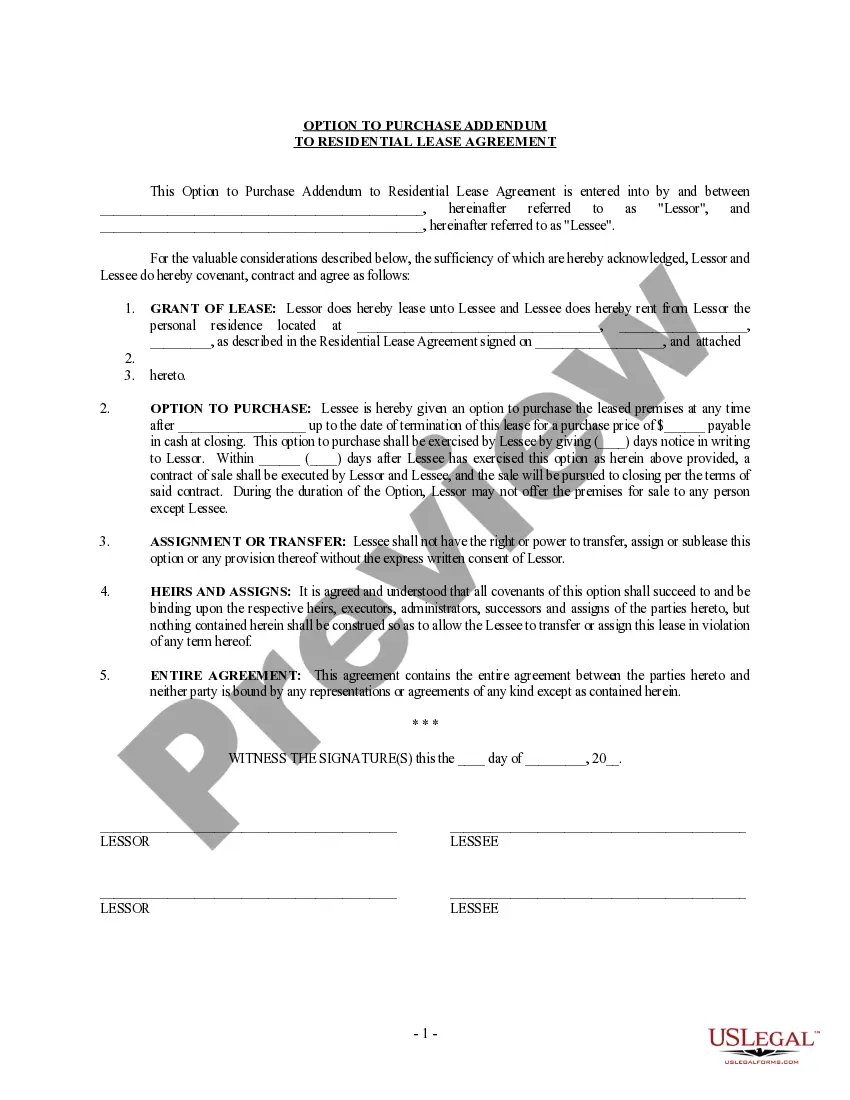

This form is when the Lessor ratifies the Lease and grants, leases, and lets all of Lessor's undivided mineral interest in the Lands to Lessee on the same terms and conditions as provided for in the Lease, and adopts and confirms the Lease as if Lessor was an original party to and named as a Lessor in the Lease.

Illinois Ratification of Oil, Gas, and Mineral Lease by Mineral Owner

Description

How to fill out Ratification Of Oil, Gas, And Mineral Lease By Mineral Owner?

If you wish to complete, down load, or print out legitimate document web templates, use US Legal Forms, the greatest variety of legitimate forms, that can be found on-line. Take advantage of the site`s simple and easy convenient search to find the documents you want. Different web templates for company and person purposes are categorized by types and says, or keywords and phrases. Use US Legal Forms to find the Illinois Ratification of Oil, Gas, and Mineral Lease by Mineral Owner in just a number of click throughs.

When you are presently a US Legal Forms client, log in in your profile and then click the Acquire switch to find the Illinois Ratification of Oil, Gas, and Mineral Lease by Mineral Owner. You can also entry forms you earlier saved within the My Forms tab of your profile.

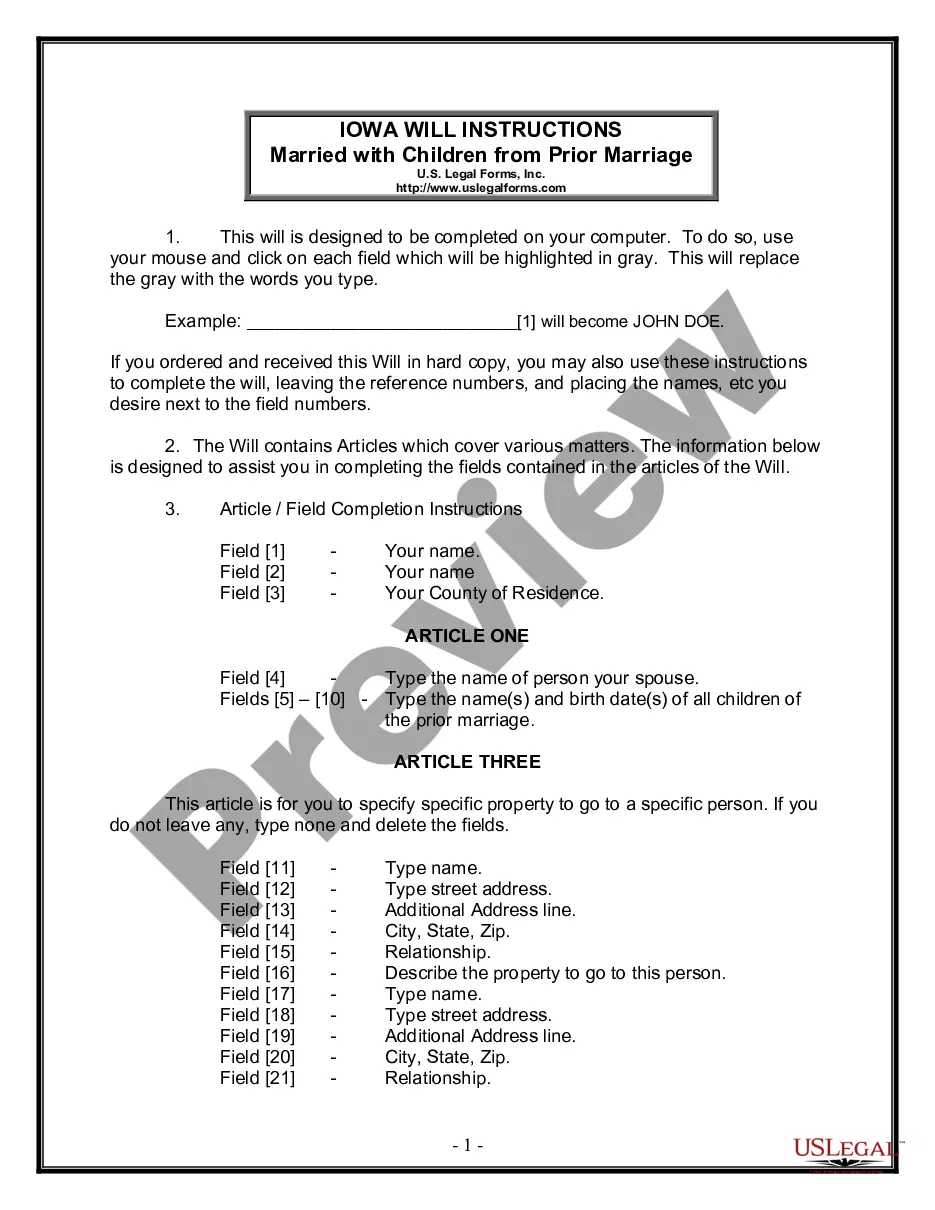

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for that proper metropolis/country.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Never forget to learn the explanation.

- Step 3. When you are unhappy together with the type, use the Research discipline at the top of the display screen to locate other types of your legitimate type template.

- Step 4. When you have found the form you want, click on the Get now switch. Opt for the prices plan you like and add your qualifications to sign up for the profile.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the structure of your legitimate type and down load it in your device.

- Step 7. Comprehensive, revise and print out or indication the Illinois Ratification of Oil, Gas, and Mineral Lease by Mineral Owner.

Every single legitimate document template you purchase is your own property for a long time. You have acces to every single type you saved in your acccount. Click on the My Forms section and decide on a type to print out or down load once again.

Compete and down load, and print out the Illinois Ratification of Oil, Gas, and Mineral Lease by Mineral Owner with US Legal Forms. There are many skilled and status-certain forms you may use for your personal company or person needs.

Form popularity

FAQ

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Oil and gas royalties are typically calculated based on the value of the production. The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

Receive Payment Royalties are a form of payment made to the owner of the mineral rights, in exchange for the right to extract and sell the resource. In the context of mineral rights, royalties are typically a percentage of the revenue generated from the sale of minerals extracted from the property.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

The fact that mineral rights can be privately owned in the United States means that homeowners with rights to valuable resources on their property can sell those mineral rights to private corporations, sometimes generating substantial up-front or ongoing royalty payments by doing so.

A royalty is a fee that is imposed by local, state or federal governments on either the amount of minerals produced at a mine or the revenue or profit generated by the minerals sold from a mine. A royalty can be imposed as either a ?net? or ?gross? royalty.

A lease bonus is a one-time payment the mineral rights owner receives when the lease is signed. Royalty is a portion of the proceeds from the sale of production which is paid monthly to the mineral rights owner. The royalty is usually described in the lease as a fraction such as 1/8th, or 1/6th.