Indiana Demand for Collateral by Creditor

Description

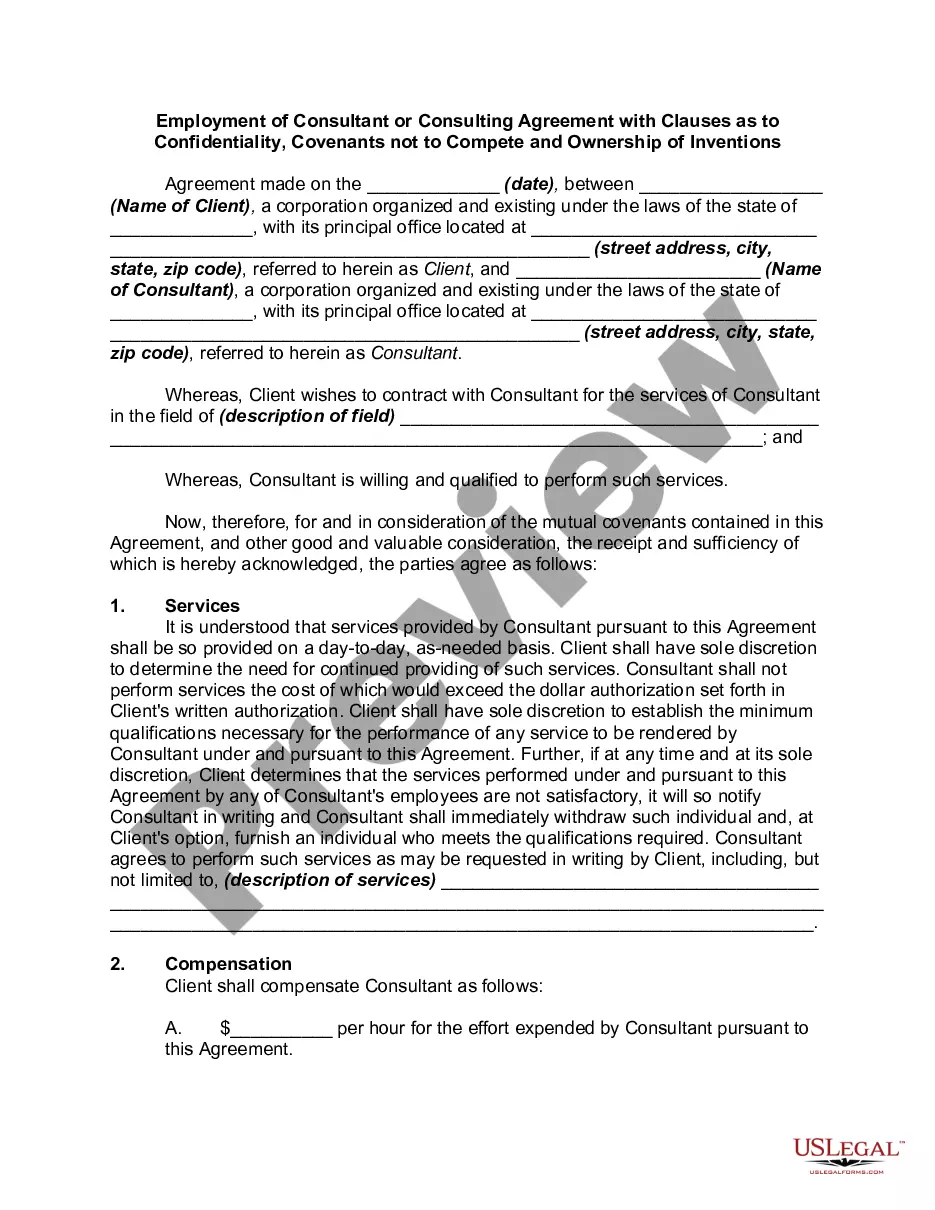

How to fill out Demand For Collateral By Creditor?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a selection of legal document templates available for download or printing.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can retrieve the latest forms such as the Indiana Request for Security by Creditor within moments.

Check the form details to ensure you have selected the right one.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you already possess an account, Log In and download the Indiana Request for Security by Creditor from the US Legal Forms collection.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms under the My documents section of your profile.

- To use US Legal Forms for the first time, follow these straightforward instructions.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Creating a valid security interest requires a few key components: a clear agreement defining the collateral, the debtor's rights to the collateral, and proper filing or notice depending on the type of collateral. Additionally, both parties should understand their obligations outlined in the agreement. Utilizing resources like USLegalForms can help streamline this process and ensure your Indiana Demand for Collateral by Creditor is legally sound.

Enforcing a security interest involves taking action to claim the collateral if a debtor fails to meet their obligations. You can initiate a process that may include repossessing the collateral or taking legal action if necessary. It’s crucial to ensure that you follow state laws to maintain compliance during this process. Knowing how to navigate these steps can enhance your Indiana Demand for Collateral by Creditor.

To establish an enforceable security interest, three essential requirements must be met: a written agreement, attachment, and perfection. The written agreement outlines the collateral, attachment occurs when the creditor acquires rights to the collateral, and perfection often involves public notice. Fulfilling these conditions ensures the effectiveness of your Indiana Demand for Collateral by Creditor.

One key requirement for a creditor to enforce a security interest is the existence of a written agreement. This agreement must clearly describe the collateral involved in the transaction. Without this document, the Indiana Demand for Collateral by Creditor may face significant challenges. Having a legally binding agreement strengthens your position as a creditor.

The process by which a creditor may take possession of collateral to satisfy an unpaid debt is called repossession. This legal action allows creditors to reclaim property when a debtor defaults on their obligations. Engaging with resources like US Legal Forms can help you understand the implications and procedures involved in an Indiana Demand for Collateral by Creditor, making the process clearer for you.

A motion for collateral relief is a legal request made by a debtor to regain access to collateral that was previously secured by the creditor. This motion can be important in scenarios where the debtor believes the creditor has acted unfairly or outside the terms of the agreement. Exploring options for such motions is advisable when dealing with an Indiana Demand for Collateral by Creditor, especially to protect your rights.

A right granted to a creditor for security of a debt is known as a security interest. This legal right allows creditors to claim specific assets of the debtor in the event of default. In the context of an Indiana Demand for Collateral by Creditor, this security interest is crucial because it outlines the creditor's claim on the collateralized property, ensuring they have a way to recover debts.

Yes, in Indiana, a debtor retains certain rights in the collateral even after it has been pledged to a creditor. These rights may include the ability to sell or use the collateral in a manner agreed upon, provided it does not violate the security agreement. Understanding these rights is essential when navigating an Indiana Demand for Collateral by Creditor, as they can influence possession and recovery actions.

Yes, the legal process by which collateral is seized by a lender is called repossession. This occurs when a borrower defaults on their obligation to repay the debt. The lender can take possession of the specified collateral without going through the courts if they follow proper procedures. Through the Indiana Demand for Collateral by Creditor, lenders can navigate this process confidently while ensuring compliance with state laws.

The right to take possession of collateral until a debt is repaid is known as a possessory lien. This right allows a creditor to hold onto the collateral and prevent the borrower from using it until the debt is settled. In Indiana, this right is crucial for protecting the creditor's interests. Utilizing the Indiana Demand for Collateral by Creditor helps solidify this right and enables creditors to secure their dues efficiently.