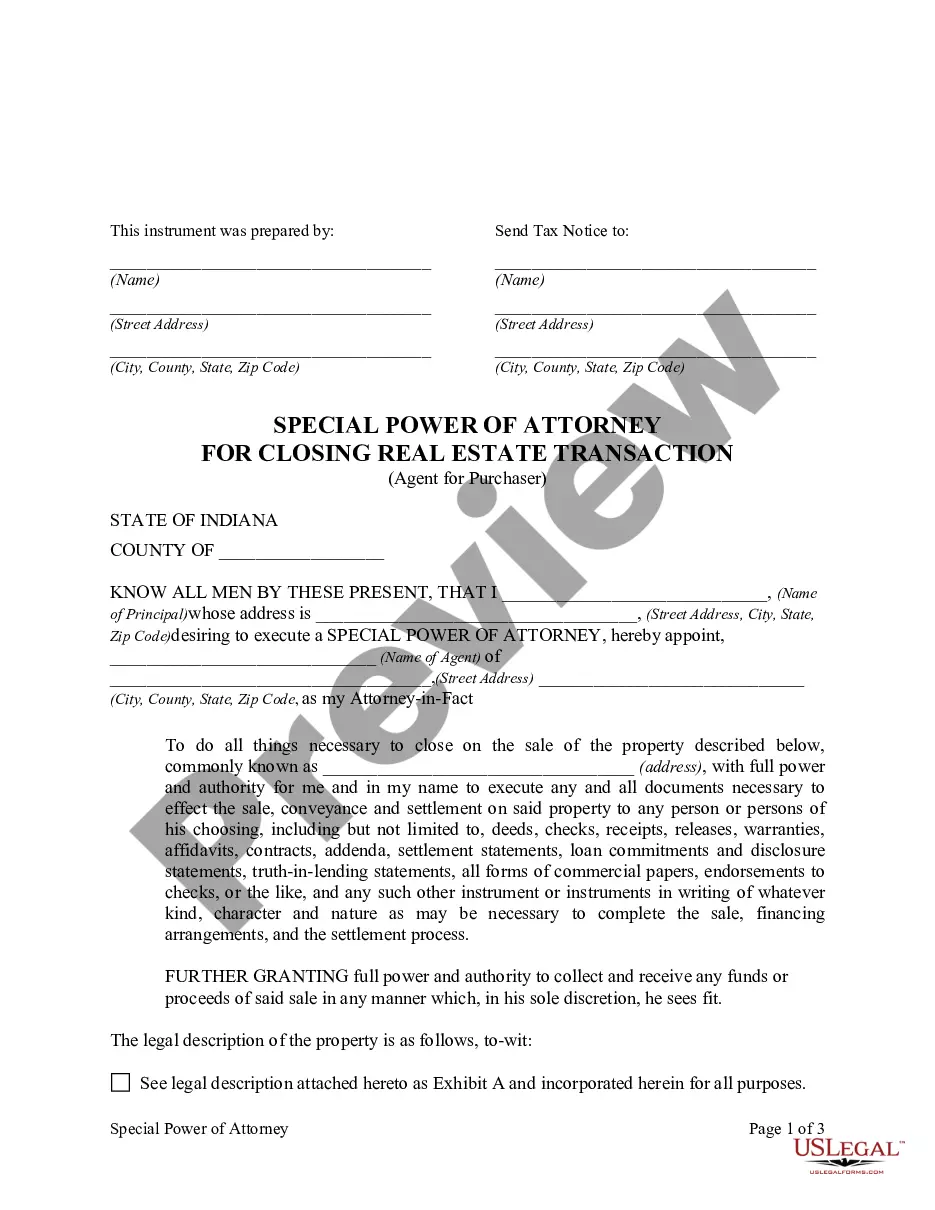

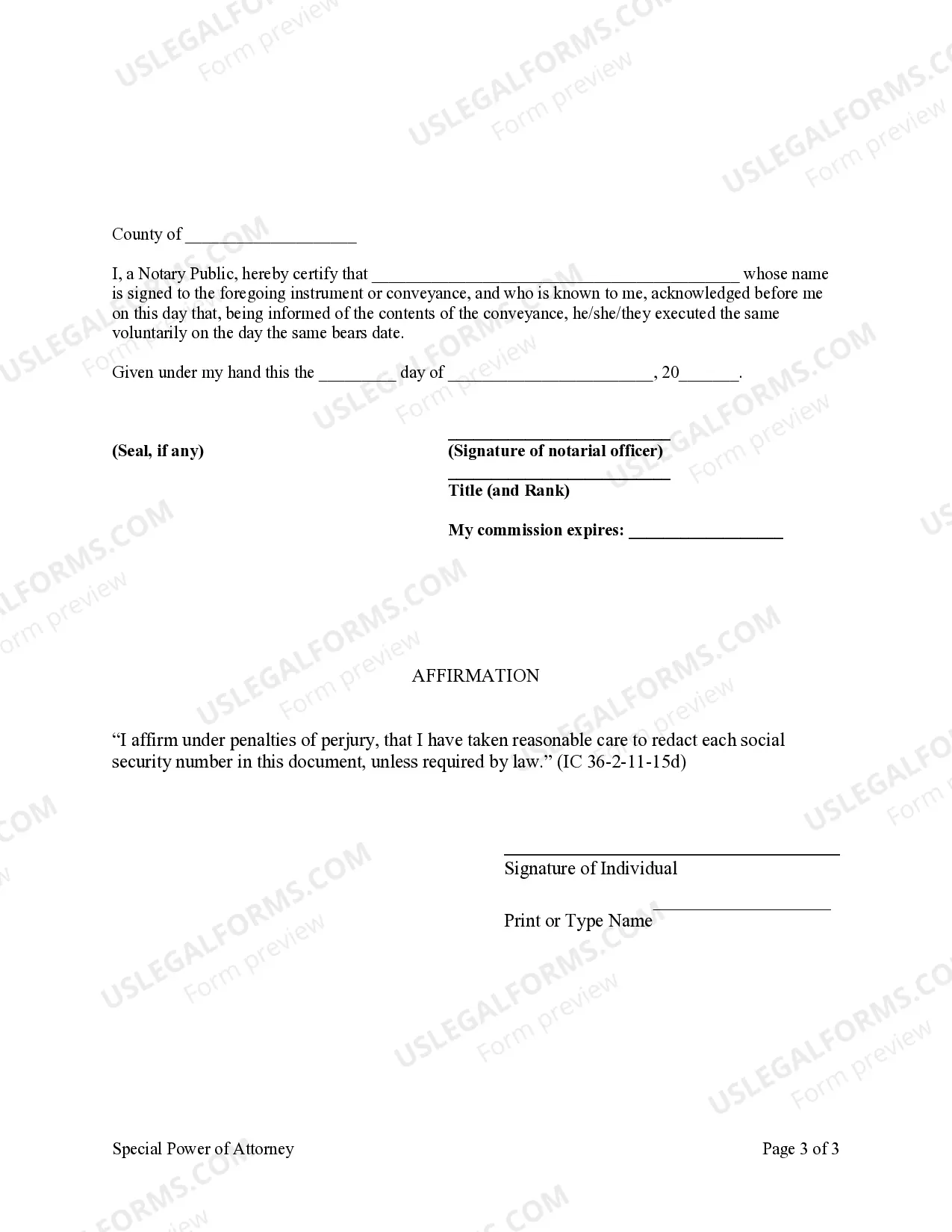

This Power of Attorney for Real Estate Transaction form is for a Purchaser to authorize an attorney-in-fact to execute all documents and do all things necessary to purchase a particular parcel of real estate for purchaser, including loan documents. This form must be signed and notarized.

Indiana Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description

How to fill out Indiana Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Searching for Indiana Special or Limited Power of Attorney for Real Estate Acquisition Transaction by Buyer models and completing them could be a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms to find the appropriate example specifically for your state in just a few clicks. Our legal experts draft each document, so you only need to complete them. It is truly effortless.

Sign in to your account, return to the form's page, and download the template. Your downloaded forms are saved in My documents and are always available for later use. If you haven't subscribed yet, you will need to register.

You can print the Indiana Special or Limited Power of Attorney for Real Estate Acquisition Transaction by Buyer form or complete it using any online editor. Don’t worry about making mistakes because your template can be used, submitted, and printed as many times as you like. Visit US Legal Forms and access over 85,000 state-specific legal and tax documents.

- To obtain a valid form, verify its applicability for your state.

- Examine the sample using the Preview feature (if available).

- If there is a description, read it to understand the specifics.

- Click Buy Now if you found what you need.

- Choose your plan on the pricing page and create your account.

- Indicate whether you would like to pay by card or via PayPal.

- Save the document in your desired format.

Form popularity

FAQ

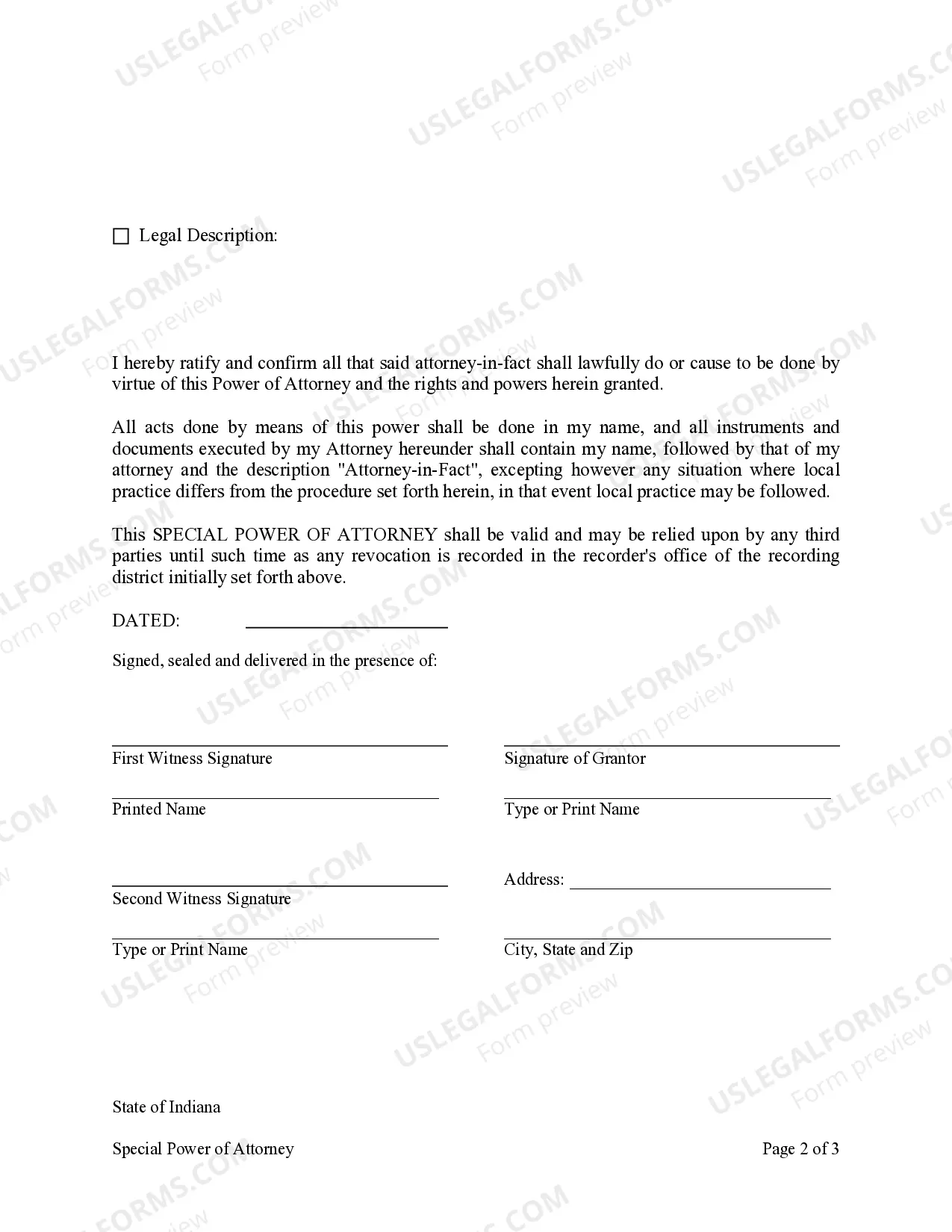

Name, signature, and address of the principal. Name, signature, and address of the agent. Properties and activities under the authority of the agent. Date of effect and termination of authority. Compensation to services of the agent.

The short answer is YES, you may send someone in your place to close for you. A closing is essentially a signing of documents, documents drafted by both the closing attorney and your lender.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.

A power of attorney letter bestows the Agent with powers to act over various transactions. Generally, the main elements in an example of power of attorney letter include: Your name, address, and signature as the principal.The name, address, and signature of the person who witnesses the signing.

Hence, rights in immovable property are vested only when a sale deed or deed of conveyance is registered between the parties.Sale of property has various implications such as capital gains tax on the seller and payment of stamp duty on the document of transfer.

Your name, address, and signature as the principal. The name, address, and signature of your Agent. The activities and properties under the Agent's authority. The start and termination dates of the Agent's powers. Any compensation you will give to the Agent.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Hence, rights in immovable property are vested only when a sale deed or deed of conveyance is registered between the parties.Sale of property has various implications such as capital gains tax on the seller and payment of stamp duty on the document of transfer.