Illinois Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

US Legal Forms - one of several biggest libraries of legal forms in the United States - delivers a wide range of legal document templates you are able to acquire or print out. Utilizing the web site, you may get thousands of forms for business and person purposes, categorized by classes, suggests, or search phrases.You will discover the most recent models of forms just like the Illinois Ratification and approval of directors and officers insurance indemnity fund with copy of agreement within minutes.

If you already possess a registration, log in and acquire Illinois Ratification and approval of directors and officers insurance indemnity fund with copy of agreement through the US Legal Forms local library. The Download button can look on every single develop you perspective. You have accessibility to all in the past downloaded forms in the My Forms tab of the profile.

In order to use US Legal Forms for the first time, allow me to share simple instructions to help you get started off:

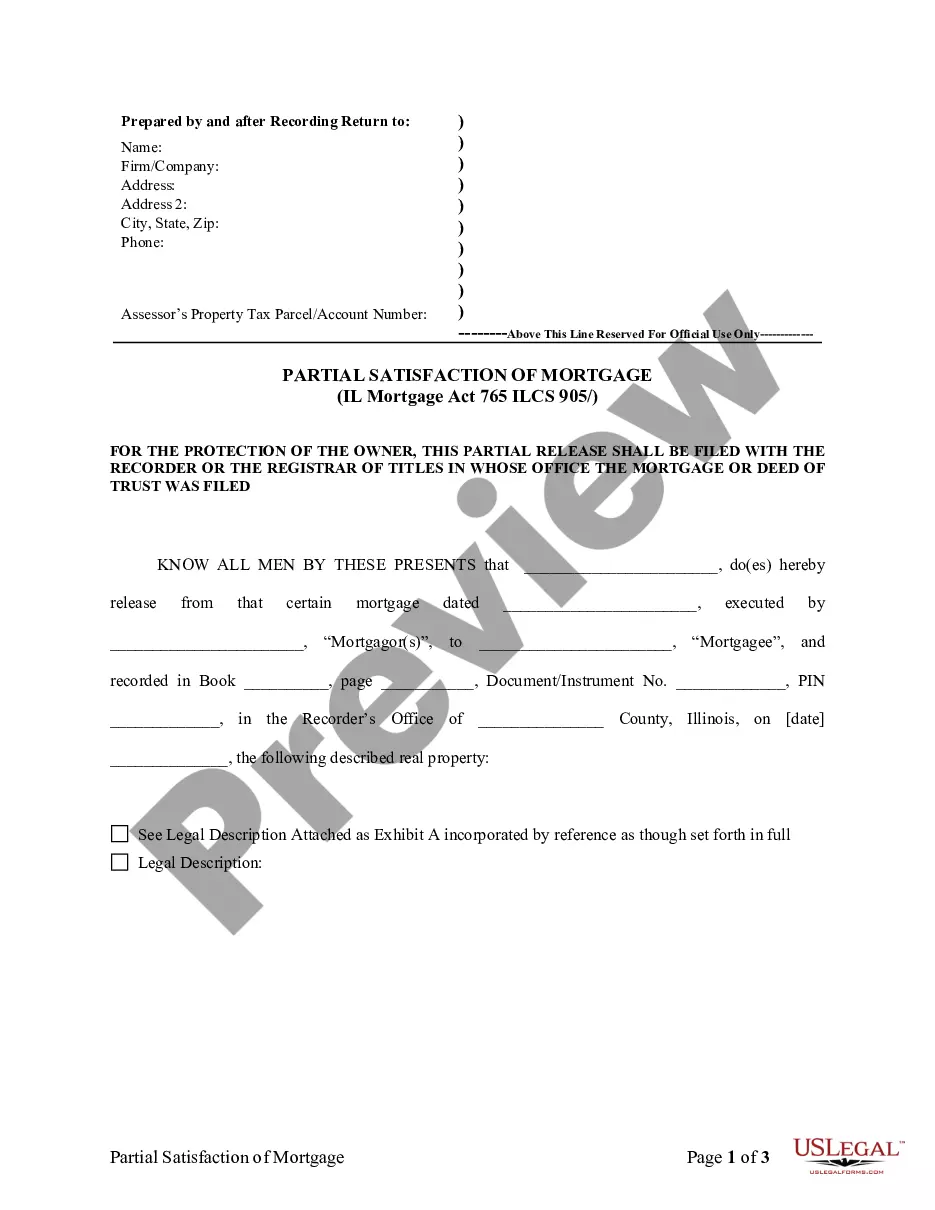

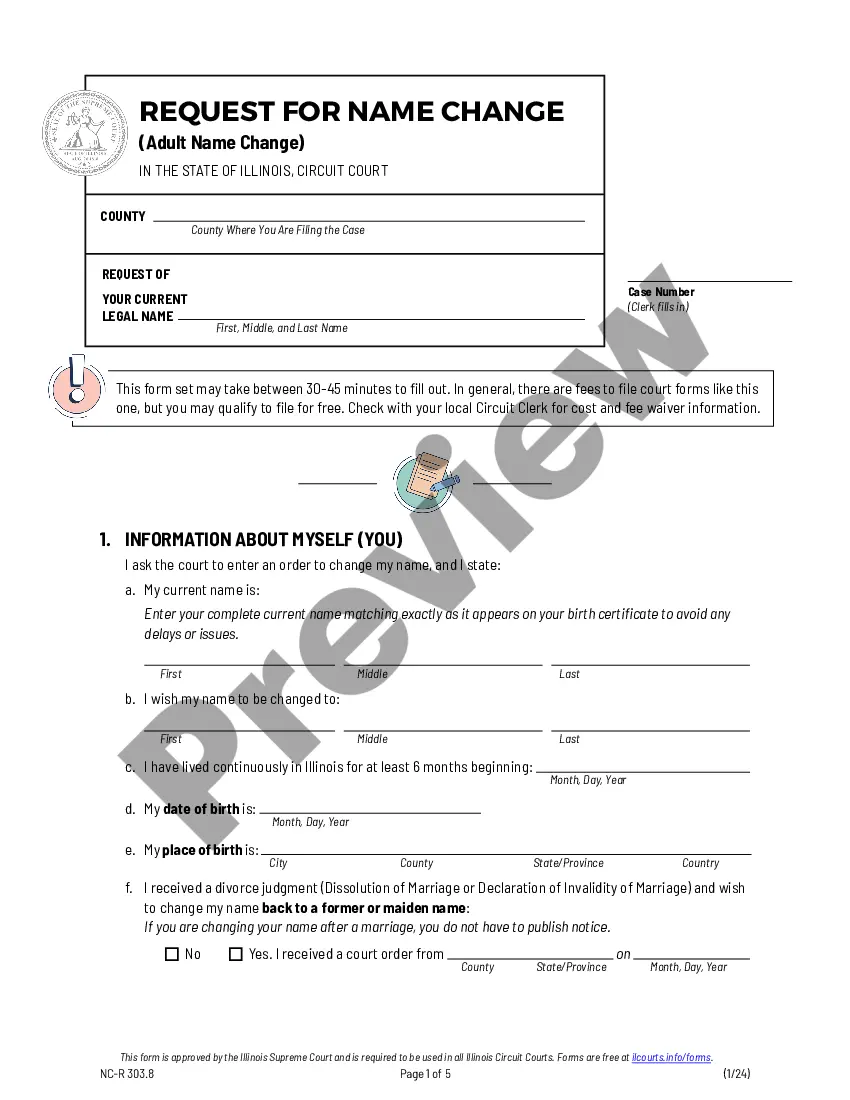

- Make sure you have picked out the correct develop for your city/area. Click the Review button to review the form`s content. Look at the develop outline to actually have selected the correct develop.

- When the develop doesn`t match your demands, utilize the Lookup field at the top of the display to discover the one which does.

- When you are satisfied with the shape, confirm your option by clicking on the Acquire now button. Then, select the costs program you like and offer your references to sign up for the profile.

- Method the financial transaction. Utilize your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Pick the format and acquire the shape on the device.

- Make modifications. Complete, change and print out and indicator the downloaded Illinois Ratification and approval of directors and officers insurance indemnity fund with copy of agreement.

Every format you put into your money lacks an expiry time and is also yours eternally. So, if you wish to acquire or print out an additional backup, just visit the My Forms portion and then click on the develop you require.

Get access to the Illinois Ratification and approval of directors and officers insurance indemnity fund with copy of agreement with US Legal Forms, probably the most comprehensive local library of legal document templates. Use thousands of professional and express-certain templates that meet up with your business or person demands and demands.

Form popularity

FAQ

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

There are three main types of express indemnity clauses: broad form, intermediate form, and limited form. Broad form express indemnity clauses require the indemnitor to hold the indemnitee harmless for all liability, even if the indemnitee is solely at fault.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.