Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building

Description

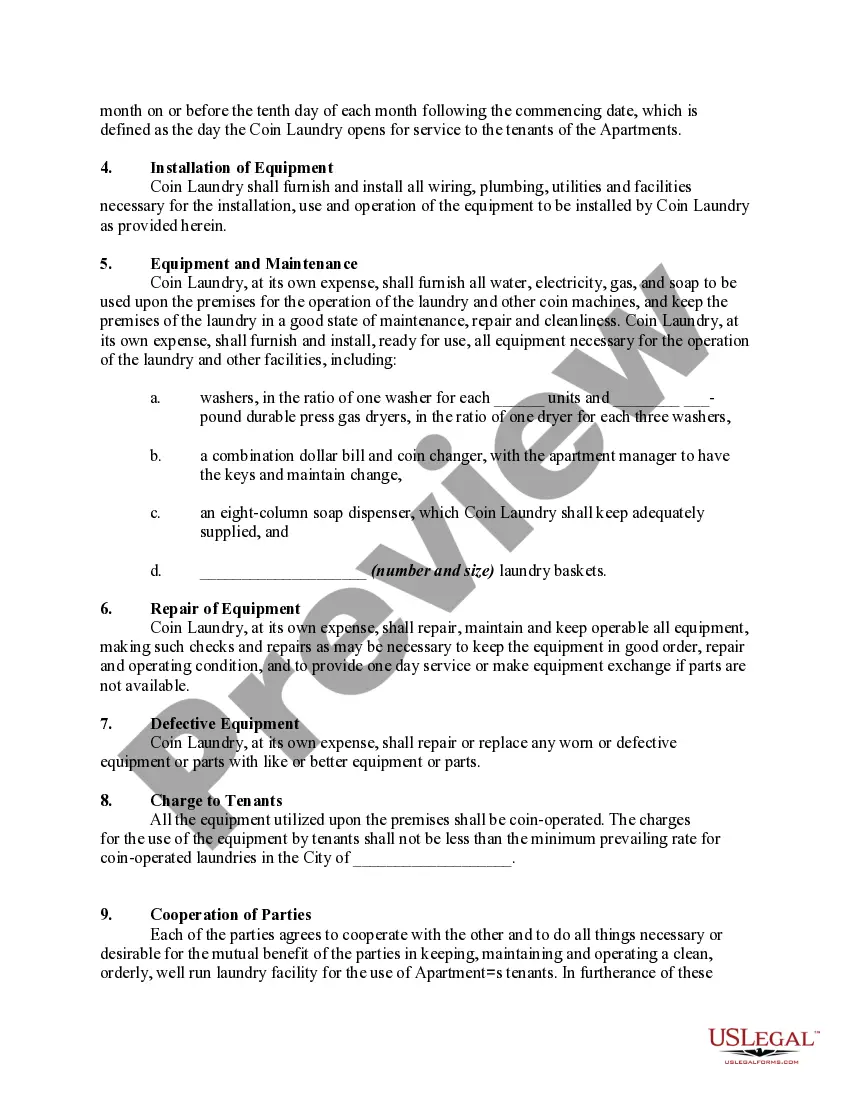

Coin-Operated Laundry in an Apartment Building.

How to fill out Agreement Granting Exclusive Right To Install, Operate And Maintain Coin-Operated Laundry In Apartment Building?

Are you facing a situation where you require documentation for both business or personal activities almost every day? There are numerous legitimate document templates available online, but finding versions that you can trust is not straightforward.

US Legal Forms offers thousands of document templates, including the Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building template.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building at any time if necessary. Simply click on the desired document to download or print the format.

Utilize US Legal Forms, the most extensive selection of legal forms, to save time and avoid errors. The service provides well-crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and begin simplifying your life.

- Find the form you need and ensure it corresponds to the correct city/state.

- Utilize the Preview button to review the document.

- Read the description to confirm you have selected the correct form.

- If the document is not what you are searching for, use the Search field to find the form that fits your needs.

- Once you locate the appropriate document, click Purchase now.

- Select the pricing plan you desire, fill in the necessary details to create your account, and place an order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Personal property in Indiana includes movable items not permanently attached to or associated with the land. This may encompass furniture, vehicles, and certain appliances. When you engage in an Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, it’s crucial to delineate which assets fall under personal property for tax implications and operational purposes. Utilizing resources like US Legal Forms can provide clarity on asset classifications.

Leasehold improvements themselves are not considered Property, Plant, and Equipment (PPE) in accounting terms, as they are usually linked to lease arrangements rather than outright ownership. Yet, when you install extensive improvements as part of the Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, these installations can be significant assets for your rental business. Hence, it is important to differentiate between various asset classes to optimize your financial planning.

In Indiana, leasehold improvements are typically not viewed as personal property because they are associated with the real property. Understanding this distinction is vital when negotiating terms under the Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. By recognizing this, you can avoid potential legal pitfalls related to your investments and renovations.

Leasehold improvements are generally not classified as personal property since they are attached to the building itself. However, under specific agreements, they might retain some characteristics of personal property when viewed from a functional perspective. When you are involved in an Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, knowing how these improvements are categorized is crucial for future transactions.

In Indiana, hotels can be considered tax-exempt after a guest stays for 30 consecutive days. This means that if you plan to install a coin-operated laundry service in an apartment building catering to long-term guests, understanding this tax exemption can be beneficial. Always consult legal resources or platforms like US Legal Forms to ensure compliance and gain clarity on your specific situation.

Leasehold improvements are classified as alterations made to rental properties to better suit the needs of the tenant. When you sign an Indiana Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, you may consider renovations such as plumbing or electrical upgrades as leasehold improvements. These modifications enhance the functionality of the space while remaining in agreement with your lease terms.