Illinois Producer Agreement - Self-Employed Independent Contractor

Description

How to fill out Producer Agreement - Self-Employed Independent Contractor?

If you need to thoroughly, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Illinois Producer Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Illinois Producer Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

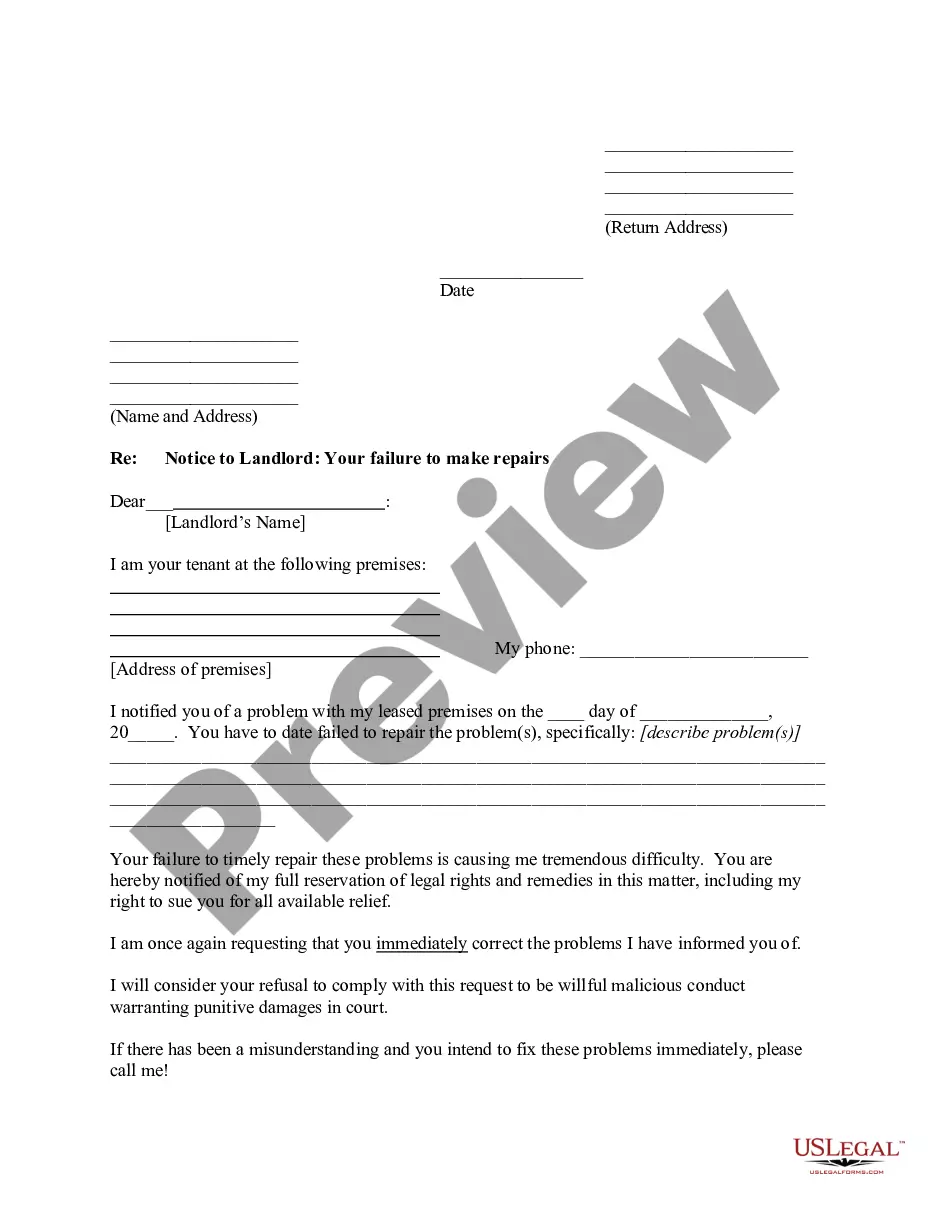

- Step 2. Use the Preview option to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Absolutely, an independent contractor counts as self-employed. The independent contractor status means you are running your own business, and you act as a separate entity in a contractual relationship. This distinction is important when you explore legal frameworks like an Illinois Producer Agreement - Self-Employed Independent Contractor, as it clarifies your rights and responsibilities within that agreement.

Yes, an independent contractor is indeed considered self-employed. Independent contractors operate their own businesses and take on clients without a direct employer-employee relationship. This means they have the independence to set their rates and control their work environment. If you are entering into an Illinois Producer Agreement - Self-Employed Independent Contractor, you should recognize the advantages that come with this designation.

Being self-employed generally means you run your own business or work for yourself, earning income through your efforts. To qualify, you need to manage your own business arrangements and have the freedom to decide how to perform your work. This definition often aligns with individuals entering an Illinois Producer Agreement - Self-Employed Independent Contractor, allowing them to reap business benefits and retain full control.

In Illinois, the independent contractor law outlines the criteria for distinguishing between employees and independent contractors. The law considers factors such as the degree of control exercised by the employer and the level of independence the worker has. This distinction is crucial for tax reporting and legal liability. Familiarizing yourself with these laws can enhance your experience when working under an Illinois Producer Agreement - Self-Employed Independent Contractor.

Both terms, self-employed and independent contractor, describe a similar concept, but they can have different connotations. Self-employed typically refers to anyone who is in business for themselves, while independent contractor emphasizes the individual’s contractual relationship with a client. Depending on the context of your work, you might choose one term over the other. In the scope of an Illinois Producer Agreement - Self-Employed Independent Contractor, either term can be applicable.

Yes, receiving a 1099 means you are likely considered self-employed. The 1099 form indicates that you are earning income as an independent contractor, not as an employee. This classification impacts your tax obligations and the ways you can deduct expenses. Understanding this distinction is key for anyone engaged in an Illinois Producer Agreement - Self-Employed Independent Contractor.

To establish an Illinois Producer Agreement - Self-Employed Independent Contractor, one must typically fill out the appropriate agreement form. This form outlines the terms of the relationship, including payment details and job responsibilities. It is essential to ensure that both parties understand their roles and obligations. By using the US Legal Forms platform, you can easily access customizable agreement templates to suit your specific needs.

To prove you are an independent contractor, maintain clear documentation of your work activities, contracts, and payment records. Highlight your autonomy in decision-making and the lack of direct oversight from your clients. The Illinois Producer Agreement - Self-Employed Independent Contractor can assist in solidifying your status by outlining your role and responsibilities formally. Keep these documents organized to support your claims if needed.

To create an independent contractor agreement, begin by defining the terms of the relationship between the parties involved. Include essential details such as the scope of work, payment terms, and deadlines. Using a reliable platform like USLegalForms can simplify this process, providing templates tailored to the Illinois Producer Agreement - Self-Employed Independent Contractor. This ensures that all necessary components are included and that your agreement complies with Illinois laws.

Typically, either party—the client or the independent contractor—can draft the agreement. However, it’s beneficial for the contractor to create the initial draft to ensure their interests are protected. Using the Illinois Producer Agreement - Self-Employed Independent Contractor template available through US Legal Forms can significantly simplify this task and create a balanced document.