Illinois Storage Services Contract - Self-Employed

Description

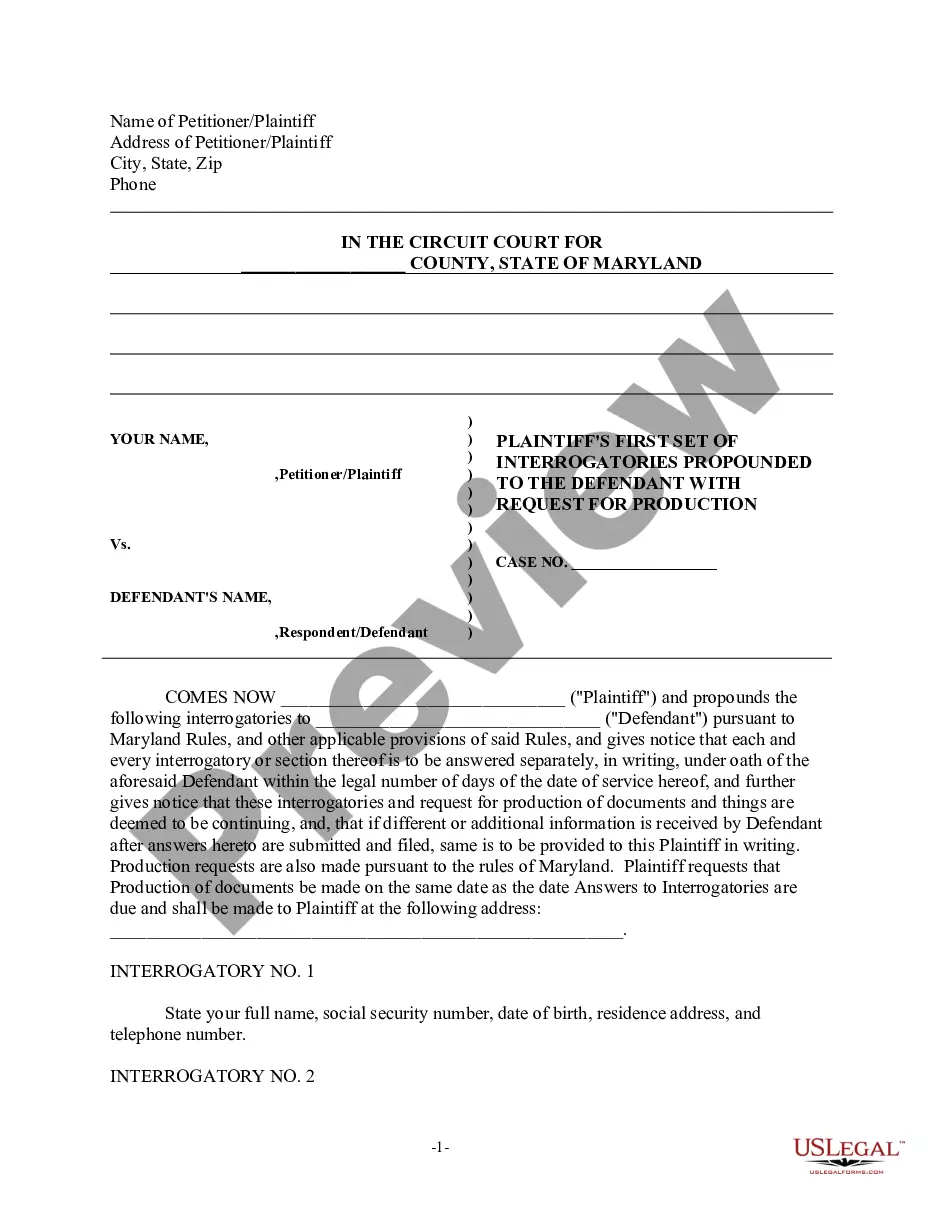

How to fill out Storage Services Contract - Self-Employed?

It is feasible to spend time on the Internet trying to locate the valid documents template that meets the state and federal requirements you require.

US Legal Forms provides numerous valid forms that are evaluated by experts.

You can easily obtain or generate the Illinois Storage Services Contract - Self-Employed through the service.

To find another version of the document, use the Search field to locate the template that suits your needs and requirements. Once you have found the template you desire, click on Purchase now to proceed. Select the pricing plan you want, enter your details, and register for an account on US Legal Forms. Complete the purchase using your credit card or PayPal account to acquire the valid document. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, and sign the Illinois Storage Services Contract - Self-Employed. Obtain and print numerous document templates using the US Legal Forms site, which offers the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you possess a US Legal Forms account, you can sign in and press the Acquire button.

- Then, you can complete, modify, generate, or sign the Illinois Storage Services Contract - Self-Employed.

- Every valid document template you purchase is yours indefinitely.

- To obtain another copy of any purchased document, go to the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document template for the area/city of your choice.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

In Illinois, freelance law provides a framework for individuals working as self-employed contractors. It outlines the rights and obligations surrounding contracts, including the Illinois Storage Services Contract - Self-Employed, which is essential for establishing clear terms between parties. Understanding this law helps freelancers protect their interests, ensuring fair compensation and defined work expectations. For a streamlined approach, you can utilize the templates available on uslegalforms to create compliant contracts.

Writing a contract as an independent contractor involves defining the scope of work, payment terms, and timelines. It is important to be specific about deliverables and responsibilities to avoid future disputes. You may find value in referencing existing templates like the Illinois Storage Services Contract - Self-Employed, which can facilitate the writing process. Additionally, using a platform such as uslegalforms can help you create a tailored contract that meets your needs.

A basic independent contractor contract outlines the key terms of the working relationship. It typically includes the project description, payment details, and timelines. Many contractors benefit from referring to the Illinois Storage Services Contract - Self-Employed to ensure compliance with state laws. This type of contract provides a solid foundation for clear communication between the contractor and client.

Yes, you can write your own legally binding contract as long as you include essential elements such as offer, acceptance, and consideration. Ensure that your contract adheres to applicable laws, especially if it is related to the Illinois Storage Services Contract - Self-Employed. Utilizing templates from platforms like uslegalforms can streamline this process and help you create a contract that is both clear and enforceable.

To write a contract for an independent contractor, start with the basic details, including the parties involved and the project scope. Clearly outline payment terms and deadlines to prevent misunderstandings. For an effective contract, consider incorporating terms that align with the Illinois Storage Services Contract - Self-Employed to ensure it meets local regulations. Always remember to review the contract for clarity before both parties sign.

The Self Storage Facility Act in Illinois outlines the legal standards for operating self-storage businesses and the rights of storage renters. This framework ensures that both parties uphold their responsibilities, making it easier for self-employed individuals to engage with storage services confidently. Familiarizing yourself with this act can enhance your understanding of your Illinois Storage Services Contract - Self-Employed, leading to a better renting experience.

Yes, storage services are generally subject to sales tax in Illinois, classified under taxable services. This means that when you rent storage space, you should be prepared for additional charges that reflect this tax. Understanding the tax implications will help you manage your budget and ensure compliance with local laws related to your Illinois Storage Services Contract - Self-Employed.

The 48-hour rule in Illinois requires that storage facility operators give at least 48 hours' notice before they auction the contents of a unit. This notice ensures that renters have a fair opportunity to reclaim their items if they are behind on payments. By following this rule, facilities uphold the standards outlined in the Illinois Storage Services Contract - Self-Employed.

Form IL-1065 is required for partnerships doing business in Illinois, including those in the self-storage sector. If you are self-employed within this field, you may need to file this form to report your income accurately. Understanding these tax filing requirements is essential for managing your finances and complying with state regulations related to your Illinois Storage Services Contract - Self-Employed.

The new security deposit law in Illinois establishes specific regulations regarding the collection and handling of security deposits by landlords and storage providers. This legislation aims to protect renters by requiring clear terms for deposit returns and prohibiting excessive fees. If you’re using an Illinois Storage Services Contract - Self-Employed, familiarize yourself with these provisions for a smoother renting experience.