Illinois Accredited Investor Status Certification Letter

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

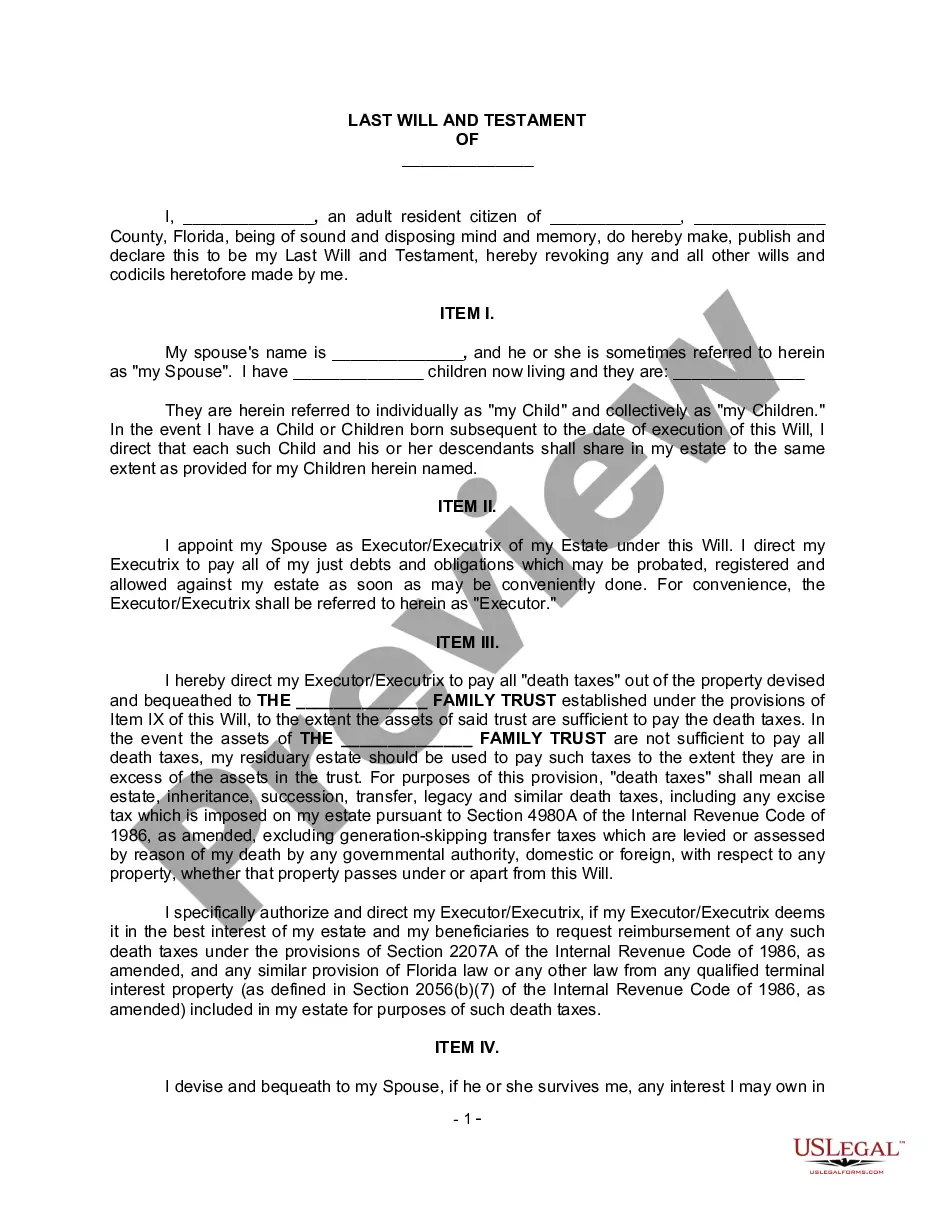

How to fill out Accredited Investor Status Certification Letter?

If you want to total, obtain, or print authorized file web templates, use US Legal Forms, the biggest assortment of authorized types, which can be found online. Take advantage of the site`s easy and handy lookup to discover the papers you require. A variety of web templates for business and personal purposes are categorized by types and says, or keywords and phrases. Use US Legal Forms to discover the Illinois Accredited Investor Status Certification Letter with a couple of mouse clicks.

If you are presently a US Legal Forms client, log in for your profile and then click the Download switch to get the Illinois Accredited Investor Status Certification Letter. You can even entry types you earlier saved inside the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for the right town/land.

- Step 2. Use the Preview choice to look over the form`s articles. Never forget to read through the description.

- Step 3. If you are not happy using the develop, use the Research field at the top of the display to locate other types in the authorized develop web template.

- Step 4. Once you have discovered the shape you require, click the Acquire now switch. Select the pricing prepare you favor and include your references to sign up for the profile.

- Step 5. Process the financial transaction. You may use your charge card or PayPal profile to finish the financial transaction.

- Step 6. Select the formatting in the authorized develop and obtain it in your device.

- Step 7. Comprehensive, modify and print or sign the Illinois Accredited Investor Status Certification Letter.

Every single authorized file web template you buy is the one you have forever. You might have acces to every single develop you saved inside your acccount. Go through the My Forms segment and select a develop to print or obtain once again.

Be competitive and obtain, and print the Illinois Accredited Investor Status Certification Letter with US Legal Forms. There are thousands of expert and state-certain types you can use for the business or personal requires.

Form popularity

FAQ

dealer registered with the Securities and Exchange Commission. An investment advisor registered with the Securities and Exchange Commission. A licensed attorney who is in good standing under the laws of the jurisdictions in which he or she is admitted to practice law. Accredited Investor Verification Letter Individual Investor 2020 First Class Demand Notes ? file ? doc First Class Demand Notes ? file ? doc PDF

The SEC in 2020 issued rules in Release No. 33-10824, Accredited Investor Definition, allowing investors holding certain professional licenses, such as a Series 7, to qualify as accredited, even if they fall short of meeting the income or asset tests. House Passes Bill to Set up SEC Accredited Investor Exam thomsonreuters.com ? news ? house-passes-bil... thomsonreuters.com ? news ? house-passes-bil...

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments. How Does the Accredited Investor Verification Process Work? montague.law ? blog ? accredited-investor-verific... montague.law ? blog ? accredited-investor-verific...

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA. SEC Amends 506(c) Accredited Investor Verification - Vela Wood velawood.com ? sec-amends-506c-accredited-inve... velawood.com ? sec-amends-506c-accredited-inve...

Please note that third-party letters are only valid for 90 days from date of issuance. Per SEC Rule 230.506(c)(2)(C), before accepting an investor into an offering, sponsors must obtain written proof of an investor's accreditation status from a qualified third-party. Accreditation overview - CrowdStreet CrowdStreet ? knowledge ? accreditat... CrowdStreet ? knowledge ? accreditat...

Based on guidance from the SEC, your accreditation is valid for 5 years as long as you self-certify that you still retain your status as an accredited investor. How often do I need to provide accreditation evidence? / Does my ... angellist.com ? en-us ? articles ? 360051512... angellist.com ? en-us ? articles ? 360051512...

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant. 3rd Party Verification Letter for Accredited Investors | Invest in Kona investinkona.com ? accredited-investor ? 3rd-part... investinkona.com ? accredited-investor ? 3rd-part...

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments. How Does the Accredited Investor Verification Process Work? montague.law ? blog ? accredited-investor-verific... montague.law ? blog ? accredited-investor-verific...