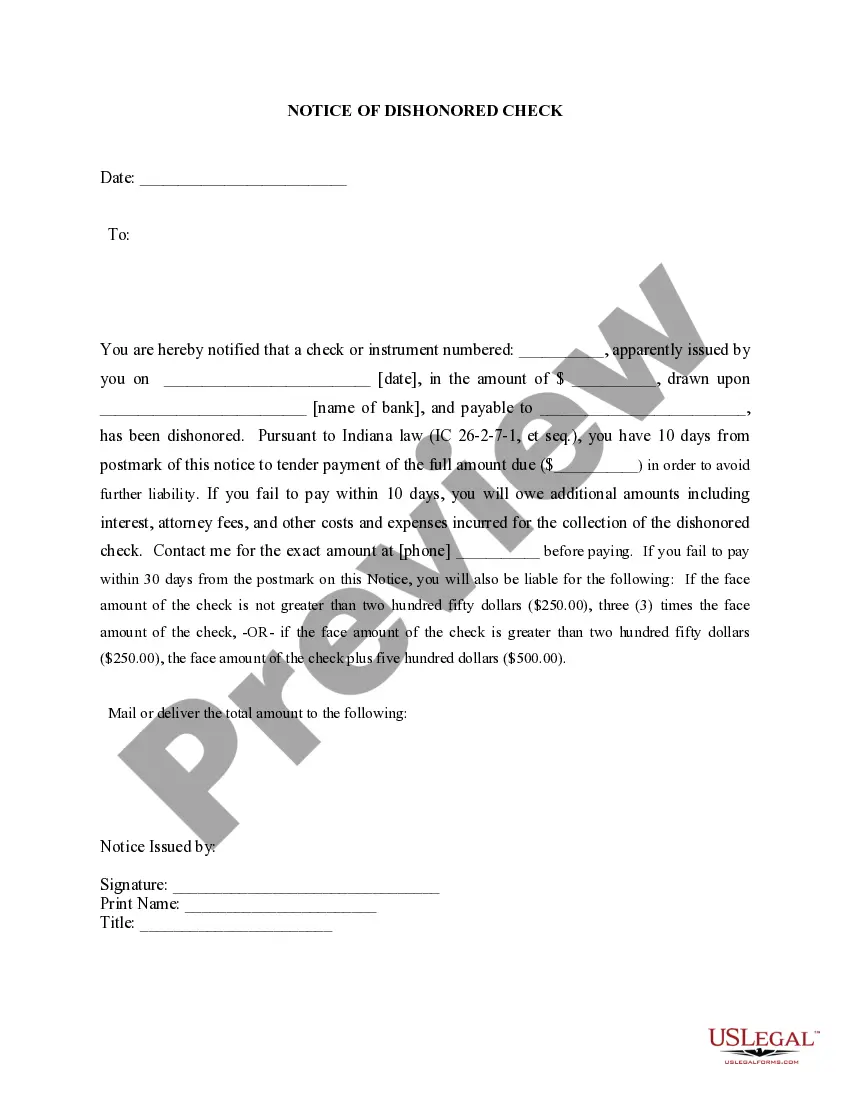

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Indiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Indiana Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Attempting to locate Indiana Notice of Dishonored Check - Civil - Keywords: faulty check, returned check samples and filling them out may pose an issue.

To minimize time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your region in just a few clicks.

Our legal experts create all documents, so you only need to complete them. It’s really that easy.

Select your plan on the pricing page and create your account. Choose your payment method via credit card or PayPal. Download the file in your preferred format. You can print the Indiana Notice of Dishonored Check - Civil - Keywords: faulty check, returned check template or complete it using any online editor. Don’t worry about making errors since your form can be utilized and submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Sign in to your account and navigate back to the form's webpage to download the document.

- All your downloaded templates are stored in My documents and are accessible anytime for later use.

- If you haven’t registered yet, you must sign up.

- Check out our detailed instructions on how to obtain your Indiana Notice of Dishonored Check - Civil - Keywords: faulty check, returned check form within a few minutes.

- To obtain a valid sample, verify its relevance for your state.

- Examine the form using the Preview option (if available).

- If there’s a description, review it to grasp the details.

- Click Buy Now if you pinpoint what you’re searching for.

Form popularity

FAQ

A bounced payment occurs when there isn't enough money in your current account to fund a pre-arranged payment, so your bank refuses to make the payment. Banks usually charge you for each bounced payment.If a bank refuses to make a payment it must generally tell you as soon as possible and explain why.

The phrase in payment of an obligation means that the check should not be issued in payment of a pre-existing obligation. When a check was issued in payment of a debt contracted prior to such issuance, there is no estafa.This law has made the mere act of issuing a bouncing check a criminal act.

But, the bank never notified me, so other checks bounced and I got hit with several overdraft fees. Shouldn't the bank have sent me a notice? The bank is not required to notify you when a check bounces because of insufficient funds. You are responsible for keeping a current and accurate check/transaction register.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft (OD) fee. If the account stays negative, the bank may charge an extended overdraft fee.