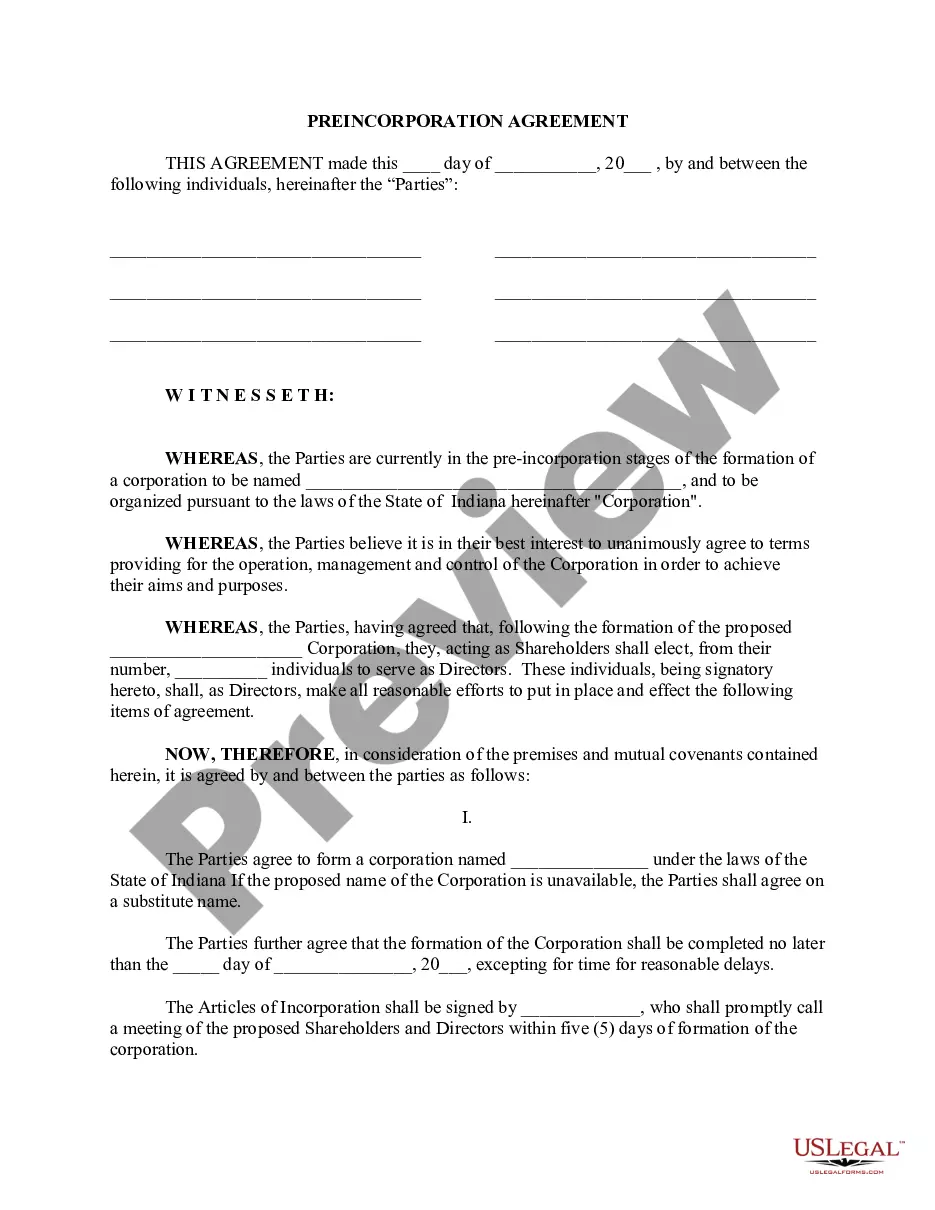

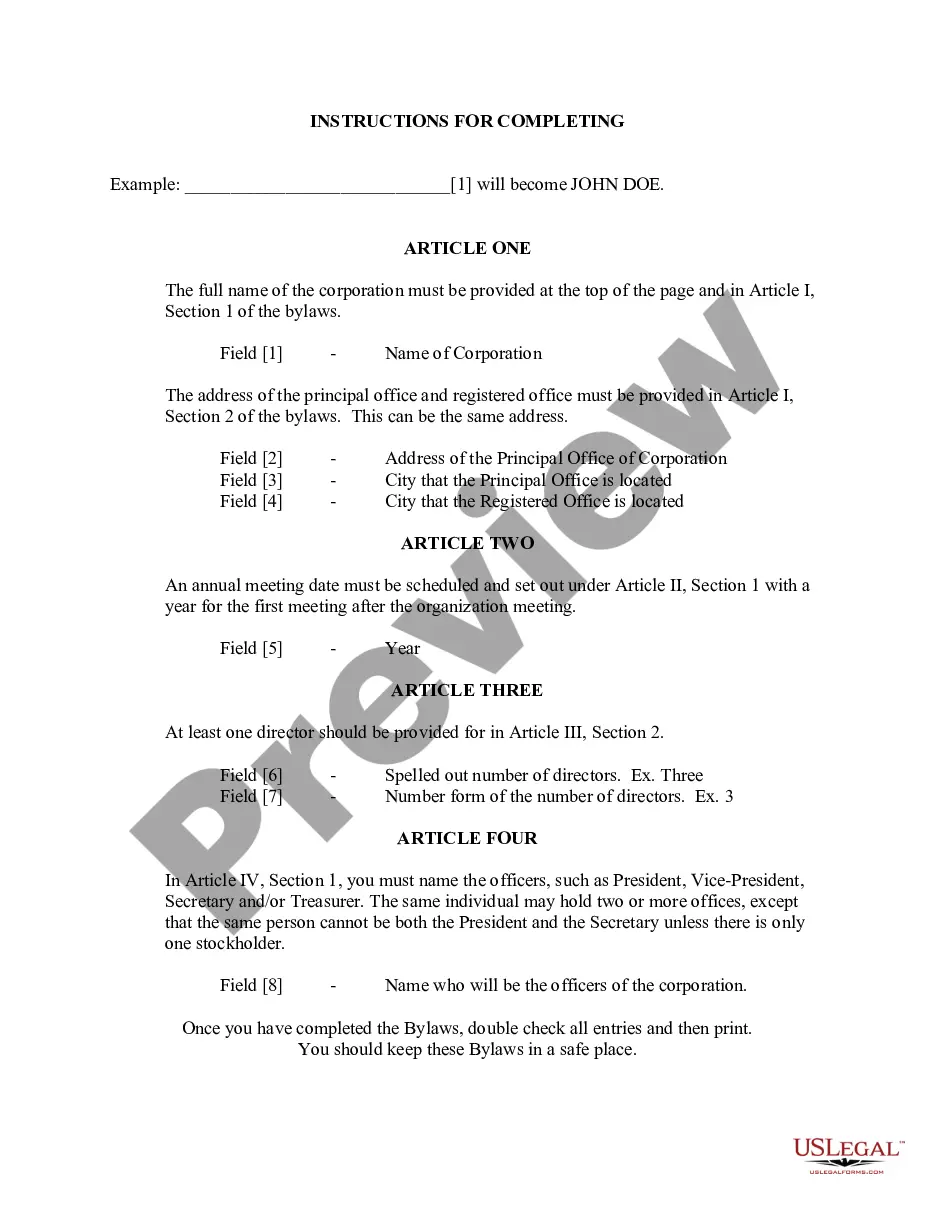

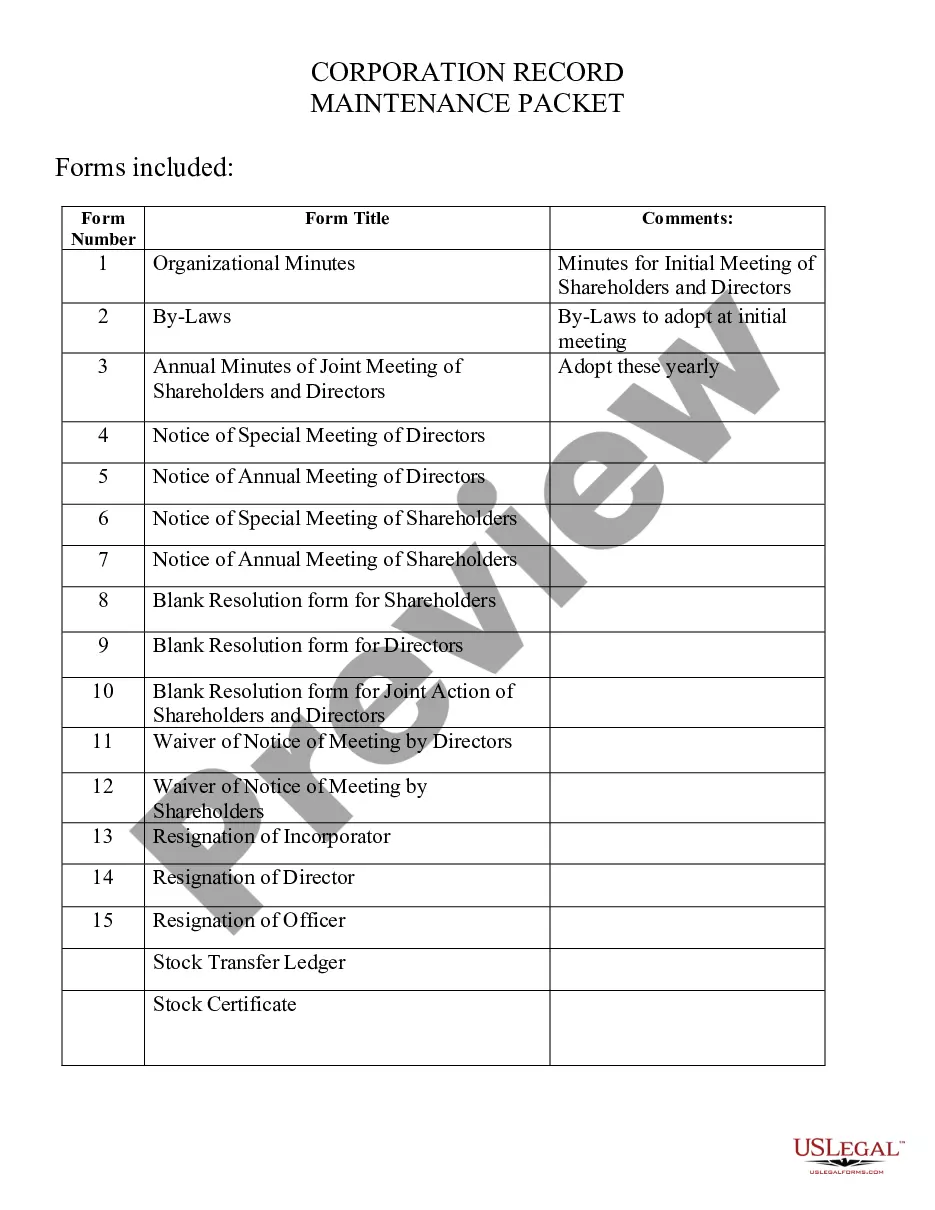

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Indiana Business Incorporation Package to Incorporate Corporation

Description

How to fill out Indiana Business Incorporation Package To Incorporate Corporation?

Looking for Indiana Business Incorporation Package to establish Corporation templates and completing them can be challenging.

To conserve substantial time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare each document, so you only need to complete them. It’s truly that simple.

Select your plan on the pricing page and create an account. Choose to pay with a credit card or via PayPal. Save the sample in your desired file format. You can now print the Indiana Business Incorporation Package to establish Corporation template or complete it using any online editor. No need to worry about errors, as your sample can be used, submitted, and printed as many times as needed. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to save the template.

- All your downloaded templates are stored in My documents and are accessible anytime for future use.

- If you haven’t registered yet, you should sign up.

- Review our detailed instructions on how to obtain your Indiana Business Incorporation Package to establish Corporation template within minutes.

- To obtain a valid sample, confirm its authenticity for your state.

- Examine the sample using the Preview feature (if available).

- If there’s an explanation, read it to understand the details.

- Click Buy Now if you found what you're looking for.

Form popularity

FAQ

Inc. is the abbreviation for incorporated. An incorporated company, or corporation, is a separate legal entity from the person or people forming it. Directors and officers purchase shares in the business and have responsibility for its operation. Incorporation limits an individual's liability in case of a lawsuit.

Choose a business name for the corporation and check for availability. Recruit and/or appoint a director or directors for the corporation. Prepare and file articles of incorporation with the Secretary of State. Create the corporation's bylaws. Hold an organizational meeting.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

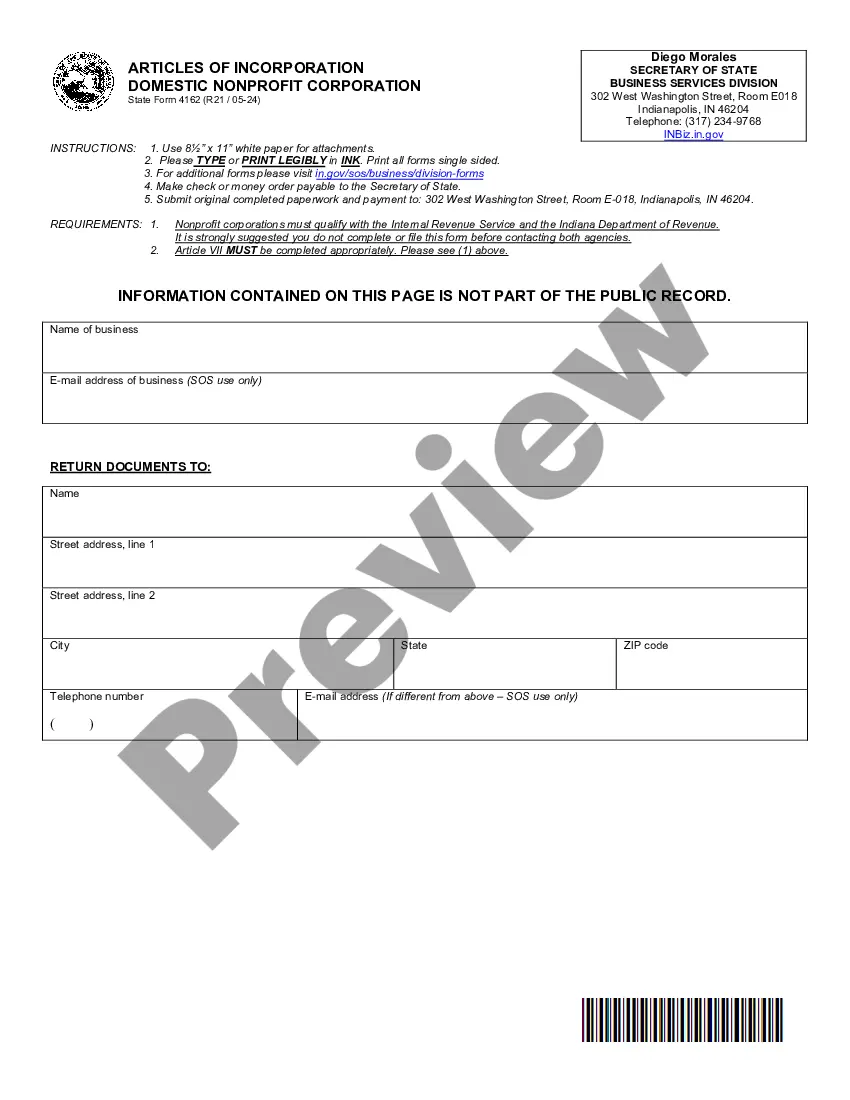

Your corporation may also need to register with state departments. To incorporate in Indiana, most businesses do the following: Form and file your Indiana Articles of Incorporation. Pay the filing fee: $98 online, $100 by mail.

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

Registered Office. Business Activity. Director's Details. Shareholders' Details. Shareholders' Details. Secretary Details (Not Compulsory) Person with Significant Control (PSC) Details Where the person is not a director, shareholder or secretary.

LLC registrants are required to complete and submit Articles of Organization to the Secretary of State. There is a filing fee that is about $90 for documents submitted by mail and another fee that is about $85 for documents submitted online.