Illinois Form - Enhanced CD Agreement

Description

How to fill out Form - Enhanced CD Agreement?

Are you presently in a place where you require papers for sometimes business or individual uses nearly every working day? There are tons of legitimate file templates available on the net, but finding types you can rely on is not simple. US Legal Forms delivers a huge number of form templates, such as the Illinois Form - Enhanced CD Agreement, that are composed to meet federal and state needs.

When you are currently knowledgeable about US Legal Forms site and have a free account, basically log in. Afterward, you can down load the Illinois Form - Enhanced CD Agreement format.

If you do not come with an bank account and wish to begin using US Legal Forms, adopt these measures:

- Get the form you need and make sure it is for that appropriate town/region.

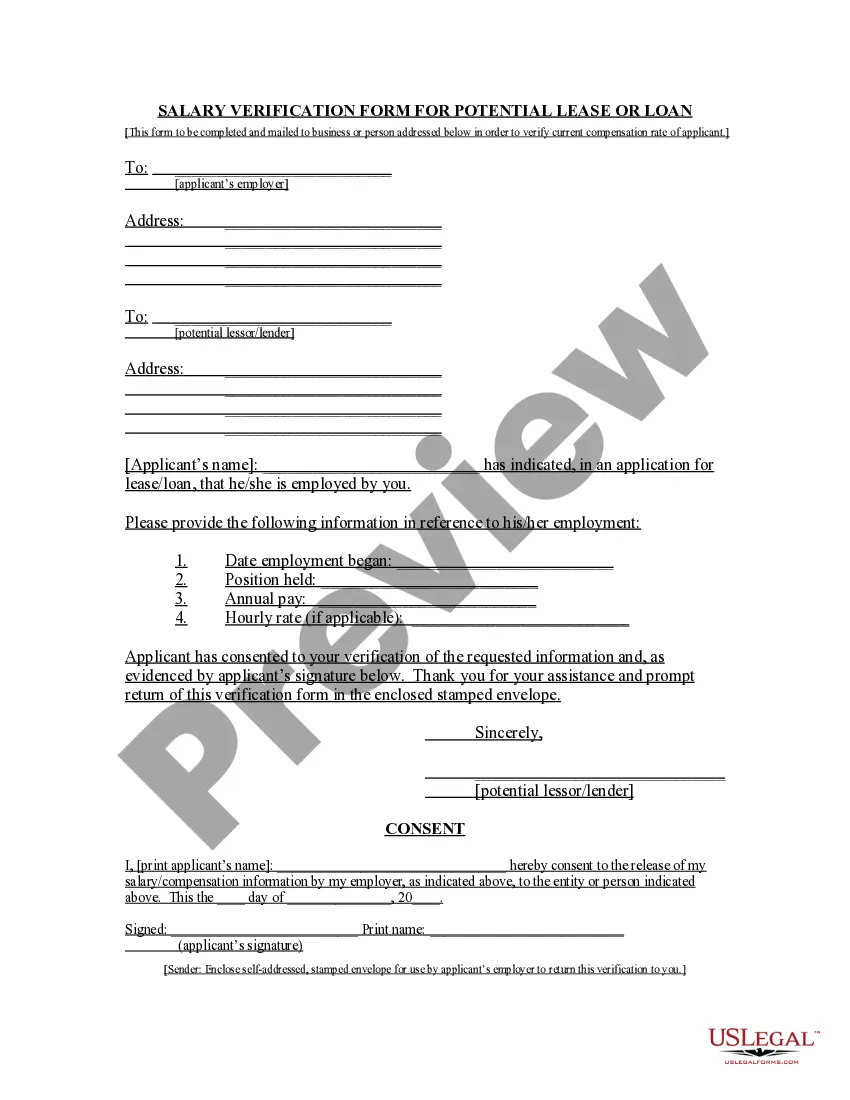

- Make use of the Review option to examine the form.

- Look at the outline to ensure that you have chosen the proper form.

- When the form is not what you are seeking, utilize the Search area to find the form that meets your requirements and needs.

- If you get the appropriate form, click Purchase now.

- Choose the costs strategy you desire, submit the required information to create your bank account, and buy your order making use of your PayPal or Visa or Mastercard.

- Choose a practical paper format and down load your copy.

Locate every one of the file templates you have bought in the My Forms menu. You can get a additional copy of Illinois Form - Enhanced CD Agreement at any time, if required. Just click the necessary form to down load or printing the file format.

Use US Legal Forms, one of the most extensive collection of legitimate varieties, in order to save efforts and steer clear of errors. The service delivers professionally manufactured legitimate file templates that you can use for a selection of uses. Create a free account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

For tax years beginning January 1, 2022, it is $2,425 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,425 or less, your exemption allowance is $2,425. If income is greater than $2,425, your exemption allowance is 0. For the 2021 tax year, it is $2,375 per exemption.

If you did not make more than $12,950, you will not owe taxes. However, you may have worked for an employer that withheld taxes from your paycheck. This means you may still choose to file a tax return to get a refund of your withheld earnings.

If no payment is enclosed, mail your return to: If a payment is enclosed, mail your return to: ILLINOIS DEPARTMENT OF REVENUE. ILLINOIS DEPARTMENT OF REVENUE. PO BOX 19041. PO BOX 19027. SPRINGFIELD IL 62794-9041. SPRINGFIELD IL 62794-9027.

The Illinois Income Tax is imposed on every trust and estate earning or receiving income in Illinois or as a resident of Illinois. The Illinois Individual Income Tax is imposed on every individual earning or receiving income in Illinois.

An Illinois resident who worked in Iowa, Kentucky, Michigan, or Wisconsin, you must file Form IL-1040 and include as Illinois income any compensation you received from an employer in these states. Compensation paid to Illinois residents working in these states is taxed by Illinois.

What is the purpose of Schedule M? Schedule M, Other Additions and Subtractions for Individuals, allows you to figure the total amount of additions you must include on Form IL-1040, Individual Income Tax Return, Line 3 and subtractions you may claim on Form IL-1040, Line 7.

Illinois Retirement Taxes The state exempts nearly all retirement income from taxation, but that doesn't mean an Illinois retirement will be tax-free. The state has some of the highest property and sales taxes in the country. A financial advisor can help you plan for retirement and other financial goals.

An Illinois resident who worked in Iowa, Kentucky, Michigan, or Wisconsin, you must file Form IL-1040 and include as Illinois income any compensation you received from an employer in these states. Compensation paid to Illinois residents working in these states is taxed by Illinois.