Illinois Heating Contractor Agreement - Self-Employed

Description

How to fill out Heating Contractor Agreement - Self-Employed?

Selecting the correct authorized document template can be a challenge.

It goes without saying that there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Illinois Heating Contractor Agreement - Self-Employed, which can be used for business and personal purposes.

You can review the document using the Review button and check the form description to ensure it is the right one for you.

- All of the forms are verified by experts and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Obtain button to locate the Illinois Heating Contractor Agreement - Self-Employed.

- Use your account to access the legal forms you may have purchased in the past.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the proper form for your location/state.

Form popularity

FAQ

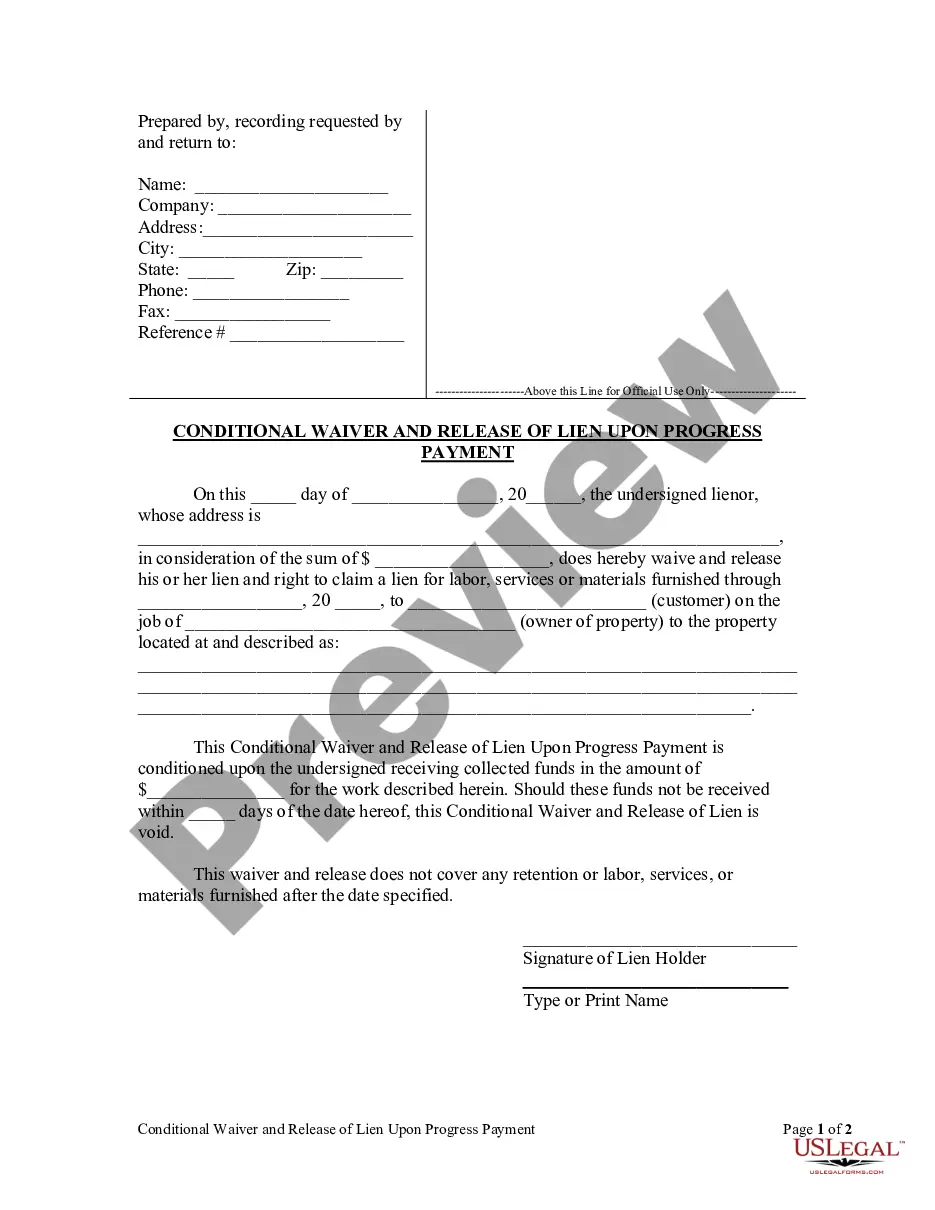

employed contract should include essential elements such as the contractor's name, description of services, payment terms, and duration of the contract. For your Illinois Heating Contractor Agreement SelfEmployed, it is wise to address how disputes will be resolved and include any necessary legal disclosures. Composing this contract correctly helps establish a solid working relationship and protects your interests.

Filling out an independent contractor form is straightforward. Begin by entering your name, contact information, and relevant tax identification numbers. For your Illinois Heating Contractor Agreement - Self-Employed, you will also document the nature of your services and payment structures clearly. Check the provided guidelines or seek assistance from platforms like US Legal Forms if you have any uncertainties.

To write an independent contractor agreement, start with a clear title and introduction, followed by sections outlining the scope of work, payment details, and issue resolution procedures. Your Illinois Heating Contractor Agreement - Self-Employed should also specify confidentiality terms if applicable. Using a template from US Legal Forms can guide you in structuring your agreement effectively and ensuring no essential elements are overlooked.

Filling out an independent contractor agreement involves documenting the scope of work, payment terms, and duration of the contract. In your Illinois Heating Contractor Agreement - Self-Employed, include key details such as deliverables and responsibilities. Take your time to ensure clarity, as a well-filled agreement protects both you and your client.

As an independent contractor, you should fill out essential forms like the W-9 for tax purposes, your Illinois Heating Contractor Agreement - Self-Employed to outline the terms of your work, and any relevant licenses or permits required by local regulations. Ensuring you have all necessary forms completed prevents future complications. You can easily find these forms on platforms like US Legal Forms, which can simplify the process for you.

Yes, you can have a contract even if you're self-employed. An Illinois Heating Contractor Agreement - Self-Employed helps define the terms of your work, rights, and responsibilities. This agreement ensures that both you and your clients understand the scope of the services provided. Having a formal contract not only protects your interests but also establishes a professional relationship with your clients.

Having a contract is essential for self-employed individuals, as it establishes clear terms between you and your clients. An Illinois Heating Contractor Agreement - Self-Employed provides a formal record of your engagement, outlining duties, payment, and other vital details. This document can prevent misunderstandings and protect your rights as a contractor. Utilizing platforms like uslegalforms can help you easily draft a comprehensive agreement tailored to your needs.

Creating an independent contractor agreement requires clear communication of terms and expectations. Start by outlining the scope of work, payment details, and timeline. Using an Illinois Heating Contractor Agreement - Self-Employed template can streamline this process, ensuring compliance with Illinois laws. This crafted agreement serves as a valuable tool to protect both parties involved in the contract.

The independent contractor law in Illinois defines the criteria for classifying workers as independent contractors versus employees. It's essential for self-employed individuals, such as those using an Illinois Heating Contractor Agreement - Self-Employed, to understand these distinctions. Proper classification impacts tax obligations, liability, and the right to benefits. Furthermore, working within this legal framework can safeguard your business interests.