Illinois Last Will and Testament for other Persons

Description

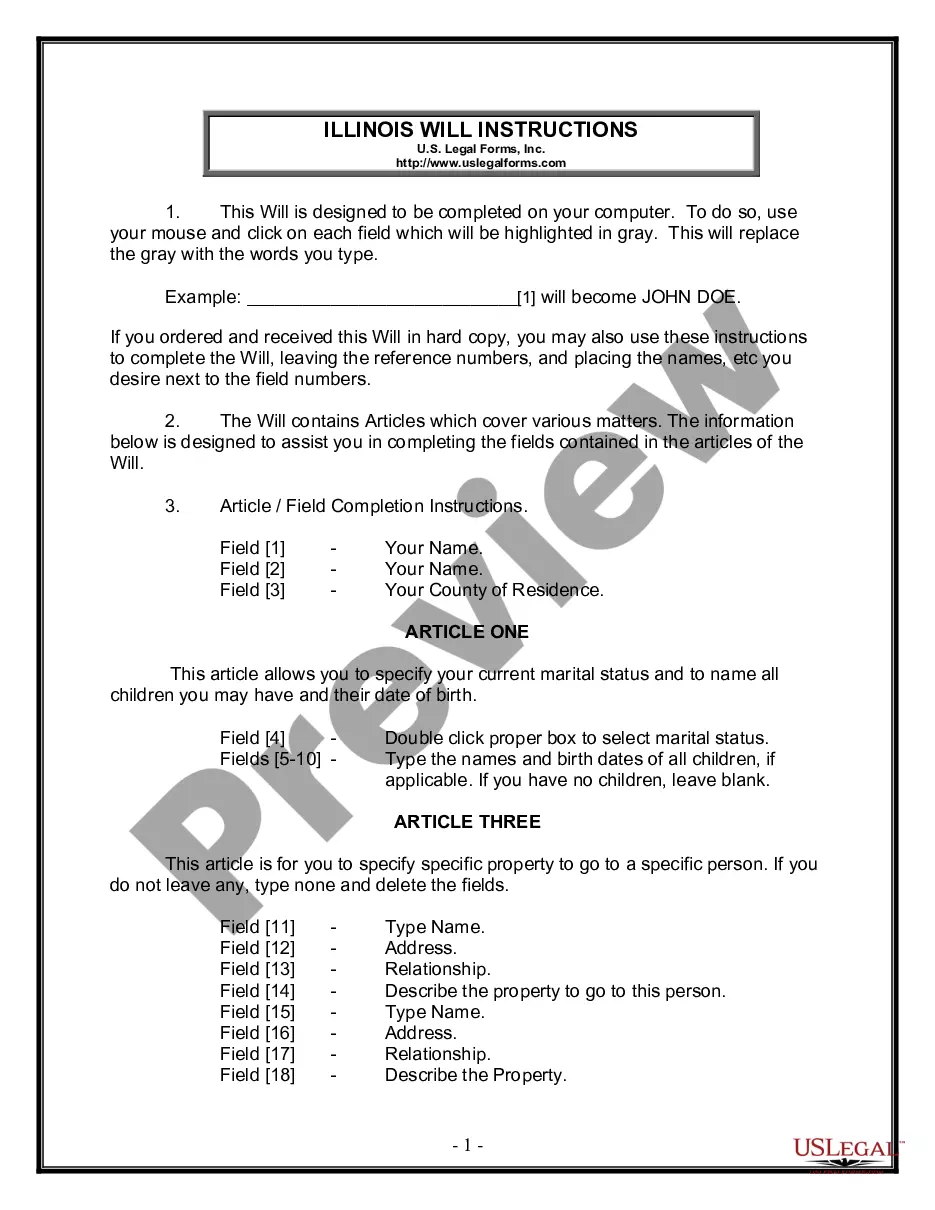

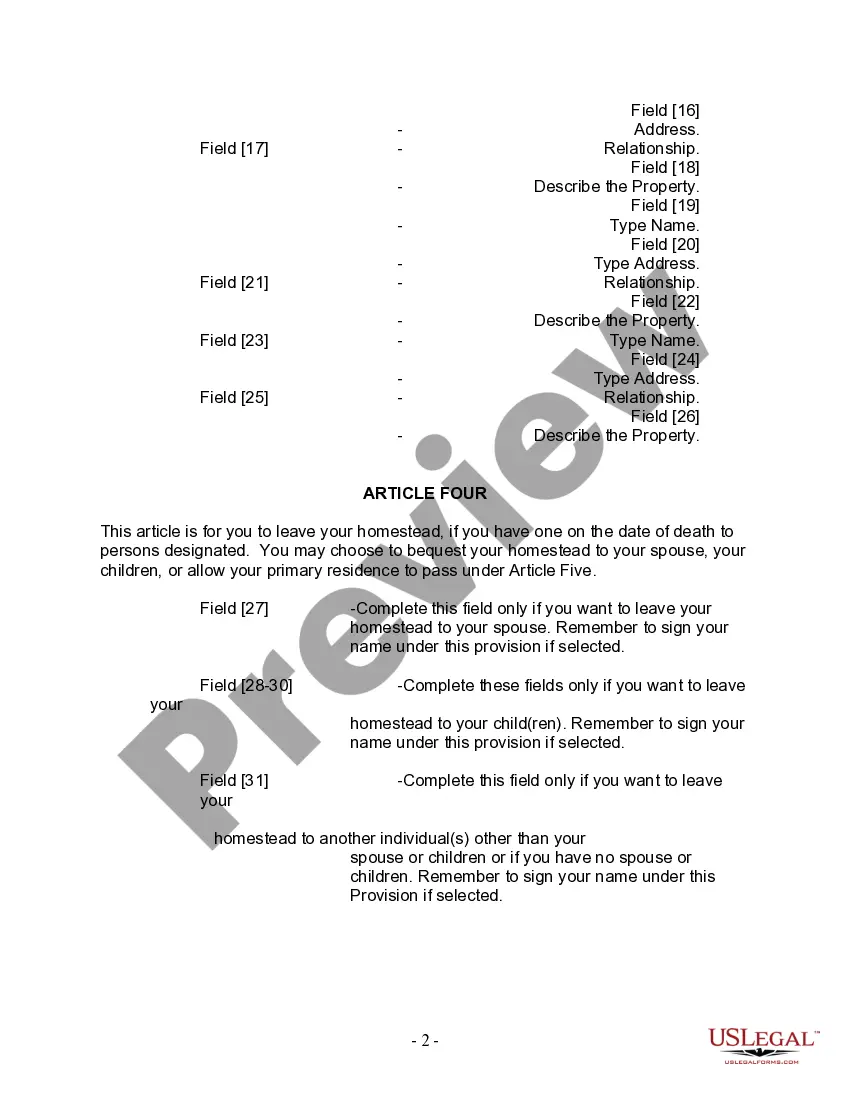

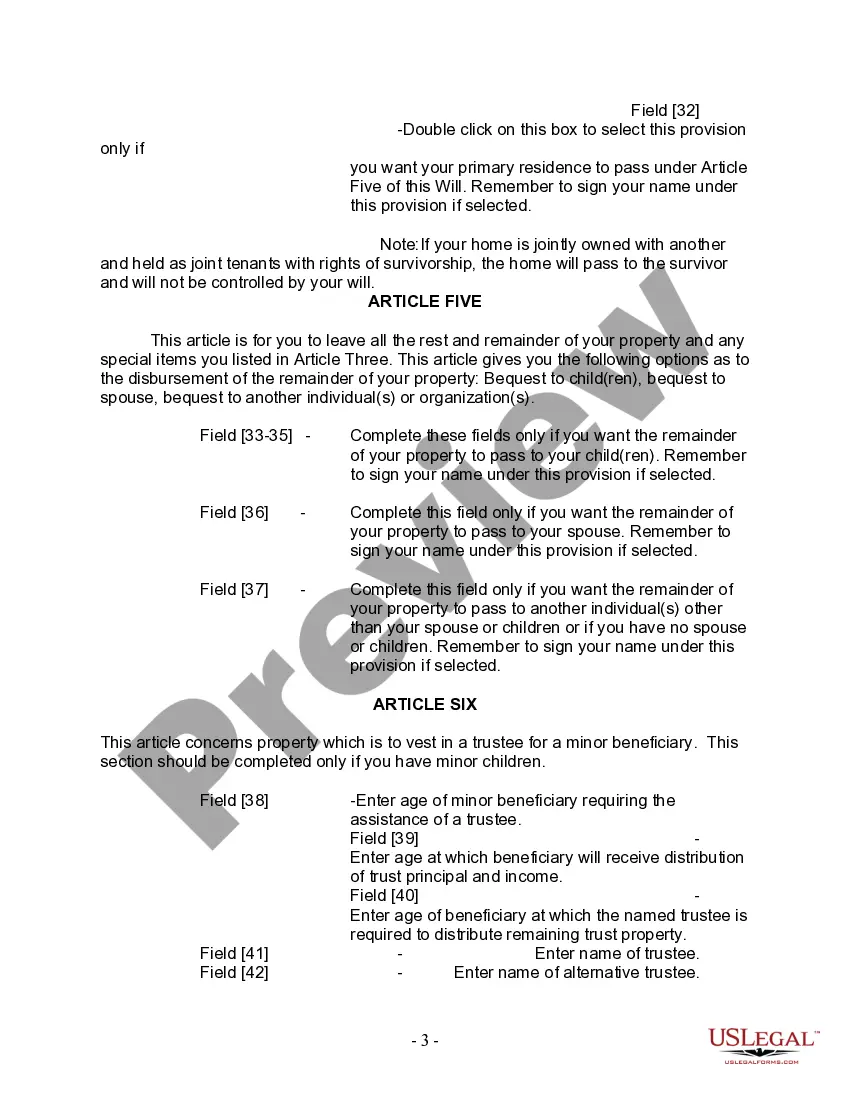

How to fill out Illinois Last Will And Testament For Other Persons?

Looking for a sample of the Illinois Last Will and Testament for other individuals and completing them might pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically designed for your state in just a few clicks.

Our attorneys prepare each document, so you merely need to fill them in. It truly is that effortless.

Select your payment method: credit card or PayPal. Save the sample in your preferred file format. You can print the Illinois Last Will and Testament for other individuals template or complete it using any online editor. There's no need to stress about typos as your sample can be used, sent, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account to return to the form's page and save the sample.

- All your saved templates can be found in My documents and are always available for future use.

- If you haven’t subscribed yet, it’s time to sign up.

- Review our detailed guidelines on how to obtain the Illinois Last Will and Testament for other individuals template within minutes.

- To acquire a suitable sample, verify its eligibility for your state.

- Examine the form using the Preview option (if available).

- If a description is provided, read it to understand the specifics.

- Click on the Buy Now button if you discovered what you were searching for.

Form popularity

FAQ

Absolutely, in Illinois, a beneficiary takes precedence over a will when it comes to specific assets. This means that if you have named a beneficiary on an account, that beneficiary will receive those assets, even if your will suggests otherwise. Ensuring your Illinois Last Will and Testament for other Persons reflects your current wishes is essential to avoid conflicts and confusion among your heirs.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements.

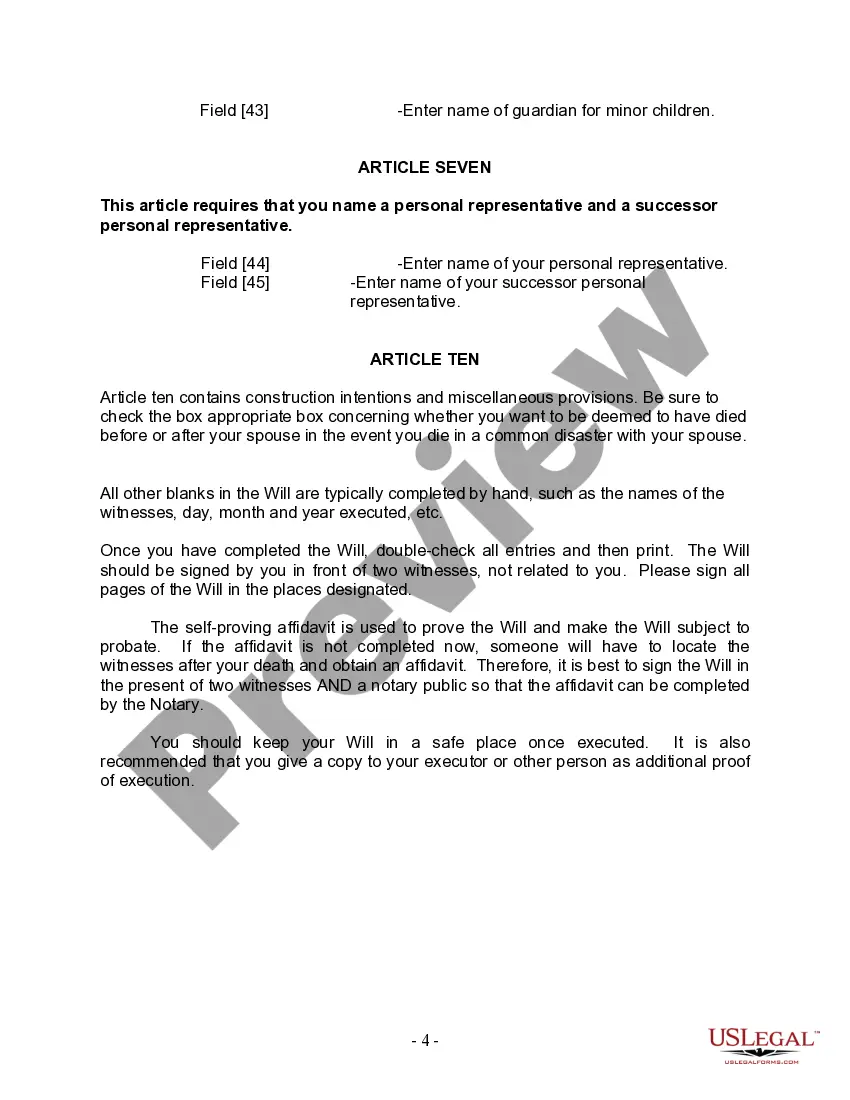

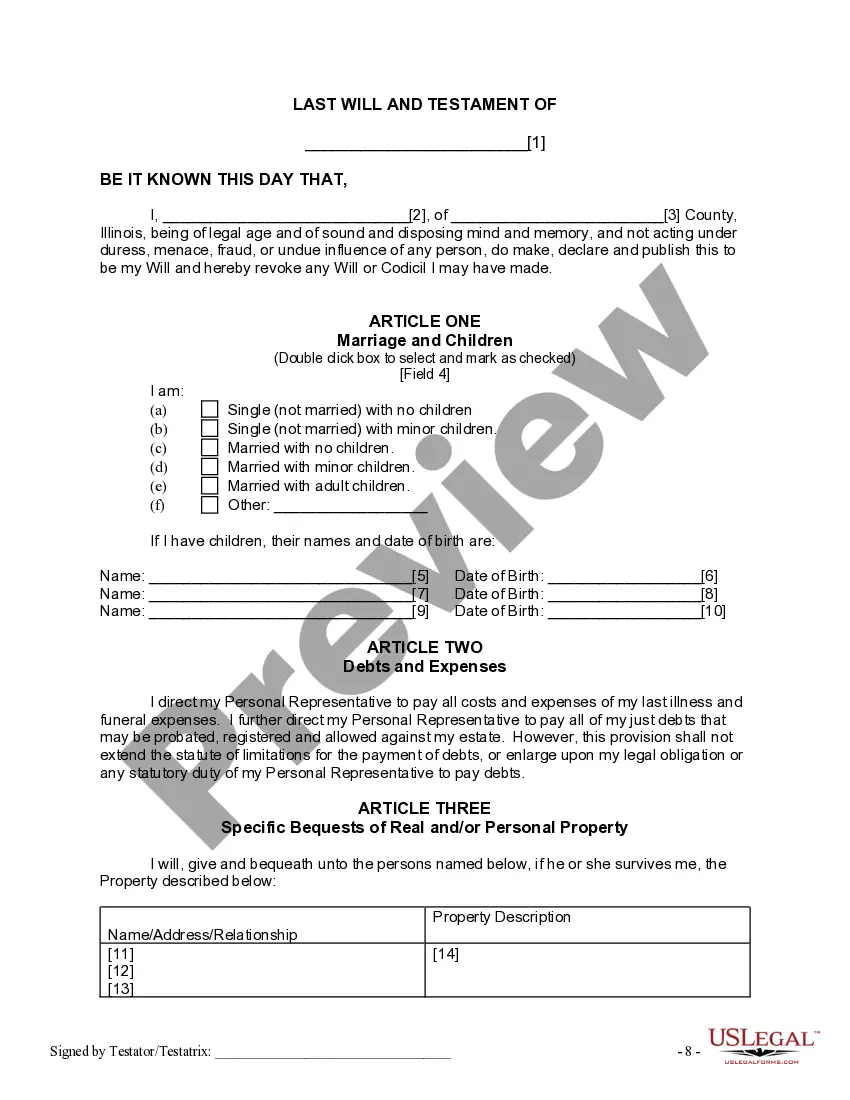

In Illinois, to have a valid will it is required that two or more credible witnesses validate or attest the will. This means each witness must watch the testator (person making his or her will) sign or acknowledge the will, determine the testator is of sound mind, and sign the will in front of the testator.

Write an Introduction. Select an Executor. Identify Your Heirs and Beneficiaries. Nominate a Guardian for Your Minor or Dependent Children. Assess and Divide Your Property. State Your Funeral Wishes (If You Have Any) Sign and Notarize the Document.

Obviously, the person who is named as executor or personal representative is entitled to a copy of the will. He or she is in charge of applying for probate, managing the decedent's property, and making sure the instructions in the will get carried out.

Do I Need to Have My Will Notarized? No, in Illinois, you do not need to notarize your will to make it legal.However, Illinois allows your will to be self-proved without a self-proving affidavit, as long as you sign and witness it correctly.

A will doesn't have to be notarized to be valid. But in most states, you'll want to add a self-proving affidavit to your will, which must be signed by your witnesses and notarized.If you sign your will in a lawyer's office, the lawyer will provide a notary public.

In Illinois, to have a valid will it is required that two or more credible witnesses validate or attest the will. This means each witness must watch the testator (person making his or her will) sign or acknowledge the will, determine the testator is of sound mind, and sign the will in front of the testator.

A notarized will does not need to be probated.When a person dies leaving behind a will that is not notarized, the law requires that its validity be ascertained by a notary or by a court. Similarly, any non-notarized modification made to a will must be probated, whether the will is notarized or not.