Illinois Housecleaning Services Contract - Self-Employed

Description

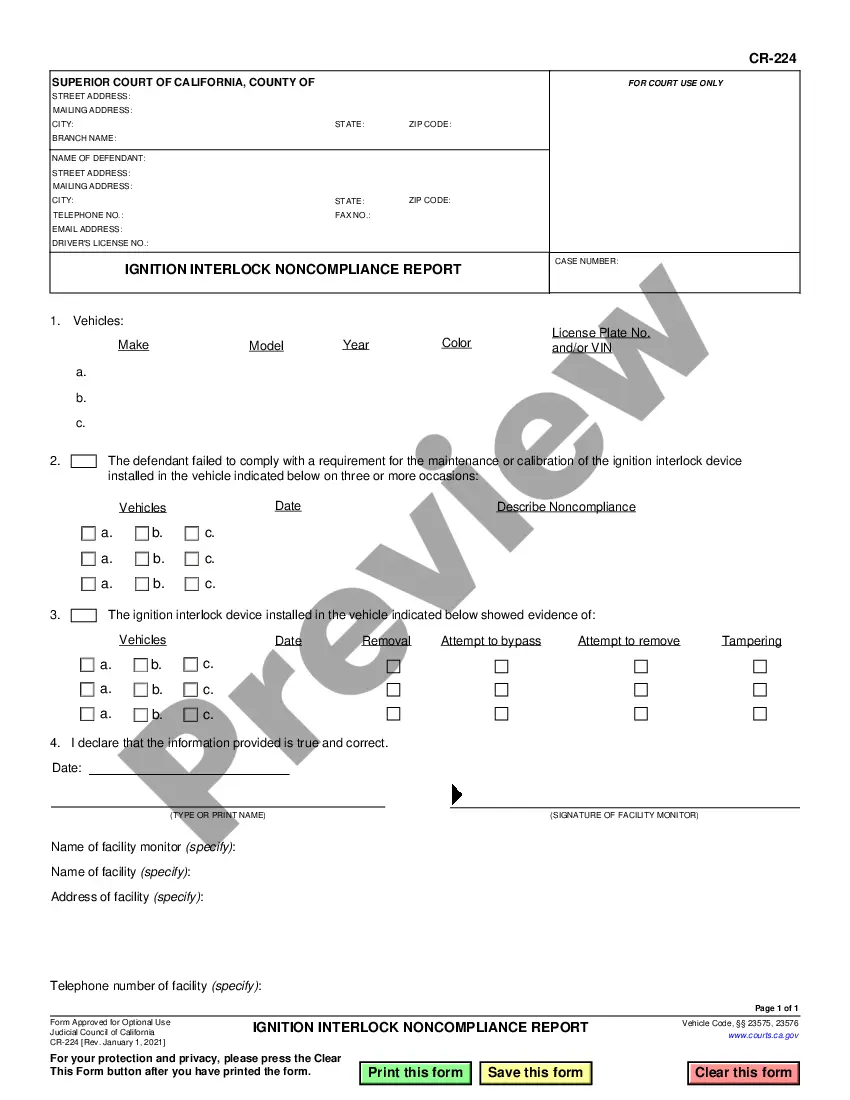

How to fill out Housecleaning Services Contract - Self-Employed?

You might spend time online trying to find the valid document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can easily download or print the Illinois Housecleaning Services Contract - Self-Employed from the service.

If available, utilize the Preview button to view the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that fits your needs and specifications. Once you have located the template you want, click Purchase now to continue. Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You may use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, adjust, sign, and print the Illinois Housecleaning Services Contract - Self-Employed. Download and print a wide range of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Afterward, you can complete, modify, print, or sign the Illinois Housecleaning Services Contract - Self-Employed.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- Firstly, ensure you have selected the correct document template for the region/area you have chosen.

- Review the form description to confirm you have picked the right form.

Form popularity

FAQ

Starting your own house cleaning business in Illinois begins with creating a solid business plan. Next, ensure you obtain the necessary licenses and permits required in your area. Additionally, consider using an Illinois Housecleaning Services Contract - Self-Employed to clearly define your services and payment terms. Resources like uslegalforms can guide you in this process, providing templates to make it easier for you to focus on growing your business.

Getting cleaning contracts can be challenging but is achievable with the right strategy. Build a solid portfolio showcasing your skills, and consider leveraging platforms like uslegalforms to access templates for Illinois Housecleaning Services Contract - Self-Employed. Networking within your community and online can also lead to opportunities, as a good reputation in your local area often leads to more contracts.

To become a subcontractor for cleaning services, you should first identify local cleaning companies that might need additional help. Reach out to them with your resume and qualifications, highlighting your experience in Illinois housecleaning services. It’s also beneficial to have an Illinois Housecleaning Services Contract - Self-Employed ready to demonstrate your professionalism and commitment. This contract outlines your terms and can enhance your attractiveness as a subcontractor.

Yes, you can freelance without a contract, but that could be risky. An Illinois Housecleaning Services Contract - Self-Employed outlines your obligations and protects both parties. Working without a contract can lead to misunderstandings and disputes. It is sensible to formalize agreements to safeguard your interests.

While you are not legally required to have a contract as a self-employed individual, it is highly recommended. An Illinois Housecleaning Services Contract - Self-Employed ensures that both you and your clients understand your responsibilities. This contract can mitigate risks and foster professional relationships. Ultimately, having one offers peace of mind.

Yes, you can absolutely be a self-employed house cleaner. With services like an Illinois Housecleaning Services Contract - Self-Employed, you define your work terms. This gives you the freedom to set your schedule and choose your clients. Self-employment in housecleaning can be rewarding and flexible.

If you do not have a contract, you may face disputes regarding payment or scope of work. An Illinois Housecleaning Services Contract - Self-Employed can help prevent misunderstandings. Without a contract, you may lack legal protection and clarity. This can potentially lead to financial losses or stress.

Self-employed individuals work for themselves, while contracted workers provide services under a specific agreement. In the context of an Illinois Housecleaning Services Contract - Self-Employed, you manage your business operations. Conversely, contracted workers typically follow guidelines set by another company, which may limit their autonomy.

Yes, you can be a 1099 employee without a formal contract, but it is not advisable. An Illinois Housecleaning Services Contract - Self-Employed provides clarity on expectations and responsibilities. This contract helps protect your rights and outlines your payment terms. Therefore, having a contract is beneficial for your success.

To write a simple contract agreement, begin with the essential elements such as the parties involved, the services to be rendered, and payment terms. Keep your language clear and straightforward to avoid confusion. Consider using templates available through uslegalforms to expedite the process and ensure you have a comprehensive Illinois Housecleaning Services Contract - Self-Employed.