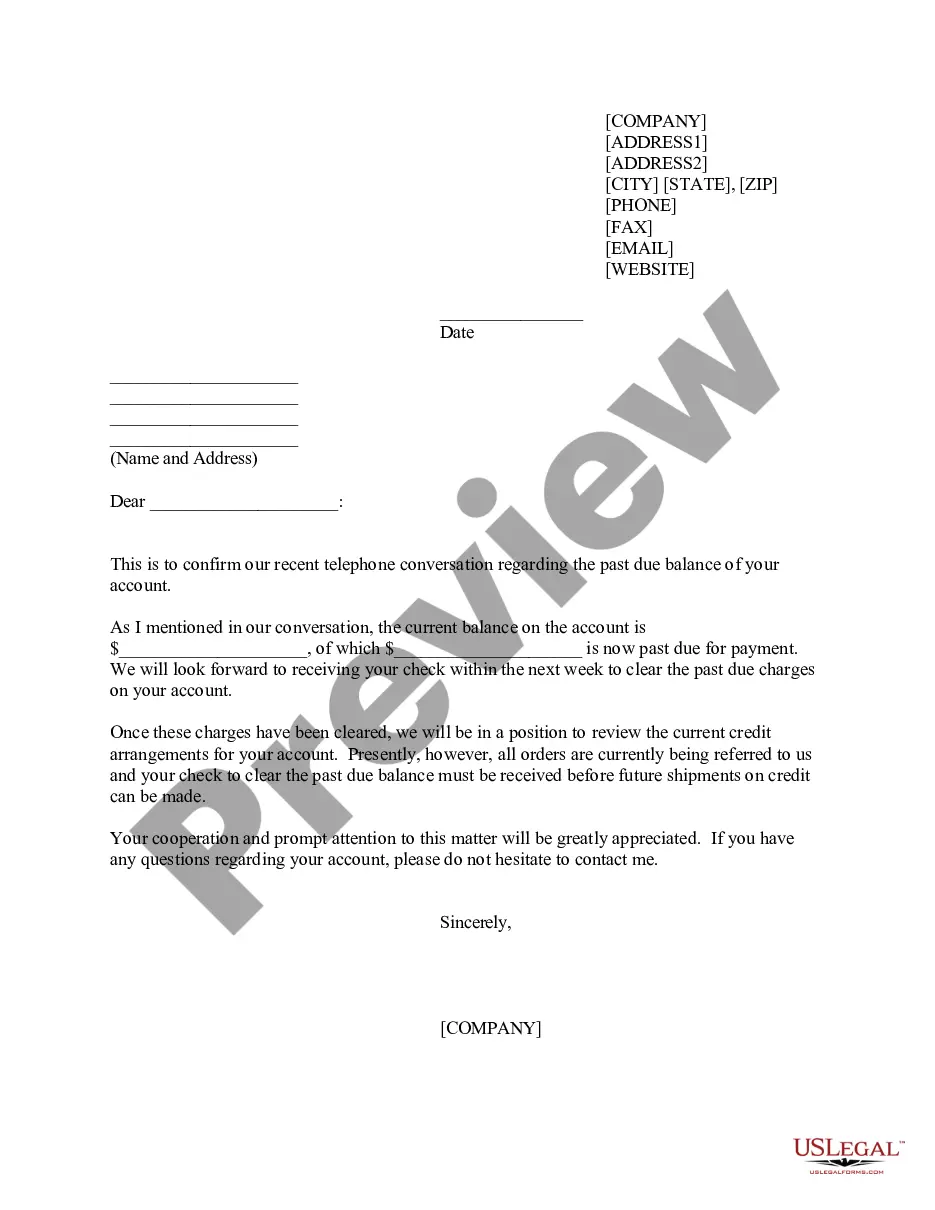

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Illinois Letter of Dispute - Complete Balance

Description

How to fill out Letter Of Dispute - Complete Balance?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad variety of legal document templates that you can access or create. By utilizing the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of documents like the Illinois Letter of Dispute - Complete Balance in just moments. If you already have a subscription, Log In to obtain the Illinois Letter of Dispute - Complete Balance from the US Legal Forms library. The Download button will appear on each document you view. You have access to all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Make sure you have selected the correct form for your city/state. Click the Preview button to review the document’s details. Check the document description to ensure you have chosen the right form. If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

Access the Illinois Letter of Dispute - Complete Balance with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your information to register for the account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

- Edit. Fill out, modify, and print and sign the downloaded Illinois Letter of Dispute - Complete Balance.

- Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need.

Form popularity

FAQ

In Illinois, the statute of limitations for most debts is generally five years. After this period, creditors may lose their legal right to collect the debt. If you are facing challenges regarding uncollectible debts, consider using an Illinois Letter of Dispute - Complete Balance to assert your rights and clarify your financial situation.

The primary difference between a 609 and 604 dispute letter lies in their focus. A 609 letter targets inaccuracies on credit reports, while a 604 letter addresses the validity of debts. Understanding these distinctions can help you choose the right approach, and an Illinois Letter of Dispute - Complete Balance can guide you through this process.

Yes, 609 dispute letters can be effective in removing inaccurate or unverifiable information from your credit report. When properly executed, these letters compel credit bureaus to investigate your claims. Utilizing an Illinois Letter of Dispute - Complete Balance enhances your chances of achieving a favorable outcome.

The time it takes to see results from a 609 letter can vary based on several factors, including the credit bureau's response time and the complexity of the dispute. Generally, you may expect a response within 30 to 45 days. By using an Illinois Letter of Dispute - Complete Balance, you can streamline the process and ensure timely communication with the credit bureaus.

A billing dispute letter typically addresses errors in charges on your account or invoice. In the letter, you would state the specific charges you dispute, provide any supporting documents, and request clarification or correction. For a comprehensive approach, consider using an Illinois Letter of Dispute - Complete Balance to ensure all necessary details are included.

An example of a 609 credit dispute letter includes a request for the removal of negative items from your credit report due to lack of verification. In this letter, you would include your personal information, a detailed description of the disputed item, and a request for documentation. Using an Illinois Letter of Dispute - Complete Balance can guide you in crafting an effective letter.

A 609 dispute letter is a tool used by consumers to challenge inaccuracies on their credit reports. This letter references Section 609 of the Fair Credit Reporting Act, which allows individuals to request the removal of unverifiable information. By utilizing an Illinois Letter of Dispute - Complete Balance, you can effectively address issues that may impact your credit score.

When responding to a notice on MyTax Illinois, first read the notice carefully to understand the issue. Gather any relevant documents that support your position and prepare a clear response. You can submit your response directly through the MyTax Illinois portal. If you need additional assistance, utilizing the Illinois Letter of Dispute - Complete Balance from US Legal Forms can help ensure your response is complete and professional.

To write a dispute letter to the IRS, start by clearly stating your intent to dispute the information. Include your personal details, such as your name, address, and Social Security number. Be sure to reference the specific notice you received and explain your situation in detail. For a more effective process, consider using the Illinois Letter of Dispute - Complete Balance template available through US Legal Forms, which can guide you in crafting a comprehensive letter.

A letter from the Illinois Department of Revenue signifies that there is significant information regarding your tax matters that you need to review. It may include notifications about assessments, requests for documentation, or updates about your account status. Understanding the context of this communication is vital. The Illinois Letter of Dispute - Complete Balance can provide guidance on how to interpret and respond to such letters.