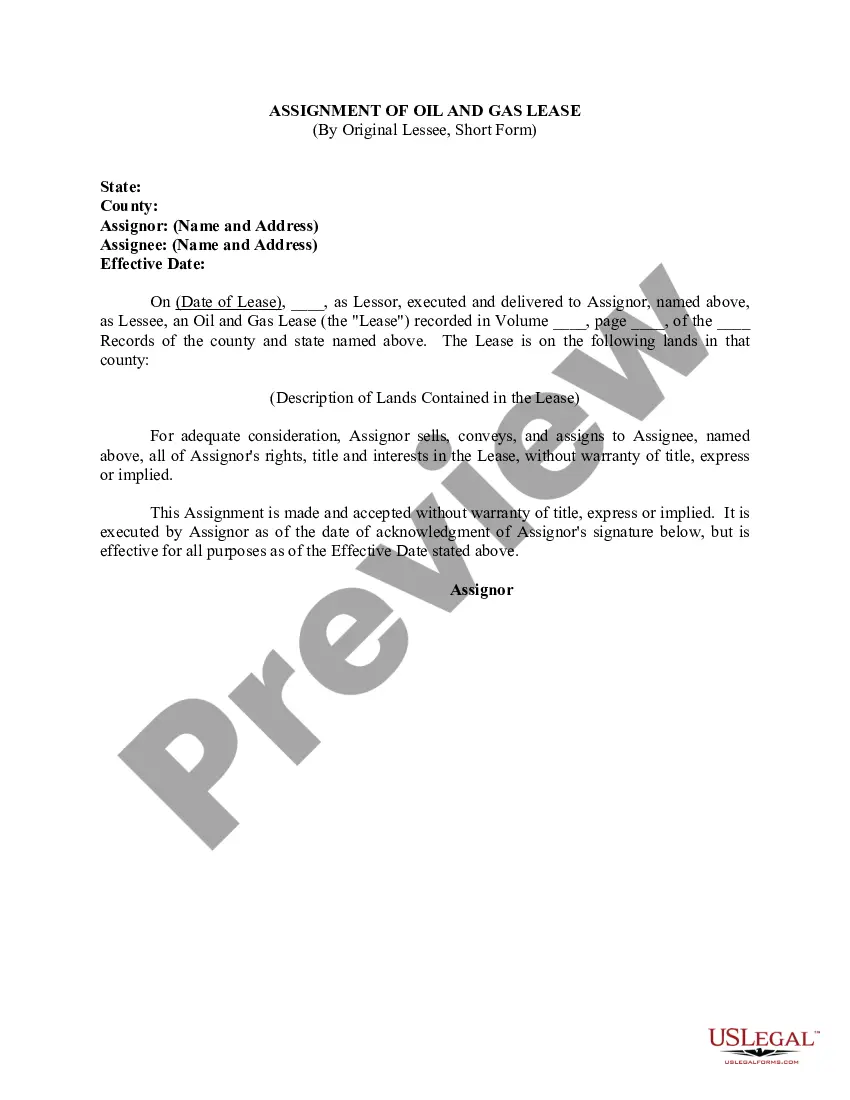

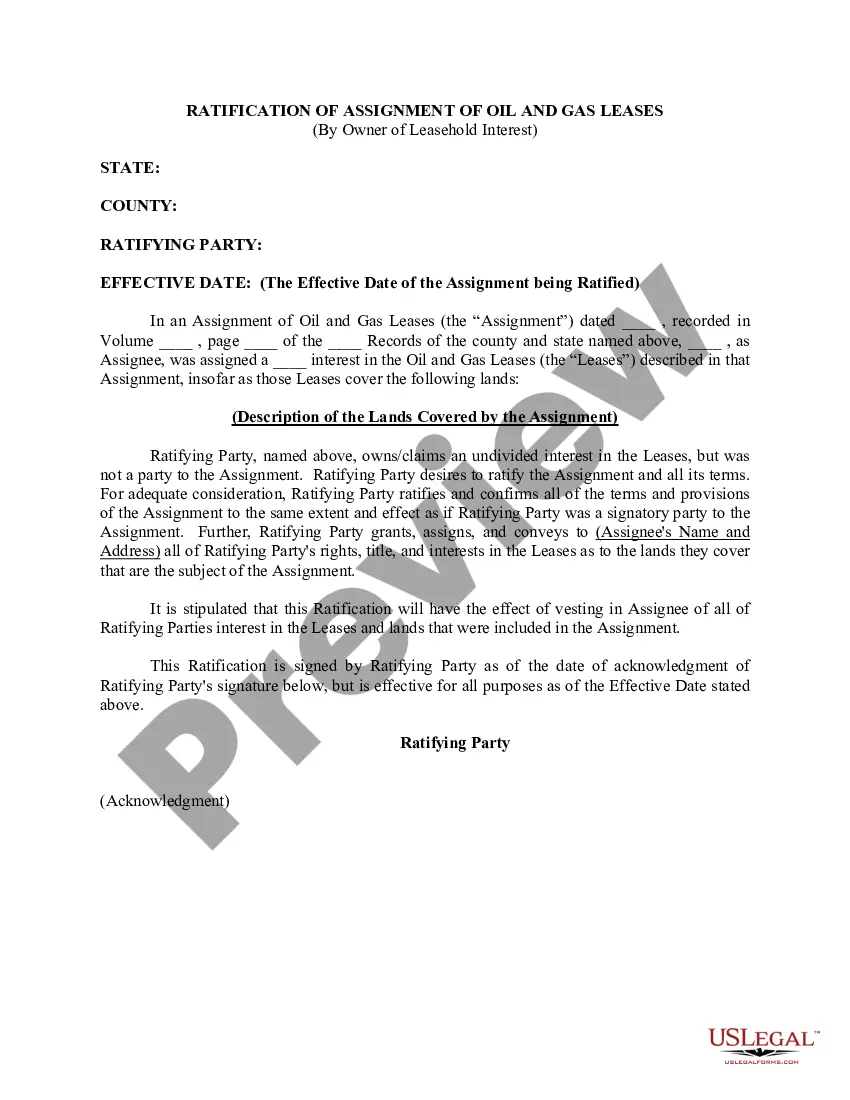

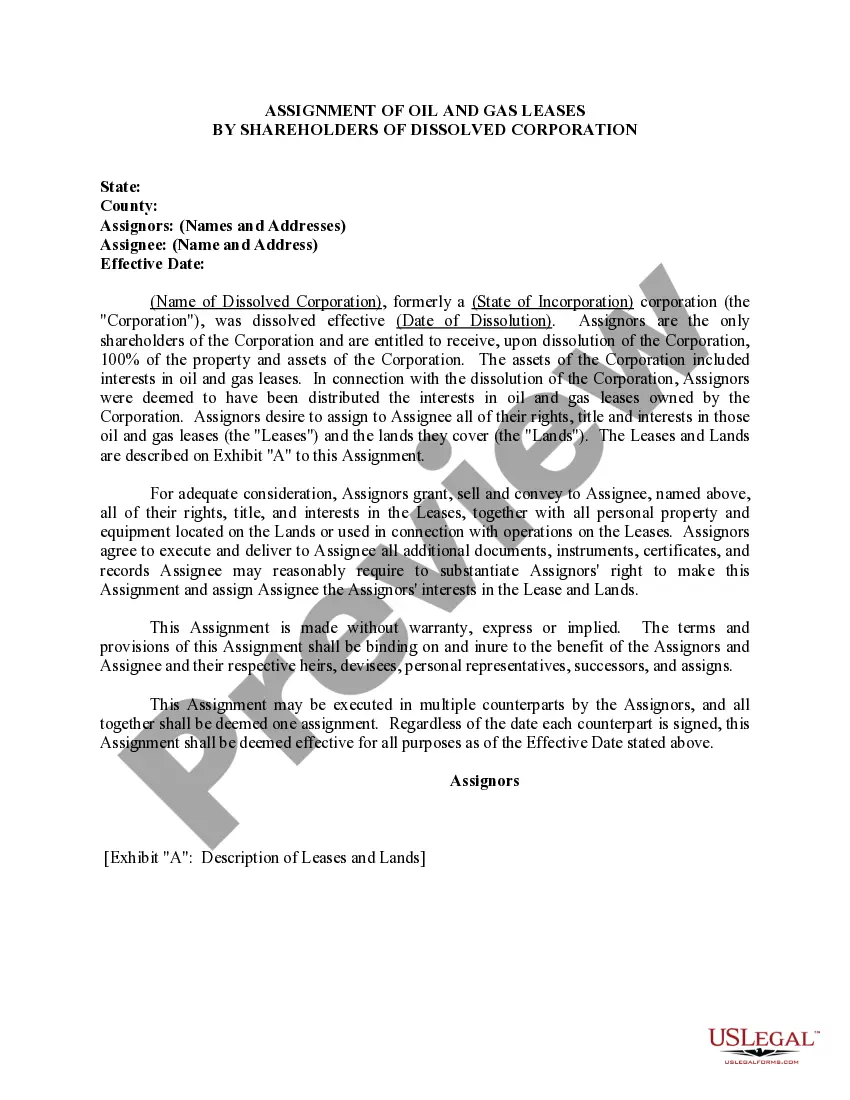

This form is used when the assets of a dissolved Corporation included interests in oil and gas leases. In connection with the dissolution of the Corporation, Assignors were deemed to have been distributed the interests in oil and gas leases owned by the Corporation and the Assignors desire to assign to Assignee all of their rights, title and interests in those oil and gas leases and the lands they cover.

Illinois Assignment of Oil and Gas Leases by Shareholders of Dissolved Corporation

Description

How to fill out Assignment Of Oil And Gas Leases By Shareholders Of Dissolved Corporation?

You are able to devote time on the web searching for the legitimate record design which fits the state and federal specifications you want. US Legal Forms offers thousands of legitimate types that happen to be evaluated by experts. You can actually down load or printing the Illinois Assignment of Oil and Gas Leases by Shareholders of Dissolved Corporation from the services.

If you already have a US Legal Forms bank account, you may log in and click on the Download option. After that, you may comprehensive, edit, printing, or signal the Illinois Assignment of Oil and Gas Leases by Shareholders of Dissolved Corporation. Each legitimate record design you buy is your own for a long time. To get an additional backup of the obtained develop, go to the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms site for the first time, stick to the easy guidelines beneath:

- First, be sure that you have selected the right record design for that county/metropolis of your liking. Look at the develop outline to make sure you have picked out the correct develop. If offered, take advantage of the Preview option to search with the record design too.

- If you would like locate an additional version of the develop, take advantage of the Lookup field to find the design that meets your needs and specifications.

- Upon having identified the design you want, just click Acquire now to proceed.

- Pick the prices prepare you want, enter your credentials, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You should use your charge card or PayPal bank account to fund the legitimate develop.

- Pick the structure of the record and down load it to the device.

- Make alterations to the record if possible. You are able to comprehensive, edit and signal and printing Illinois Assignment of Oil and Gas Leases by Shareholders of Dissolved Corporation.

Download and printing thousands of record layouts while using US Legal Forms web site, which provides the most important variety of legitimate types. Use expert and express-certain layouts to tackle your small business or person needs.

Form popularity

FAQ

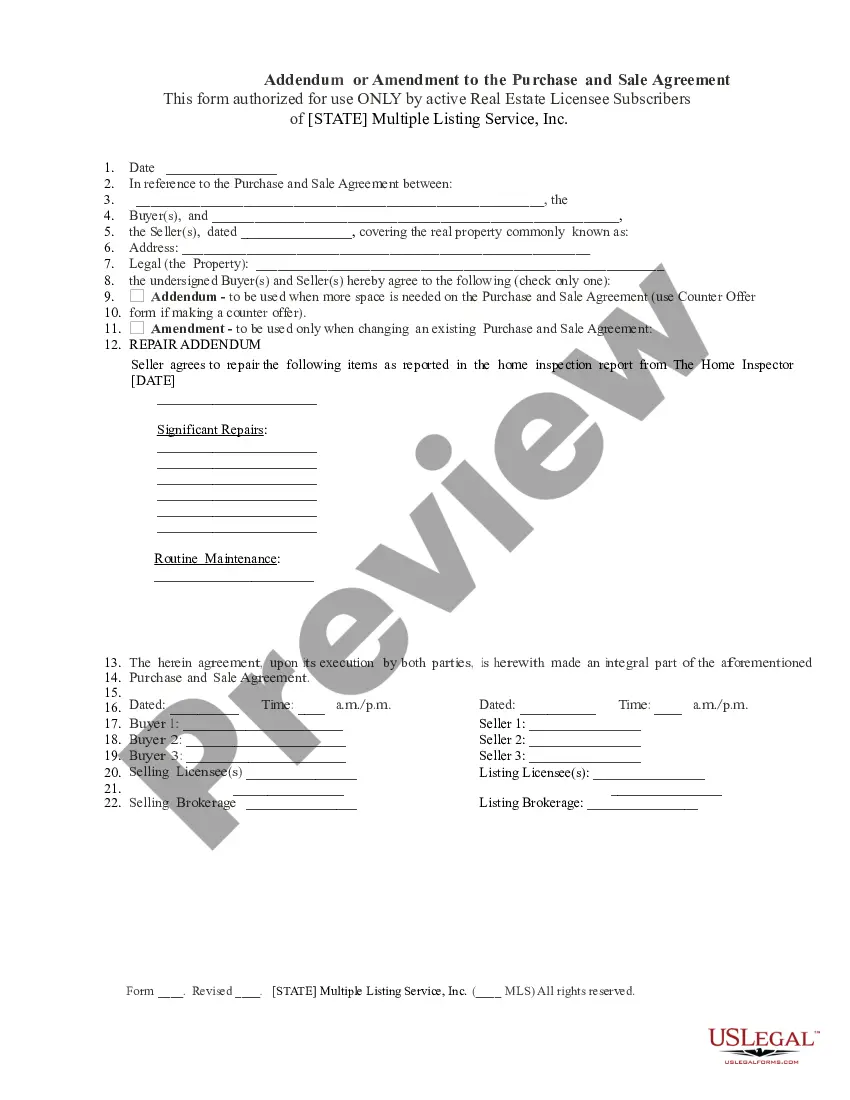

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

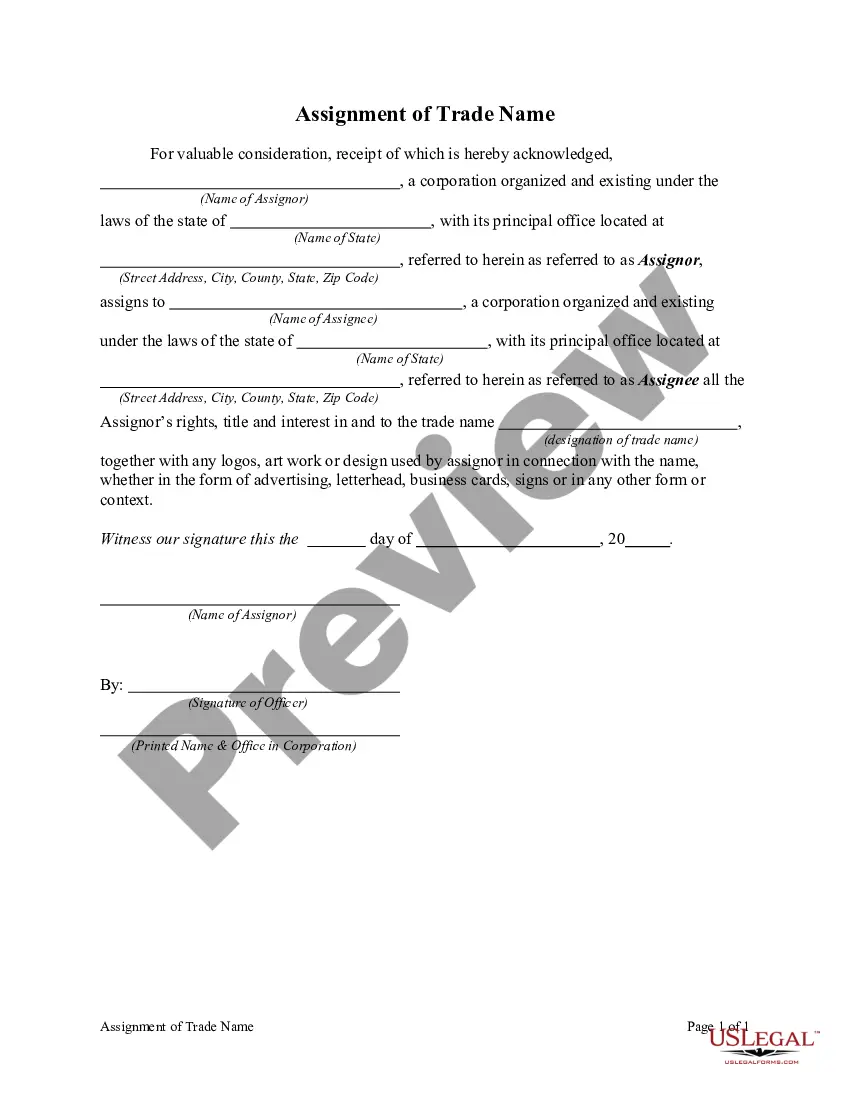

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

The primary term is the initial period during which a well may be drilled. If a successful well is drilled within the primary term, the lease will extend for as long as the well remains productive. If a well is not drilled within the primary term, the lease will usually expire.

The period of time in the life of an oil & gas lease that begins after the expiration of the primary term. Production, operations, continuous drilling, or shut-in royalty payments are most often used to extend an oil & gas lease into its secondary term.

Record Title: Primary ownership of an interest in an oil and gas lease including the obligation to pay rent, and the right to transfer and relinquish the lease. Overriding royalty and operating rights are severable from record title interests.