Illinois Home Based Worker Policy

Description

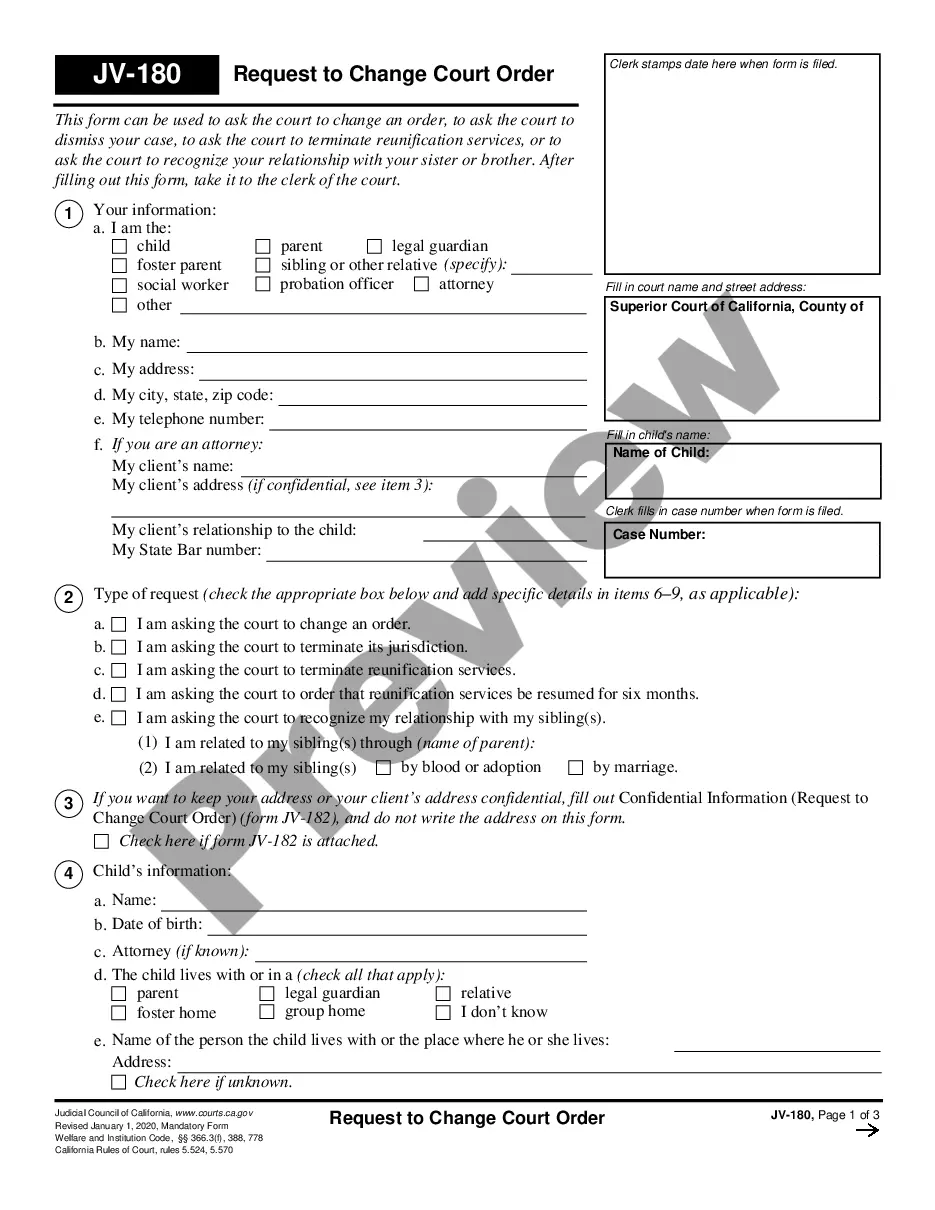

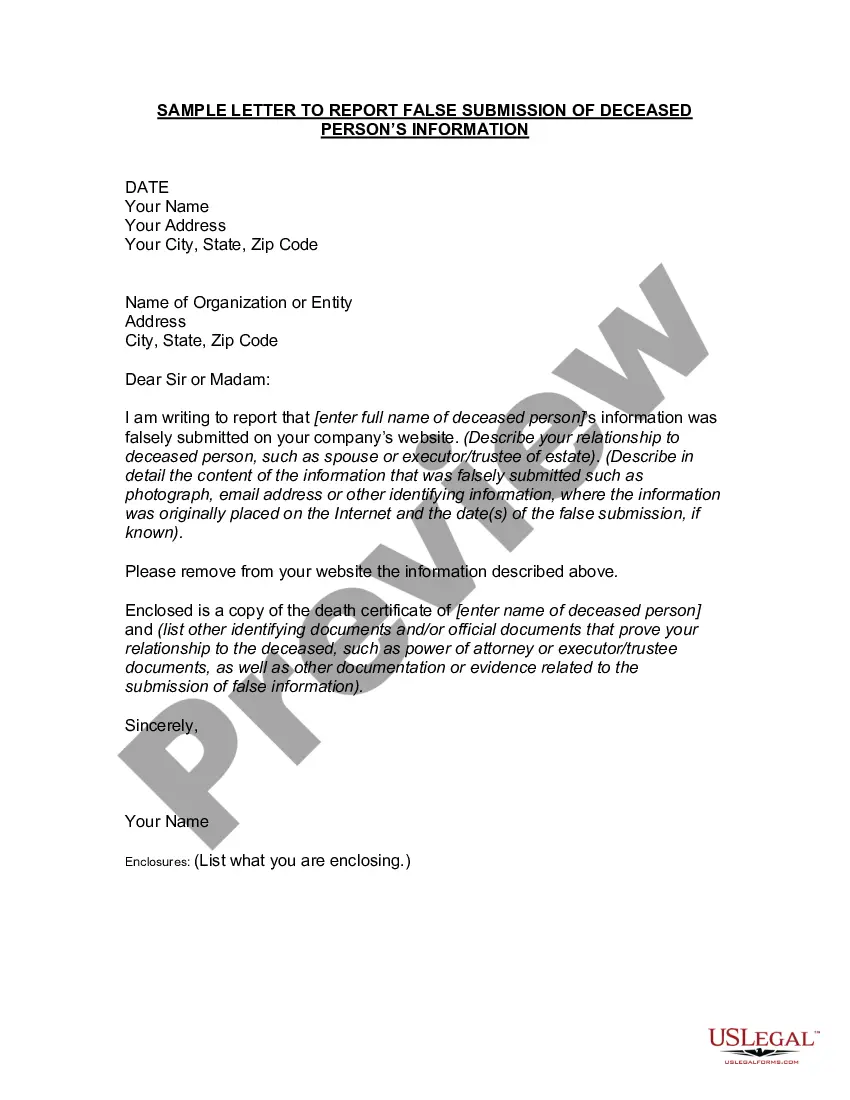

How to fill out Home Based Worker Policy?

If you desire to obtain, secure, or create official document templates, utilize US Legal Forms, the foremost repository of official templates, accessible online.

Utilize the website's user-friendly and convenient search feature to retrieve the documents you require.

Various templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Illinois Home Based Worker Policy with just a few clicks.

- If you are currently a US Legal Forms member, Log Into your account and click the Download button to retrieve the Illinois Home Based Worker Policy.

- You can also access documents you have previously saved within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form’s details. Do not forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the official form template.

Form popularity

FAQ

Not all employers reimburse the costs of homeworking, however, there is an opportunity for homeworkers to claim tax relief themselves. Employees can claim tax relief on household expenses if they can demonstrate that they were incurred 'wholly, exclusively and necessarily' in the performance of their duties.

Do employers need to provide homeworkers with equipment to use at home? There is no general legal obligation on employers to provide the equipment necessary for homeworking. However, if homeworking is to be a success, it is important for employees to have the equipment they need to perform their role.

Among people who believe employers should cover home internet costs, 26% believed employers should pay some of the bill directly, 40% believed employers should pay the full bill directly and 34% felt this should be covered via a routine stipend.

Under the Fair Labor Standards Act (FLSA), employers are not required to reimburse employees working remotely for business expenses they incur while working from home or elsewhere.

Illinois courts have interpreted this to require reimbursement for internet and cell phone expenses when they are used for work purposes. However, Illinois law includes a time restriction and requires employees to submit expense reimbursement requests within 30 calendar days of incurring the expense.

Several states, including California, the District of Columbia, Illinois, Iowa, Massachusetts, Montana and New York, do require employers to reimburse employees for necessary business-related expenses.

Equipment and Technology An employee may need to provide data lines and office equipment to work from home. An employer needs to be very clear in the telecommute agreement that each party is required to provide. However, employers may want to consider providing the computers and software for a telecommuter.

The federal Fair Labor Standards Act (FLSA) generally does not require that an employee be reimbursed for expenses incurred while working from home.

In truth, there is no wide-reaching federal law that requires the employer to reimburse Internet expenses for their remote employers only some states require employees to do so.

Is my employer required to cover my expenses if I work from home? The federal Fair Labor Standards Act (FLSA) generally does not require that an employee be reimbursed for expenses incurred while working from home.