Ohio Incorporation Questionnaire

Description

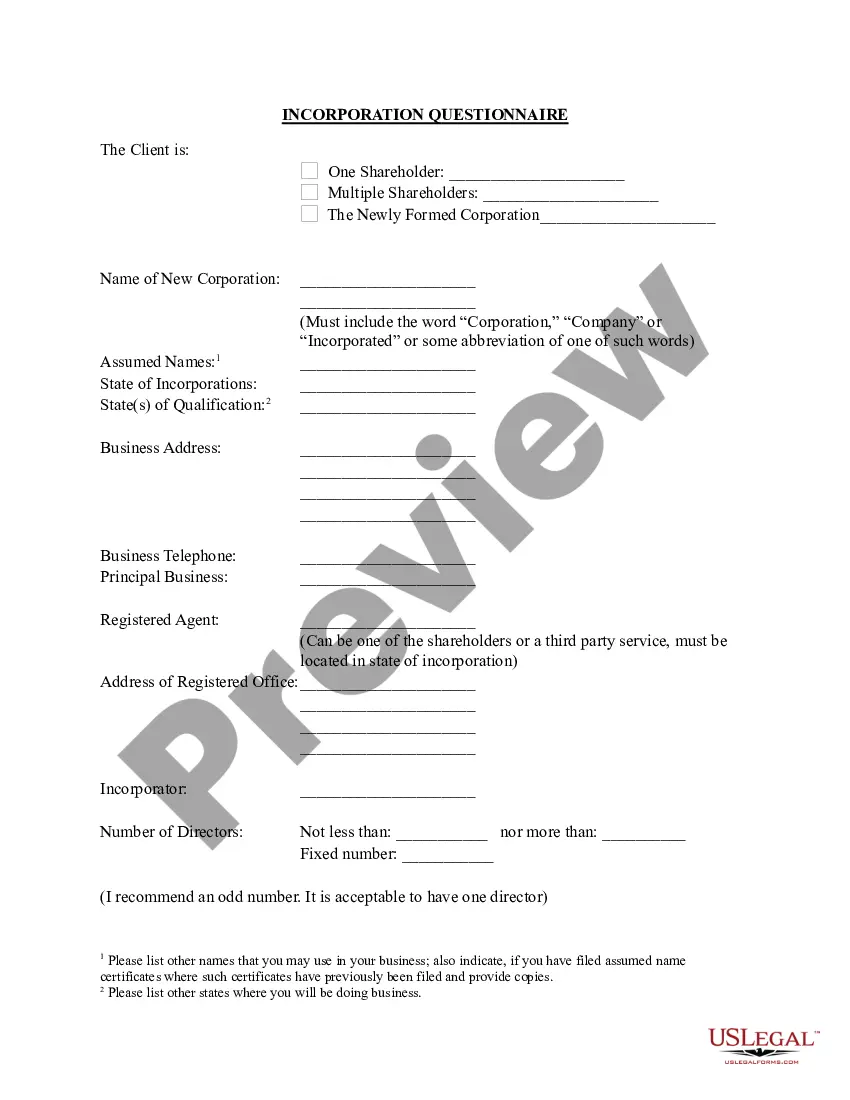

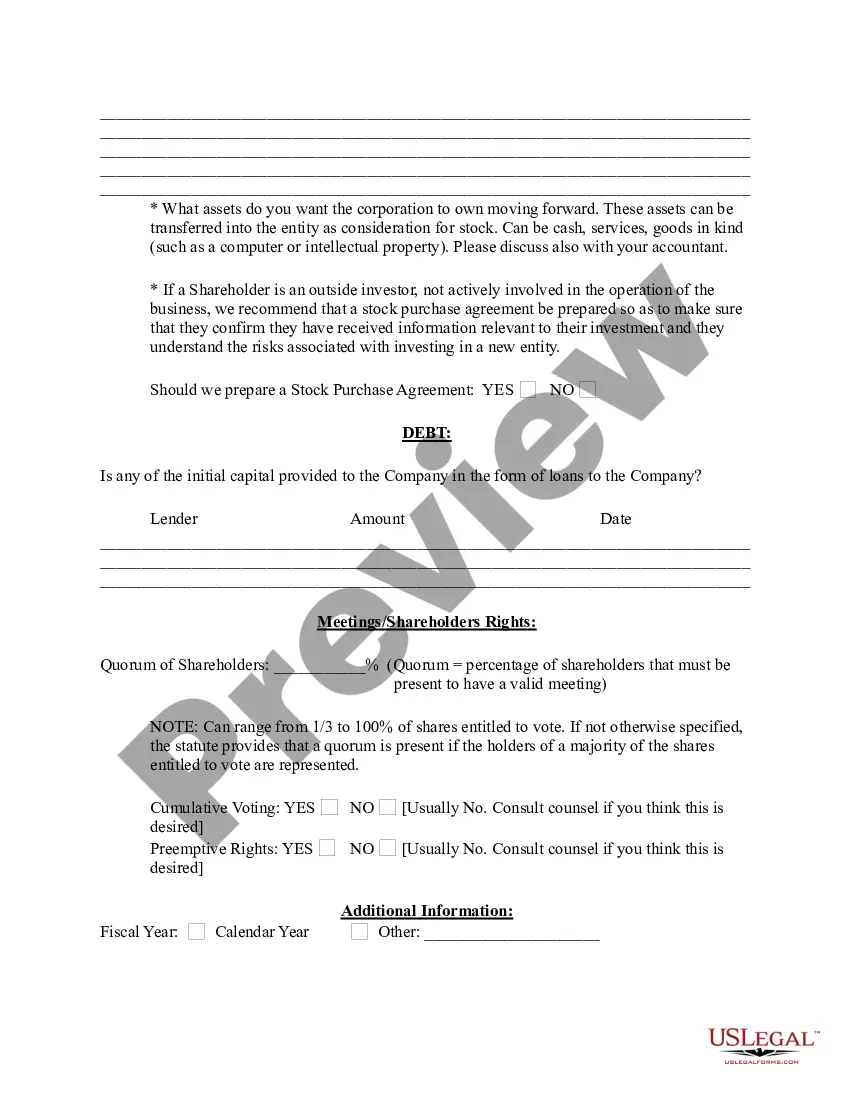

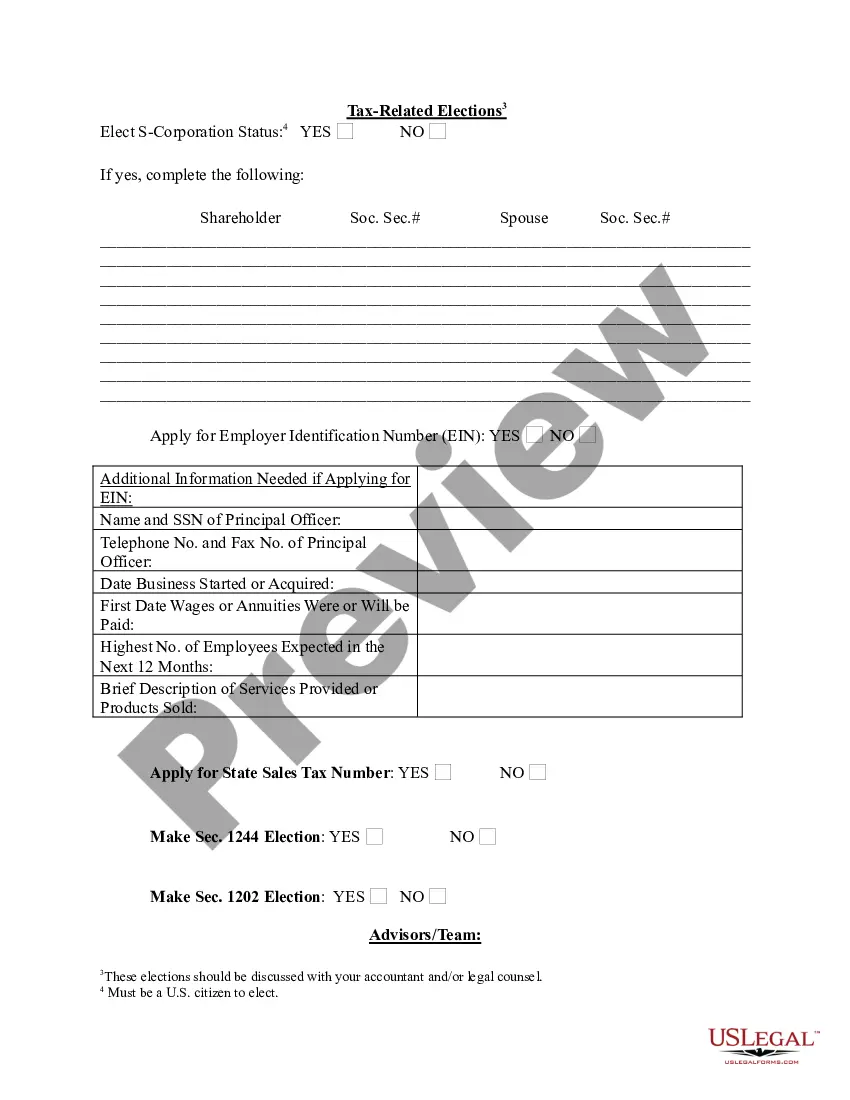

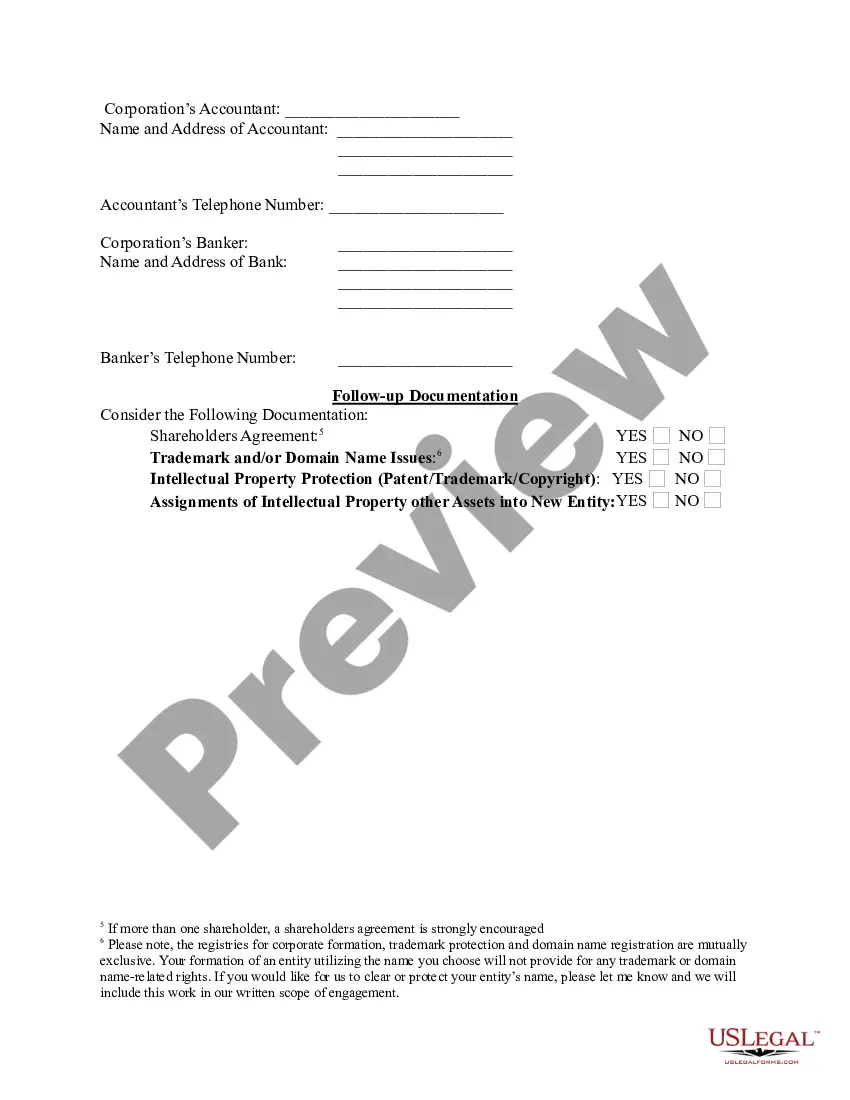

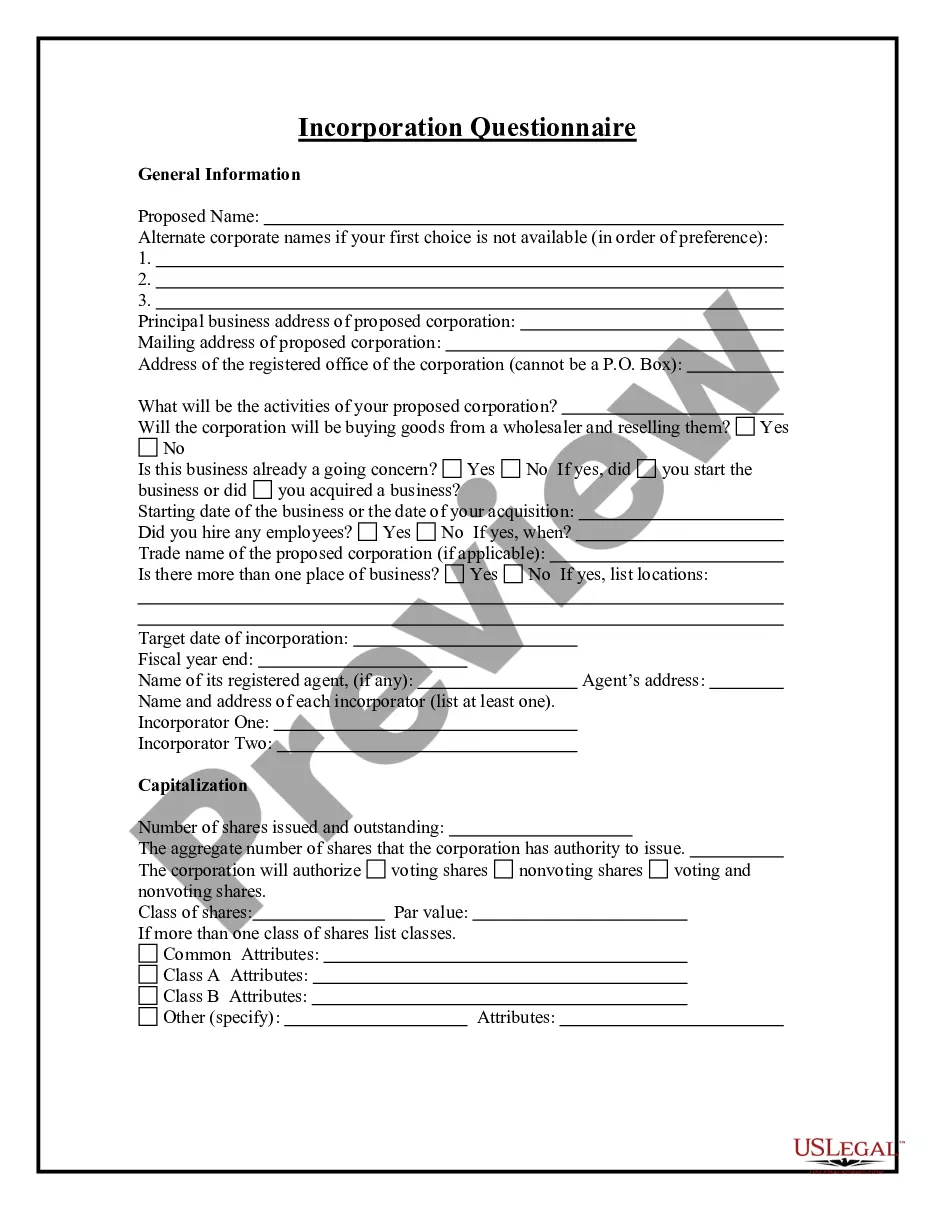

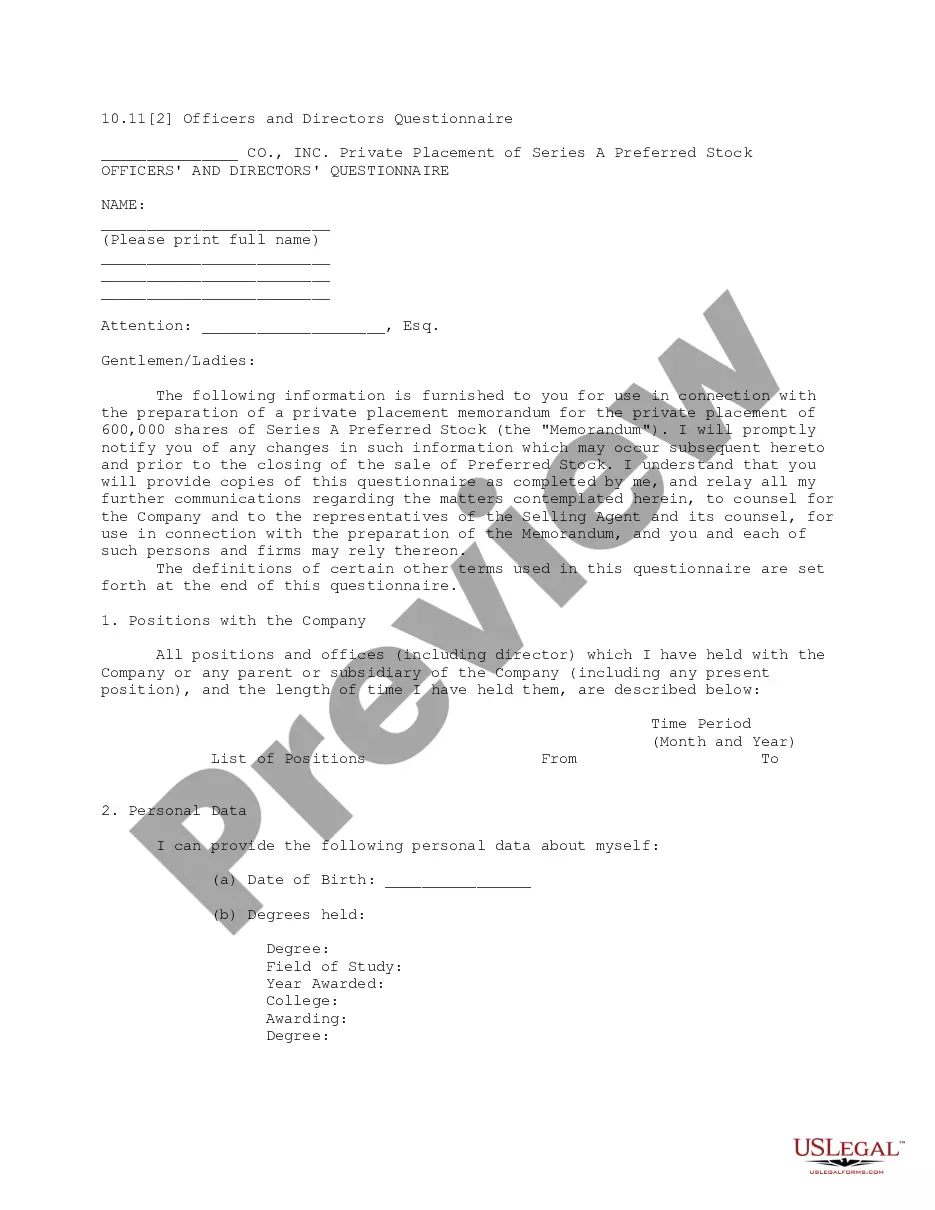

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews."

How to fill out Incorporation Questionnaire?

You may commit hours on-line trying to find the legitimate file design that suits the state and federal specifications you will need. US Legal Forms offers 1000s of legitimate forms which can be examined by professionals. You can actually acquire or print out the Ohio Incorporation Questionnaire from my services.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Acquire key. Following that, it is possible to full, edit, print out, or signal the Ohio Incorporation Questionnaire. Every legitimate file design you purchase is yours permanently. To get one more backup of any bought form, proceed to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms web site the first time, keep to the basic directions under:

- Very first, be sure that you have chosen the right file design for the state/city of your choice. See the form outline to ensure you have picked the right form. If readily available, use the Preview key to look throughout the file design also.

- If you want to get one more edition of your form, use the Research discipline to get the design that suits you and specifications.

- After you have located the design you want, click on Acquire now to proceed.

- Pick the costs plan you want, type your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You can utilize your Visa or Mastercard or PayPal bank account to cover the legitimate form.

- Pick the file format of your file and acquire it in your gadget.

- Make modifications in your file if possible. You may full, edit and signal and print out Ohio Incorporation Questionnaire.

Acquire and print out 1000s of file layouts making use of the US Legal Forms Internet site, that provides the biggest assortment of legitimate forms. Use expert and status-specific layouts to deal with your business or specific requirements.

Form popularity

FAQ

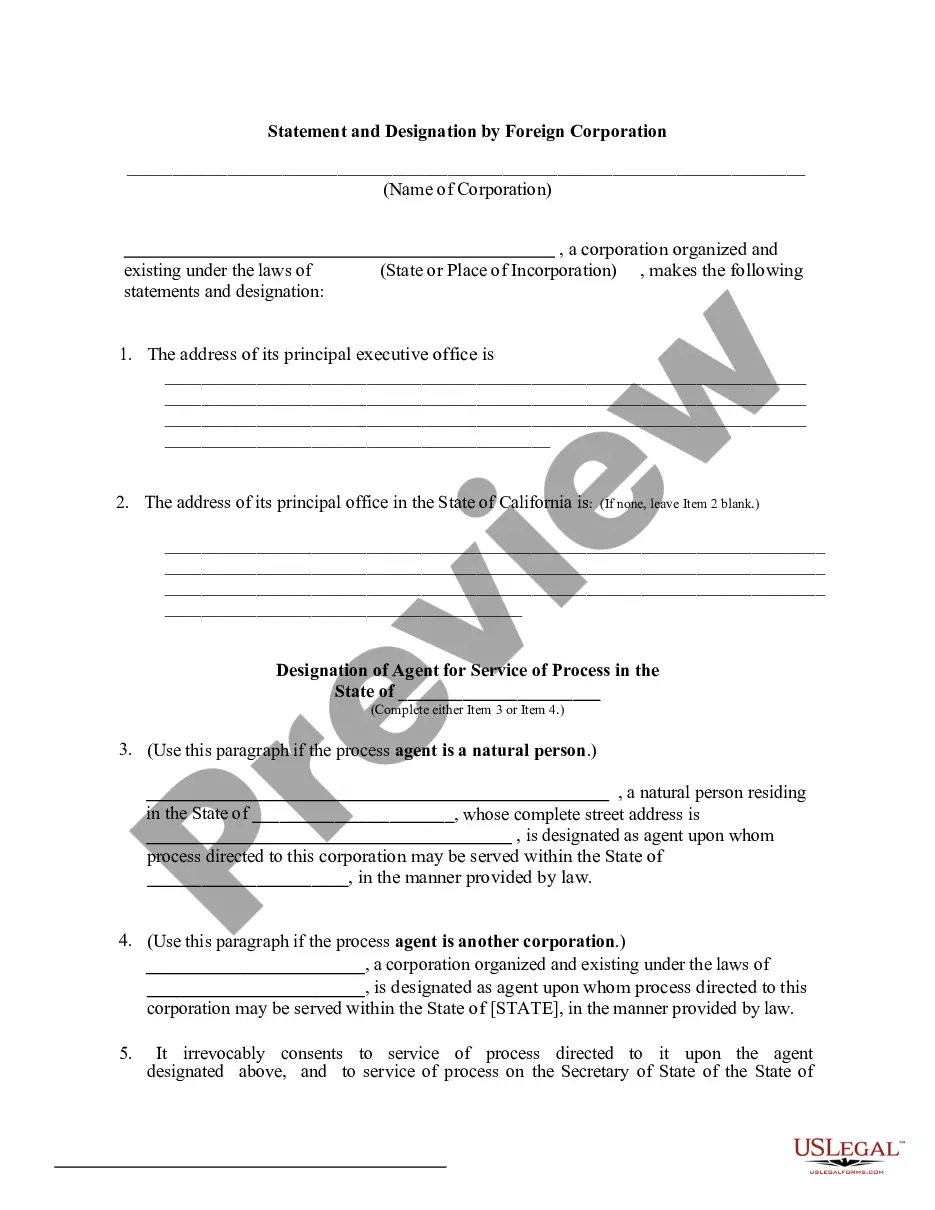

Even if you are incorporated in a different state, you have to register as a foreign corporation in order to do business in Ohio. This means submitting a Foreign Corporation Application for License (Form 530A) or the Foreign Nonprofit Corporation Application for License (Form 530B) depending on your business entity.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by mail or in person, but we recommend mailing. Normal processing takes up to 2 days, plus additional time for mailing, and costs $5. Expedited service is not available.

Business entities in Ohio are not required to file an annual report. However, certain types of entities and registrations are required to file reports at different intervals.

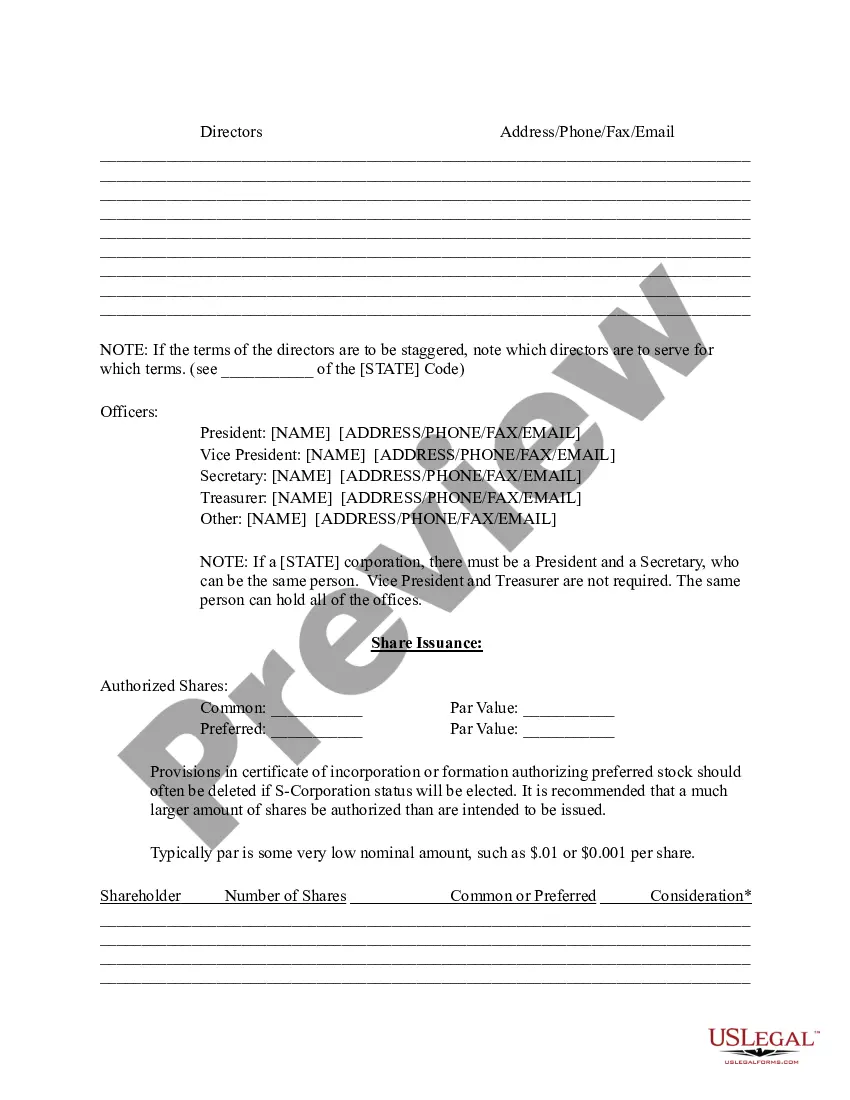

Does Ohio require corporate bylaws? Ohio Rev Code § 1701.11 states that a corporation's directors MAY adopt regulations. But Ohio statutes don't explicitly state that bylaws or regulations are required. However, bylaws are essential for a well-functioning corporation.

To start a corporation in Ohio, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail.

A corporation must file Articles of Incorporation (Articles) with the Ohio Secretary of State before it transacts business in Ohio.

If you have an address in the state, you can be the Registered Agent for your Ohio LLC. We don't recommend this approach as there can be some drawbacks: The Registered Agent must have a physical street address in Ohio. If you're forming an LLC outside the state, you'll need to use an in-state Registered Agent.

Ohio Revised Code Section 1706.16 provides that ?one or more person shall execute articles of organization and deliver the articles to the secretary of state for filing.? All limited liability companies must register with the Ohio Secretary of State to lawfully conduct business in Ohio.