Illinois Share Appreciation Rights Plan with amendment

Description

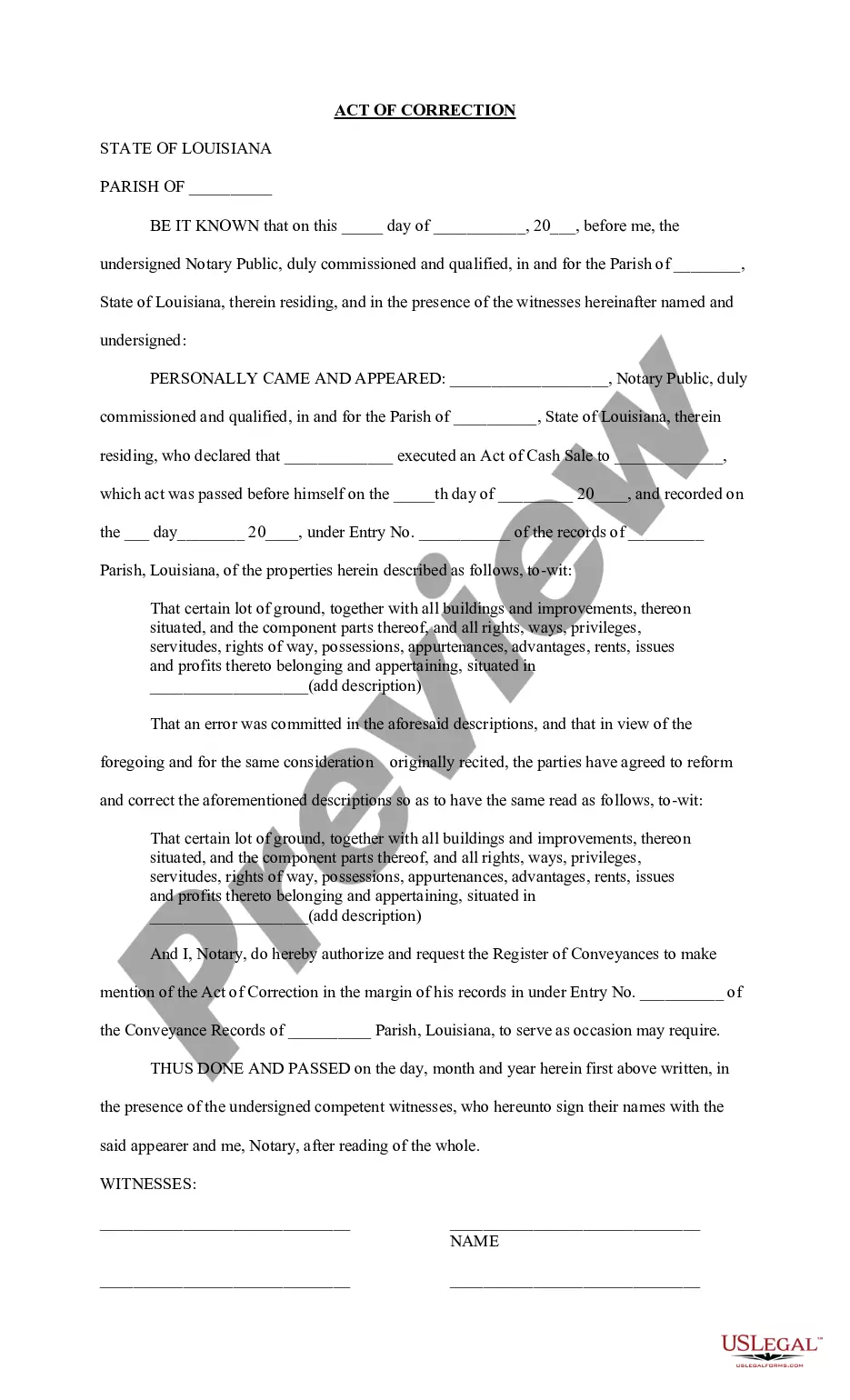

How to fill out Share Appreciation Rights Plan With Amendment?

If you need to full, obtain, or printing lawful papers templates, use US Legal Forms, the most important variety of lawful types, which can be found on the Internet. Make use of the site`s basic and convenient lookup to get the documents you will need. Numerous templates for business and person purposes are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Illinois Share Appreciation Rights Plan with amendment within a couple of click throughs.

If you are previously a US Legal Forms customer, log in to your bank account and click the Down load option to get the Illinois Share Appreciation Rights Plan with amendment. Also you can access types you earlier delivered electronically from the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for your correct metropolis/country.

- Step 2. Use the Preview option to look through the form`s content. Don`t overlook to learn the explanation.

- Step 3. If you are not happy with all the form, take advantage of the Research discipline on top of the monitor to discover other models of your lawful form design.

- Step 4. Upon having located the form you will need, select the Acquire now option. Choose the costs program you prefer and include your references to sign up for an bank account.

- Step 5. Procedure the transaction. You may use your credit card or PayPal bank account to perform the transaction.

- Step 6. Pick the formatting of your lawful form and obtain it on your device.

- Step 7. Full, edit and printing or sign the Illinois Share Appreciation Rights Plan with amendment.

Each and every lawful papers design you acquire is your own property permanently. You have acces to each form you delivered electronically inside your acccount. Click on the My Forms area and select a form to printing or obtain yet again.

Compete and obtain, and printing the Illinois Share Appreciation Rights Plan with amendment with US Legal Forms. There are millions of professional and status-distinct types you can use for your business or person requirements.

Form popularity

FAQ

Intrinsic value is the difference between the fair value of the shares and the price that is to be paid for the shares by the counterparty.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a preset period. Unlike stock options, SARs are often paid in cash and do not require the employee to own any asset or contract.

How do I value it? For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

SARs may be settled in cash or shares. However, it is more common for SARs to be settled in cash. A SAR is similar to a stock option except that the recipient is not required to pay an exercise price to exercise the SAR.

Stock appreciation rights are similar to stock options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a stock appreciation right vests, an employee can exercise it at any time prior to its expiration.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.