Your Broker to Execute a Short Sale on a Specific Stock.Make Sure You Know the Rules Before You Sign Off on the Short Sale Order.Buy the Stock Back and Pay Off the Loan.

Investors maintain long security positions in the expectation that the stock will rise in value in the future. The opposite of a long position is a short position. A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value.

A short call is a strategy involving a call option, which obligates the call seller to sell a security to the call buyer at the strike price if the call is exercised. A short call is a bearish trading strategy, reflecting a bet that the security underlying the option will fall in price.

Key Takeaways A short call is a strategy involving a call option, which obligates the call seller to sell a security to the call buyer at the strike price if the call is exercised. A short call is a bearish trading strategy, reflecting a bet that the security underlying the option will fall in price.

Short Selling Options When you employ a short option strategy, you incur the obligation to either buy or sell the underlying security at any time up until the option expires or until you buy the option back to close.