Illinois Proposed Additional Compensation Plan with copy of plan

Description

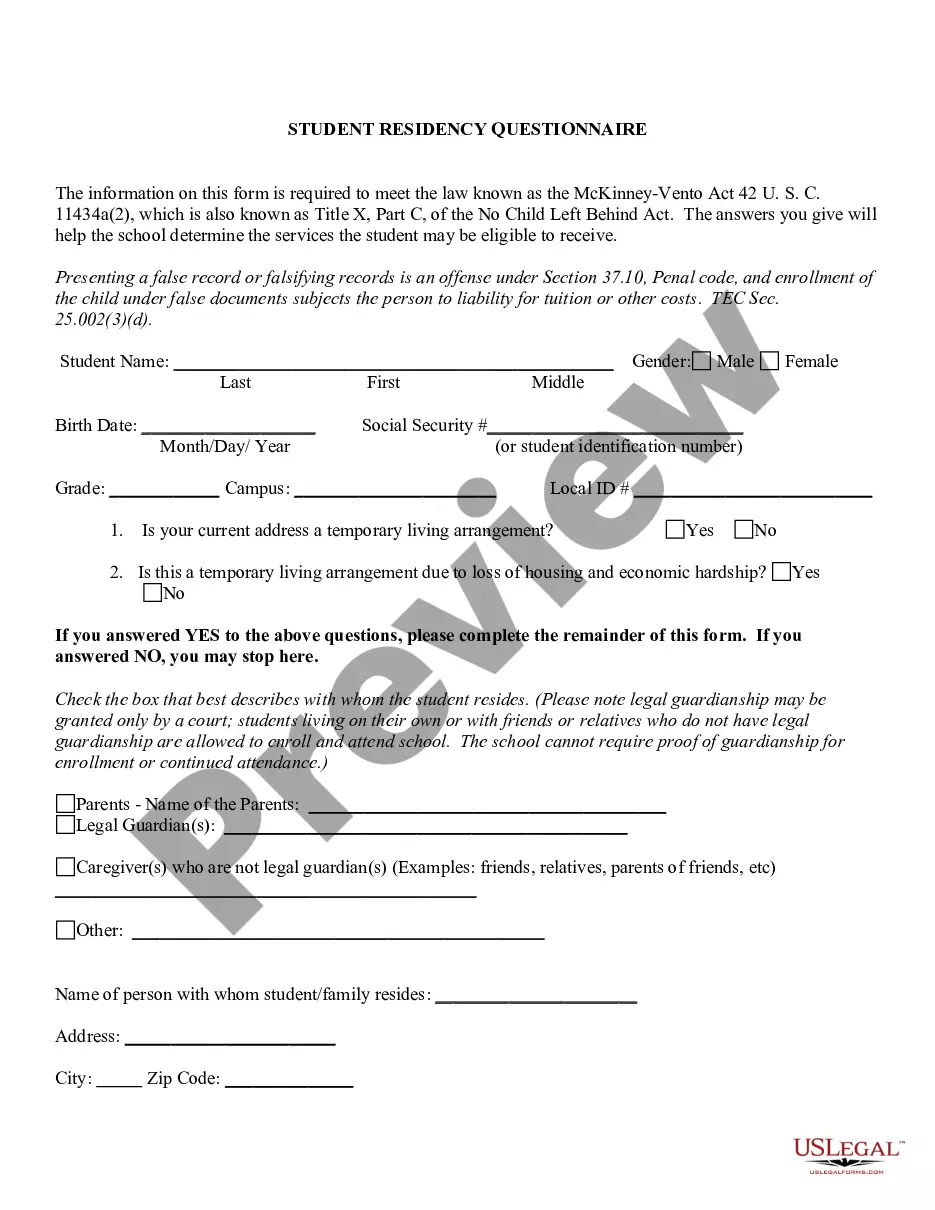

How to fill out Proposed Additional Compensation Plan With Copy Of Plan?

Discovering the right legitimate papers format can be quite a have a problem. Naturally, there are tons of themes available on the net, but how would you obtain the legitimate type you require? Utilize the US Legal Forms internet site. The assistance offers thousands of themes, such as the Illinois Proposed Additional Compensation Plan with copy of plan, which you can use for company and private demands. All the kinds are checked out by professionals and meet up with state and federal demands.

When you are presently signed up, log in in your account and click on the Download switch to have the Illinois Proposed Additional Compensation Plan with copy of plan. Utilize your account to search with the legitimate kinds you may have ordered formerly. Check out the My Forms tab of your respective account and get another backup of your papers you require.

When you are a brand new end user of US Legal Forms, allow me to share simple directions so that you can stick to:

- Initially, ensure you have chosen the appropriate type to your area/county. You are able to look through the form making use of the Preview switch and browse the form outline to guarantee this is basically the best for you.

- When the type is not going to meet up with your preferences, use the Seach field to obtain the appropriate type.

- When you are certain the form is suitable, click the Buy now switch to have the type.

- Opt for the prices strategy you would like and enter the required information and facts. Build your account and buy the order with your PayPal account or Visa or Mastercard.

- Pick the submit format and down load the legitimate papers format in your product.

- Full, modify and print out and indicator the acquired Illinois Proposed Additional Compensation Plan with copy of plan.

US Legal Forms is definitely the largest collection of legitimate kinds that you can find numerous papers themes. Utilize the service to down load professionally-created documents that stick to state demands.

Form popularity

FAQ

Key Takeaways. A SERP is a non-qualified retirement plan offered to executives as a long term incentive. Unlike in a 401(k) or other qualified plan, SERPs offer no immediate tax advantages to the company or the executive. When the benefits are paid, the company deducts them as a business expense.

The plan is a voluntary savings program that allows employees to defer any amount, subject to annual limits, from their paycheck on a pretax basis.

Deferred Compensation Plans Versus 401(k)s and IRAs The distributions later will be subject to income taxes. Unlike a 401(k) or traditional IRA, there are no contribution limits for a deferred compensation plan. The 401(k) plan contribution limits for 2023 are $22,500, or $30,000 if you are 50 or older.

The State of Illinois Deferred Compensation Plan (?Plan?) is a supplemental retirement program for State employees. Contributions to the Plan can be made on a pre-tax or Roth basis through salary deferrals.

Deferring compensation reduces your current year tax burden, which is valuable for high income earners in top tax brackets. Recognizing deferred compensation income at lower tax brackets when you're retired can save you money on taxes. Choosing to defer income is very difficult to reverse if your circumstances change.

In general, deferred compensation plans allow the participant to defer income today and withdraw it at some point in the future (usually upon retirement) when taxable income is likely to be lower. Like 401(k) plans, participants must elect how to invest their contributions.

You can request a loan by logging in to your DCP account, completing a Loan Application Form, or calling the Service Center at 844-523-2457.

The plan is offered only to public service employees and employees at tax-exempt organizations. Participants are allowed to contribute up to 100% of their salaries up to a dollar limit for the year. The interest and earnings in the account are not taxed until the funds are withdrawn.