Indiana Business Credit Application

About this form

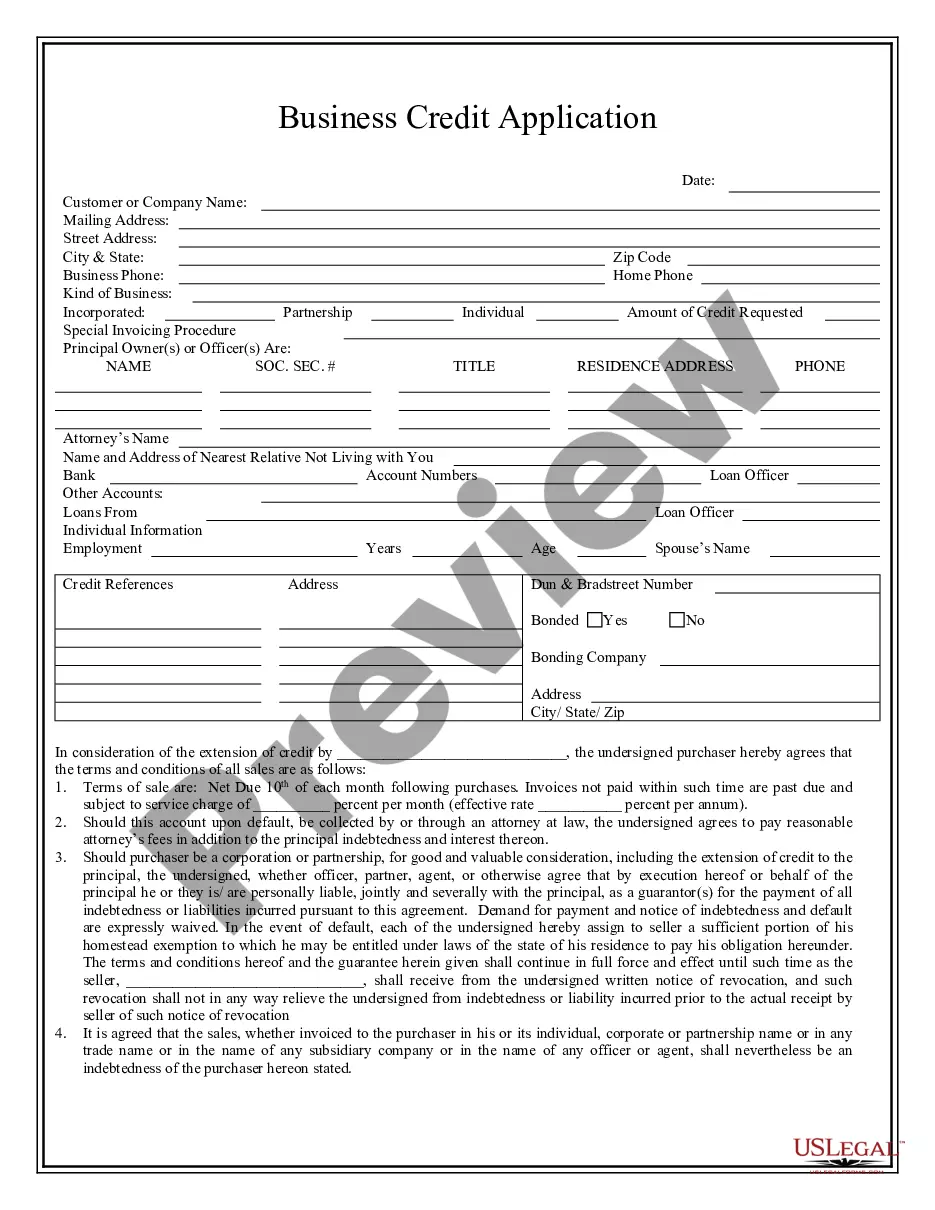

A business credit application is a document used by businesses to request credit from suppliers or lenders. This form establishes the terms under which credit will be extended and outlines the purchaser's obligations. Unlike personal credit applications, this form is tailored for business entities seeking to manage cash flow and purchase inventory or services on credit.

What’s included in this form

- Details of the purchaser, including business name and type of business.

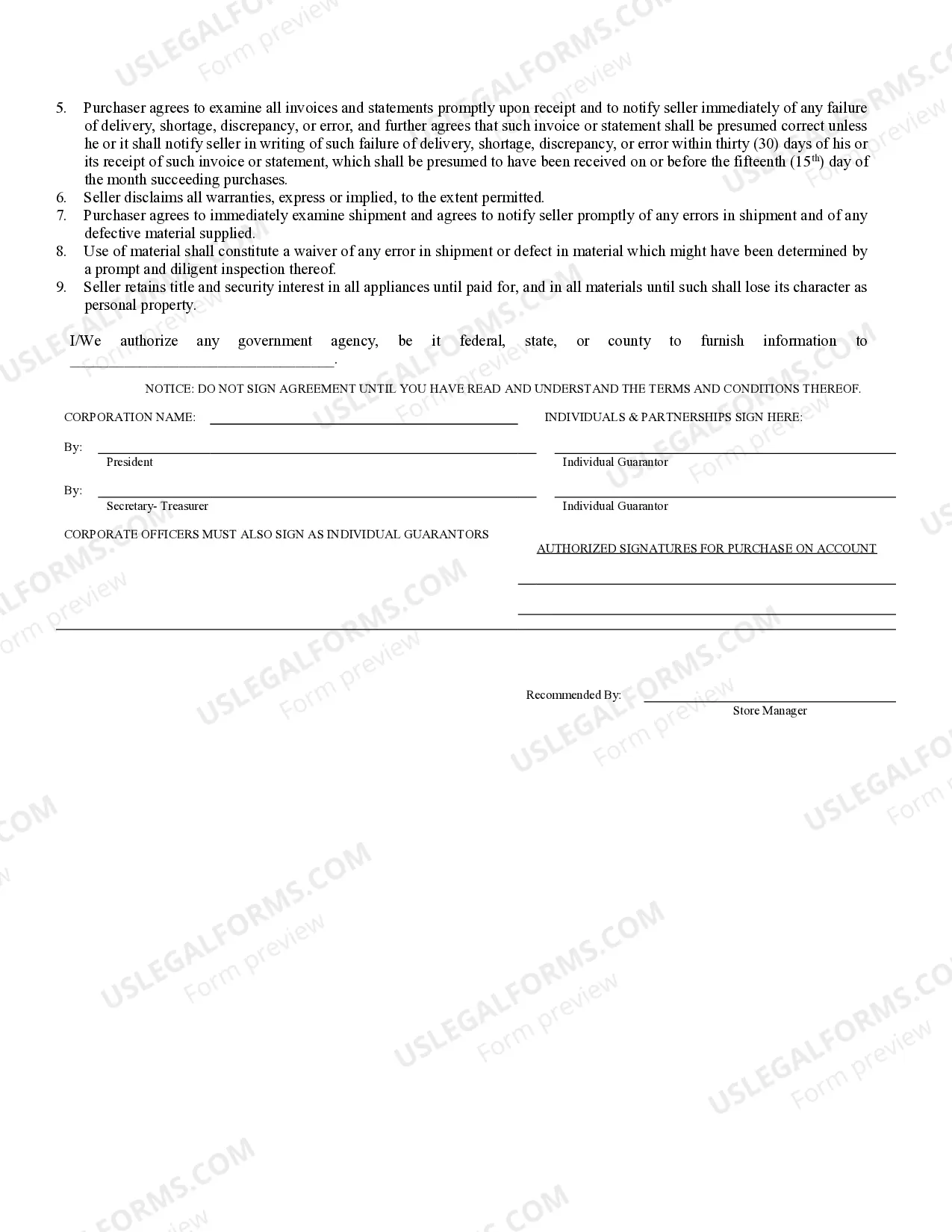

- Terms of sale, including payment schedule and interest rates for late payments.

- Personal guarantee agreement for officers or partners of the business.

- Clauses regarding examination of invoices and notifications of discrepancies.

- Warranties and liabilities concerning the seller's goods and services.

- Authorization for information to be shared with government agencies.

When this form is needed

This form is typically used when a business needs to establish credit with suppliers or lenders. It is appropriate when a business wants to buy inventory, equipment, or services on credit terms. Using this application helps clarify the payment terms and conditions which can prevent future disputes over billing and payment obligations.

Who should use this form

- Business owners looking to secure credit from suppliers or vendors.

- Corporations and partnerships seeking to obtain goods or services on credit.

- Financial managers or officers responsible for managing company accounts.

- Small businesses looking for flexible payment terms in order to maintain cash flow.

How to complete this form

- Identify the purchaser's legal name and business structure (e.g., corporation, partnership).

- Enter the terms of sale, including payment due dates and interest percentages for late payments.

- Include signatures from authorized officers or partners to confirm personal guarantees.

- Review all invoice handling procedures and agree to notify the seller of any discrepancies.

- Sign and date the application, ensuring all required parties have acknowledged the terms.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include all necessary signatures, particularly from guarantors.

- Not specifying payment terms clearly, leading to misunderstandings.

- Ignoring details regarding invoice disputes and notification timelines.

- Assuming the form is satisfactory without reading the terms and conditions thoroughly.

Benefits of using this form online

- Immediate access to professional templates drafted by licensed attorneys.

- Convenient download options in Word or Rich Text formats for easy editing.

- Time-efficient completion and submission process without the need for in-person appointments.

- Updated legal forms that reflect current laws and regulations.

Looking for another form?

Form popularity

FAQ

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Biennial Reports.

Launch & Grow your Business. File & Maintain Amendments. File with the Secretary of State. Register with the Department of Revenue. Launch & Grow your Business. File & Maintain Amendments. File with the Secretary of State.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

To form an LLC in Indiana, file your Articles of Organization with the Indiana Secretary of State along with the $100 filing fee. Forming a corporation in the State of Indiana also costs $100. Does the state of Indiana require a business license? The state of Indiana doesn't require a general business license.

How much does it cost to start a business in Indiana? To form an LLC in Indiana, file your Articles of Organization with the Indiana Secretary of State along with the $100 filing fee. Forming a corporation in the State of Indiana also costs $100.

Applying for an EIN for your LLC is free ($0) Applying for an EIN for your Indiana LLC is completely free. The IRS doesn't charge anything for applying for an EIN.

According to the IRS, getting an EIN for your business should come at no cost to you, as they offer the service for free.

Apply for an EIN with the IRS assistance tool. It will guide you through questions and ask for your name, social security number, address, and your "Doing Business As" (DBA) name. Your nine-digit federal tax ID becomes available immediately upon verification.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.