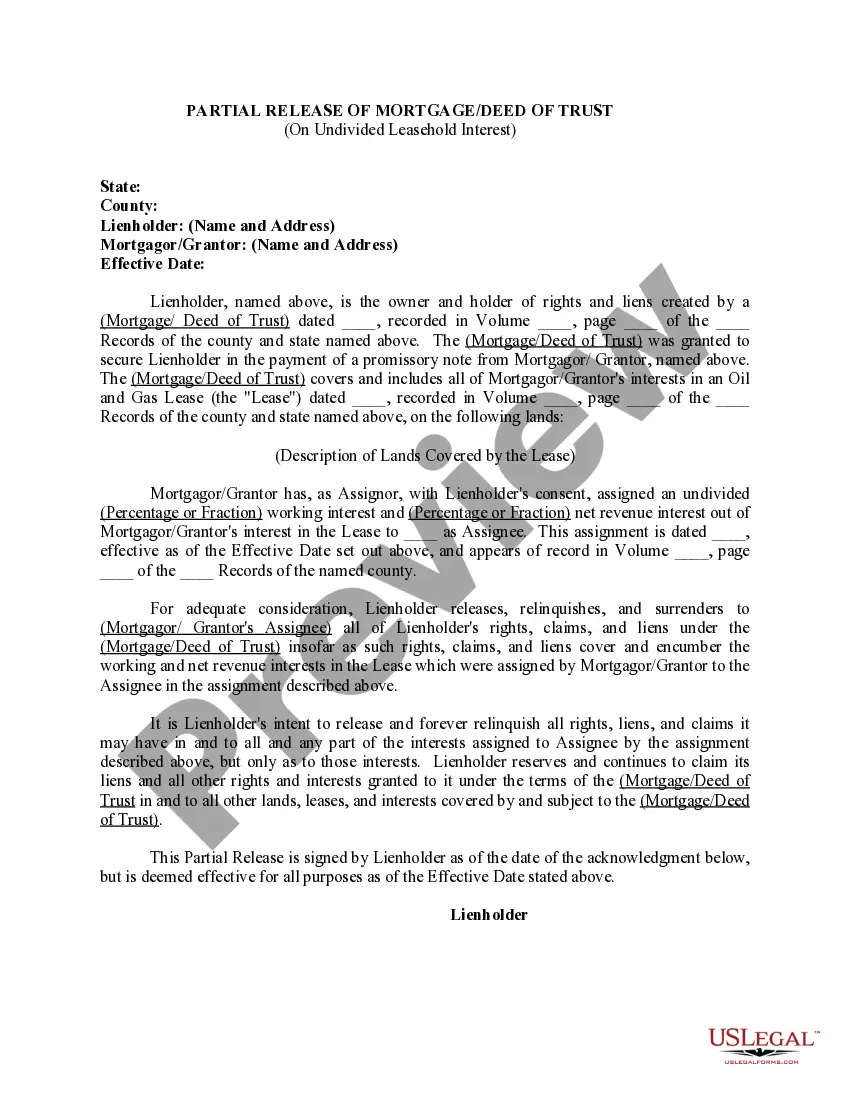

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

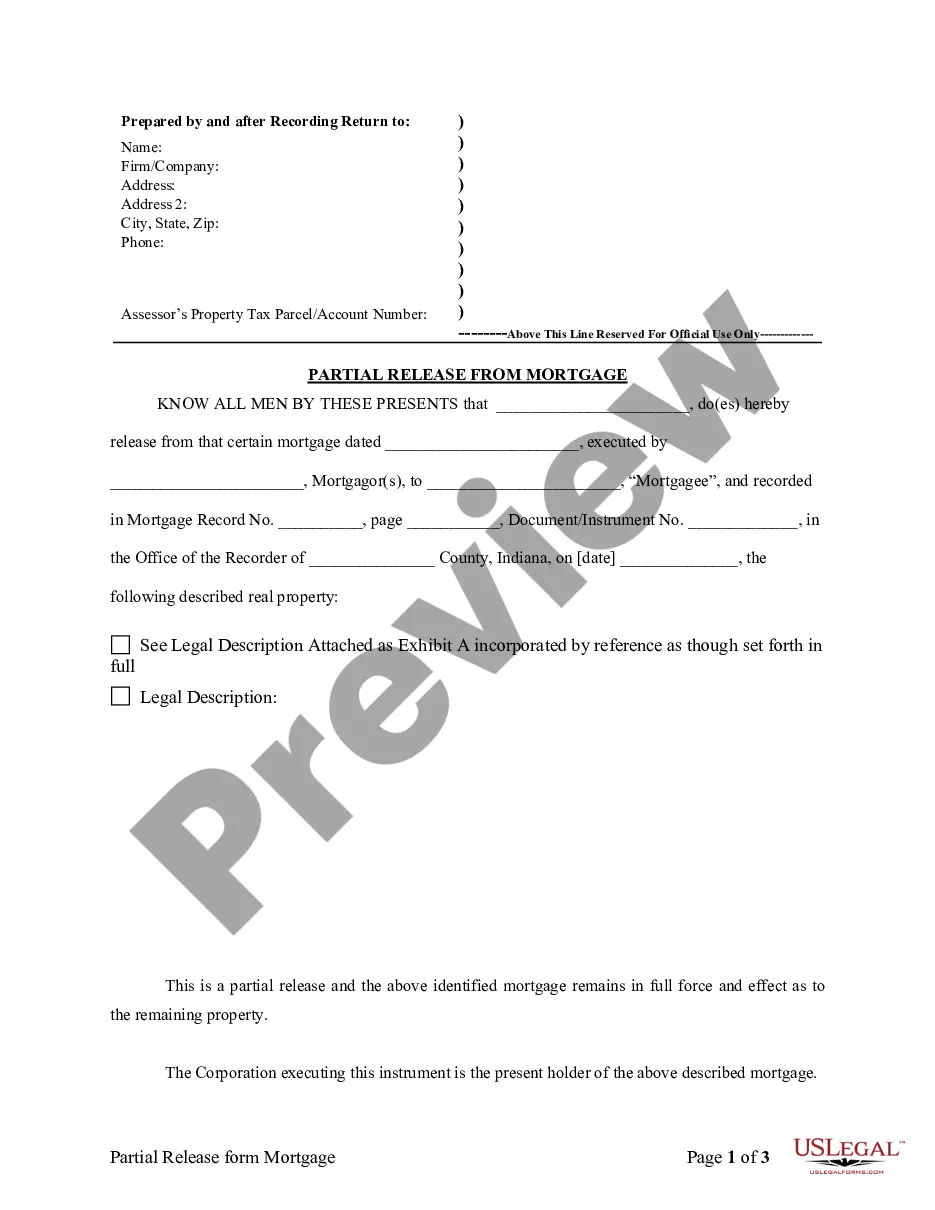

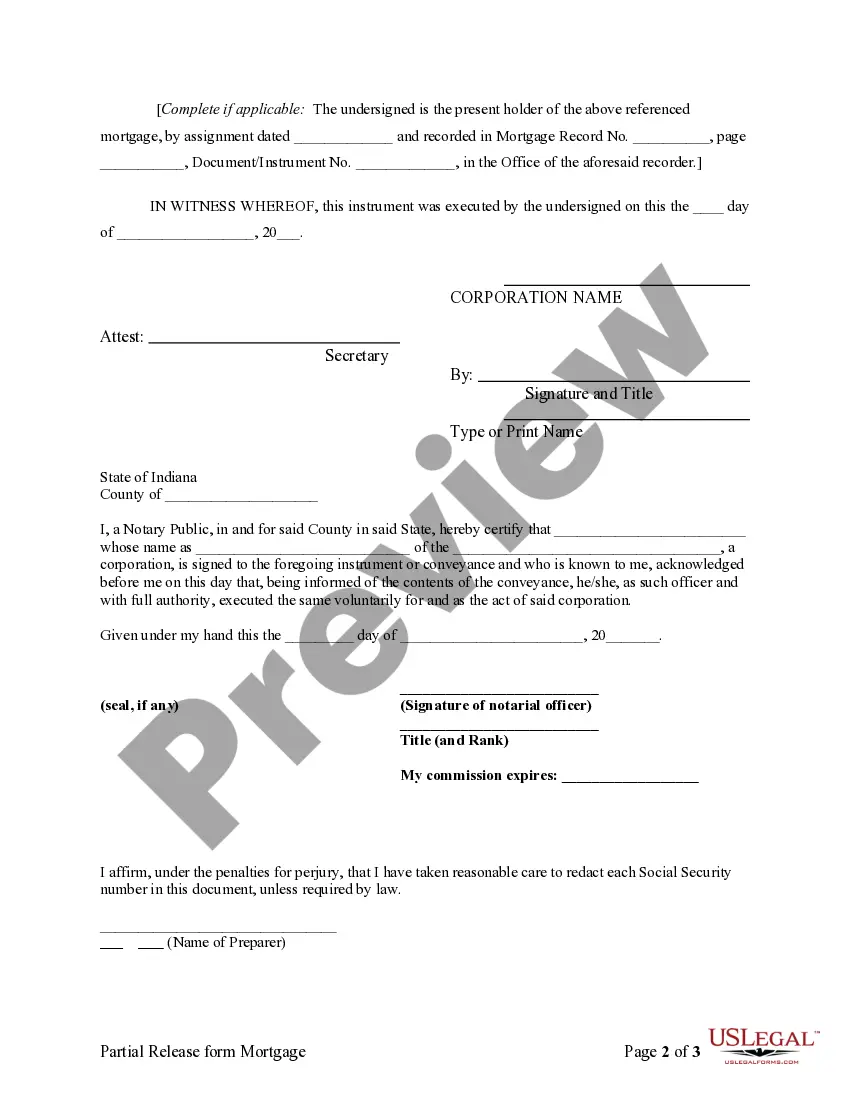

Indiana Partial Release of Property From Mortgage for Corporation

Description

How to fill out Indiana Partial Release Of Property From Mortgage For Corporation?

Searching for a sample of Indiana Partial Release of Property From Mortgage for Corporation and completing it can be difficult.

To minimize time, expenses, and effort, utilize US Legal Forms to discover the appropriate sample tailored for your state in just a few clicks. Our legal experts prepare every document, so all you need to do is fill them in. It's really that straightforward.

Sign in to your account and return to the form's page to save the sample. All your saved samples are stored in My documents and are always available for future use. If you haven't subscribed yet, you should register.

Store the sample in your desired format. You can print the Indiana Partial Release of Property From Mortgage for Corporation template or complete it using any online editor. Don't worry about typographical errors as your sample can be used and submitted repeatedly, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Review our detailed instructions on how to obtain the Indiana Partial Release of Property From Mortgage for Corporation form in just a few minutes.

- To acquire a valid form, confirm its authenticity for your state.

- Examine the sample using the Preview option (if available).

- If there's a description, read it to understand the key details.

- Click on the Buy Now button if you've located what you're looking for.

- Select your pricing plan on the payment page and create an account.

- Indicate your payment method, either by card or via PayPal.

Form popularity

FAQ

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount.He will have to wait to pay off the full loan before the property is granted back to him.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.