Illinois Stipulation of Ownership of Mineral Interest in Specific Lands

Description

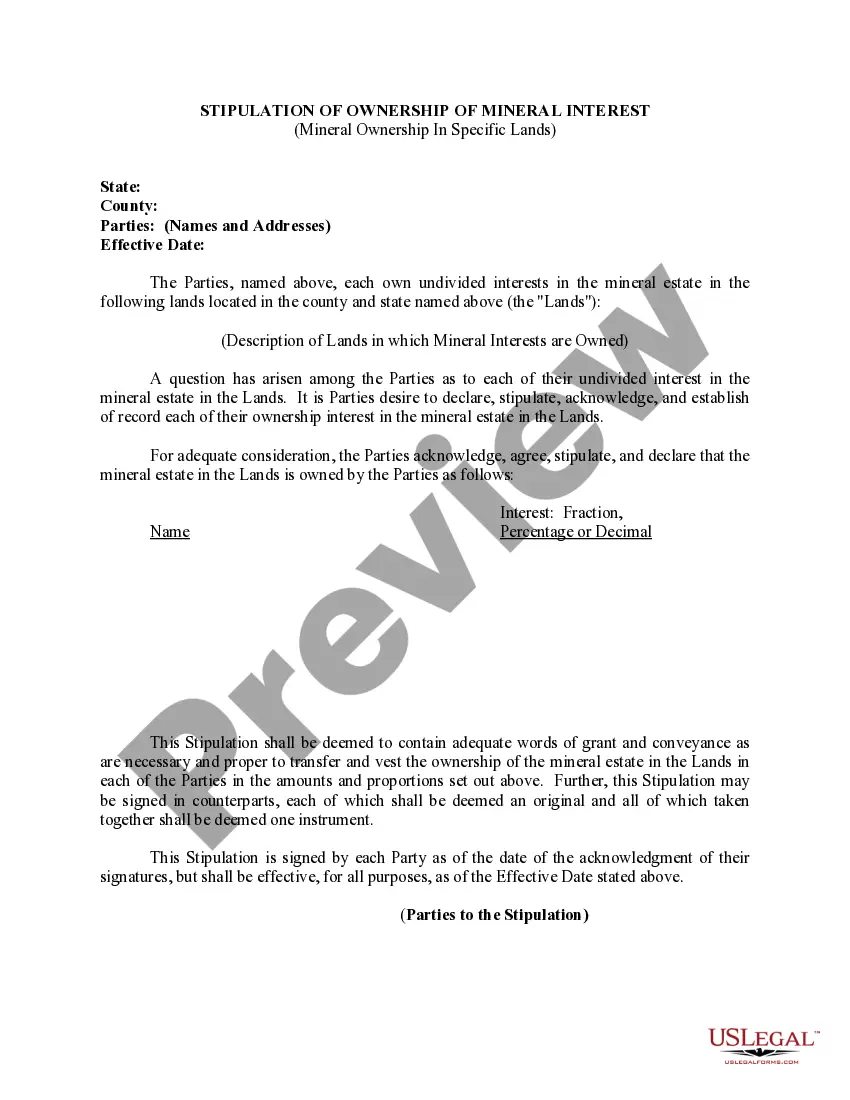

How to fill out Stipulation Of Ownership Of Mineral Interest In Specific Lands?

Have you been within a placement where you need to have papers for either company or individual purposes just about every working day? There are a lot of authorized file web templates available on the Internet, but getting versions you can depend on isn`t straightforward. US Legal Forms offers a huge number of form web templates, just like the Illinois Stipulation of Ownership of Mineral Interest in Specific Lands, which can be published to fulfill state and federal demands.

When you are currently knowledgeable about US Legal Forms web site and possess your account, simply log in. Afterward, it is possible to down load the Illinois Stipulation of Ownership of Mineral Interest in Specific Lands format.

Unless you come with an account and would like to begin using US Legal Forms, follow these steps:

- Get the form you want and ensure it is for the correct city/area.

- Utilize the Review key to analyze the form.

- Read the description to actually have chosen the right form.

- When the form isn`t what you`re searching for, make use of the Research field to discover the form that meets your requirements and demands.

- Whenever you find the correct form, click Acquire now.

- Pick the costs plan you need, submit the required info to produce your money, and buy the transaction using your PayPal or bank card.

- Choose a hassle-free paper structure and down load your copy.

Get each of the file web templates you have bought in the My Forms food selection. You can get a more copy of Illinois Stipulation of Ownership of Mineral Interest in Specific Lands at any time, if necessary. Just click on the necessary form to down load or printing the file format.

Use US Legal Forms, by far the most considerable variety of authorized forms, to save lots of efforts and steer clear of errors. The support offers professionally produced authorized file web templates which can be used for a range of purposes. Generate your account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

By statute and case law, mineral properties are taxable as real property and are subject to the same laws and appraisal methodology as all real property in the state.

What Are Mineral Rights? Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Working Interest: The operating interest under an oil and gas lease. The owner of the working interest has the exclusive right to exploit the minerals on the land. This is only the right to expend money, NOT the right to recoup revenues.

In the U.S., mineral rights belong to the person who owns the land or to the persons who own the right to extract the oil and gas from under the land. Landowners are free to convey those mineral/oil rights to a mining company or similar entity to extract the minerals.

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

However, since mineral rights are a severed portion of the land rights themselves (they're separated from the land's "surface rights" and sold separately by deed, just like the land itself), they are usually considered real property.