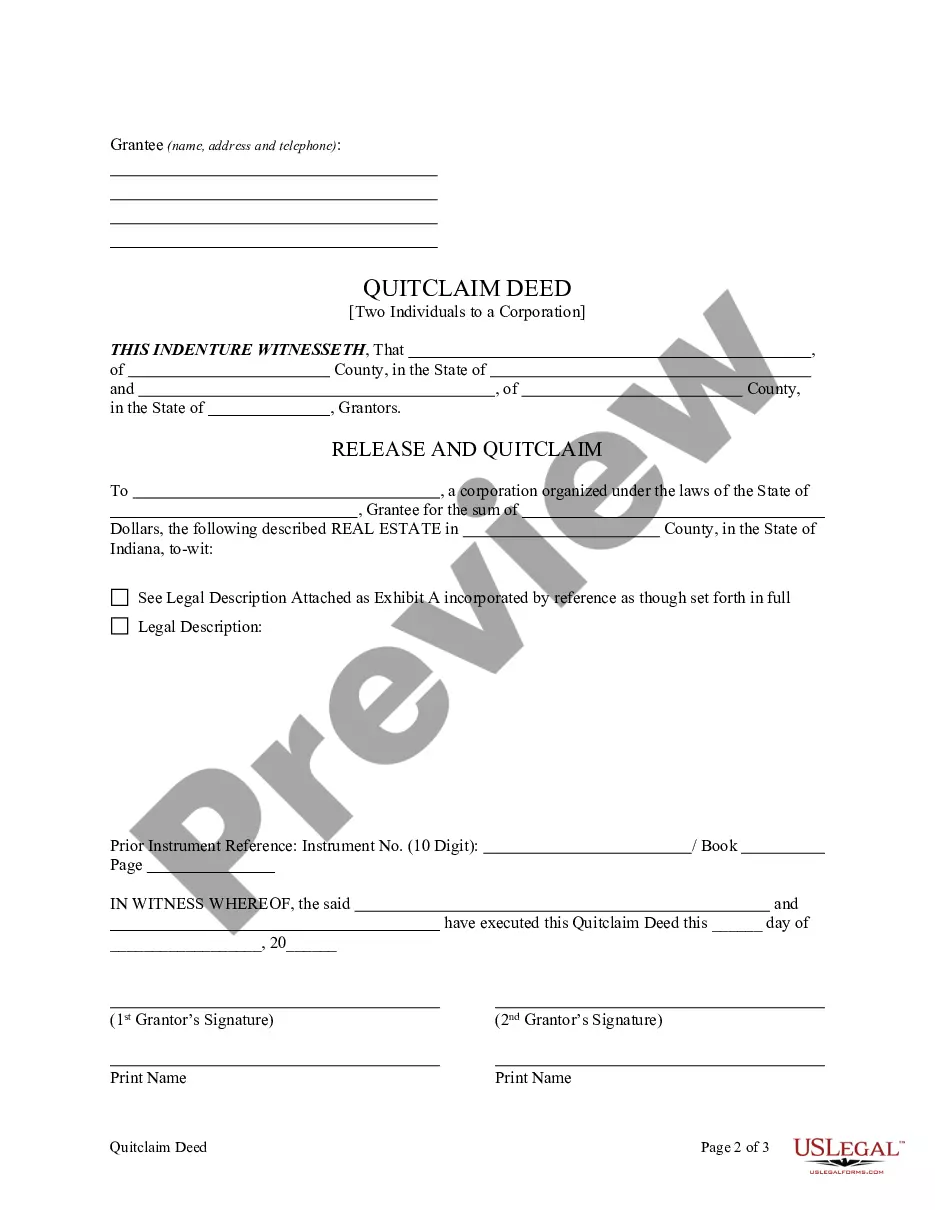

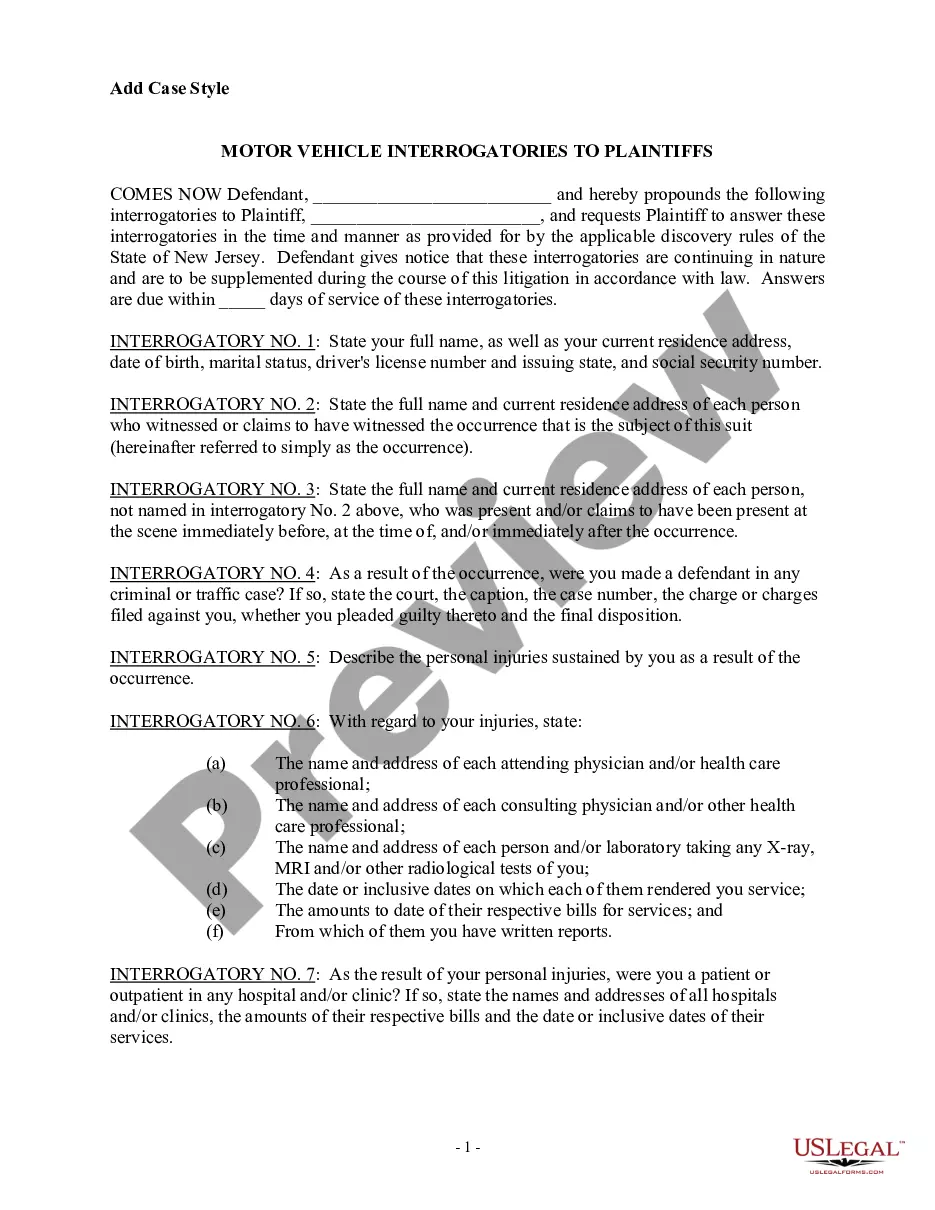

This form is a Quitclaim Deed where the grantors are two unmarried individuals and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indiana Quitclaim Deed by Two Individuals to Corporation

Description

How to fill out Indiana Quitclaim Deed By Two Individuals To Corporation?

Searching for Indiana Quitclaim Deed by Two Individuals to Corporation samples and completing them can be challenging.

To save time, money, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare each and every document, so you only need to fill them out. It's truly that simple.

Select your plan on the pricing page and create your account. Choose your preferred payment method, either by credit card or via PayPal. Download the sample in your desired format. You can print the Indiana Quitclaim Deed by Two Individuals to Corporation form or fill it out using any online editor. There's no need to worry about typos as your template can be used, submitted, and printed an unlimited number of times. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the document.

- All of your downloaded templates are saved in My documents and can be accessed at any time for future use.

- If you haven't registered yet, you need to sign up.

- Check out our extensive instructions on how to obtain the Indiana Quitclaim Deed by Two Individuals to Corporation sample in a matter of minutes.

- To acquire a valid example, verify its suitability for your state.

- Preview the sample (if the option is available).

- If a description exists, read it to understand the details.

- Click the Buy Now button if you found what you're seeking.

Form popularity

FAQ

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.