This office lease clause should be used in a base year lease. This form states that when the building is not at least 95% occupied during all or a portion of any lease year the landlord shall make an appropriate adjustment in accordance with industry standards of the building operating costs. This amount shall be deemed to be the amount of building operating costs for the year.

Illinois Gross up Clause that Should be Used in a Base Year Lease

Description

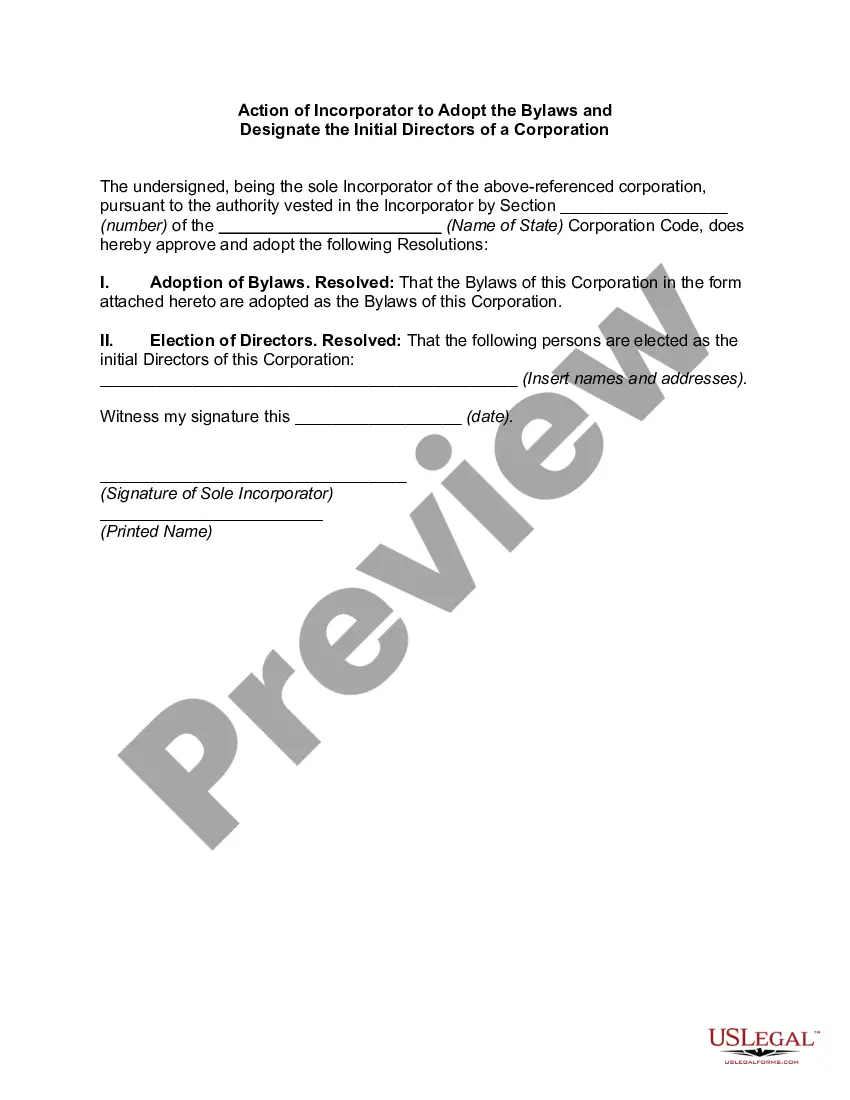

How to fill out Gross Up Clause That Should Be Used In A Base Year Lease?

Discovering the right lawful document design might be a struggle. Of course, there are a variety of templates accessible on the Internet, but how would you obtain the lawful develop you need? Use the US Legal Forms web site. The service provides 1000s of templates, like the Illinois Gross up Clause that Should be Used in a Base Year Lease, that you can use for business and personal demands. Each of the varieties are inspected by specialists and fulfill federal and state needs.

When you are currently authorized, log in to your bank account and then click the Acquire key to get the Illinois Gross up Clause that Should be Used in a Base Year Lease. Use your bank account to check through the lawful varieties you might have acquired in the past. Visit the My Forms tab of your bank account and acquire one more backup of your document you need.

When you are a fresh end user of US Legal Forms, here are straightforward recommendations for you to adhere to:

- Very first, be sure you have selected the correct develop for your personal metropolis/county. You may check out the form while using Review key and look at the form outline to make sure this is basically the right one for you.

- When the develop fails to fulfill your requirements, make use of the Seach industry to get the appropriate develop.

- When you are certain the form is acceptable, select the Get now key to get the develop.

- Select the costs strategy you would like and enter in the essential information. Create your bank account and pay for the transaction using your PayPal bank account or Visa or Mastercard.

- Choose the submit formatting and acquire the lawful document design to your device.

- Full, change and print out and indicator the obtained Illinois Gross up Clause that Should be Used in a Base Year Lease.

US Legal Forms will be the most significant library of lawful varieties that you can find a variety of document templates. Use the service to acquire appropriately-created files that adhere to status needs.

Form popularity

FAQ

Grossing Up is a process for calculating a tenant's share of a building's variable operating expenses, where the expenses are increased for expense recovery purposes, or Grossed Up, to what they would be if the building's occupancy remained at a specific level, typically 95%- 100%.

Gross-ups are also practical for tenants. A prime example is a lease with a base year or expense stop. If a tenant negotiates a base year, then, in most cases, the tenant will pay its share each year of the operating expenses which exceed the base year's expenses. What Are Gross-Ups and Are They Fair? - Chelepis chelepis.com ? post ? what-are-gross-ups-an... chelepis.com ? post ? what-are-gross-ups-an...

A Base Year clause is found in many Full-Service and Gross Leases. It is not found in triple net leases. The Base Year clause is a year that is tied to the actual amount of expenses for property taxes, insurance and operating expenses (sometimes called CAM) to run the property in a specified year. Base Year, Expense Stop and Annual Escalations - CARR.us carr.us ? commercial-real-estate-leases-and-clauses carr.us ? commercial-real-estate-leases-and-clauses

So, what is a gross-up provision? Simply stated, the concept of ?gross up provision? stipulates that if a building has significant vacancy, the landlord can estimate what the variable operating expense would have been had the building been fully occupied, and charge the tenants their pro-rata share of that cost. What is an Operating Expense Gross Up Provision in a Lease? aquilacommercial.com ? learning-center ? operati... aquilacommercial.com ? learning-center ? operati...

A Base Year clause is found in many Full-Service and Gross Leases. It is not found in triple net leases. The Base Year clause is a year that is tied to the actual amount of expenses for property taxes, insurance and operating expenses (sometimes called CAM) to run the property in a specified year.

Correctly drafted, a gross up provision relates only to Operating Expenses that ?vary with occupancy??so called ?variable? expenses. Variable expenses are those expenses that will go up or down depending on the number of tenants in the Building, such as utilities, trash removal, management fees and janitorial services.

A base year is the first of a series of years in an economic or financial index. Base years are also used to measure business activity, such as growth in sales from one period to the next. A base year can be any year and is chosen based on the analysis being performed.