Illinois Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner

Description

How to fill out Ratification Of Pooled Unit Designation By Overriding Royalty Or Royalty Interest Owner?

Are you in the place where you need to have documents for possibly business or personal functions just about every day? There are a lot of legal document web templates accessible on the Internet, but getting versions you can rely isn`t effortless. US Legal Forms provides a huge number of kind web templates, like the Illinois Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner, that are composed to meet federal and state needs.

In case you are already acquainted with US Legal Forms web site and possess an account, basically log in. Next, you are able to download the Illinois Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner web template.

If you do not provide an bank account and need to start using US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is for the proper town/state.

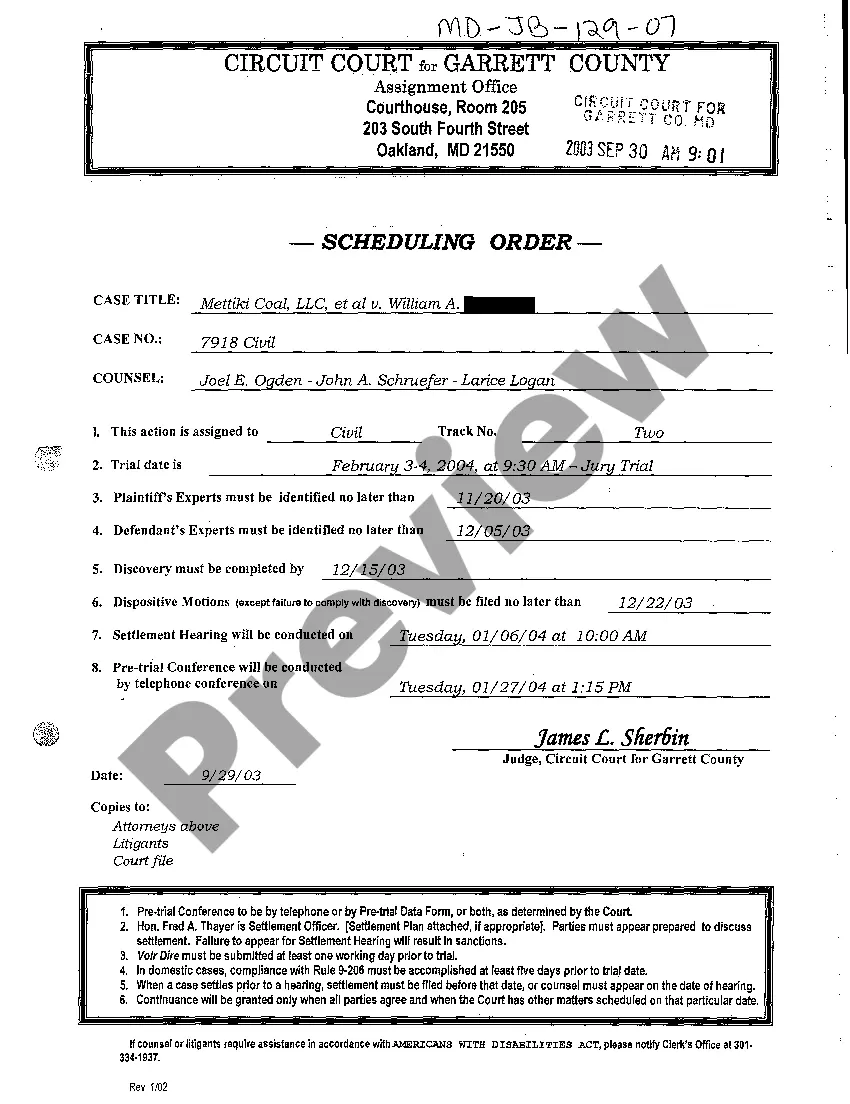

- Utilize the Review key to review the form.

- See the description to actually have chosen the appropriate kind.

- In the event the kind isn`t what you are searching for, take advantage of the Search field to obtain the kind that meets your needs and needs.

- Once you get the proper kind, just click Purchase now.

- Choose the rates plan you desire, submit the necessary details to make your money, and pay for your order utilizing your PayPal or bank card.

- Decide on a practical document formatting and download your backup.

Discover all of the document web templates you may have bought in the My Forms food list. You can aquire a additional backup of Illinois Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner anytime, if necessary. Just go through the essential kind to download or printing the document web template.

Use US Legal Forms, one of the most comprehensive collection of legal types, to save time and prevent blunders. The service provides skillfully produced legal document web templates which you can use for a variety of functions. Produce an account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...