Indiana Accounts Receivable Monthly Customer Statement

Description

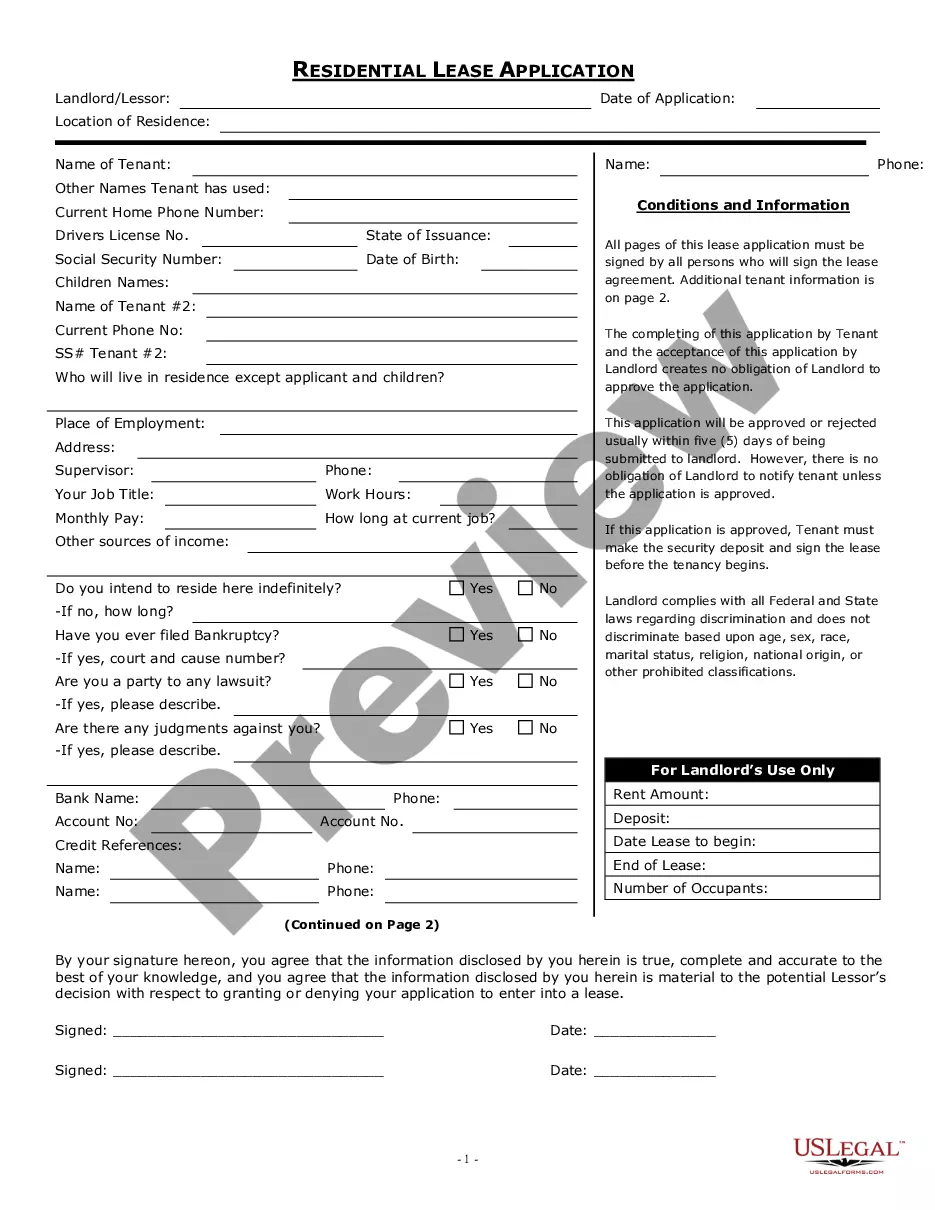

How to fill out Accounts Receivable Monthly Customer Statement?

It is feasible to spend multiple hours online attempting to locate the sanctioned document format that meets the federal and state requirements you desire.

US Legal Forms provides a vast array of legal forms that can be reviewed by professionals.

You can conveniently access or print the Indiana Accounts Receivable Monthly Customer Statement from your account.

If available, use the Preview option to view the document format as well. If you wish to find another version of your form, use the Search field to locate the format that fits your requirements. Once you have found the format you want, click Acquire now to proceed. Select your preferred pricing plan, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the file format of your document and download it to your device. Make any necessary changes to your document. You can complete, edit, sign, and print the Indiana Accounts Receivable Monthly Customer Statement. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- Then, you can complete, modify, print, or sign the Indiana Accounts Receivable Monthly Customer Statement.

- Every legal document format you obtain is yours indefinitely.

- To acquire an additional copy of any purchased document, visit the My documents section and select the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple guidelines provided below.

- First, ensure you have selected the correct document format for your state/city of preference.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

The accounts receivable information is primarily shown on the balance sheet. This financial statement summarizes your company's financial position, including current assets like accounts receivable. Moreover, the Indiana Accounts Receivable Monthly Customer Statement can serve as a supplementary report that details outstanding amounts. Utilizing both resources allows for a comprehensive view of your financial health.

Accounts receivable is typically represented as a subsidiary ledger that details individual customer accounts. This statement provides an overview of outstanding invoices and payment history. A well-organized accounts receivable statement helps you manage collections effectively. Using the Indiana Accounts Receivable Monthly Customer Statement can enhance your tracking and follow-up efforts.

You should send your Indiana state tax payment to the Indiana Department of Revenue. Payments can be made electronically through the Indiana ePay system, or you may send a check to the address specified on your tax return. Ensure you include your tax identification number to avoid any delays. Keeping your Indiana Accounts Receivable Monthly Customer Statement updated will help you allocate funds for tax payments efficiently.

In Indiana, businesses must file sales tax returns on a monthly or quarterly basis, depending on their sales volume. Typically, the return is due on the 20th of the month following the reporting period. Staying on top of your sales tax obligations is crucial to avoid penalties. You can use the Indiana Accounts Receivable Monthly Customer Statement to track sales and ensure accurate tax filings.

Accounts receivable is reported on the balance sheet as a statement of financial position. It shows the total amount due from customers for credit sales made by your business. Regularly updating your accounts receivable helps maintain accurate financial records. Utilizing Indiana Accounts Receivable Monthly Customer Statements can streamline this process.

A customer account statement is a detailed summary of a customer's transactions with your business over a specific period. This statement includes invoices, payments received, and any outstanding balances. It serves as an essential tool for transparent communication between your business and your customers. Utilizing the Indiana Accounts Receivable Monthly Customer Statement can enhance clarity and ensure that both parties are on the same page regarding account activity.

Put simply, accounts payable and accounts receivable are two sides of the same coin. Whereas accounts payable represents money that your business owes to suppliers, accounts receivable represents money owed to your business by customers.

The Accounts Receivables Statements are documents that itemize all invoices, payments, and credits created during a specific time period, and whose intention is to remind the account holder of their account status.

Accounts payable is the money a company owes its vendors, while accounts receivable is the money that is owed to the company, typically by customers.

Traditionally, the accounts receivable cycle begins when a customer makes a purchase for a product or service, and ends once any outstanding payment has been collected. The step-by-step process taken to record and collect the debt is what's known as an accounts receivable workflow or A/R process.