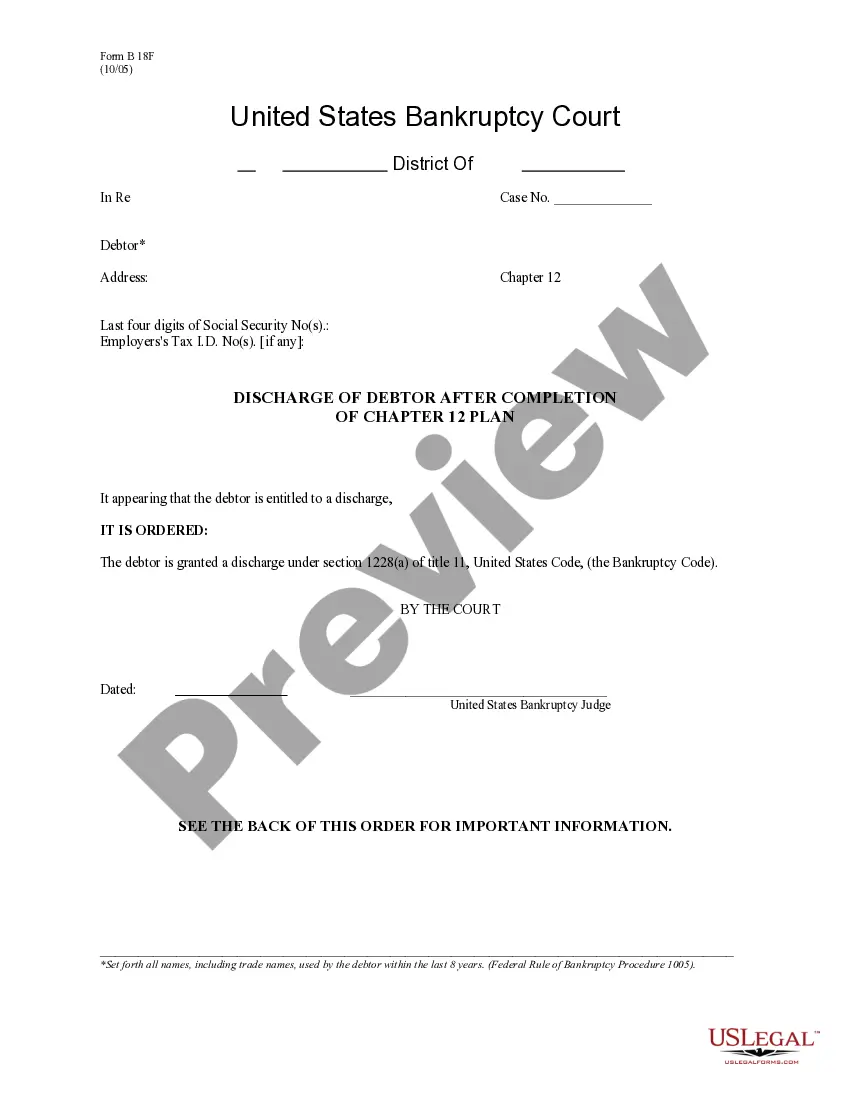

Illinois Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Finding the right authorized document template might be a struggle. Of course, there are plenty of themes available online, but how do you find the authorized form you need? Make use of the US Legal Forms site. The assistance offers thousands of themes, like the Illinois Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form, which can be used for enterprise and personal requires. All of the varieties are inspected by pros and fulfill state and federal needs.

Should you be previously authorized, log in to your account and click the Acquire key to get the Illinois Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form. Utilize your account to check with the authorized varieties you possess purchased earlier. Visit the My Forms tab of your account and obtain another version of the document you need.

Should you be a brand new user of US Legal Forms, allow me to share simple guidelines so that you can adhere to:

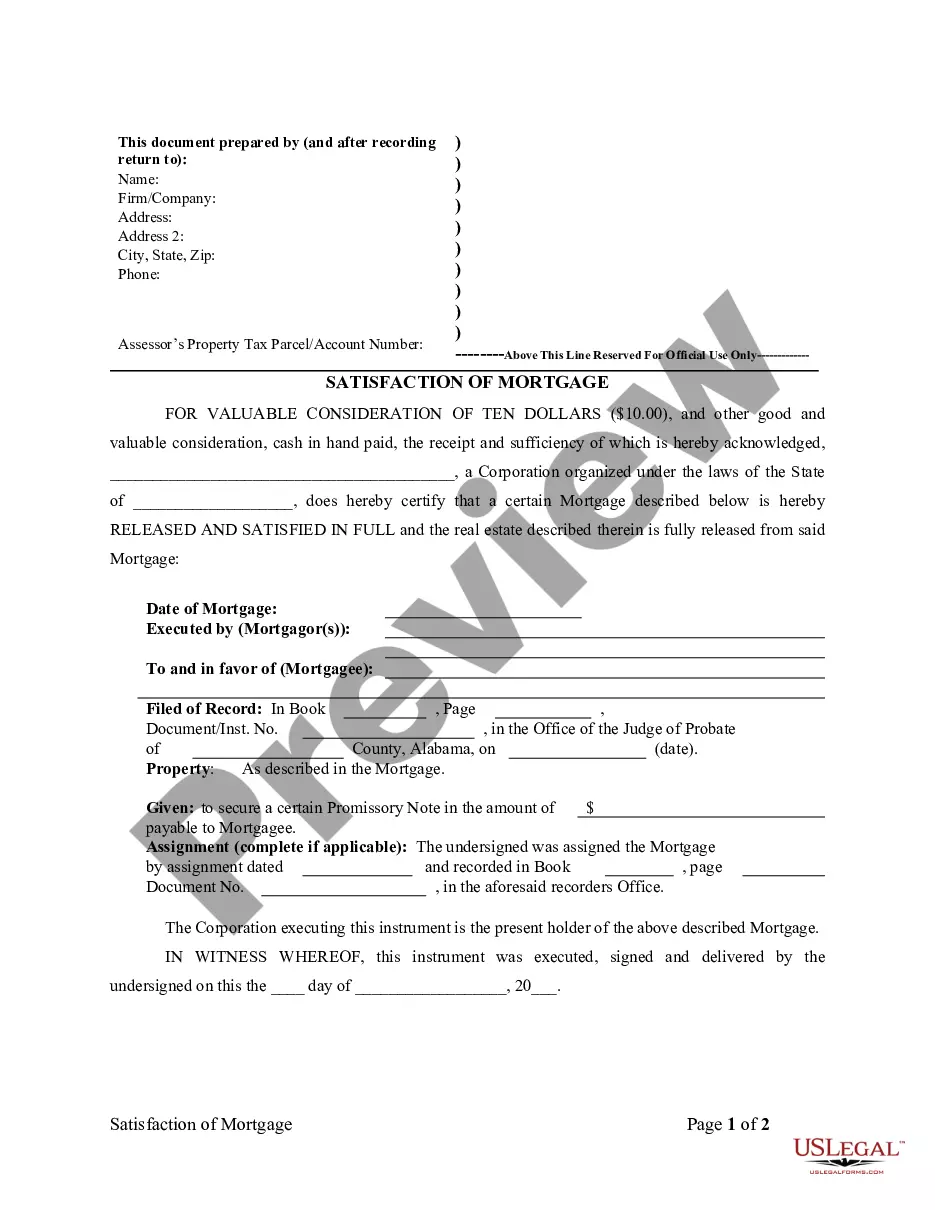

- First, be sure you have chosen the appropriate form for your personal city/area. You are able to check out the shape making use of the Preview key and study the shape explanation to make certain it will be the best for you.

- When the form does not fulfill your needs, utilize the Seach field to get the correct form.

- When you are sure that the shape is proper, click on the Get now key to get the form.

- Opt for the prices plan you would like and enter the required information. Build your account and buy an order using your PayPal account or credit card.

- Select the file structure and obtain the authorized document template to your device.

- Comprehensive, change and printing and indication the received Illinois Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

US Legal Forms will be the most significant collection of authorized varieties where you can discover different document themes. Make use of the service to obtain professionally-made files that adhere to condition needs.

Form popularity

FAQ

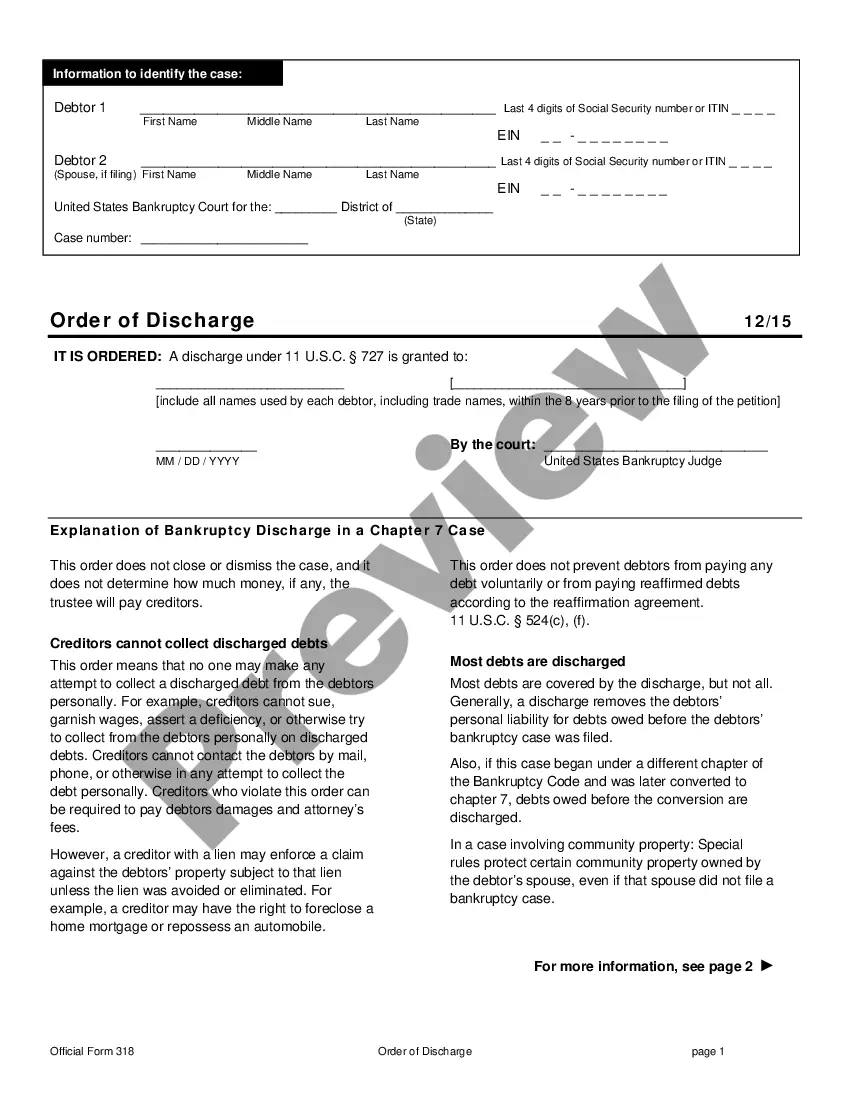

Chapter 7 bankruptcy allows liquidation of assets to pay creditors. Unsecured priority debt is paid first in a Chapter 7, after which comes secured debt and then nonpriority unsecured debt. Filing Chapter 7 typically involves completing forms and a review of assets by the trustee.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

Secured creditors generally get priority, while unsecured creditors are paid pro-rata on their claims. The intent of Chapter 7 is to give the debtor a ?fresh start? and for the creditors to recover as much as they otherwise would've been able to under non-bankruptcy law.

The U.S. bankruptcy code doesn't specify a minimum dollar amount someone must owe to make them eligible for a qualified filing. In short, any debt is enough debt. More important than the size of your debt is the size of your income. How much money you earn affects whether you qualify for Chapter 7.

In Most Cases, Chapter 7 Filers Keep Their Property Most Chapter 7 bankruptcy cases are no-asset cases. That means the debtors give up nothing to the trustee. The exemption systems permit debtors to retain the means of day-to-day living, free from the claims of their creditors.

A Chapter 7 bankruptcy is a type of bankruptcy that can quickly clear away debts. It's also called a liquidation bankruptcy because you will have to sell nonexempt possessions or assets to repay your creditors. Another name for it is a straight bankruptcy because there are no drawn-out repayment plans.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

When the bankruptcy court denies your discharge in a Chapter 7 case, you remain responsible for paying back all your debts. Denial of your Chapter 7 discharge doesn't end the case, though. The Chapter 7 trustee will still gather and liquidate any non-exempt assets; all you lose is your fresh start free of those debts.