Illinois Indemnity Agreement between corporation and directors and / or officers

Description

How to fill out Indemnity Agreement Between Corporation And Directors And / Or Officers?

Are you presently within a situation that you need to have documents for possibly business or personal purposes nearly every working day? There are a variety of legal papers templates available on the net, but getting kinds you can rely isn`t straightforward. US Legal Forms offers thousands of form templates, such as the Illinois Indemnity Agreement between corporation and directors and / or officers, which are composed in order to meet federal and state specifications.

In case you are previously informed about US Legal Forms website and have an account, basically log in. Afterward, you are able to down load the Illinois Indemnity Agreement between corporation and directors and / or officers template.

If you do not have an account and wish to begin to use US Legal Forms, follow these steps:

- Discover the form you need and make sure it is for your right city/state.

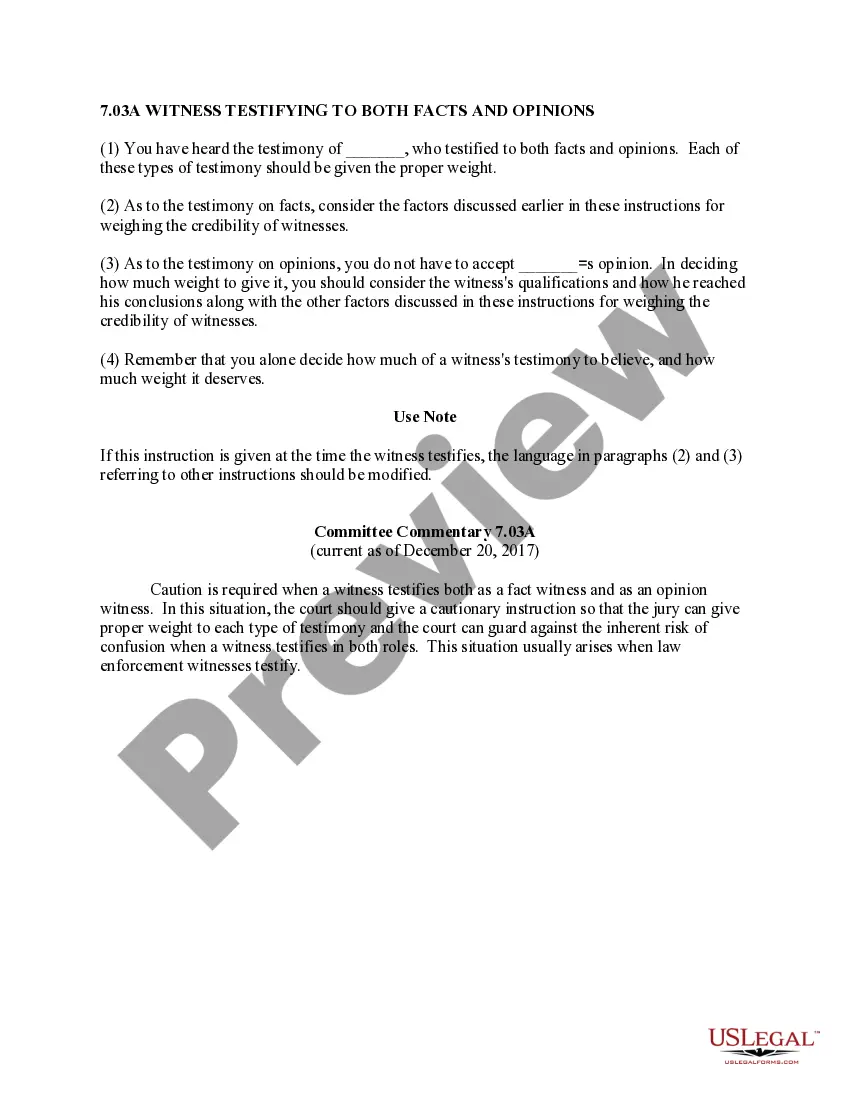

- Take advantage of the Preview button to analyze the form.

- Look at the outline to ensure that you have selected the proper form.

- When the form isn`t what you are seeking, utilize the Research field to find the form that meets your needs and specifications.

- Whenever you get the right form, click Get now.

- Choose the rates strategy you desire, submit the desired information to make your money, and pay for an order making use of your PayPal or credit card.

- Decide on a practical document file format and down load your backup.

Locate each of the papers templates you have purchased in the My Forms food selection. You may get a more backup of Illinois Indemnity Agreement between corporation and directors and / or officers at any time, if possible. Just click on the required form to down load or print out the papers template.

Use US Legal Forms, by far the most substantial variety of legal varieties, in order to save some time and prevent blunders. The support offers professionally created legal papers templates which you can use for a variety of purposes. Make an account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

Many company constitutions set out rights of indemnity for directors, and often also include provision for directors and officers (D&O) insurance. Alternatively, they may simply provide that the company may indemnify directors. The deed of indemnity is an agreement between the company and a director.

A company may, however, lend money to a director to fund the director's defence costs. Frequently, an indemnity will include a provision under which the company agrees to lend the director the amounts necessary to fund the director's defence costs.

Section 145(b) empowers a corporation to indemnify its directors against expenses incurred in connection with the defense or settlement of an action brought by or in the right of the corporation, subject to the standard of conduct determination, and except that no indemnification may be made as to any claim to which ...

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

Indemnification is often very broad, often extending ?to the maximum extent permitted by law?, whereas D&O insurance polices contain numerous exclusions and conditions. In addition, D&O insurance must be renewed each year, with possible changes in terms and conditions.

Indemnification Agreement to secure against loss or damage; to give security for the reimbursement of a person in case of an anticipated loss falling upon him. Also to make good; to compensate; to make reimbursement to one of a loss already incurred by him.

There are quite a few differences between vitamin D and vitamin D3, but the main difference between them is that vitamin D is a fat-soluble vitamin that regulates calcium and phosphorous levels in the body, whereas the vitamin D3 is the natural form of vitamin D produced by the body from sunlight.

Indemnification refers to the right to have a company reimburse current or former directors or officers for all losses, including legal fees, incurred in connection with litigation arising from actions taken in service to the company or at the company's direction.