Indiana Sample Letter for Agreement to Compromise Debt

Description

How to fill out Sample Letter For Agreement To Compromise Debt?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a vast assortment of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords. You can obtain the latest versions of forms such as the Indiana Sample Letter for Agreement to Compromise Debt in moments.

If you already have an account, Log In and retrieve the Indiana Sample Letter for Agreement to Compromise Debt from your US Legal Forms library. The Download button will be visible on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Edit. Fill out, modify, print, and sign the downloaded Indiana Sample Letter for Agreement to Compromise Debt.

Every template you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply head to the My documents section and click on the document you need. Access the Indiana Sample Letter for Agreement to Compromise Debt with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you're using US Legal Forms for the first time, here's a simple guide to get started.

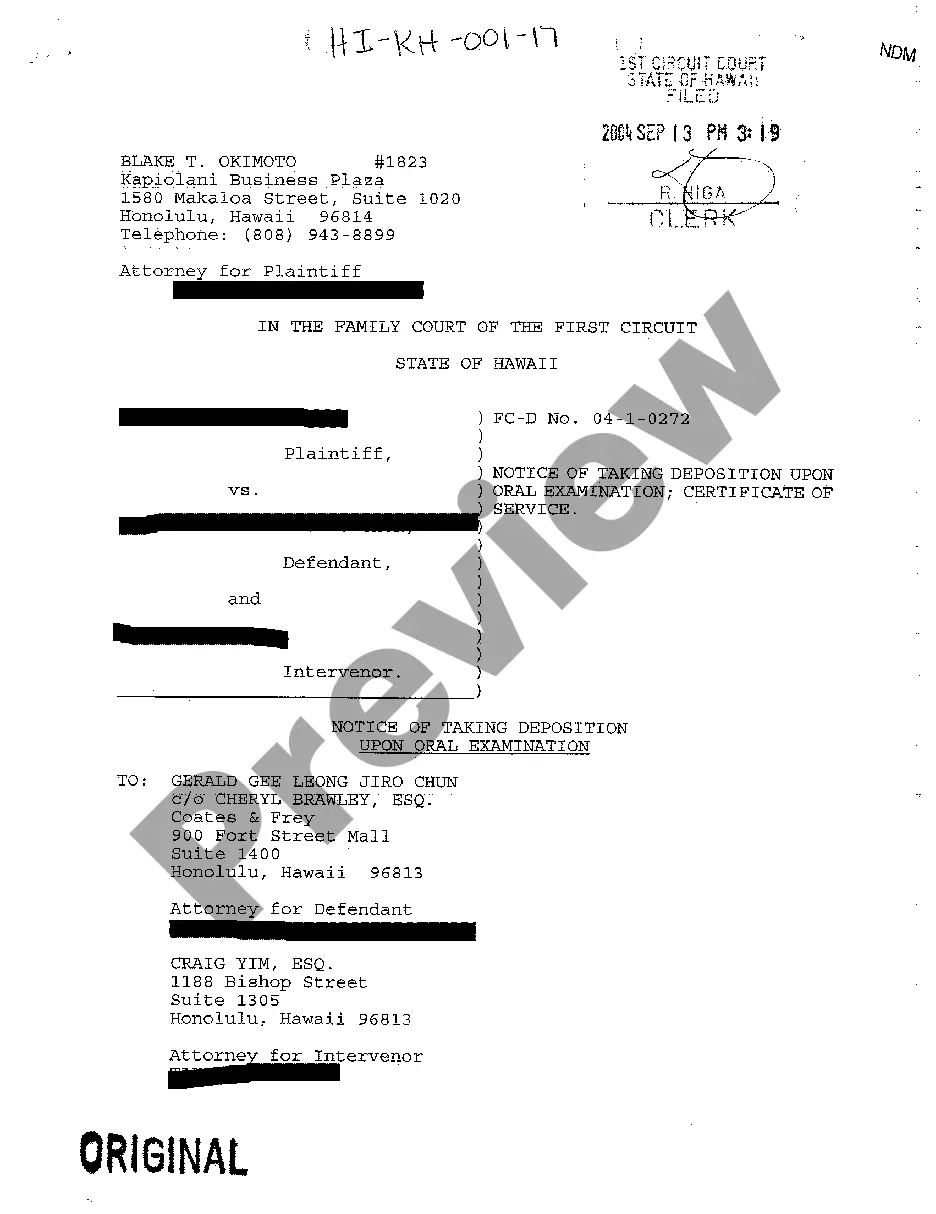

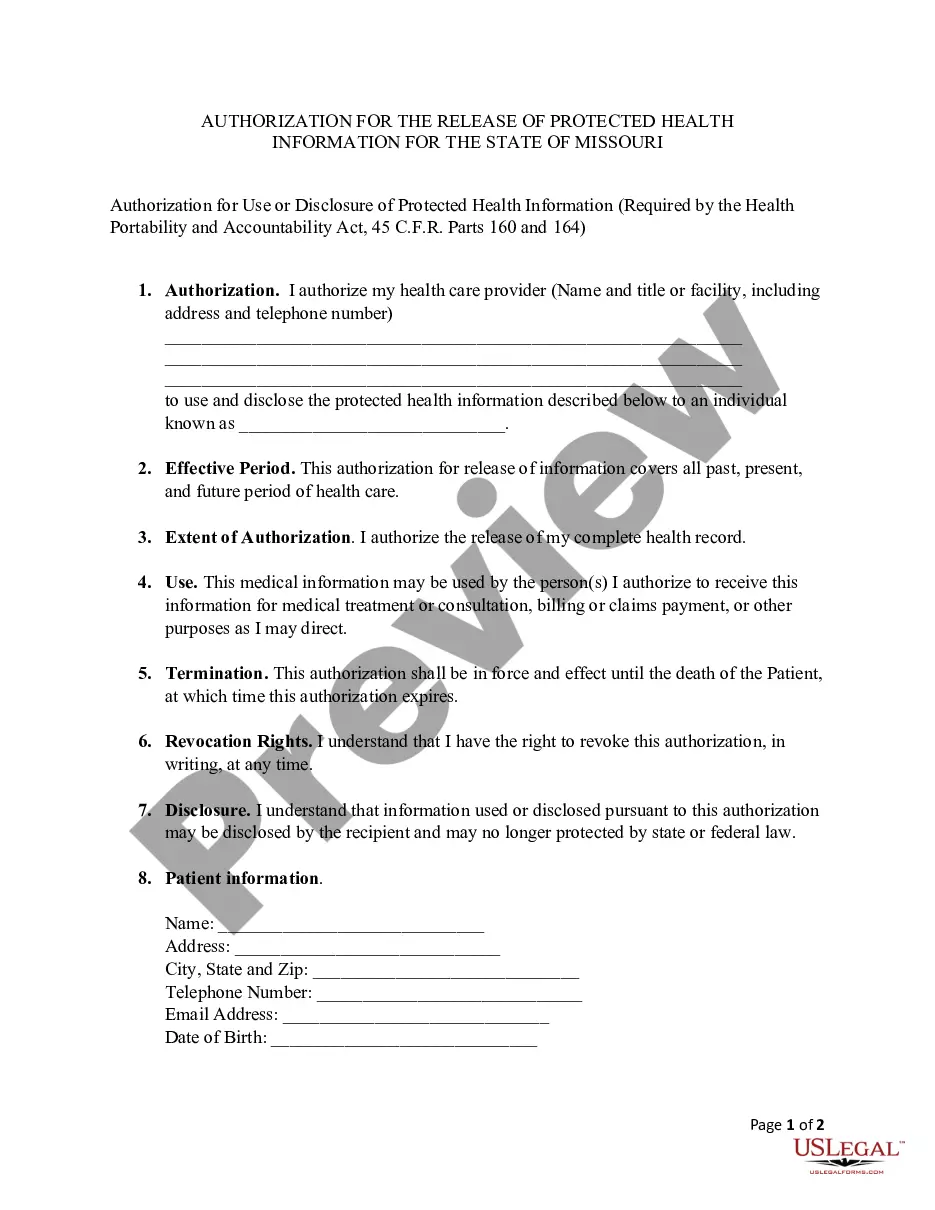

- Ensure you have selected the correct form for your city/county. Click the Review button to examine the form's details. Read the form description to confirm you have chosen the right document.

- If the form doesn’t meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Get now button. Then, choose the pricing plan you prefer and enter your details to create an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Select the format and download the document to your device.

Form popularity

FAQ

Writing a strong settlement offer can significantly improve your chances of reaching an agreement. Start by being clear about the debt amount and your reasons for proposing a compromise. You can use an Indiana Sample Letter for Agreement to Compromise Debt as a guide to structure your offer professionally. Always aim for a respectful tone, outline why the settlement is favorable for both parties, and include a proposed payment plan to demonstrate your commitment.

When considering a debt settlement, it is common to aim for an offer of 40% to 60% of the total amount owed. However, the percentage can vary based on your specific situation and the lender's willingness. Using an Indiana Sample Letter for Agreement to Compromise Debt can help you present your offer clearly and professionally. This approach increases the likelihood of reaching a favorable agreement.

Writing a debt agreement involves outlining your payment terms clearly and concisely. Begin with the date of the agreement and the parties involved, followed by the total amount of debt and the proposed payment plan. Use the Indiana Sample Letter for Agreement to Compromise Debt as a guide to ensure your terms are fair and reasonable. Finally, both parties should sign the agreement to make it legally binding.

To fill out a debt validation letter, start by including your personal information, such as your name and address, at the top. Next, clearly state that you are requesting validation of the debt in question, specifying the creditor’s name and the account number. It's important to emphasize your request for the Indiana Sample Letter for Agreement to Compromise Debt, as this will help you set the stage for negotiating your repayment options. Lastly, sign and date the letter to make it official.

To write a debt agreement, start with the date and the names of the parties involved. Clearly outline the total debt amount, the settlement figure, and the payment terms. Ensure that you include signatures from all parties to make the agreement legally binding. For a complete guide and example, you can refer to the Indiana Sample Letter for Agreement to Compromise Debt available on the USLegalForms platform.

A common phrase to stop debt collectors from contacting you is, 'I request that you cease all communication with me immediately.' This straightforward statement can serve as a powerful tool in your debt management toolkit. Consider using the Indiana Sample Letter for Agreement to Compromise Debt to formalize your request. By putting it in writing, you establish a clear record of your intentions.

The 777 rule refers to the time limits that debt collectors typically follow when trying to collect a debt. It illustrates that if a debt remains unpaid for seven months, collectors may intensify their efforts for up to seven years. Consequently, understanding these timelines can help you navigate your financial obligations more effectively. Utilizing resources like the Indiana Sample Letter for Agreement to Compromise Debt can provide clarity and assistance in this process.

Writing a debt settlement agreement begins with clearly stating the parties involved, the total amount owed, and the agreed-upon settlement amount. Next, you should include payment terms and the timeline for completing the settlement. It’s crucial to also specify that once the agreement is fulfilled, the debt will be considered settled. For guidance, you can refer to the Indiana Sample Letter for Agreement to Compromise Debt available through USLegalForms.