Illinois Training Expense Agreement

Description

How to fill out Training Expense Agreement?

It is feasible to invest time online seeking the legal document template that aligns with the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are evaluated by experts.

You can indeed download or print the Illinois Training Expense Agreement from the service.

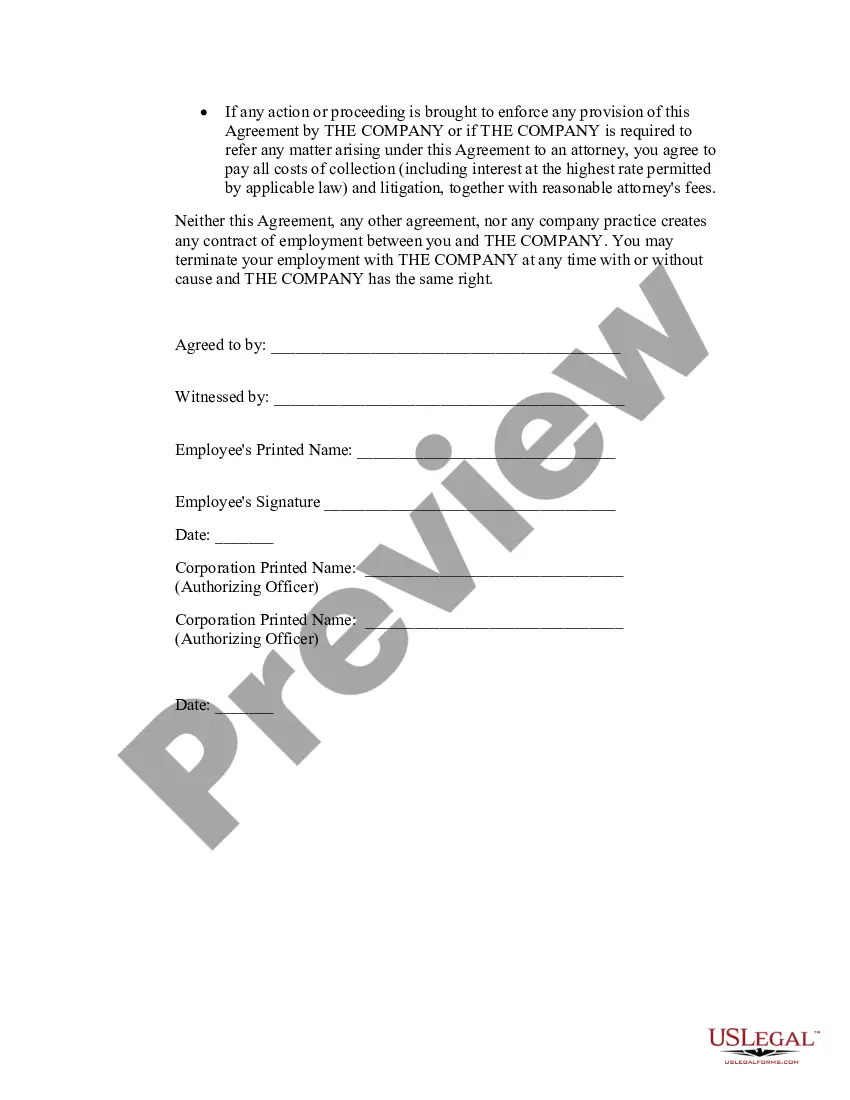

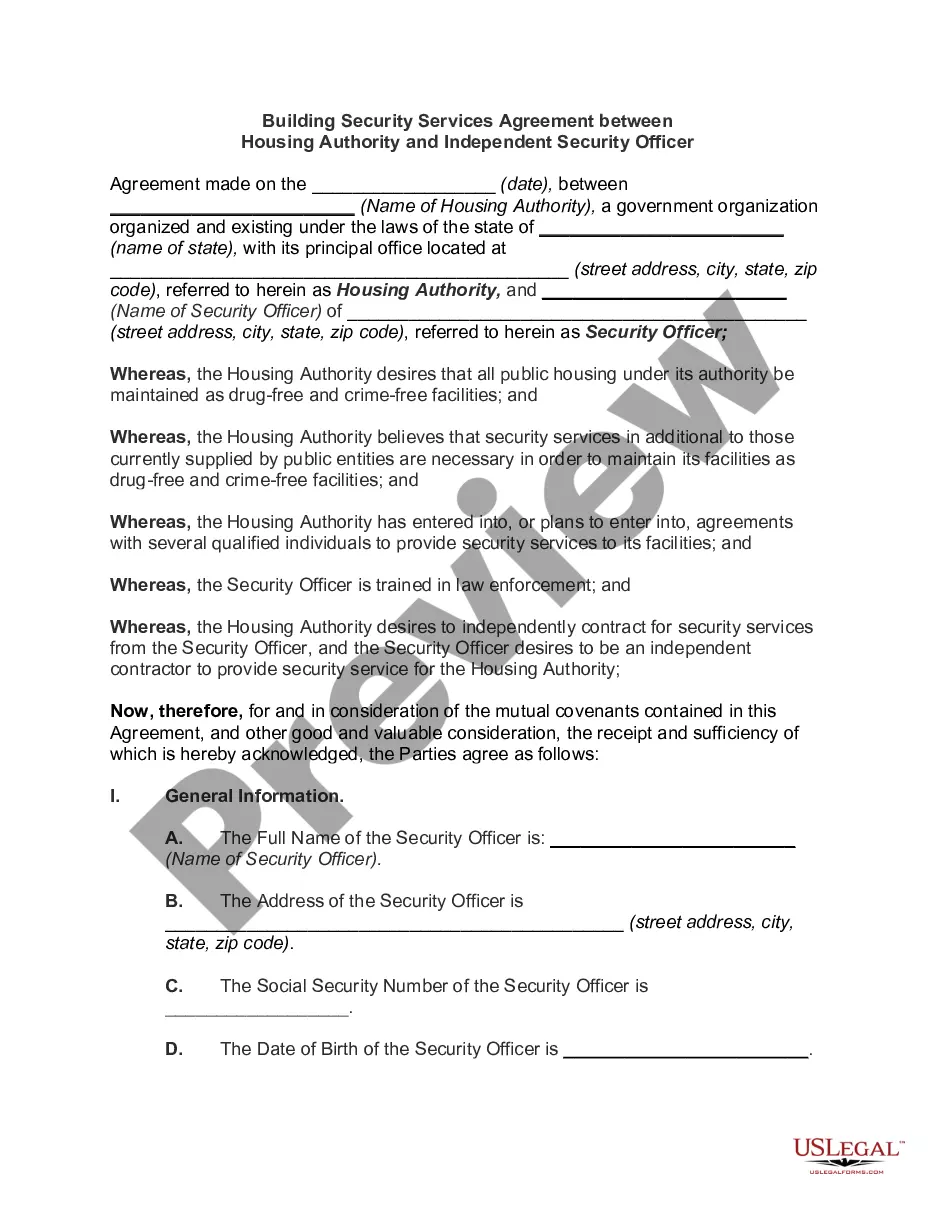

If available, use the Review button to browse the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Following that, you can complete, modify, print, or sign the Illinois Training Expense Agreement.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of the purchased form, visit the My documents tab and then click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/city of choice.

- Examine the form description to confirm you have chosen the correct form.

Form popularity

FAQ

This deduction excludes from the employee's taxable income provided that the expenses are legitimate business expenses and the reimbursements comply with IRS rules. The best way to reimburse employees for expenses can be accomplished by using either the per diem method or an accountable plan.

Does Federal Law Require the Reimbursement of Cell Phone Usage? The Fair Labor Standards Act (FLSA) does not require employers to reimburse employees for cell phone use, but California law does require cell phone reimbursement per the California Labor Code Section 2802.

Employee expenses are costs associated with tasks performed for an employer. Employers generally designate a list of allowable expenses for which they are willing to reimburse employees. Such a list might include expenses related to business travel, meals, lodging, phone calls, Internet and office supplies.

In 2019, Illinois passed new law regarding reimbursement by employers. This new law requires all employers to reimburse their employees for any expenses incurred within the scope of their employment. This can include several expenses, including personal cell phones.

Legally, you do not have to pay employees if they request time off for training or study that isn't required for them to carry out their job.

Illinois courts have interpreted this to require reimbursement for internet and cell phone expenses when they are used for work purposes. However, Illinois law includes a time restriction and requires employees to submit expense reimbursement requests within 30 calendar days of incurring the expense.

Illinois Law Now Requires Employers to Reimburse Employee Business Expenses. Effective January 1, 2019, Illinois law requires employers to reimburse employees for qualifying expenses and losses incurred by employees in the course of their employment.

What Expenses Should a Business Cover?Business-related travel. Airfare, train, and/or other transportation expenses should be reimbursed to employees.Meals. Employees should also be reimbursed for meals as part of travel or business-related activities.Smartphones.Accommodations for travel.Training.

The new year brought a new concern for Illinois employers: a mandatory expense reimbursement law. As of January 1, 2019, Illinois employers must reimburse all necessary expenditures their employees incur in the scope of employment directly related to services performed by the employer.

Employers sometimes attempt to recoup the cost of such training from employees through various means, but if an employer requires an employee to undergo training, it cannot force the employee to bear any portion of the cost, even if the employee resigns shortly after completing the training.